Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global pharmaceutical contract packaging market size was valued at USD 25.99 Billion in 2025. The market is further projected to grow at a CAGR of 7.50% between 2026 and 2035, reaching a value of USD 53.57 Billion by 2035.

Base Year

Historical Period

Forecast Period

The market is driven by the increasing demand for temperature-controlled products, biologics, and personalised medicines.

Prefilled syringes are gaining popularity among healthcare professionals, as they offer convenience and accuracy for drug delivery.

Some of the key players in the pharmaceutical packaging industry include Ropack Inc., PCI Pharma Services, Adelphi Healthcare Packaging, and UNICEP Packaging LLC.

Compound Annual Growth Rate

7.5%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Pharmaceutical Contract Packaging Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 25.99 |

| Market Size 2035 | USD Billion | 53.57 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 7.50% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 8.2% |

| CAGR 2026-2035 - Market by Country | India | 9.9% |

| CAGR 2026-2035 - Market by Country | China | 8.3% |

| CAGR 2026-2035 - Market by Industry | Biopharmaceutical | 8.4% |

| CAGR 2026-2035 - Market by Packaging | Plastic Bottles | 8.6% |

| Market Share by Country 2025 | France | 3.1% |

Pharmaceutical contract packaging is the outsourcing for secondary activities such as product packaging and labelling to third parties. A contract pharmaceutical packager provides services, installations, as well as equipment, ranging from drug packaging design to the testing of the packaged drug. Pharmaceutical companies employ secondary packaging companies because it is more reliable, profitable, and helps them improve customer satisfaction and provides brand recognition.

A growing focus on sustainability is likely to drive the use of recyclable and biodegradable materials in pharmaceutical packaging products, which is predicted to aid in pharmaceutical contract packaging market growth. The thriving demand for convenient packaging, which makes it easier to manage the storage and use of pharmaceuticals, is expected to have a positive impact on the pharmaceutical contract packaging market outlook.

Growing adoption of smart packaging technologies, rising environmental concerns, and increasing need for reliable packaging of medicines are increasing the demand for pharmaceutical contract packaging solutions

| Date | Company | News |

| February 2024 | Almac Pharma Services | Received the renewal of its HPRA Certificate of GMP compliance for its European facility after a comprehensive audit |

| February 2024 | Berry Global | Unveiled a new Circular Stretch Film Innovation and Training Centre aimed at developing sustainable and flexible packaging solutions |

| December 2023 | PCI Pharma Services | Announced the full operation of three new automated sterile fill-finish machines at its San Diego and Melbourne facilities |

| October 2023 | Adelphi Healthcare Packaging | Adelphi’s partner STELLA acquired seven new state-of-the-art injection moulding machines in Q4 of 2023 and plans to introduce more machines in early 2024 |

| Trends | Impact |

| Increasing demand for biologics and biosimilars | Biologics and biosimilars require specialised packaging and handling, which creates opportunities for contract packaging organisations (CPOs) to offer value-added services and solutions. |

| Growing adoption of smart packaging technologies | Smart packaging technologies, such as RFID, NFC, and QR codes, can enhance product traceability, security and provide interactive features for consumers. CPOs can leverage these technologies to differentiate their offerings and increase customer loyalty. |

| Rising environmental concerns and regulations | Environmental issues, such as plastic waste, carbon footprint, and resource depletion, have prompted governments and consumers to demand more sustainable and eco-friendly packaging solutions. CPOs can gain a competitive edge by adopting green packaging materials and practices, such as biodegradable, recyclable, and reusable packaging. |

| Shifting consumer preferences and expectations | Consumers are becoming more aware and demanding of the quality, safety, and convenience of pharmaceutical products. CPOs meet these expectations by offering innovative and flexible packaging designs, such as child-resistant, senior-friendly, and smart packaging, which, in turn, can lead to pharmaceutical contract packaging market expansion. |

One of the main factors that results in pharmaceutical contract packaging market development is the introduction of strict rules and regulations for product labelling. Moreover, pharmaceutical contract packaging companies can use different types of packaging and can easily solve problems arising from diverse packaging requirements, compared to drug makers. These manufacturers invest in research and development programs to improve the quality of their products.

Moreover, these organisations also help pharmaceutical firms establish a dynamic platform for distributing drugs and medical devices in various regions. Furthermore, the increasing use of smart packaging solutions, such as QR codes, is expected to provide a positive pharmaceutical contract packaging market outlook.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Global Pharmaceutical Contract Packaging Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Industry

Market Breakup by Type

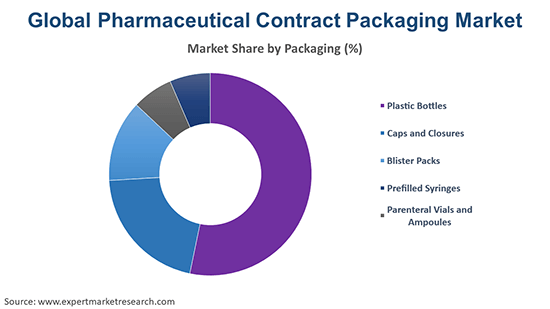

Market Breakup by Packaging

Market Breakup by Region

| CAGR 2026-2035 - Market by | Country |

| India | 9.9% |

| China | 8.3% |

| USA | 6.7% |

| Australia | 5.9% |

| France | 5.9% |

| Canada | XX% |

| UK | XX% |

| Germany | XX% |

| Italy | 5.3% |

| Japan | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Sterile products to hold significant market share as they offer high level of quality and safety

The sterile product segment accounted for the largest share in pharmaceutical contract packaging market. Sterile products are those that are free from any viable microorganisms, such as injectables, ophthalmics, inhalables, and biologics. Sterile products require a high level of quality and safety, as they are directly administered to the patients. Therefore, the demand for sterile contract packaging is high, as it ensures the sterility, stability, and integrity of the products.

On the other hand, non-sterile products are those that do not require sterility, such as oral solids, oral liquids, topical creams, and gels. Non-sterile products require a lower level of quality and safety, as they are not directly administered to the patients. As per pharmaceutical contract packaging market analysis, the demand for non-sterile contract packaging is also high, as it offers flexibility to pharmaceutical companies and can be customised.

Plastic bottles will bolster the pharmaceutical contract packaging market growth as they are low in cost and easy to handle

The plastic bottles segment is expected to increase the pharmaceutical contract packaging market value as they are widely used for oral solid and liquid formulations, such as tablets, capsules, syrups, and suspensions. Plastic bottles also offer advantages such as low cost, high durability, easy handling, and recyclability.

Caps and closures are used to seal and protect the pharmaceutical products from contamination, tampering, and leakage. Caps and closures include screw caps, flip-top caps, child-resistant caps, tamper-evident caps, and dispensing caps. The caps and closures segment is expected to witness a growing pharmaceutical contract packaging market share due to the increasing demand for safe and secure packaging, the growing preference for convenience and ease of use, and the emergence of smart and interactive caps and closures.

Prefilled syringes are used for injectable formulations, such as vaccines, biologics, and biosimilars. Prefilled syringes consist of a glass or plastic barrel, a plunger, a needle, and a cap. Prefilled syringes are the fastest growing segment in the pharmaceutical contract packaging market as they offer advantages such as ease of administration, dosage accuracy, reduced wastage, and enhanced safety.

Furthermore, parenteral vials and ampoules are made of glass or plastic and have a rubber stopper and a metal seal. Parenteral vials and ampoules offer benefits such as sterility, stability, and compatibility. The pharmaceutical contract packaging market projects that share of parenteral vials and ampoules segment will grow at a steady rate. The growth of this segment can be attributed to the increasing demand for sterile and aseptic packaging, the rising incidence of infectious and chronic diseases, and the expansion of the biosimilar market.

Market players are providing contract packaging services to pharmaceutical manufacturers, ensuring efficient and reliable packaging solutions for medicines and healthcare products.

| Company Name | Year Founded | Headquarters | Products/Services |

| Adelphi Healthcare Packaging | 1947 | West Sussex, United Kingdom | Primary and secondary packaging materials, filling and sealing equipment, laboratory equipment, and cold chain solutions |

| Almac Group | 1968 | Craigavon, Northern Ireland | Pharmaceutical development, clinical trial services, commercial packaging, and supply chain management |

| Berry Global Inc. | 1967 | Indiana, United States | Plastic packaging products, such as bottles, jars, tubes, closures, caps, and labels |

| PCI Services | 1979 | Illinois, United States | Clinical and commercial packaging, global distribution, and analytical testing |

Other key players in the global pharmaceutical contract packaging market include Sharp Corporation, among others.

United States leads the market share due to rising healthcare spending, which creates a demand for packaging solutions

The United States represents the world's largest market in pharmaceutical contract packaging, followed by China and India. The tremendous growth of pharmaceutical contract packaging market in United States is majorly driven by the rising healthcare spending, increasing geriatric population, and the increasing value of pharmaceutical exports. The growth is further driven by the high demand for innovative and specialised packaging solutions, the presence of leading pharmaceutical companies and contract packagers, and the stringent regulatory standards for quality and safety.

On the other hand, the pharmaceutical contract packaging market size in China is driven by the rapid growth of the pharmaceutical industry, the increasing outsourcing of packaging services, and the rising demand for biologics and biosimilars. According to pharmaceutical contract packaging market report, the Indian market is driven by the low-cost advantage, the availability of skilled labour, the increasing exports of generic drugs, and the growing domestic demand for pharmaceutical products.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the pharmaceutical contract packaging market reached an approximate value of USD 25.99 Billion.

The market is expected to grow at a CAGR of 7.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 53.57 Billion by 2035.

The market is being driven by the growing use of intelligent labelling solutions, increasing R&D activities by key players, technological advancements and innovations, and rapid population growth.

Key trends aiding pharmaceutical contract packaging market expansion include the rising demand for sustainable and eco-friendly packaging solutions, stringent packaging regulations, and growing adoption of smart packaging technologies.

The major regions considered in the market are the United States, Europe, China, and India, among others.

Small molecule, biopharmaceutical, and vaccines are some of the leading industries in the market.

The significant packaging segments considered in the market report are plastic bottles, caps and closures, blister packs, prefilled syringes, and parenteral vials and ampoules.

The major types of pharmaceutical contract packaging are sterile and non-sterile.

Key players in the industry are Adelphi Healthcare Packaging, Almac Group, Berry Global Inc., PCI Services, and Sharp Corporation, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Industry |

|

| Breakup by Type |

|

| Breakup by Packaging |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share