Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global mobile payment market size reached a value of nearly USD 3547.37 Billion in 2025. The market is projected to grow at a CAGR of 18.80% between 2026 and 2035 to reach around USD 19864.19 Billion by 2035.

Base Year

Historical Period

Forecast Period

In 2021, smartphone penetration increased to 85%. Around 15% of American adults only use their smartphones for internet access.

American Express Company, Apple Inc., and Google LLC are a few of the major companies in the market.

In terms of payment prototypes, the bank-centric model is rapidly being replaced by a more decentralised model that may involve settlement by non-financial service providers.

Compound Annual Growth Rate

18.8%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Mobile Payment Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 3547.37 |

| Market Size 2035 | USD Billion | 19864.19 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 18.80% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 21.7% |

| CAGR 2026-2035 - Market by Country | India | 24.9% |

| CAGR 2026-2035 - Market by Country | China | 20.8% |

| CAGR 2026-2035 - Market by End User | Personal | 20.7% |

| CAGR 2026-2035 - Market by Application | Retail | 21.4% |

| Market Share by Country 2025 | Italy | 2.4% |

Mobile payment (also known as mobile money, mobile money transfer, and mobile wallet) refers to payment services that are carried out from or via a mobile device and are governed by financial regulations. A user can use a mobile phone to pay for a variety of services and digital or tangible products instead of cash, check, or credit card.

Mobile payments have experienced significant growth, with smartphones becoming the preferred choice for financial management. The expansion of digital wallets is aiding the mobile payment market expansion. In 2023, 53% of Americans made more frequent use of digital wallets than traditional payment methods.

Another trend aiding the market is the rise of mobile point of sale (mPOS), which has shifted card payment processing to a wireless economy, offering a space-saving, wire-free solution for accepting payments. Apple has successfully integrated mPOS into its operations.

Some of the factors driving the mobile payment market growth are the rising internet penetration and growing smartphone ownership. Mobile payments are quick, simple, and linked to established, well-known financial processing systems and more retailers are rapidly supporting and encouraging them. Mobile payments are a viable alternative to cash, credit cards, and money held in the banking system. As a result, mobile payments are gaining popularity in developing economies.

Increasing internet penetration; surging smartphone users; government initiatives to promote digital payments; and technological advancements and innovations support the mobile payment market growth.

| Date | Company | Details |

| October 2023 | Google LLC | Google Pay India introduced a loan option to support small traders, eliminating the need for traditional banks. |

| October 2023 | CCAvenue | The payment gateway CCAvenue.ae, a subsidiary of the fintech company Infibeam Avenues, unveiled a mobile-based QR Code payment solution tailored for merchants operating in the UAE market. |

| September 2023 | Mastercard | Mastercard and UK fintech Paysend partnered to improve cross-border payments for SMEs. |

| September 2023 | Paytm | In a groundbreaking initiative, the fintech behemoth Paytm unveiled the Paytm Card Soundbox, which facilitates card payments alongside mobile payments through QR codes, all the while delivering immediate audio payment notifications. |

| Trends | Impact |

| Increasing smartphone users | In 2023, 54% of the world's population owned a smartphone. This rising adoption of smartphones offers a growth opportunity for the utilisation of mobile payment applications. |

| Rising internet penetration | Global internet usage via mobile devices has surged by 67% in 2022-23, and the number of internet users is rising. According to industry reports, the percentage of mobile data traffic that uses 5G is expected to increase to 76% by 2029. |

| Government investments aimed at enhancing digital payment accessibility | Governments of the USA, EU, and India are investing substantial amounts to make digital payments more accessible. |

| Technological advancements | By incorporating cutting-edge technological advancements like wearables, biometrics, and the integration of blockchain technology, the mobile payment market is poised to transform the payment landscape. |

| Growth in e-commerce | The growing e-commerce market is driving a heightened demand for convenient online payment solutions such as mobile payment applications. |

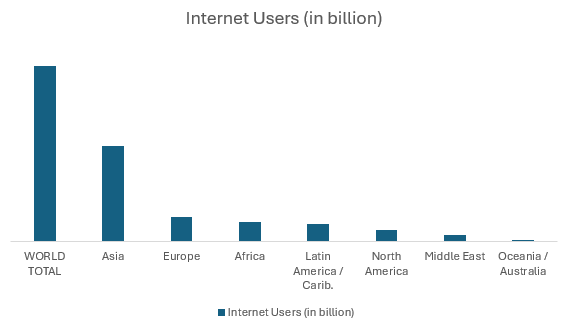

Figure: Global Internet Users (in Billion), 2021

Mobile payment adoption varies by region due to economic, regulatory, and banking differences. The Asia Pacific is the largest adopter, driven by its significant unbanked population, followed by Europe and North America. Companies from various backgrounds are drawn to this market, leading to competition between newcomers such as Samsung and Google, and traditional financial players.

Furthermore, the widespread availability of internet connectivity in both developed and developing economies is anticipated to be a significant catalyst for the mobile payment market growth in the coming years. The increasing adoption of QR codes allows smaller merchants to begin accepting electronic payments.

Figure: Country-wise Representation of Credit Card Ownership (age 15+) w.r.t. % of Population, 2021

"Global Mobile Payment Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Transaction Mode

Market Breakup by End User

Market Breakup by Purchase Type

Market Breakup by Application

Market Breakup by Region

By transaction type, mobile web payments are expected to hold a significant market share due to the flexibility and security offered by this technology

The global mobile web payments market is expected to grow in the forecast period due to the increasing use of mobile devices and the increasing popularity of mobile payments. Mobile wallets are becoming increasingly popular, as they offer a convenient and secure way to make payments. Due to the increasing e-commerce market, there is a growing demand for mobile web payments for online transactions.

The adoption of mobile payment solutions by businesses is significantly increasing

Businesses are widely employing mobile payment methods for B2B transactions, such as EFT, wire transfers, and corporate credit cards. Additionally, banks are increasingly adopting B2B mobile payments to enhance the experience for business customers. In 2022, the B2B segment led with over 60.0% of the total revenue share. Notably, substantial investments from private equity and venture capital firms in B2B payments are opening new growth avenues.

Meanwhile, individuals use mobile payment to reduce expenses, improve cash flow, enhance convenience, simplify bookkeeping, and surge payment security. The low cost of usage and adoption of mobile wallets, coupled with the speed of payments offered by this method, further aids the mobile payment market growth.

The use of mobile payment for money transfers and bill payments is expected to rise in the forecast period

Money transfers and bill payments are anticipated to hold a substantial mobile payment market share due to the rising popularity of contactless payment. In 2022, money transfer operators represented over 73.68% of global revenue. The introduction of digital-first operators and enhanced digital capabilities from established operators are expected to drive this segment's growth in the forecast period.

In travel and ticketing applications, mobile payments are preferred as alternatives to credit cards. They simplify the payment process, build customer engagement, and increase traveller satisfaction. Reportedly, three-quarters of travellers use mobile payments for shopping and around 68% use it for beverage, food, and restaurants.

Market players are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

| Company Name | Year Founded | Headquarters | Products/Services |

| American Express Company | 1850 | United States | Provides AMEX Pay, a secure and user-friendly mobile payment solution accessible through the American Express Mobile App. |

| Apple Inc. | 1976 | United States | Provides a comprehensive suite of mobile payment services through offerings like Wallet, Apple Card, Apple Pay, and Apple Cash. |

| Google LLC | 1998 | United States | Provides mobile payment solutions via Google Pay, enabling users to transfer funds without incurring fees directly from their bank accounts to nearly anyone |

| JPMorgan Chase & Co. | 1968 | United States | provides J.P. Morgan Wallet™, an accounting-based mobile payment solution that offers real-time sub-ledger creation across multiple platforms. |

Other key players in the mobile payment market include Mastercard Incorporated, Paytm (One 97 Communications Limited), and PayPal Holdings, Inc.

| CAGR 2026-2035 - Market by | Country |

| India | 24.9% |

| China | 20.8% |

| UK | 17.2% |

| USA | 16.8% |

| France | 14.7% |

| Canada | XX% |

| Germany | XX% |

| Italy | XX% |

| Japan | 12.9% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

North America is anticipated to dominate the mobile payment market share in the forecast period. In 2023, 104 million Americans aged 14 years and older used in-store mobile payment apps, marking a significant milestone. By 2028, use is expected to reach 58% of all smartphone users in the coming years. By the end of 2025, over 85% of Americans are likely to own smartphones, leading to a greater uptake of mobile payments at the business-to-consumer level.

The Europe mobile payment market is being driven by the consumer preference for digital payments, easier cross-border transactions, and the launch of the European Digital Identity Wallet. Mobile online payment systems in Europe have surged by over 30% in the past three years. In Germany, around 44% of all domestic online transactions are done using digital wallets.

The Asia Pacific is expected to hold a prominent market share in the coming years, driven by the rise of e-commerce and the O2O (Online to Offline) market. The mobile payment market landscape across the Asia Pacific region is changing rapidly owing to unsettling digital transformation. Technological developments in the smartphone and government initiatives have enabled POS at retail terminals and on-the-go fund transfers, which are fuelling the market growth.

India Ductile Iron Pipes Market

Micro Irrigation Systems Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was nearly USD 3547.37 Billion.

The market is projected to grow at a CAGR of 18.80% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 19864.19 Billion by 2035.

The major market drivers include increasing smartphone users and rising internet penetration.

The key trends include technological advancements in the mobile payment landscape and the growth of the e-commerce sector.

The transaction modes of mobile payment include mobile web payments, near field communication, and SMS direct carrier billing, among others.

The major end users of mobile payment include personal, and business.

The major players in the market include American Express Company, Apple Inc., Google LLC, JPMorgan Chase & Co., Mastercard Incorporated, Paytm (One 97 Communications Limited), and PayPal Holdings, Inc.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Transaction Mode |

|

| Breakup by End User |

|

| Breakup by Purchase Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share