Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Oceania rotating equipment market size was approximately USD 4.61 Million in 2025. The market is estimated to grow at a CAGR of 10.20% during 2026-2035 to reach a value of USD 12.18 Million by 2035.

Base Year

Historical Period

Forecast Period

Digital technologies such as rotating machines analytics are being incorporated in rotating equipment.

New Zealand's renewable sector, providing 84% electricity, aims for 100% renewable usage by 2035 and a carbon-neutral economy by 2050, thereby providing lucrative opportunities for market expansion in the power generation sector.

Countries such as Australia, Papua New Guinea, and New Zealand are among the largest gas-producing countries in Oceania.

Compound Annual Growth Rate

10.2%

Value in USD Million

2026-2035

*this image is indicative*

Rotating equipment are integral components in a wide range of industries such as oil and gas during various stages of production and transportation; water supply; and wastewater treatment processes involving chemical mixing.

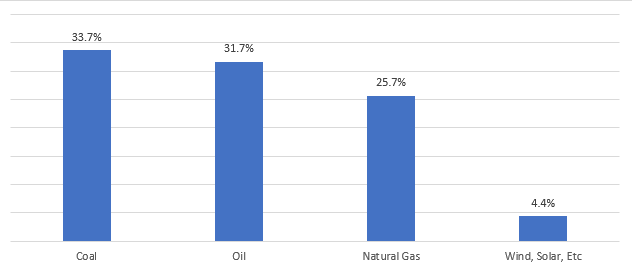

Figure: Total Energy Supply, Australia, 2022

The rising initiatives in Oceania to boost energy generation using renewable sources are adding to the demand for rotating equipment. In 2020, the turbine market witnessed a remarkable surge, with its market share soaring from 36.3% in 2019 to an impressive 62.0%. This growth can be largely attributed to the increased deployment of wind energy, a major application of turbines. Australia made significant strides, adding 2.3 GW of on-shore wind energy generation capacity to bolster its renewable energy portfolio.

Advancements in technologies; expansion of the oil and gas sector; rising industrialisation; and use in renewable power generation are impacting the Oceania rotating equipment market growth

| Date | Company | Event |

| Aug 2023 | Grundfos | The company introduced a new range of end-suction pumps with premium NKE range utilising smart technology. |

| May 2023 | CAPS | The company launched new energy efficient range of rotary screw compressors. |

| Mar 2023 | Honeywell International | Honeywell introduced its Versatilis™ Transmitters, tailored for condition-based monitoring of diverse rotating equipment such as pumps, motors, compressors, fans, blowers, and gearboxes. |

| Mar 2023 | General Electric Company | General Electric Company, a prominent high-technology industrial organization, had planned to introduce the high-efficiency GT26 power unit at Australia's Tallawarra, a power plant boasting a capacity of 435 megawatts. |

| Trends | Impact |

| Growing oil and gas sector | The advancements in the oil and gas sector, encompassing drilling technologies, pipeline construction materials and methods, and engineering and design, are supporting the Oceania rotating equipment market development. |

| Technological improvements | Features like predictive maintenance and digitalisation contribute to better monitoring, control, and optimisation of rotating equipment. |

| Rapid industrialisation | Rotating equipment play a major role in various industrial operations and constitute a major share of their total energy consumption. Rapid industrialisation in Australia, Papua New Guinea, and New Zealand, is creating greater requirements for energy efficient rotating equipment. |

| Use in renewable power generation | Efforts to decarbonise and achieve carbon neutrality are leading to increased investments in the renewable energy sector. Rotating equipment plays a critical role in advancing renewable applications, particularly in wind, gas, and wave converters, where it is essential for efficient energy conversion and performance. |

Oceania's ongoing infrastructure development projects, including the construction of transportation infrastructure, present opportunities to install and utilise rotating equipment, such as centrifugal and displacement pumps. Oceania has significant potential for renewable energy generation, such as hydro, wind, and solar power. This expansion aids the deployment of rotating equipment, including turbines and generators, to harness clean energy sources.

Oceania is rich in natural resources. For instance, Papua New Guinea is rich in gold, and copper while Australia boasts an abundance of iron ore and black coal. The mining sector plays a crucial role in Oceania's economic growth. In 2021, global exploration budgets in Australia expanded by 38.8% y-o-y to USD 1.90 billion, exceeding the average global budget growth rate of 35.0%. The growing mining sector is likely to aid the demand for rotating equipment, such as pumps and conveyors to conduct efficient extraction and processing operations.

“Oceania Rotating Equipment Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Voltage

Market Breakup by End Use

Market Breakup by Region

Based on product type, pumps dominate the Oceania rotating equipment market share

Pumps play an indispensable role in industries including manufacturing, chemical processing, and water treatment sectors due to their vital contribution in fluid transportation and processing. The mining sector, for instance, relies on pumps for dewatering, slurry transportation, and oil extraction.

Countries like Australia, benefit from an increasing range of pumps available domestically for markets such as oil and gas and wastewater treatment. High-pressure process pumps find use in oil refineries and large machines for water and wastewater treatment. Additionally, the local mining sector uses slurry pumps for abrasive solids-handling duties.

A rising focus on renewable energy, is likely to increase the demand for various rotating equipment, such as turbines and generators to harness and generate clean energy. Oceania is rich in renewable energy resources with the potential to increase hydropower generation in Fiji and Papua New Guinea.

The market players are focusing on improving product quality and engaging in product innovations to capture market share and maintain a competitive edge

| Company | Founded | Headquarters | Services |

| Siemens AG | 1847 | Bayern, Germany | The company's drive technology and machinery and plant construction segments encompass a diverse range of rotating equipment. Through SIMOTICS & SINAMICS systems, the company offers pumps, fans, and compressors. |

| Sulzer Ltd | 1834 | Winterthur, Switzerland | The company offers rotating equipment such as SALOMIX™ SSF and SLR/STR side-mounted agitators, SX chemical mixer, Submersible mixer type ABS XRW, Flow booster type ABS SB, Aerator type ABS Venturi jet, Submersible aerator type ABS XTA XTAK, HST™ turbocompressor, and AH axial flow pump. |

| Ingersoll Rand Inc. | 1872 | North Carolina, United States | The company's diverse range of air compressors includes single-stage and two-stage reciprocating models, as well as oil-free, oil-flooded, and centrifugal solutions. |

| Atlas Copco AB | 1873 | Stockholm, Sweden | The company boasts a wide array of rotating equipment, including oil-injected compressors, oil-free compressors, screw compressors, GAVSD+ screw compressors, G 2-75Kw screw compressors, and piston compressors, among others. |

Other notable players operating in the Oceania rotating equipment market include The Weir Group PLC, Ebara Corporation, Hitachi, Ltd, General Electric Company, and Mitsubishi Heavy Industries, Ltd, among others.

The market benefits from the growth of the power generation sector, one of the major end use sectors for rotating equipment. Within the power generation sector, there is an increased focus on producing renewable power. The New Zealand government’s target to achieve 100% renewable electricity generation by 2035, in addition to their net zero carbon emissions target by 2050, is shifting the consumption towards renewable energy sources such as wind, and solar. New Zealand is set to have 19 operational onshore wind farms with a combined installed capacity of 1,045 MW by the end of 2023. This favours the demand for turbines which are widely used to create electric power in combination with a generator.

Fiji is favoured by its abundant renewable energy resources as it transitions to use them to produce electricity on account of the 20-year National Development Plan, which stipulates all power to be generated from renewable sources by 2030.

Animal Feed Micronutrients Market

Artificial intelligence market

Latin America Explosives Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of USD 4.61 Million in 2025.

The market is estimated to grow at a CAGR of 10.20% during 2026-2035

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 12.18 Million by 2035.

The key drivers include rising technological advancements, the growth of the oil and gas sector, and expansion of the renewable energy sector.

The market covers countries such as Australia, New Zealand, Papua New Guinea, Fiji, and others.

The various product types are turbines, pumps, compressors, and agitators and mixers.

The key players in the market include Siemens AG, Sulzer Ltd, Ingersoll Rand Inc., Atlas Copco AB, The Weir Group PLC, Ebara Corporation, Hitachi, Ltd, General Electric Company, and Mitsubishi Heavy Industries, Ltd, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Voltage |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share