Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India premium tea market was estimated to attain a volume of 1.20 Million Tons in 2025. The market is expected to grow at a CAGR of 4.20% during the forecast period of 2026-2035 to reach a volume of 1.81 Million Tons by 2035. Rising consumer demand for wellness-oriented and functional tea blends is driving rapid growth in the market, boosting specialty offerings, exports, and innovative product development across B2B and retail categories.

The market is expanding rapidly, driven by rising consumer preference for high-quality, specialty teas. Urbanization, increasing disposable incomes, and health-conscious lifestyles are boosting demand for artisanal and single-origin teas. As per the India premium tea market analysis, India's tea exports saw a rise of 9.92% in 2024. Total exports reached 254.67 million kg, reflecting both domestic and global recognition. Cafés, luxury hotels, and online platforms are promoting curated tea experiences, enhancing market growth.

Government initiatives further support market development. For example, the Tea Board of India’s Plantation Development Scheme provides financial and technical support to estates for sustainable cultivation, improving quality and traceability, boosting demand in the India premium tea market. Meanwhile, the APEDA GI certification program safeguards Darjeeling, Assam, and Nilgiri teas, enhancing their premium positioning in international markets. Such measures ensure consistent production standards while helping B2B buyers source authentic, high-value teas.

Innovation is redefining the market landscape. Launches of cold-brew Assam teas, adaptogen-enriched blends, and organic certifications are creating new consumption trends. Additionally, premium ready-to-drink teas are gaining popularity among urban consumers. These developments combine heritage, health, and convenience.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.2%

Value in Million Tons

2026-2035

*this image is indicative*

Consumers are increasingly choosing teas with functional benefits, including antioxidants, digestive support, and immunity-boosting properties. As per FSSAI's 2023 Tea Consumption Report, urban India's green tea drinkers grew by 45%, reflecting a modern resurgence of ancient practices. As a response, cafés and hotels now serve functional teas, while regulatory labeling encourages transparency. B2B buyers benefit from offering these teas to appeal to health-conscious consumers, accelerating further growth in the India premium tea market. Estates are innovating with blends infused with tulsi, lemongrass, or adaptogens, ensuring differentiation in both domestic and export markets. Health-driven launches strengthen brand portfolios and align with consumer demands for premium, wellness-oriented beverages.

Indian tea variants are being valued internationally. According to the India premium tea market analysis, in 2024, top quality Darjeeling tea prices rose 10-15%, supported by GI certification and heritage branding. Tea Board initiatives promote participation in global trade fairs, marketing campaigns, and export incentives. B2B buyers can leverage this recognition to source high-value teas with established quality. Countries in Europe, the United States, and the Middle East prioritize Indian specialty teas, encouraging sustainable supply chains. Export growth enhances revenue streams and strengthens global positioning, making premium Indian tea a strategic asset for institutional buyers seeking traceable, high-quality products.

Specialty and flavored teas are reshaping the India premium tea market dynamics. Single-origin Assam teas, cold-brew variants, and blends infused with cardamom, lemongrass, or functional herbs attract urban consumers. Companies like Tata Tea and Goodricke have launched such products in cafés and premium retail. Collaborations with F&B outlets enhance visibility and repeat sales. B2B stakeholders benefit by offering differentiated options that cater to evolving tastes.

Organic cultivation and biodegradable packaging are being increasingly demanded. The Tea Board’s organic certification program helps estates access niche markets while reducing chemical use. Companies adopting eco-friendly packaging appeal to conscious consumers and regulators. B2B buyers benefit from marketing sustainable products to clients focused on corporate social responsibility. Sustainable practices also ensure compliance with export regulations in Europe and North America, strengthening the India premium tea market expansion opportunities. Investments in carbon-neutral sourcing and recyclable materials enhance brand image while meeting market expectations, driving long-term growth. Premium buyers increasingly prefer suppliers demonstrating environmental responsibility and traceable sourcing.

Organized retail and e-commerce are reshaping premium tea consumption in India. Online sales grew by 9% in 2024, offering convenience and wide reach. Retail chains provide visibility for packaged premium teas, while institutional buyers can access bulk purchases. E-commerce enables estate-to-consumer models, supporting traceability and freshness. Hotels, cafés, and gourmet stores increasingly source teas via digital platforms. B2B stakeholders benefit from partnerships and streamlined procurement. Modern retail and online presence enhance brand recognition, broaden distribution, and allow targeted marketing.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India Premium Tea Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Premium tea types include flavored black, green, herbal blends, probiotic teas, iced teas, and others. Flavored black teas dominate the market for rich taste and premium appeal, green teas grow popular with functional benefits, and herbal blends cater to wellness-focused consumers. Probiotic and iced teas serve niche, modern preferences, while functional botanical blends address health trends. All these tea types allow B2B buyers to offer diverse portfolios that appeal to urban consumers, luxury hotels, cafés, and export markets, ensuring differentiation, traceable sourcing, thereby propelling the India premium tea market scope.

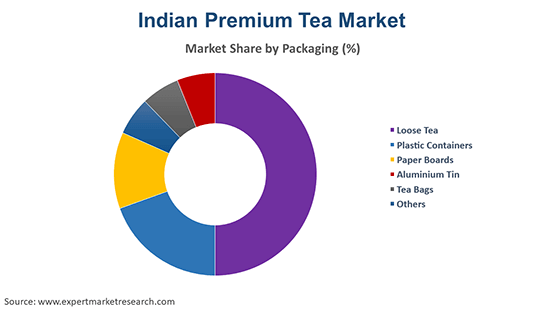

Market Breakup by Packaging

Key Insight: Loose tea largely contributes to the market value for flavor retention and custom blend. Tea bags are also growing popular due to convenience, tins appeal for gifting, and eco-friendly solutions support sustainability. Paper boards and other innovative formats cater to niche presentation and premium branding. Packaging innovations enhance user experience, allow bulk and single-serve options, and align with urban, luxury, and export markets, making it a key motivator for the India premium tea market growth.

Market Breakup by Distribution Channel

Key Insight: Supermarkets and hypermarkets primarily drive the India premium tea market revenue due to wide reach, product variety, and bulk sales potential. Online channels are expanding their market shares with convenience, urban penetration, and access to niche products. Specialty stores enhance premium branding and curated experiences, while convenience stores support impulse buying. Other channels like corporate supply and gifting channels serve specialized B2B needs. Each channel supports marketing, sampling, and packaging strategies that reinforce brand positioning and market penetration in domestic and export markets.

Market Breakup by Application

Key Insight: The residential application dominates the market, powered by daily consumption, household wellness, and lifestyle preferences, while commercial grows fastest with hotels, cafés, and corporate buyers seeking premium experiences. Functional blends, flavored teas, and ready-to-drink formats cater to both categories, transforming the India premium tea market trends. B2B buyers leverage bulk procurement, curated offerings, and traceable sourcing to meet consumer or institutional demand.

Market Breakup by Region

Key Insight: The India premium tea market spans across North, South, East, and West regions, each with unique strengths. The North dominates due to urban demand and café culture, while the South grows at an accelerated pace with traditional tea habits and modern retail expansion. East India serves as the production hub, offering single-origin and heritage teas with strong export infrastructure. The West Indian market is being driven by urbanization, premium retail, and institutional demand. Together, these regions provide strategic B2B opportunities in curated blends, functional teas, traceable sourcing, and innovative packaging.

By Type, Flavored Black Teas Register the Largest Share of the Market due to Premium Taste Preferences

Flavored black teas dominate the market, combining rich Assam or Darjeeling bases with herbs, spices, or floral notes. Consumers and institutional buyers, such as cafés, luxury hotels, and specialty retailers, favor these blends for their complex aroma and premium positioning. Brands like Tata Tea Gold and Goodricke’s specialty lines offer both domestic and export options, leveraging heritage and flavor innovation. Estates are increasingly experimenting with small-batch artisanal blends, meeting demand for authenticity while supporting traceable sourcing.

As per the India premium tea market report, green teas are rapidly growing popular due to antioxidant content, detoxifying properties, and functional health benefits. Single-origin and organic variants from Darjeeling, Nilgiri, and Assam cater to wellness-conscious urban consumers. B2B buyers, including cafés and hotels, increasingly incorporate green tea into premium beverage menus and functional health packages. Flavored infusions, like lemongrass or tulsi, provide differentiation and align with global health trends. Export demand also supports growth, as markets in Europe and North America favor organic, traceable teas.

By Packaging, Loose Tea accounts for the Largest Share of the Market due to Traditional and Customizable Offerings

Loose tea currently holds the dominant share of the market because it preserves aroma, flavor, and brewing flexibility. Institutional buyers, such as hotels, restaurants, and specialty retailers, prefer loose tea for custom blends and bulk usage. Estates and exporters provide curated assortments to meet both domestic and international standards. Packaging innovations, including eco-friendly pouches and gift boxes, enhance appeal. Loose tea also supports small-batch artisanal production, enabling estates to differentiate their offerings and cater to niche, premium markets while sustaining B2B partnerships.

Tea bags are the fastest-growing packaging category, boosting the India premium tea market value by combining convenience with premium quality. Pyramid and biodegradable formats allow uniform brewing and controlled flavor, appealing to urban consumers and institutional buyers. Ready-to-serve options, single-origin, and functional blends are increasingly sold in this format. Hotels, cafés, and corporate offices leverage premium tea bags for consistent flavor and presentation. Brands incorporate sustainable materials to meet eco-conscious demand while ensuring traceable sourcing.

Supermarkets and Hypermarkets lead with the Largest Share of the Market due to Wide Reach

Supermarkets and hypermarkets dominate premium tea distribution in India because they provide extensive reach across urban and semi-urban markets. Consumers prefer shopping in these formats due to the variety of options, curated displays, and the ability to compare premium teas. Institutional buyers and bulk purchasers also leverage these channels for cost efficiency and brand visibility. Companies such as Tata Tea and Goodricke use supermarket placements to reinforce brand recognition while offering seasonal or specialty collections.

Online distribution channels witness rapid growth in the India premium tea market, owing to convenience, urban lifestyle, and rapid e-commerce adoption. Digital platforms enable consumers to access niche, single-origin, or limited-edition premium teas that may not be available offline. B2B buyers, including cafés, corporate offices, and retail chains, procure bulk or curated selections online, leveraging subscription models and direct-to-consumer logistics. Estates benefit from direct digital sales that enhance traceability, freshness, and profitability.

Residential Application clock in substantial Share of the Market due to Daily Consumption

Residential consumption dominates the premium tea market in India, as households increasingly adopt specialty teas for health, wellness, and premium experiences. Urban and semi-urban consumers prefer single-origin, flavored, or functional blends, often served in daily routines or social occasions. Estates and brands focus on residential marketing through retail displays, digital campaigns, and curated assortments to attract end consumers. Residential demand ensures volume stability while supporting product diversification and introduction of value-added blends for long-term growth.

Commercial applications are driven by hotels, cafés, restaurants, and corporate offices adopting premium tea offerings. Institutions seek consistent quality, variety, and traceable sourcing to meet sophisticated customer preferences. B2B buyers benefit from bulk procurement, curated selections, and specialty blends that enhance service offerings, stabilizing the India premium tea forecast. Premium ready-to-drink, functional, and flavored teas are particularly popular in café menus and corporate gifting programs. Brands leverage commercial partnerships to reinforce visibility, promote seasonal or limited editions, and increase market share.

North India Holds the leading position in the Market due to Urban Premium Demand

North India dominates the premium tea market, driven by large urban centers such as Delhi, Chandigarh, and Lucknow. Consumers are increasingly adopting specialty teas, single-origin Assam and Darjeeling blends, and functional wellness variants. Premium cafés, hotels, and retail chains in this region contribute to significant B2B demand. Estates and distributors focus on high-quality packaging and curated gift collections for urban households. E-commerce platforms and organized retail channels amplify accessibility, supporting traceable sourcing and seasonal limited-edition launches.

The southern region, including Tamil Nadu, Karnataka, and Kerala, is witnessing rapid growth in the India premium tea market. Traditional tea-drinking culture, coupled with expanding urban cafés, modern retail outlets, and online platforms, is driving demand. Single-origin Nilgiri teas, flavored black blends, and herbal wellness teas are increasingly popular among consumers. B2B buyers, such as luxury hotels and specialty retailers, are investing in curated assortments. Estates are innovating with eco-friendly packaging and artisanal small-batch production to cater to health-conscious and premium-focused consumers.

The India premium tea market players are focusing on product differentiation, heritage branding, and innovation. Companies are increasingly investing in functional and wellness-oriented blends, organic certifications, and sustainable packaging to capture urban and export-oriented consumers. There is a growing emphasis on digital sales channels, e-commerce partnerships, and curated gifting solutions. Export markets are driving strategic collaborations with international distributors to meet global demand for single-origin Darjeeling and Assam teas.

Premium ready-to-drink teas and cold-brew variants are emerging as high-margin opportunities, especially for cafés, luxury hotels, and health-conscious consumers. India premium tea companies are innovating with small-batch artisanal collections, supporting traceability and eco-friendly cultivation practices. These initiatives enable brands to stand out in a crowded market while catering to evolving consumer preferences. Institutional buyers and B2B partners benefit from consistent quality, diverse portfolios, and scalable supply chains, making this sector attractive for strategic growth.

Established in 1962, headquartered in Kolkata, Tata Consumer Products is a leading player in Indian premium tea. The company focuses on specialty blends, single-origin Assam and Darjeeling teas, and functional wellness variants. Tata has pioneered cold-brew teas and premium ready-to-drink offerings for urban consumers and cafés. The company leverages estate-based traceability, eco-friendly packaging, and curated gift collections, catering to both B2B and retail segments with innovative premium tea solutions.

Founded in 1933 and headquartered in Mumbai, Hindustan Unilever produces premium teas under its Brooke Bond and Lipton brands. The company emphasizes functional and flavored blends, targeting health-conscious urban consumers. The company invests in digital platforms and modern retail partnerships to expand distribution and visibility.

Founded in 1980, headquartered in Ahmedabad, Gujarat Tea Processors & Packers produces high-quality Assam and specialty teas for both domestic and export markets. The company is innovating with flavoured and organic teas, and limited-edition single-origin blends. It focuses on B2B partnerships with specialty retailers, cafés, and hotels, providing consistent quality and traceable supply.

Established in 1933 and headquartered in Mumbai, Society Tea is a major player in premium Indian teas, specializing in Assam and Darjeeling varieties. The company focuses on flavored, single-origin, and wellness teas, targeting high-end retail and hospitality sectors. It is innovating with functional blends, ready-to-drink teas, and cold-brew variants.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Another key player in the market is Teaxpress Pvt Ltd among others.

Explore the latest trends shaping the India premium tea market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on India premium tea market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 4.20% between 2026 and 2035.

The tea market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach 1.79 Million Tons by 2035.

Developing innovative blends, adopting sustainable cultivation, expanding e-commerce channels, leveraging single-origin marketing, collaborating with cafés and retailers, and implementing traceable supply chains are driving growth in the India premium tea market.

The key trends guiding the market include technological advancements in the packaging sector, the growing popularity of premium tea among the affluent class, the expansion of the foodservice sector, and the rising preference for packaged varieties of premium teas.

The major regions in the market are North India, South India, West India and East India.

Flavoured black teas, green teas, functional botanical blends and herbal blends, probiotic teas, and iced tea, among others, are the significant types of premium tea.

The major segments based on packaging of premium tea considered in the market report are loose tea, plastic containers, paper boards, aluminium tea, and tea bags, among others.

The various distribution channels in the market are supermarkets and hypermarkets, convenience stores, speciality stores, and online, among others.

The several applications of premium tea are residential and commercial.

The key players in the market include Tata Consumer Products Ltd., Hindustan Unilever Limited, Gujarat Tea Processors & Packers Ltd, Society Tea, and Teaxpress Pvt Ltd, among others.

In 2025, the India premium tea market reached an approximate volume of 1.20 Million Tons.

High production costs, climate variability, sustainability compliance, export regulations, and shifting consumer preferences challenge companies, requiring constant innovation, quality assurance, and supply chain optimization to remain competitive.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Packaging |

|

| Breakup by Distribution Channel |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share