Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The mushroom market attained a value of USD 73.47 Billion in 2025. The market is expected to grow at a CAGR of 8.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 158.62 Billion.

The mushrooms market revenue is expanding with rising demand as key ingredients in alternative meat products to render texture and flavour. Food startups and established brands are launching mushroom-based burgers, jerky, and meat substitutes. For instance, in February 2025, iChoose Global introduced Muskee Musky, a premium Vietnamese mushroom jerky, made from highland-grown mushrooms. The growing popularity of sustainable protein sources is further encouraging product launches for targeting millennials and Gen Z.

Scientific research and media coverage is highlighting the nutritional value of mushrooms, including vitamins, minerals, antioxidants, and dietary fibre. This awareness drives consumer interest in incorporating mushrooms into daily diets for overall health, immunity, and longevity. Educational campaigns by industry bodies and health influencers reinforce these benefits. Nutritional claims on packaging enhance product positioning, particularly for functional and organic mushroom lines, strengthening demand.

The mushroom market is diversifying with new varieties, such as Maitake, Enoki, and Chestnut gaining popularity alongside traditional button, shiitake, and oyster mushrooms. Product innovation extends to value-added forms including powders, extracts, ready-to-cook packs, and infused snacks. In April 2025, Happiee introduced the United Kingdom's first easy-cook lion's mane mushroom chunks, available in Original and Teriyaki flavors. Innovation also includes hybrid products combining mushrooms with other superfoods or supplements. These developments differentiate brands and meet evolving consumer preferences for taste, convenience, and health benefits, stimulating category growth.

Base Year

Historical Period

Forecast Period

Reportedly, there are over 10,000 species of mushrooms, varying greatly in size, shape, colour, and habitat.

Advances in mushroom cultivation technology, such as controlled environment agriculture, are improving its yield, quality, and sustainability.

The major production regions for mushroom are Asia, Europe, and North America.

Compound Annual Growth Rate

8%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Mushroom Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 73.47 |

| Market Size 2035 | USD Billion | 158.62 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 8.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 8.9% |

| CAGR 2026-2035 - Market by Country | China | 9.0% |

| CAGR 2026-2035 - Market by Country | Mexico | 8.4% |

| CAGR 2026-2035 - Market by Type | Shiitake | 8.8% |

| CAGR 2026-2035 - Market by Form | Dried | 9.2% |

| Market Share by Country 2025 | Italy | 2.4% |

With growing consumer awareness about health and sustainability, plant-based diets are gaining traction. As per the Vegan Society, about 25.8 million people globally tried vegan food in January 2025. In 2023 This trend is driving increased demand for mushrooms in vegetarian and vegan products. The surge in flexitarian consumers also supports mushroom consumption as a meat extender or substitute. This shift benefits fresh, dried, and processed mushroom markets worldwide, especially in North America and Europe.

Consumer preference for organic foods continues to rise globally, further driving up the demand for organically grown mushrooms. Organic certification assures customers about pesticide-free, chemical-free cultivation, appealing to health-conscious buyers. In February 2025, M2 Ingredients opened its new organic mushroom facility in Vista, the United States for boosting capacity, and rapid supply of functional mushrooms. This growth in organic mushroom farming also aligns with sustainable agriculture practices, reducing environmental impact.

Environmental concerns are pushing mushroom market players to adopt sustainable packaging solutions. In April 2025, South Mill Champs partnered with Sprouts Farmers Market to launch 8 oz flow-wrapped bamboo tills offering recyclable, biodegradable mushroom packaging to enhance freshness and reduces plastic waste. These alternatives reduce plastic waste and appeal to eco-conscious consumers. Retailers and producers are also promoting eco-friendly packaging as part of brand identity and corporate responsibility.

Governments worldwide are promoting mushroom cultivation to improve rural livelihoods and food security. Support includes subsidies, training programs, research funding, and infrastructure development. Policies favouring sustainable agriculture and local production boost mushroom farming. In April 2022, the Canadian government invested CAD 344,100 via AgriMarketing for enabling Mushrooms Canada to promote nutritional benefits and expand domestic and United States market access. Such support enhances mushroom industry competitiveness and encourages innovation, especially in emerging economies.

Technological innovation in mushroom farming, including automated growing systems, climate control, and precision agriculture is helping to improving yield and quality. Smart farms are also using sensors and AI to monitor conditions, optimize water and nutrient use, and reduce waste. In May 2025, JKUAT unveiled a smart mushroom farming initiative using sensor-equipped, containerized farms remotely controlled via smartphone for boosting yields and sustainability. These advances lower production costs and enhance supply chain efficiency. Investments in cultivation tech also helps meet rising demand for specialty mushrooms.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Mushroom Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

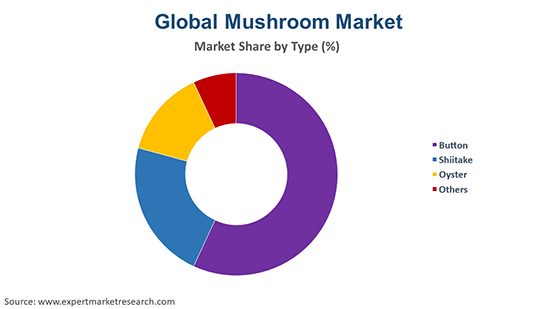

Market Breakup by Type

Key Insight: Button mushrooms demand forecast is driven by widespread cultivation, affordability, and versatility in cuisines. For instance, the button mushroom production plant inaugurated in June 2023 in Rwanda’s Musanze District is likely to yield 250 MT annually, boosting regional food security. Major producers heavily rely on button mushroom production as they are used in canned, frozen, and dried forms, boosting their shelf life and export potential. Continuous innovation, such as vitamin D-enriched varieties, further supports their market leadership and consumer appeal.

Market Breakup by Form

Key Insight: Fresh mushrooms remain the dominant form in the mushroom market due to high consumer preference for minimally processed, nutritious food. Major producers invest heavily in logistics and packaging to maintain freshness and extend shelf life. In February 2024, Neofungi expanded its production capacity by almost 1 million kg/year in early 2025, enabling year-round fresh mushroom supply and signalling growth in the fresh category. Retailers also offer fresh mushrooms in various forms driven by demand for healthy, plant-based foods. Freshness, taste, and versatility further ensure continued segment dominance.

Market Breakup by Distribution Channel

Key Insight: Supermarkets and hypermarkets represent the largest distribution channel for the mushrooms industry. These large-format retailers provide extensive shelf space, attracting a wide consumer base seeking fresh, canned, frozen, and specialty mushrooms. Walmart, Tesco, and Carrefour invest heavily in mushroom sourcing, packaging innovations, and promotional activities to drive sales. For instance, in November 2024, Carrefour collaborated with Belgian retailers to pilot reusable mushroom packaging in Mechelen to reduce plastic waste and promote a circular economy. Additionally, supermarkets are integrating functional and organic mushroom products to meet health-conscious demands.

Market Breakup by Region

Key Insight: North America remains a dominant region in the global mushroom market, driven by high consumer demand for fresh and processed mushrooms. The United States leads with advanced cultivation technologies and strong retail presence. The rise of plant-based diets and functional foods, fuel market growth. As per Plant Based Foods Association, about 62% of households in the United States bought plant-based products in 2023. Strategic partnerships and expansions, such as the South Mill Champs–Mountain View Mushrooms alliance, further strengthen North America’s leadership in mushroom production and distribution.

Shiitake & Oyster Mushrooms to Record Popularity

Shiitake mushrooms hold a major share and are primarily cultivated in Asia, especially China and Japan. Shiitake is gaining popularity in Western markets due to rising awareness of its immune-boosting and cholesterol-lowering properties. Several companies are capitalizing on this trend by integrating shiitake into alternative meat products and wellness beverages. With strong demand in both fresh and dried forms, shiitake mushrooms are expanding into global cuisines and health product formulations, narrowing the gap with button mushrooms in the premium segment.

The oyster mushroom industry is favoured for its delicate texture and nutritional value. These mushrooms are gaining momentum in Asia and emerging markets due to easy cultivation and fast growth cycles. In November 2024, China's first intelligent oyster mushroom production plant was launched to yield about 8 tonnes of mushrooms per day. Startups and small-scale farms are also focusing on oyster mushrooms on account of their low infrastructure needs. Rising role in sustainability, functional food, and dietary diversification is gradually boosting their global market presence.

Canned & Dried Mushrooms to Garner Widespread Demand

Canned mushroom demand is expanding, particularly popular in Europe and North America due to convenience and long shelf life combined with wide usage in the foodservice industry, including pizzerias and fast-food chains. Netherlands and China are major exporters of canned mushrooms. The format supports year-round availability and reduces spoilage risks. Although less nutritionally rich than fresh varieties, canned mushrooms offer affordability and ease of storage. Producers focus on BPA-free, sustainable packaging and product diversity, such as mixed mushroom cans. These attributes make canned mushrooms an accessible option for consumers and businesses.

Dried mushrooms market share is growing, led by their long shelf life and concentrated flavour. Popular in gourmet cooking, particularly in Asian and European cuisines, dried varieties including shiitake, porcini, and chanterelle are used in soups, broths, and sauces. Companies are exploring dried mushroom varieties to cater to different food options. In May 2025, Urban Farm It launched United Kingdom-grown and organically certified dried Lion’s Mane mushrooms, ideal for teas, soups, as well as savoury recipes. The growing popularity of functional ingredients in wellness markets has also expanded dried mushroom demand.

Grocery Stores & Online Channels to Boost Mushroom Sales

Grocery stores, including regional chains and independent retailers, serve as a significant sales channel in the mushrooms market due to their focus on convenience and specialty products. These outlets stock fresh mushrooms, especially button and oyster varieties, and increasingly offer organic and dried mushrooms to appeal to niche consumers. Stores, such as Kroger and REWE tailor product assortments to regional tastes. The flexibility of grocery stores allows quicker adaptation to emerging trends, such as plant-based and functional mushrooms, helping them maintain steady market share in both urban and rural areas.

Online mushroom sales represent the fastest-growing segment in mushroom retail. E-commerce platforms and specialty health food sites offer fresh, dried, and powdered mushrooms with convenient home delivery. Innovations in packaging and cold chain logistics support the online expansion of fresh mushrooms. In August 2024, Mushroom Material developed a unique pelletized fungi packaging as an alternative to Styrofoam to offer scalable and sustainable alternative to single-use synthetic packaging materials. Online channels are also crucial for reaching younger, tech-savvy consumers and driving niche segments globally.

Thriving Mushroom Consumption in Europe & Asia Pacific

Europe mushroom market share is propelled by increasing demand for organic and specialty mushrooms. The United Kingdom, Netherlands, and Poland are significant producers and consumers. As per ReportLinker, the Dutch mushroom production industry is estimated to reach 314,350 metric tons by 2026. Companies, such as Hughes Group and Monaghan Mushrooms drive innovation with selenium-enriched mushrooms and vertical farming techniques. Sustainability plays a vital role, with eco-friendly packaging and cultivation gaining traction. The region also benefits from trade agreements facilitating cross-border distribution.

| CAGR 2026-2035 - Market by | Country |

| China | 9.0% |

| Mexico | 8.4% |

| Canada | 8.3% |

| UK | 7.9% |

| France | 7.5% |

| USA | XX% |

| Germany | XX% |

| Italy | XX% |

| India | XX% |

| Australia | 7.4% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Japan | 7.3% |

Asia Pacific is rapidly growing in the mushroom industry due to fragmented production and emerging consumer awareness. China dominates production with a vast cultivation base but lower processed product penetration compared to Western markets. Japan and India show increasing demand for functional mushrooms and alternative proteins. Urbanization, rising disposable incomes, and health-conscious consumers are driving growth. Strategic collaborations and modernization of farming practices promise accelerated growth in the coming years.

Key players operating in the mushroom market are deploying strategies that revolve around innovation, sustainability, and market expansion. Product diversification is enabling companies to introduce value-added products like mushroom-based snacks, powders, and functional supplements to cater to health-conscious individuals. The growing demand for plant-based and immune-boosting foods has encouraged investments in functional mushrooms. Investment in research & development is helping to improve yields, develop disease-resistant mushroom varieties, and innovate packaging solutions to extend shelf life.

Sustainability is another critical strategy. Players are adopting eco-friendly cultivation methods, including vertical farming and the use of agricultural waste as growing substrates, to reduce environmental impact and enhance production efficiency. Organic certification and clean-label products are also being prioritized to meet consumer expectations. Strategic partnerships, mergers, and acquisitions are being used to expand geographical reach and gain competitive advantage. Companies are strengthening their supply chains and distribution networks, including direct-to-consumer e-commerce channels, to ensure better market penetration.

Established in 1937, Costa Group is headquartered in Victoria, Australia and operates fully integrated vertical farms supplying fresh produce within 24 hours. The firm’s innovations include the Mush Boom consumer brand launched in 2020 and recyclable, informative packaging to boost mushroom consumption.

Founded in 1964, Hughes Group is headquartered in Dungannon, the United Kingdom. The firm produces around 300 tonnes of mushrooms weekly, opened an 11 acre energy efficient site in Howden (2018), and introduced the industry’s first selenium enriched "Gathered" mushrooms.

Founded in 1981 and headquartered in County Monaghan, Ireland, Monaghan Mushrooms is a vertical agribusiness operating across the United Kingdom, Ireland, Canada, and Europe The company fully controls substrate, cultivation, packing, and distribution, and offers varied lines including chestnut, portobello, organic mushrooms, and mushroom powders.

Monterey Mushrooms, founded in 1971 with headquarters in California, the United States, is North America’s largest mushroom grower. The firm maintains ten farms in the United States and Mexico and pioneered a patented "sunlight" vitamin D enrichment process and advanced washing systems for fresh mushrooms.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the mushroom market include Okechamp S.A., among others.

Download your free sample of the mushroom market report to explore detailed mushroom market trends 2026, growth drivers, and competitive analysis. Stay ahead in the evolving global mushroom industry by accessing expert insights, forecasts, and market opportunities today!

United States Mushroom Market

Functional Mushrooms Market

Argentina Mushroom Market

Mushroom Substrate Market

Colombia Mushroom Market

Chile Mushroom Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 73.47 Billion.

The market is projected to grow at a CAGR of 8.00% between 2026 and 2035.

The market is estimated to witness a healthy growth during 2026-2035 to reach around USD 158.62 Billion by 2035.

The key strategies driving the market include product innovation, expanding organic and functional mushroom lines, strategic partnerships, vertical farming, sustainability initiatives, and geographic expansion. Companies focus on health trends, plant-based diets, and efficient distribution channels to meet rising consumer demand and enhance profitability in both fresh and processed mushroom segments.

The key trends aiding the market growth include rising demand for plant-based food products, sustainable mushroom farming practices, growing demand for value-added mushrooms, and innovations in mushroom cultivation.

The major regions in the market are North America, Latin America, Europe, the Middle East and Africa, and the Asia Pacific.

The major mushroom types considered in the market report are button, shiitake, and oyster, among others.

The various forms of mushroom are fresh, frozen, dried, and canned, among others.

The several distribution channels in the market are supermarkets and hypermarkets, grocery stores, and online, among others.

The key players in the market report include Costa Group, Hughes Group, Monaghan Mushrooms, Monterey Mushrooms Inc., and Okechamp S.A., among others.

Fresh mushrooms remain the dominant form in the market due to high consumer preference for minimally processed, nutritious food.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Form |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share