Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Mexico jam market was valued to reach a market size of USD 447.45 Million in 2025. The industry is expected to grow at a CAGR of 4.70% during the forecast period of 2026-2035. The growing expenditure on food and groceries, increasing popularity of packaged food, strong domestic production of fruits, and the rising popularity of online sales are aiding the market to attain a valuation of USD 708.29 Million by 2035.

Base Year

Historical Period

Forecast Period

Mexico’s forecasted berry production for the 2025 calendar year (CY) is 250,000 MT for blackberries, 219,000 MT for raspberries, and 700,000 MT for strawberries.

Mexico is home to 25 supermarket chains, with a combined total of 6,768 stores, contributing significantly to the growth of the jam market.

In 2025, Mexican grocery eCommerce market is predicted to reach about USD 3,389.5 million, accounting for 6.4% of the total eCommerce market.

Compound Annual Growth Rate

4.7%

Value in USD Million

2026-2035

*this image is indicative*

| Mexico Jam Market Report Summary |

Description |

Value |

|

Base Year |

USD Million |

2025 |

|

Historical Period |

USD Million |

2019-2025 |

|

Forecast Period |

USD Million |

2026-2035 |

|

Market Size 2025 |

USD Million |

447.45 |

|

Market Size 2035 |

USD Million |

708.29 |

|

CAGR 2019-2025 |

Percentage |

XX% |

|

CAGR 2026-2035 |

Percentage |

4.70% |

|

CAGR 2026-2035- Market by Region |

Baja California |

5.6% |

|

CAGR 2026-2035 - Market by Country |

The Bajío |

5.2% |

|

CAGR 2026-2035 - Market by Product Type |

Low Sugar and Sugar Free |

6.5% |

|

CAGR 2026-2035 - Market by Application |

Online |

9.0% |

|

Market Share by Country 2025 |

Central Mexico |

37.4% |

The increasing consumer expenditure on food items is driving the growth of the Mexico jam market. As spending on groceries continues to rise, demand for jam and other food products is expected to grow, further fueling market expansion. In 2023, food retail sales in the country totaled USD 78.4 billion. Major supermarket and department stores in Mexico, aiding the demand for jams, include Walmart, Inc., Costco Wholesale Corporation, Tiendas Soriana, S.A. de C.V. and Chedraui Group.

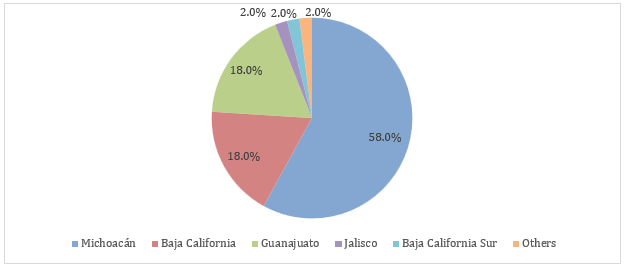

Figure: Key Strawberry Producing States in Mexico, 2024

The strawberry harvest season in Mexico is known for its extended duration and regional diversity, typically running from November to July, with peak production occurring in May and June. Central Mexican states, such as Michoacán, Guanajuato, Jalisco, and Mexico, begin their harvest in October and continue through June, with the highest activity seen between January and April.

Baja California, on the other hand, primarily produces strawberries in the summer, ensuring near year-round availability of strawberries in Mexico.

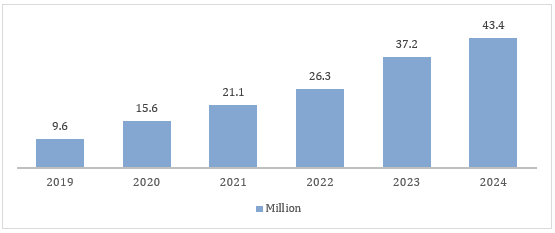

Figure: Online Retail Sales (USD Billion) in Mexico: 2019-2024

Online grocery shopping is growing in popularity, driven by the rise of grocery and food apps, as more consumers prioritise convenience and easy access to goods and services. Online purchases are more common in the larger cities of Mexico City, Guadalajara, and Monterrey. In 2024, Mexico online retail sales were USD 43.4 billion compared to 9.6 billion in 2019.

Key players in Mexico jam market are investing in new product launches to develop and introduce jams with unique and innovative flavours. In 2021, Grupo Herdez (McCormick Mexico) introduced a new line of jams called "Sabores de México," inspired by traditional Mexican flavours. This collection includes some of the country's most iconic regional tastes, including strawberry with guava, strawberry with hibiscus, and strawberry with mango.

As consumers become more health-conscious and aim to reduce their sugar intake, there is an increasing preference for jams that maintain rich flavour while containing fewer artificial ingredients and less sugar. Key companies offering jams that has less, or no sugar include the J.M. Smucker Company (Smucker) and Grupo Herdez.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Mexico jam market development is driven by the growing popularity of innovative and artisanal jams, robust production of fruits like strawberry, peach, and blackberry in the country, and expansion of the food service sector.

Mexico is experiencing a growing demand for handmade artisanal jams with little to no sugar. Consumers are increasingly willing to invest in high-quality, gourmet jams that feature unique flavours and are crafted using traditional methods, which is supporting the Mexico jam market expansion. Companies are leveraging this trend to capture consumer attention. Producers like Heavenly Jams and Mexpofood are offering these artisanal jams through online platforms, making them more accessible to a wider audience.

Jams are considered breakfast staples and often served with breads. The expansion in hotels, cafes and restaurants creates a demand for high-quality jams. As per 2023 report, top 5 hotels in Mexico include Accor, Xcaret, Marriott, Riu, and Hilton.

Mexico’s arable land can produce a variety of fruits, which is beneficial for domestic production of jams. Mexico's climatic and geographic diversity provides an ideal environment for growing a wide variety of fruits. Blackberry and strawberries are some of the majorly grown fruits in Mexico. As per Mexico jam market analysis, Mexico's strawberry production for CY 2025 is expected to reach 700,000 MT, reflecting a 6% increase from 661,260 MT in 2024. Michoacán and Baja California are among the leading strawberry production areas in the country.

The growing preference among millennials for innovative jam flavours is driving the growth of the Mexico jam market. To capitalize on this trend, market players in Mexico have introduced unique products, such as ginger and onion jams mixed with fruits, catering to the rising demand for sweet and spicy flavors. Key players offering jams with unique flavors include El Cielo Jams (Balsamic Onion Jam, Pineapple Ginger Jam, and Jamaica Chipotle Jam) and Grupo Herdez (Sabores de Mexico Jams and Chili-infused Jams).

In Mexico, strawberries, peaches, and blackberries are among the most preferred flavours. The country is a leading producer of these fruits, supporting local production of jams.

Blackberry production is projected to reach 250,000 MT in CY 2025, marking a 3% increase from an estimated 243,000 MT in 2024.

According to USDA report of 2024, the top four peach-producing states in Mexico account for around 71% of the country's total production. Zacatecas leads with nearly 40%, followed by Michoacán, Chihuahua and Puebla. Restaurants and hotels are increasingly demanding premium and artisanal varieties. The National Statistical Directory of Economic Units (DENUE) 2024 report shows that 7,23,285 economic units were registered for restaurants and other eating establishments, with the highest numbers in Estado de México, Ciudad de México, and Jalisco.

Growing popularity of artisanal jams offer significant opportunities to the Mexico jam market. The growing consumer preference for natural, organic, and health-oriented food products provides growth opportunities for the expansion of artisanal jams market in Mexico. Consumers are increasingly seeking products that offer not only taste but also functional health benefits. This trend opens opportunities for businesses to innovate by incorporating nutrient-rich fruits, herbs, and medicinal plants into their jam formulations. Products that emphasise immunity-boosting properties, antioxidant content, and natural sweetness can cater to health-conscious buyers.

Selling jams through online platforms is enhancing market accessibility and allowing players to reach a wider customer audience. The expansion of e-commerce in Mexico is fuelling the Mexico jam market development. With the increasing penetration of online platforms, consumers now have easier access to a wide range of jam products. This shift has allowed brands to reach a broader audience, leveraging the convenience of digital shopping. Some of the major e-commerce channels selling jams include Walmart Mexico and Central America, and Costco Mexico, SA de CV.

Adopting sustainable production practices and packaging provides a competitive edge to market players. As environmental concerns continue to shape consumer behavior, sustainability has become a critical factor in product differentiation within the jam market. For instance, market players like YEMA and Las Pitayas uses recycled packaging for their jams in Mexico.

Labour shortages could hinder operational efficiency and impact jam production in Mexico. The market relies heavily on a stable labour force for manufacturing, packaging, and distribution activities. Therefore, factors such as increased turnover rates, rising labour costs, or difficulties in retaining skilled workers can hinder the operational efficiency of players in Mexico jam market.

Jam and jelly manufacturers face several common challenges during production, such as issues with softness, weeping, fermentation, darkening, clouding, mold growth, and crystal formation. For instance, jams and jellies may darken at the top of the container when stored in warm environments, or if a defective seal allows air to enter. Red fruits, like strawberries, are particularly susceptible to fading over time. Additionally, mold growth can occur if the jar seal is imperfect or there is excessive air space between the lid and the product, compromising shelf life and quality.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Mexico Jam Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of flavour, the market can be divided into the following:

On the basis of distribution channel, the market can be divided into the following:

By packaging type, the market is bifurcated into the following:

By distribution channel, the market is segmented into the following:

Based on region, the market can be segregated into:

Market Analysis by Flavour

Improved techniques, including reduced water and fertiliser use and annual planting of new varieties, are driving higher productivity and efficiency of strawberry and blackberry in Mexico, ensuring a stable supply for jam production in the country.

According to USDA report of 2025, strawberry producers achieve yields of 59 to 62 MT per hectare, with up to 54,000 plants per hectare.

As per Mexico jam market report, in 2024, peach production in Mexico reached around 266,400 metric tons (MT), marking a 3% increase compared to 2023.

In 2024, Michoacán accounted for 90% of the country’s blackberry production, followed by Jalisco with 7%.

Market Analysis by Type

As consumers become more aware of the health risks associated with excessive sugar consumption, there is a driving shift toward fruit-focused jams that offer natural sweetness. The Mexican Official Standard NMX-F-131-1982 defines jam as containing 40% fruit and 60% sugar, highlighting the importance of fruit. Key companies offering sugar-free jams in Mexico jam market include The J.M. Smucker Co, St Dalfour, Famesa, and Happy Marmalades SA de CV, among others. Several jam producers in Mexico prefer sourcing raw materials locally. For instance, Happy Marmalades SA de CV sources all its ingredients from local farmers to create sugar-free, handmade jams that are 100% natural and organic.

Key players offering traditional jams in Mexico include Mccormick, The J.M. Smucker Company, and La Costeña.

Market Analysis by Packaging Type

Glass jam jars, available in various sizes and colours, are ideal for high-acid jams as they prevent reactions and keep products fresh with tight-fitting lids. Their transparency highlights color and texture, enhancing shelf appeal, while reusability makes them an eco-friendly, sustainable choice. Key companies offering jams in glass jars includes St Dalfour, Famesa, and Grupo Herdez, among others.

Plastic packaging is a convenient option for bulk purchases by bakeries. According to 2023 data, Mexico has 59,881 traditional bakeries. The State of Mexico is home to 14.3 percent of these bakeries, making it the state with the most bakeries of this type, followed by Veracruz and Oaxaca, with 8.3 and 8.1 percent, respectively.

Market Analysis by Distribution Channel

Dominance of supermarket and convenience stores in the market, stimulates the Mexico jam market growth. In 2023, Mexico was home to over 990,000 traditional and modern retail establishments. Prominent supermarket stores include Walmart, Chedraui Group, and Soriana. Walmart controls a large portion of the supermarket sector in Mexico with its four store formats: Bodega Aurrerá (the most popular), Walmart Supercenter, Sam's Club, and Superama. In total, the company operates nearly 2,700 supermarkets. With their smaller size and shorter checkout times, convenience stores allow for fast and efficient purchases. Major convenience stores in Mexico include Oxxo, 7-Eleven, and Circle K, driving impulse purchases in the market.

Expansion of online retail fueled by urban consumer demand, is another crucial driver of Mexico jam market. Online purchases are growing in Mexico City, Guadalajara, and Monterrey, improving convenience and accessibility for consumers. As per 2024 data, Mexico has the highest mobile e-commerce penetration in Latin America, at 79%. The Mexican grocery e-commerce market is projected to hit USD 3,389.5 million by 2025 (6.4% of total e-commerce).

Presence of several supermarkets and strong hotel industry supports Mexico jam market growth in Central Mexico. Leading supermarkets in Central Mexico include Walmart, Chedraui, and Soriana, among others. With 656 hotels in Mexico City, the hospitality sector significantly boosts jam market growth by driving demand for premium, and artisanal jams in breakfast buffets and room service.

In Northern Mexico, in October 2024, Soriana announced its plan to open 10 new stores and renovate nine others by 2025. As part of its annual growth program, the company aims to strengthen its presence, particularly in northern Mexico, with new stores set to open in the states of Chihuahua, Tamaulipas, and Nuevo León.

Increasing consumption of peach jams among Mexican consumers is one of the key trends of Mexico jam market. Chihuahua, located in Northern Mexico, is a leading producer of peaches, accounting for 12% of the country’s total peach production in 2023.

Michoacán, part of the Bajío, accounted for 90% of Mexico's national blackberry production in 2024. Further, Zacatecas, located in the Bajío region, leads peach production in Mexico, contributing 39% of the national share in 2024. This ensures a steady supply for jam manufacturers and fuels market growth.

The production of raspberry, one of the preferred flavour types for jams in Mexico has grown steadily since 2019, surpassing 205,000 MT in 2024. In that year, Baja California accounted for 17% of the country's total raspberry production. Baja California is home to several supermarkets and retail chains, such as Soriana, Walmart, and Calimax.

|

CAGR 2026-2035 - Market by |

Region |

| Baja California |

5.6% |

| The Bajío |

5.2% |

| Pacific Coast |

4.1% |

| Northern Mexico |

XX% |

| Central Mexico |

XX% |

| Yucatan Peninsula |

XX% |

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market participants distinguish themselves by launching jams inspired by Mexican roots, competitive pricing, and utilising advertising campaigns, digital initiatives, and point-of-sale materials to attract a broader customer base and expand the Mexico jam market share.

Founded in 1910, Grupo Herdez S.A.B. de C.V. is a leading Mexican food company with a strong presence in production, distribution, and sales. A dominant player in Mexico's processed food sector, it also holds a significant position in the ice cream market domestically and in the U.S. Mexican food segment. Through its diversified portfolio and subsidiaries, the company serves local and international markets with a robust supply chain and a reputation for quality.

Founded in 1897, The J.M. Smucker Co. is a leading company renowned for its diverse portfolio of trusted brands that consumers rely on daily. It excels in categories such as coffee, peanut butter, fruit spreads, frozen foods, sweet baked goods, and pet products. With well-known brands like Folgers, Dunkin', Jif, and Meow Mix, the company is committed to producing high-quality products while maintaining ethical operations and contributing positively to society. This approach supports sustainable business growth.

Agave Trading México is a pioneering producer of premium agave-based sweeteners, specializing in 100% natural agave syrup and innovative agave-sweetened products. Rooted in Mexico’s rich agave heritage, we combine traditional knowledge with sustainable practices to deliver high-quality, healthier alternatives to refined sugars. It focuses on delivering high-quality, sustainable, and innovative agave-based products, catering to consumers seeking natural and healthier alternatives.

Established in 1984, St. Dalfour, recognised as the world’s first French fruit spread brand, has been crafted using a cherished family recipe and traditional French methods. Ethically sourced and Project Non-GMO verified, its fruit spreads are made entirely from fruit and naturally sweetened with vineyard-ripened grape and fruit juices.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Mexico jam market are Sabormex, SA de CV, Andros Group, and Famesa Group, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 4.70% between 2026 and 2035.

The major market drivers include increasing usage of jam, availability of speciality flavours and variants, and preference for easy to prepare foods.

The key trends guiding the growth of the market include rising health concerns, lifestyle changes, and increasing popularity of organic fruit-based food products.

The significant distribution channels in the Mexico jam market are supermarkets and hypermarkets, convenience stores, and online, among others.

Ideal market for jams includes businesses with regular utilisation of jams, bakeries and restaurants, direct consumers and households, and food store chains, among others.

One of the most expensive jams in the world is red currant jam.

Strawberry jam is one of the oldest jams ever made and can be traced back to the sixteenth century.

Jam market holds great potential for profits; however, they are heavily dependent upon the texture, quality, and taste of the jam which would influence the selling price as well as the production price.

The different flavours of the jam in the market are grapes, peach, blackberry, strawberry, raspberry, apricot, and cherry, among others.

The key players in the Mexico jam market are Grupo Herdez S.A.B. de C.V., The J.M. Smucker Co., Agave Trading México, S. DE RL DE CV, St. Dalfour, Sabormex, SA de CV, Andros Group, and Famesa Group, among others.

In 2025, the Mexico jam market reached an approximate value of USD 447.45 Million.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 708.29 Million by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Flavour |

|

| Breakup by Type |

|

| Breakup by Packaging Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share