Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India cold chain market reached a value of nearly INR 2162.56 Billion in 2025. The industry is further expected to grow at a CAGR of 12.70% over the forecast period of 2026-2035 to attain a value of INR 7148.37 Billion by 2035.

Base Year

Historical Period

Forecast Period

India has 6,300 cold storage facilities with an installed capacity of 30.11 million metric tonnes, mostly used for storing potatoes. However, the market is gradually getting organised with a focus on multi-purpose cold storages.

As per industry reports, over 50% of the cold storage facilities in India are concentrated in Uttar Pradesh and West Bengal.

The government has launched various schemes and initiatives to promote the development of the cold chain infrastructure in the country, including financial assistance for setting up cold storage facilities.

Compound Annual Growth Rate

12.7%

Value in INR Billion

2026-2035

*this image is indicative*

Cold chain logistics refers to a temperature-controlled supply chain, involving a series of refrigerated production, storage, and distribution activities. It also includes equipment that helps to maintain the desired temperature range, thus ensuring preservation and extension of the shelf life of various temperature-sensitive products.

The India cold chain market development is influenced by the growing demand for processed food products and the growth of the retail and e-commerce industry in the region. One of the biggest factors which will aid market growth over the forecast period is the growth of the organised food retail sector in the region.

Currently, the country is the largest producer of milk and the second-largest producer of fruits and vegetables. The region is also experiencing substantial production of marine, meat, and poultry products. As most of these products are perishable and temperature-sensitive, they require a specific temperature for storage and transportation. This is generating the demand for and leading to the establishment of large cold chain facilities in the region.

Rising demand for perishable goods, expansion of e-commerce sector, and advancements in refrigerating technologies are factors boosting the India cold chain market growth.

The demand for perishable goods such as fruits, vegetables, and dairy products is driving the growth of the India cold chain market. Companies like ColdEX Logistics and Snowman Logistics are focusing on providing end-to-end cold chain solutions for the transportation and storage of perishable goods.

Organised retail and e-commerce sectors in India are creating a significant demand for cold chain services as they require reliable transportation and storage solutions to maintain the quality and freshness of their products. Amazon and Flipkart are relying heavily on cold chain logistics providers to ensure timely and temperature-controlled delivery of perishable goods to their customers.

The government has been actively promoting the growth of the cold chain market in India through initiatives such as the development of cold chain infrastructure and the implementation of regulations that ensure food safety and quality.

The development of new and more efficient refrigeration technologies is enabling cold chain logistics providers to offer better services to their customers. The use of dry ice and gel packs is becoming increasingly popular in the industry as it is a cost-effective way of maintaining the required temperatures during transportation.

The growing demand for effective cold chain facilities from the health care sector to preserve heat sensitive products like vaccines, biopharmaceuticals, and clinical trial materials, among others, is also propelling the market growth. With the expected growth in India's pharmaceutical industry, the market is expected to witness a strong demand in the forecast period. Companies like Gati Kausar are focusing on providing integrated cold chain solutions that cater to the needs of the pharmaceutical industries.

Government initiatives and regulations are also playing a crucial role in shaping the India cold chain market outlook. For example, regulations such as the Food Safety and Standards Act (FSSA) and the Prevention of Food Adulteration (PFA) Act are ensuring that food products are stored and transported safely and hygienically, which is driving the demand for cold chain services.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India Cold Chain Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:

Market Breakup by Services

Market Breakup by Temperature Type

Market Breakup by Application

Market Breakup by Region

Both cold chain storage and transportation facilities are crucial for efficient and safe delivery of perishable and time-sensitive goods

The cold chain storage segment plays a critical role in maintaining the quality and freshness of products across industries such as fruits & vegetables, bakery and confectionery, dairy & frozen desserts, drugs & pharmaceuticals, meat, fish & seafood. ColdEX Logistics offers comprehensive cold chain solutions for fruits and vegetables, ensuring their preservation and quality throughout the supply chain.

According to India cold chain market report, the cold chain transportation segment is vital for ensuring the seamless and temperature-controlled movement of perishable goods from manufacturers to storage facilities, distribution centers, retailers, and consumers. Kool-ex specialises in providing temperature-controlled logistics solutions for pharmaceutical products, ensuring their efficacy and safety during transportation. Snowman Logistics focuses on cold chain transportation services for dairy products, highlighting the significance of maintaining product freshness and quality throughout the delivery process.

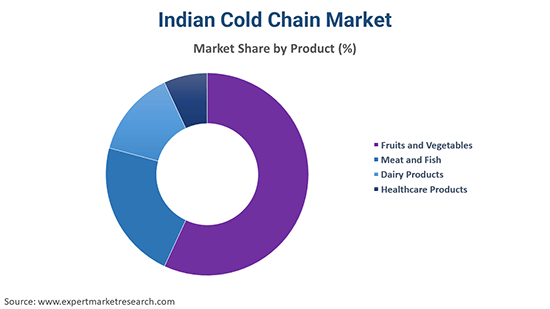

Fruit and vegetables segment bolsters the market growth due to their perishable nature

In the India cold chain logistics market analysis, the fruits and vegetables segment see a high demand for efficient cold chain storage and transportation solutions due to India's significant production of perishable produce. The meat and fish segment showcases an increasing need for cold chain services to maintain the safety and quality of these perishable products. Dairy products represent another crucial segment in the market, requiring cold chain infrastructure to preserve the quality and freshness of dairy items such as milk, cheese, and ice cream. In the healthcare products segment, particularly pharmaceuticals and biopharmaceuticals, there is a rapidly growing demand for precise temperature control during storage and transportation to maintain product efficacy and safety.

Market players are focused on facility expansion, technology adoption, and serving agro-food and pharmaceuticals industries to expand their presence.

CEVA Logistics SA was founded in 2007 as a joint venture between Thomas Nationwide Transport and Eagle Global Logistics. The company is headquartered in Marseille, France and provides freight management, contract logistics, and supply chain solutions in 170 countries worldwide.

Snowman Logistics Limited was established in 1993 and is based in Bangalore, India. The company specialises in temperature-controlled logistics services, including cold storage warehousing and distribution.

ColdEX Logistics Pvt. Ltd. was founded in 1997 and is headquartered in New Delhi, India. The company offers temperature-controlled logistics, cold chain solutions, warehousing, and distribution services.

TCIEXPRESS LIMITED was founded in 1958 as Transport Corporation of India. The company is headquartered in Gurugram, India and provides express logistics services, including surface express, domestic and international air express.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the India cold chain market include GK Cold Chain Solutions, Coldrush Logistics Pvt. Ltd., Gubba Cold Storage Pvt. Ltd., Future Enterprises Limited, Container Corporation of India Limited (Fresh and Healthy Enterprises Ltd.), and Coldman Logistics Pvt.Ltd., among others.

North India has a prominent market due to the presence of various cold chain logistics facilities

In northern India, Uttar Pradesh dominates market share as it is one of the major states with a growing demand for processed food products and a thriving retail sector. Punjab can account for a larger India cold chain market share due to its emphasis on the production and consumption of perishable food products, which is driving the need for efficient cold chain infrastructure. Companies like Kool-ex have established a strong foothold in Punjab, providing temperature-controlled logistics solutions to support the state's thriving dairy and horticulture sectors.

West Bengal in east India is also contributing to the growth of the market with its focus on enhancing food processing and storage capabilities. The state's emphasis on improving its cold chain infrastructure has attracted investments from key players.

North America Cold Chain Market

United States Cold Chain Market

China Cold Chain Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the India cold chain market reached an approximate value of INR 2162.56 Billion in 2025.

The market is expected to grow at a CAGR of 12.70% between 2026 and 2035.

The market is estimated to reach a value of about INR 7148.37 Billion by 2035.

The major drivers of the market include rising disposable incomes, increasing middle class population, growing organised food retail, increased production and consumption of perishable food products, and the rapid urbanisation and industrialisation.

The flourishing e-commerce and organised food retail sectors, the surging production of meat, marine, and poultry products, government initiatives promoting food safety and quality, advancements in refrigeration technologies, and expansion of cold chain infrastructure are the key trends fuelling the market growth.

The various services of cold chain considered in the market report include cold chain storage and cold chain transportation, among others.

The various applications considered in the market report are fruit and vegetables, meat, fish, and seafood products, dairy products, processed food products, healthcare products, and others.

Major regions considered in the market are North India, East and Central India, West India, and South India.

Key players in the market are CEVA Logistics SA, Snowman Logistics Limited, TCIEXPRESS LIMITED, GK Cold Chain Solutions, Coldrush Logistics Pvt. Ltd., ColdEX Logistics Pvt. Ltd., Gubba Cold Storage Pvt. Ltd., Future Enterprises Limited, Container Corporation of India Limited (Fresh and Healthy Enterprises Ltd.), and Coldman Logistics Pvt.Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Service |

|

| Breakup by Temperature Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share