Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global digital camera market size was valued at USD 11461.88 Million in 2025, and it is projected to grow at a CAGR of 4.00% from 2026 to 2035, reaching USD 16966.38 Million by 2035.

The expansion of the digital camera market is influenced by the increasing demand for digital imaging devices and the popularity of social media platforms, where high-quality images are in demand. Additionally, the rise of smartphones with advanced digital camera technology is a key factor. Other growth factors include continuous innovation and consumer preferences.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4%

Value in USD Million

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Digital Camera Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 11461.88 |

| Market Size 2035 | USD Million | 16966.38 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 4.5% |

| CAGR 2026-2035 - Market by Country | Brazil | 4.6% |

| CAGR 2026-2035 - Market by Country | Canada | 4.4% |

| CAGR 2026-2035 - Market by Type | Built-in Lens Cameras | 4.3% |

| Market Share by Country 2025 | France | 3.7% |

The digital camera products market is diverse, encompassing various types of digital cameras, including mirrorless cameras, professional-grade DSLRs, and compact models. These products are often paired with essential peripherals and accessories, such as lenses, to enhance usability/functionality. As digital cameras continue to evolve, the inclusion of advanced features boosts their appeal in both film & photography and marketing & advertising. The increasing demand for high-quality imaging solutions drives the growth of cameras and accessories across different sectors, meeting the needs of both professionals and consumers.

The global digital camera market continues to grow, driven by the demand for digital cameras among professional photographers, cinematographers, and enthusiasts. While customers rely on their smartphones for basic recreational photography, digital cameras remain the preferred product for those seeking superior image quality and manual controls. Mirrorless digital cameras, optical zoom features and large-format image sensors cater to those requiring high-end technology for capturing detailed images. Professional photographers and cinematographers prioritise these advanced features over smartphones for their precision and capabilities. In March 2025, FUJIFILM India launched the FUJIFILM X-M5, a new addition to its X Series of mirrorless cameras, known for its compact design, advanced technology, and excellent image quality. They also introduced the Tripod Grip TG-BT1 to enhance mobility and stability for content creators.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The benefits of built-in features in digital cameras include enhanced convenience and ease of use. With components integrated into the camera body, users don’t need additional accessories, making it compact and portable. This simplifies operation, especially for beginners or casual users, while maintaining high-quality performance. Built-in systems often streamline the shooting experience, offering faster setup times and improved reliability, making them an appealing choice in the global digital camera market. In April 2024, Canon unveiled the CJ27ex7.3B broadcast zoom lens, featuring a 27x optical zoom and built-in 2x teleconverter. Offering a focal range of 7.3mm to 197mm, it extends to 394mm, delivering exceptional optical performance and enhancing visual storytelling for various media sectors.

The interchangeable lenses in the global digital camera market are significant, offering unparalleled flexibility and creativity. Photographers can select lenses tailored to specific shooting conditions, such as wide-angle lenses for landscapes or telephoto lenses for wildlife. This adaptability ensures optimal image quality, allowing for a wide range of photographic styles and techniques. Interchangeable lenses also extend the camera’s lifespan, as users can upgrade or switch lenses as technology advances. This versatility is highly valued by both professionals and enthusiasts, enhancing their ability to capture diverse scenes and achieve superior results across various environments and subjects.

Compact digital cameras offer portability and ease of use, making them ideal for casual photographers and travellers. Their small size allows for easy carrying, while still providing high-quality images and essential features. With user-friendly interfaces, compact digital cameras are perfect for beginners or those seeking a simple, no-fuss experience. Their affordability and convenience make them a popular choice in the global digital camera market. Leica announced the launch of the Leica D-Lux 8 in July 2024, continuing its legacy of compact digital cameras. The D-Lux 8 features a 21 MP sensor, fast Leica lens, and improved design, with simplified controls and enhanced user experience.

DSLR cameras are renowned for their exceptional image quality, advanced manual controls, and versatility, making them a top choice for professionals and photography enthusiasts. Their larger sensors capture more light, providing superior detail and clarity, especially in low-light situations. The ability to change lenses allows for complete creative control, catering to various photography styles. DSLR cameras also offer faster autofocus and continuous shooting, making them ideal for fast-paced action shots. While more substantial and expensive than compact cameras, their advanced features and high-quality output make them a dominant force in the global digital camera market, particularly in professional settings.

Pro photographers benefit from high-performance digital cameras that offer exceptional image quality, manual controls, and advanced features such as larger sensors and interchangeable lenses. These cameras provide the flexibility needed for various shooting conditions, ensuring optimal results. With fast autofocus, high-speed continuous shooting, and reliable low-light performance, professional-grade cameras are essential tools in capturing detailed and accurate images, making them crucial in the global digital camera market. In July 2024, Canon launched the pro-spec EOS R1 and EOS R5 Mark II cameras. The EOS R1, designed for high-speed sports and action, and the EOS R5 Mark II, a high-resolution all-rounder, both feature Canon’s new "Accelerated Capture" technology and Eye Control Focus.

Prosumers, or serious photography enthusiasts, benefit from digital cameras that provide a perfect blend of advanced features and ease of use. These cameras, often equipped with larger sensors, manual controls, and high-quality lenses, allow prosumers to capture professional-level images while still being accessible for non-professionals. The ability to adjust settings for creative expression, such as exposure and focus, caters to those seeking more control than typical consumer cameras offer. With superior image quality and additional functions like 4K video recording, these cameras offer versatility for a range of applications. In the global digital camera market, prosumers are a key segment driving innovation and demand for mid-to-high-end cameras.

The North American digital camera market has seen a shift towards mirrorless and high-performance DSLR cameras, driven by both professional photographers and avid hobbyists. In the U.S., demand for cameras with advanced features, such as enhanced autofocus, 4K video recording, and improved low-light capabilities, is growing. Social media influencers, vloggers, and content creators continue to fuel the market, seeking cameras that offer excellent image quality and portability. Additionally, consumers are increasingly opting for cameras that integrate seamlessly with mobile devices for easier sharing and connectivity. The North American market is expected to grow steadily, with innovation being a key driver.

U.S. Digital Camera Market Trends

The U.S. digital camera market has witnessed a shift towards mirrorless cameras, driven by both professional photographers and hobbyists. The demand for compact, high-performance cameras that offer superior image quality and video recording capabilities has increased. Technological advancements, such as enhanced autofocus systems, higher-resolution sensors, and connectivity features, continue to attract consumers. Additionally, the rise of social media platforms has contributed to the demand for cameras that cater to content creators. With a growing interest in vlogging and live-streaming, the U.S. market is expected to maintain steady growth in the coming years.

Europe Digital Camera Market Trends

In Europe, the digital camera market is influenced by an increasing preference for high-end mirrorless cameras among both professionals and enthusiasts. Countries like Germany and the UK see a growing adoption of cameras with advanced features, including 4K video, improved low-light performance, and high-resolution sensors. Consumers seek versatility and portability, which has led to the rise of compact models with interchangeable lenses. Additionally, the popularity of digital photography and social media content creation boosts demand across Europe, encouraging brands to focus on innovation and functionality.

Asia Pacific Digital Camera Market Trends

The Asia Pacific digital camera market is experiencing rapid growth, largely driven by technological advancements and rising disposable incomes. Countries like Japan and China are seeing strong demand for both professional-grade and consumer-focused digital cameras. Japan remains a key market due to its established camera manufacturing base, with brands like Canon, Nikon, and Sony leading innovation. Consumers increasingly favour mirrorless cameras for their compact design and advanced features. Additionally, the growing interest in video content creation and social media platforms has propelled the demand for high-quality cameras across the region.

Australia’s digital camera market is driven by growing consumer interest in photography and videography. There is a strong demand for high-performance cameras, particularly from travel enthusiasts and outdoor photographers. With the popularity of social media, more Australians are turning to advanced cameras to improve their content quality. The demand for mirrorless cameras and digital SLRs continues to rise due to their superior image quality, portability, and ease of use. Australia’s camera market remains competitive, with consumers seeking products offering both high-tech features and aesthetic design.

In India, the digital camera market is witnessing steady growth, spurred by the increasing popularity of photography and vlogging. Consumers are increasingly opting for mirrorless and DSLR cameras for their superior performance and image quality. The market is also being shaped by the rising influence of social media platforms, with content creators seeking professional-level equipment. Affordable entry-level models continue to attract first-time buyers, while higher-end cameras appeal to professionals and serious enthusiasts.

Middle East & Africa Digital Camera Market Trends

The digital camera market in the Middle East and Africa (MEA) is expanding, driven by growing interest in professional photography, travel, and content creation. In countries like Saudi Arabia and South Africa, demand for high-quality cameras is increasing as more consumers seek advanced features like 4K video recording, improved autofocus, and enhanced image stabilisation. The rise of social media and e-commerce has also spurred market growth, as more people invest in digital cameras for both personal and professional use. The MEA market is expected to see continued growth as photography becomes more ingrained in the region’s culture.

In the UAE, the digital camera market is characterised by a high demand for premium products with cutting-edge features. With many tourists and a growing local population of content creators, the demand for high-quality cameras, particularly mirrorless models and DSLRs, is on the rise. The UAE's strong presence in the global luxury market has also driven sales of high-end cameras. Consumers seek cameras with features like 4K video, faster autofocus, and advanced image quality, making the UAE a key market for high-performance digital cameras.

| CAGR 2026-2035 - Market by | Country |

| Brazil | 4.6% |

| Canada | 4.4% |

| China | 4.3% |

| Germany | 3.9% |

| Mexico | 3.7% |

| USA | XX% |

| UK | XX% |

| France | XX% |

| Italy | 3.6% |

| Japan | XX% |

| India | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

Some of the leading companies in the digital camera sector include Canon Inc., Eastman Kodak Company, FUJIFILM Holdings Corporation, Leica Camera AG, among others. Increasing competition within the industry has driven key players to implement strategies such as enhanced research and development in technology, innovative new product offerings, global expansion, and improved distribution networks.

Canon Inc., a Japanese multinational, specialises in imaging, optical, and industrial products, including cameras, lenses, scanners, and medical equipment. Canon’s focus is on fostering professional growth by offering high-performance, high-quality digital solutions.

Nikon Corporation, a major player in the digital camera market, provides imaging products and optical technologies designed to empower both photographers and videographers.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

A digital camera refers to a multimedia device that uses an electronic image sensor to preserve digital photographs or videos. It comprises of a lens and a variable diaphragm to modify the electronic lighting, along with a viewfinder monitor to show a captured image or video. Unlike a movie camera, digital camera photos or videos are immediately accessible. Additionally, these devices also provide basic image editing functions, including cropping and image enhancement. Other features such as auto focusing, best shot selector, ISO, and AWB updates, burst shots, shutter speed, and optical zoom are standardised.

Lens Outlook (Revenue, Million, 2026-2035)

Product Outlook (Revenue, Million, 2026-2035)

End Use Outlook (Revenue, Million, 2026-2035)

Region Outlook (Revenue, Million, 2026-2035)

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global digital camera market attained a value of nearly USD 11461.88 Million.

The market is expected to grow at a CAGR of 4.00% between 2026 and 2035.

The major drivers of the market, such as the rising demand for mirrorless cameras and the growing innovations by the manufacturers, are expected to propel the market growth.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific, with the Asia Pacific accounting for the largest market share.

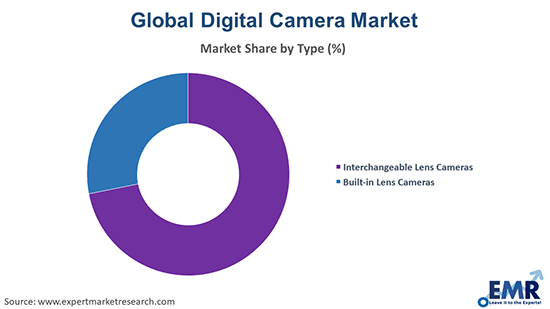

The major product types in the market are divided into interchangeable lens cameras and built-in lens cameras.

The major players in the market are Canon Inc., Nikon Corporation, Sony Corporation, Panasonic Corporation, FUJIFILM Holdings Corporation, Eastman Kodak Company, Leica Camera AG, Olympus Corporation, OM Digital Solutions Corporation, Comp9RICOH IMAGING COMPANY, LTD., SIGMA CORPORATION, and Hasselblad, among others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 16966.38 Million by 2035.

Asia Pacific is the fastest-growing region in the digital camera market.

North America holds the largest share of the digital camera market.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Lens |

|

| Breakup by Product |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share