Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The paints and coatings market size USD 187.18 Billion in 2025. The market is expected to grow at a CAGR of 4.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 277.07 Billion.

Rapid urbanization in emerging economies is driving significant construction activity, adding to the paints and coatings industry revenue. According to the United Nations Population Fund, India’s urban population is estimated to rise to about 5 billion. This growth boosts demand for architectural coatings used in residential, commercial, and infrastructure projects. Increasing investments in smart cities, highways, and airports also stimulate demand for protective and industrial coatings. Government initiatives promoting affordable housing and urban renewal programs further fuel paint consumption.

The influx of advanced coating technologies is driving the growth of the paints and coatings market by enhancing performance, sustainability, and application efficiency. New technologies are meeting rising industry demands for smarter, greener, and more durable solutions. In May 2025, AkzoNobel launched a new water based “sunscreen” coating system in China, combining a radiative-topcoat and aerogel mid-coat to cut building surface temperatures by up to 10% passively. These innovations unlock new applications in electronics, automotive, and infrastructure, broadening market scope and boosting competitiveness across regions.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Paints and Coatings Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 187.18 |

| Market Size 2035 | USD Billion | 277.07 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 4.6% |

| CAGR 2026-2035 - Market by Country | India | 5.3% |

| CAGR 2026-2035 - Market by Country | China | 4.5% |

| CAGR 2026-2035 - Market by Raw Material | Resins | 4.3% |

| CAGR 2026-2035 - Market by End Use | Architectural | 4.4% |

| Market Share by Country 2025 | Japan | 4.2% |

The automotive industry is a crucial driver for the paints and coatings market expansion, as automakers require specialized paints for durability, corrosion protection, and aesthetic appeal. The rise of electric vehicles (EVs) is fostering demand for innovative coatings that offer thermal management, lightweight properties, and sustainability. As per International Energy Agency (IEA), the global electric car sales topped 17 million in 2024. Additionally, aftermarket refinish coatings continue to grow with increased vehicle ownership and extended vehicle lifespans.

Consumers and industries are increasingly prioritizing sustainable products. Paint manufacturers respond by incorporating renewable raw materials, recycled content, and solvent-free formulations. In February 2025, AkzoNobel introduced RUBBOL WF 3350, a waterborne wood coating featuring 20% bio-based content. The rise of green building certifications promotes sustainable coatings to reduce environmental footprints. Companies also develop bio-based resins and biodegradable additives to align with circular economy principles.

Nanomaterials are gaining traction in the paints and coatings market as they are incorporated to enhance mechanical strength, scratch resistance, UV protection, and thermal conductivity. These additives enable thinner, lighter coatings with superior performance, reducing material usage and extending service life. In October 2022, Asian Paints acquired nanotechnology specialist Harind Chemicals, enhancing its capabilities in surface coating innovation and advanced nano additives. The development of multifunctional nanocoating also supports smart coating trends.

Digital tools are revolutionizing coatings production and customer interaction. AI and machine learning optimize formulations for performance and cost, while IoT sensors monitor production parameters in real time, ensuring consistent quality. In December 2023, AkzoNobel’s Powder Coatings division partnered with coatingAI to launch an advanced machine learning-based platform aimed at optimizing powder coating applications. Leading companies also invest in smart factories and digital services to meet evolving market demands efficiently. Cloud-based platforms further improve supply chain transparency and inventory management.

The paints and coatings market sees frequent mergers and acquisitions (M&A) activity as companies seek to expand product portfolios, geographic reach, and technological capabilities. Collaborations between chemical firms, startups, and automotive manufacturers drive innovation and faster market entry. In October 2024, Indian pigments firm Sudarshan Chemical acquired German-based Heubach to create a global pigments powerhouse to serve Europe and the Americas with enhanced technological capabilities. This consolidation trend strengthens market leadership and supports global expansion, especially in emerging markets with high growth potential.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Paints and Coatings Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Breakup by Raw Material

Key Insight: Pigments and fillers are largely benefiting the paints and coatings industry revenue as essential components to provide colour, opacity, and durability. Pigments offer high whiteness and opacity, widely used in architectural and industrial coatings. Innovations include eco-friendly, non-toxic pigments and nano-pigments enhancing performance. In February 2025, LANXESS introduced Scopeblue Bayferrox micronized yellow pigments featuring eco-efficient raw materials, reducing carbon footprint by ~35% while maintaining performance. This segment’s dominance stems from its critical role in coating aesthetics and protective functions, driving demand across automotive, construction, and packaging industries.

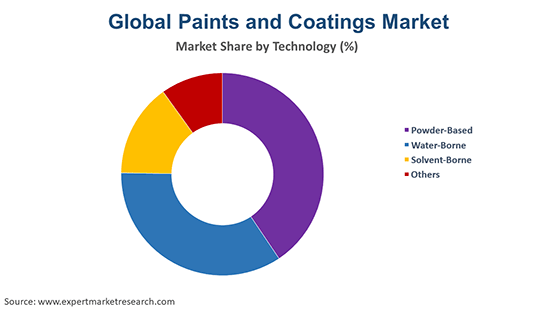

Breakup by Technology

Key Insight: The water-borne segment is adding to the paints and coatings market share due to their low environmental impact, reduced VOC emissions, and compliance with strict environmental regulations. These coatings use water as a solvent, making them safer for both users and the environment. Companies continue to innovate in this segment with high-performance water-borne solutions, boosting demand across residential, commercial, and industrial sectors. For instance, in June 2025, Tnemec introduced two advanced waterborne epoxy coatings, including the Series 288 and 289, designed for flooring and wall applications.

Breakup by End Use

Key Insight: The architectural segment is the largest in the paints and coatings market. Indoor paints focus on aesthetics, low odour, and easy maintenance, with increasing demand for low-VOC and anti-microbial coatings. Outdoor paints prioritize weather resistance, UV stability, and durability. Rapid urbanization, rising construction activities, and DIY home improvement trends globally drive this segment. In November 2023, AkzoNobel introduced the Interpon D1036 Low-E, an industry-first architectural powder coating that can be cured at temperatures as low as 150°C. Architectural coatings also reflect sustainability trends, with major players introducing decorative solutions to meet green building regulations.

Breakup by Region

Key Insight: North America holds a leading position in the paints and coatings market, driven by high demand in automotive, construction, and industrial sectors. Stringent environmental regulations have accelerated the adoption of eco-friendly, low-VOC, and waterborne coatings. Major players have expanded their portfolios with innovative, sustainable products. In December 2024, Nouryon inaugurated a new paint application centre in Bridgewater, the United States for developing innovative solutions for architectural decorative paints. Increasing urbanization and renovation activities also boost regional demand for decorative paints.

| CAGR 2026-2035 - Market by | Country |

| India | 5.3% |

| China | 4.5% |

| Canada | 4.0% |

| Germany | 3.3% |

| France | 3.1% |

| USA | XX% |

| UK | XX% |

| Italy | XX% |

| Japan | 2.8% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Solvents & Additives to Gain Popularity

Solvents are vital in the paints and coatings industry for ensuring smooth application and drying. Solvents remain significant in traditional solvent-borne coatings, especially in industrial and automotive sectors. Common solvents include mineral spirits, acetone, and alcohols. The market is witnessing innovations, such as bio-based solvents to reduce environmental impact, as seen in companies promoting greener alternatives. In January 2024, Syensqo Ventures invested USD 2.1 million in Bioeutectics to accelerate the commercialization of high-performance green solvents to serve sustainable industrial applications.

The paints and coatings market value is growing through additives as they help enhance paint properties, such as drying time, stability, flow, and mildew resistance. Common additives include dispersants, anti-foaming agents, and UV stabilizers. Leading companies innovate additives to improve sustainability and functionality, such as bio-based and low-VOC additives. Despite their low volume, additives are crucial for fine-tuning coatings for specific applications and environmental compliance. Their supporting role makes them the least dominating segment but indispensable for achieving desired paint performance and longevity.

Surging Demand for Solvent-Borne & Powder-Based Paints and Coatings

Solvent-borne paints and coatings market is growing, as they rely on organic solvents for application and drying, offering excellent durability, gloss, and performance in harsh environments. They are favoured in industries, such as marine, automotive OEM, and heavy machinery, where superior protection is essential. Solvent-based products remain prevalent in developing regions due to their affordability and climate adaptability. Firms are continuing to produce high-quality solvent-borne coatings for industrial applications where water-borne alternatives are less effective due to extreme temperatures or high moisture levels.

The powder-based segment is rapidly expanding in the paints and coatings industry, owing to their sustainability and efficiency. These coatings are applied as dry powder and cured under heat, forming a durable, uniform finish. In November 2023, AkzoNobel introduced an industry-first architectural powder coating, Interpon D1036 Low-E, which can be cured at temperatures as low as 150°C. Powder coatings are increasingly used in appliances, furniture, automotive parts, and metal structures. Advancements in technology are expanding their use in architectural and industrial design.

Industrial Paints and Coatings to Witness Huge Adoption

The industrial paints and coatings market is growing, with general industrial coatings recording broad use in machinery, appliances, and manufacturing components. Automotive and transportation coatings follow closely, driven by innovations. In March 2025, BASF Coatings partnered with NIO for automotive exterior coatings tailored for electric vehicles. Wood coatings are used in furniture and flooring, with advances in UV-cured and waterborne finishes. Aerospace and marine coatings are critical for performance under extreme conditions. Meanwhile, protective coatings, used in infrastructure and oil & gas, are essential for long-term asset protection.

Thriving Paints and Coating Innovations in Europe & Asia Pacific

Europe paints and coatings industry is supported by strong emphasis on sustainability and innovation. Regulatory frameworks promote environmentally friendly coatings, such as waterborne and bio-based products. The region’s mature construction and automotive sectors demand high-performance coatings, especially in Germany, France, and the United Kingdom. Additionally, Europe’s focus on circular economy principles encourages recycling and waste reduction in coatings production, making Europe a significant and steadily growing market.

Asia Pacific is the fastest-growing paints and coatings market. Rapid industrialization, urbanization, and expanding automotive and infrastructure projects in China, India, and Southeast Asia drive demand. Market leaders and Asian subsidiaries of global firms focus on cost-effective and sustainable coatings tailored to regional needs. In April 2024, BASF’s Coatings division introduced a next generation range of clearcoats and undercoats for the Asia Pacific automotive refinish market. The region’s large population and rising middle class further provide enormous growth potential.

Key players operating in the paints and coatings market are deploying strategies that focus on innovation, sustainability, and market expansion. Companies are heavily investing in research and development to introduce advanced formulations, such as low-VOC, waterborne, and nano-based coatings, addressing environmental regulations and customer demand for eco-friendly products. Strategic mergers, acquisitions, and partnerships are common, helping firms expand geographic reach, diversify portfolios, and strengthen supply chains. Major players also focus on brand differentiation and premiumization, offering specialized solutions for several industries.

Digitalization and e-commerce growth have led to investments in online platforms and virtual colour visualization tools to enhance customer engagement and streamline purchasing. Additionally, companies are localizing production facilities to reduce logistics costs and ensure quicker delivery, especially in emerging markets. Sustainability initiatives, including circular economy practices and recycling, are increasingly central to long-term strategies. Furthermore, market players continuously monitor raw material costs and geopolitical risks, adapting pricing and sourcing strategies accordingly to maintain profitability in a competitive landscape.

Founded in 1883, and headquartered in Pittsburgh, the United States PPG Industries Inc., is a global leader in paints, coatings, and specialty materials. PPG is known for its pioneering work in automotive and aerospace coatings and its development of sustainable products, including low-VOC and advanced powder coating technologies.

Established in 1994 and based in Amsterdam, Netherlands, Akzo Nobel is renowned for its decorative paints and performance coatings. The company has made significant strides in sustainability, launching eco-efficient solutions, such as water-based paints and bio-based ingredients, while advancing digital tools for colour selection and application.

Founded in 1881 and headquartered in Osaka, Japan, Nippon Paint is Asia’s largest paint manufacturer, known for its innovation in antibacterial coatings, automotive refinishing, and eco-friendly solutions. The company actively pursues global expansion and sustainability, offering products that enhance energy efficiency and reduce environmental impact.

Headquartered in Ludwigshafen, Germany, and founded in 1865, BASF SE is a global chemical giant with a strong presence in coatings, with its innovations including automotive coatings offering self-healing properties and low-emission formulations. BASF emphasizes R&D and digitalization to drive sustainability and performance in surface solutions worldwide.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the paints and coatings market include The Sherwin-Williams Company, RPM International Inc, and Beckers Group, among others.

Unlock valuable insights into the paints and coatings market trends 2026 with our expertly curated report. Get a sample today to explore detailed forecasts, key market drivers, and growth opportunities. Stay ahead of the competition with data-driven strategies—download your free paints and coatings market report sample now.

India Paints and Coatings Market

United States Paints and Coatings Market

Australia Paints and Coatings Market

North America Paints and Coatings Market

Antifouling Paints and Coatings Market

Egypt Paints and Coatings Market

Peru Paints and Coatings Market

Mexico Paints and Coatings Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 187.18 Billion.

The market is projected to grow at a CAGR of 4.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 277.07 Billion by 2035.

The key strategies driving the market include innovation in eco-friendly and high-performance formulations, strategic mergers and acquisitions, expansion into emerging markets, and investment in digital technologies. Companies also focus on enhancing supply chain efficiency, sustainability initiatives, and tailored solutions for industries like automotive, construction, and industrial manufacturing.

The key trends propelling the market growth are technological advancements and innovations and the increasing launches of paints with superior properties by key players.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The raw materials in the paints market are pigments and fillers, solvents, resins, and additives, with resins further sub-divided into acrylic, alkyd, epoxy, and polyurethane, among others..

The technologies of paints and coatings considered in the market report are powder-based, water-borne, and solvent-borne, among others.

The different end use of paints and coatings are architectural and industrial.

The key players in the market report include PPG Industries Inc., Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., BASF SE, The Sherwin-Williams Company, RPM International Inc, and Beckers Group, among others.

The architectural segment is the largest in the market as they focus on aesthetics, low odour, and easy maintenance.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Raw Material |

|

| Breakup by Technology |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share