Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Saudi Arabia PE pipes market size attained a volume of 288.45 KMT in 2025. The industry is expected to grow at a CAGR of 5.40% during the forecast period of 2026-2035 to reach 488.06 KMT by 2035.

The Saudi Arabia PE pipes market is witnessing steady growth, driven by expanding infrastructure projects, increasing urbanization, and rising investments in water supply, irrigation, and sewage systems. Government initiatives like Saudi Vision 2030, which emphasize sustainable development and modernization of utilities, are further boosting demand for high-performance polyethylene piping systems across residential, industrial, and agricultural sectors. A notable example is the Jeddah Central project, a USD 20 billion development encompassing 5.7 million square meters. This initiative is expected to create 25,000 jobs and contribute over USD 12.5 billion to the national GDP by 2030. Such large-scale projects necessitate advanced piping solutions, further driving the demand for PE pipes.

The competitive landscape of Saudi Arabia PE pipes market is dominated by both regional and international players, with companies focusing on product innovation, capacity expansion, and strategic partnerships to strengthen their market presence. Local manufacturers benefit from proximity to raw material sources and growing public sector demand, while global firms often collaborate with Saudi-based distributors or invest in local manufacturing to meet regional standards and reduce lead times. In October 2024, an agreement was signed between Saudi Vitrified Clay Pipe Co. (SVCP) and Qatar's Laffan Pipes Factory to establish a joint venture focused on producing and trading durable pipes and related components. Such alliances aim to enhance production capabilities and meet the growing regional demand.

Base Year

Historical Period

Forecast Period

The expansion of the construction sector in Saudi Arabia is paving way for the increased requirement for pipelines, further contributing to the demand for PE pipes.

As part of its Vision 2030, the Saudi Arabian government is increasingly investing in infrastructural development projects, including water and wastewater treatment plants.

The influx of people into urban centres is propelling the demand for commercial spaces and residential properties with improved public facilities in the region.

Compound Annual Growth Rate

5.4%

Value in KMT

2026-2035

*this image is indicative*

| Saudi Arabia PE Pipes Market Report Summary | Description | Value |

| Base Year | KMT | 2025 |

| Historical Period | KMT | 2019-2025 |

| Forecast Period | KMT | 2026-2035 |

| Market Size 2025 | KMT | 288.45 |

| Market Size 2035 | KMT | 488.06 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.40% |

| CAGR 2026-2035 - Market by Type | HDPE | 5.5% |

| CAGR 2026-2035 - Market by Application | Mining and Slurry Lines | 5.7% |

Saudi Arabia is one of the largest investors in desalination projects across the world. At the 3rd MENA Desalination Projects Forum, in March 2022, the country announced around 60 water projects amounting to USD 9.33 billion to increase its desalination capacity to 7.5 million cubic meters of water per day in 2027 from 2.54 cubic meters per day in 2021. This ambitious expansion supports Saudi Arabia’s efforts to secure a sustainable water supply for its growing population and industrial sectors, underscoring the importance of robust water infrastructure, including the extensive use of polyethylene pipes for efficient distribution, thereby propelling the Saudi Arabia PE pipes market development.

As the adoption of PE pipes, such as HDPE pipes increases to transport water, it can help Saudi Arabia achieve its sustainable water infrastructure goal. Neom is a planned city in Tabuk Province, designed to be a hub for innovation and sustainability. The city includes various regions such as Oxagon, a floating industrial complex, and Neom Bay, which will feature residential areas and infrastructure. The development's focus on renewable energy and sustainable living suggests the use of HDPE pipes for water supply and distribution systems, supporting the growth of the Saudi Arabia PE pipes market.

Rapid urbanisation in Saudi Arabia is creating a demand for efficient and quality public services, including safe drinking water. PE pipes are resistant to corrosion making them an excellent option of water piping systems. As per the Saudi Arabia PE pipes market analysis, in 2023, the Saudi Arabian government allocated USD 9.17 billion for Saudi’s infrastructural development. Saudi Arabia’s population growth is exerting pressure on its existing infrastructure, especially water infrastructure. PE pipes help to efficiently distribute water into homes and industries.

Mining is a key sector of the economic diversification plan that is part of the Vision 2030 project. The mining sector comes third after oil and gas and petrochemicals as the key factor in the industrial growth of the Kingdom, thereby boosting the Saudi Arabia PE pipes market expansion. In March 2025, the kingdom was awarded mining exploration licenses to several firms, including India's Vedanta and a consortium of local Ajlan & Bros and China's Zijin Mining, covering regions like Jabal Sayid and Al Hajar, known for rich deposits of base and precious metals such as copper, zinc, gold, and silver. These licenses encompass a total area of 4,788 square kilometers, with an investment of approximately 366 million riyals (USD 97.6 million) planned over three years.

The Saudi Arabia PE pipes market is growing as a result of the growing use of insulated polyethylene piping systems brought about by the expansion of infrastructure development throughout urban and industrial zones. The thermal efficiency, resistance to corrosion, and adaptability to harsh desert conditions make these systems popular. Applications where long service life and low maintenance are crucial, like district cooling, water transport, and industrial utilities, are seeing an increase in their utilization. The expanded use of cutting-edge insulation technologies in the nation's pipeline networks is also being aided by a growing emphasis on environmentally friendly and energy-efficient building techniques. In July 2024, for instance, Perma-Pipe International Holdings, Inc. was awarded contracts for USD 10 million for infrastructure projects in Mekkah, Madinah, and Riyadh, Saudi Arabia. The insulation technology XTRU-THERM would be used in these projects.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The Expert Market Research’s report titled “Saudi Arabia PE Pipes Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

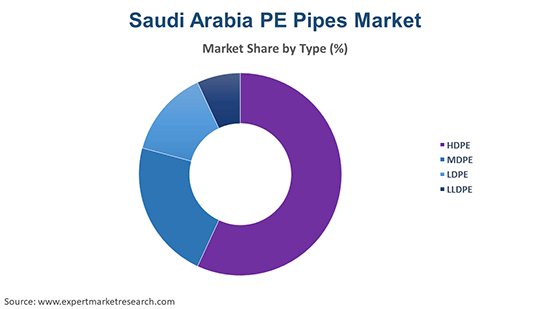

Market Breakup by Type

Key Insight: HDPE pipes are employed in the infrastructural sector owing to their abrasion resistance, durability, and ability to be used over long distances using heated fused joints. Alwasail Industrial Company, Saudi Plastic Products Company (SAPPCO), Saudi Pipe Systems Company, and Saudi Hepco LLC are some of the renowned HDPE pipe manufacturers in Saudi Arabia.

Market Breakup by Application

Key Insight: Through the 2022 budget, the Saudi Arabian government allocated USD 14.4 billion for the water sector. The economic development, rapid urbanisation, and increasing demand for water in Saudi Arabia is contributing to the demand for PE pipes for transporting water. To meet the increasing water demand, SWCC, the largest desalinated water producer in KSA is increasing their water production capacity to about 8.8 MCM/d by 2030. In 2020, larger cities such as Dammam, Medina, Riyadh, and Mecca used almost 90% of the desalinated water.

| CAGR 2026-2035 - Market by | Type |

| HDPE | 5.5% |

| MDPE | 5.3% |

| LDPE | XX% |

| LLDPE | XX% |

| CAGR 2026-2035 - Market by | Application |

| Mining and Slurry Lines | 5.7% |

| Water Supply | 5.6% |

| Irrigation | 5.5% |

| Sewerage and Drainage | XX% |

| Gas Supply | XX% |

| Others | XX% |

LDPE account for a significant share of the Saudi Arabia PE pipes market

LDPE pipes in the Saudi Arabia PE pipes market are used primarily in specialised low-pressure applications such as irrigation and cable protection. Their softer nature and flexibility allow easy installation in agricultural settings and environments requiring gentle flow control. Although less common for large-scale water transport, LDPE supports niche sectors in the Saudi market. The ongoing development of infrastructure projects under Vision 2030, such as the Red Sea Development and NEOM, has increased the demand for various types of PE pipes, including LDPE, for applications in water supply and sewage systems.

LLDPE pipes combine flexibility and toughness, offering improved puncture resistance and elongation compared to LDPE. They are increasingly used in irrigation and underground utility conduits where durability and flexibility are critical. LLDPE supports evolving infrastructure needs requiring reliable yet adaptable pipe materials.

Irrigation systems, among other applications, dominates the Saudi Arabia PE pipes market

Irrigation systems, particularly drip and sprinkler irrigation, heavily rely on PE pipes for efficient water delivery. The modernisation of agriculture under Vision 2030, with an emphasis on water conservation, fuels the use of flexible and durable PE pipes like LLDPE and LDPE in large-scale irrigation projects, supporting the Saudi Arabia PE pipes market. Agriculture in Saudi Arabia consumes about 85% of the country's water resources. To address inefficiencies, traditional irrigation methods are being replaced with advanced systems like drip and sprinkler irrigation. PE pipes, particularly low-density polyethylene (LDPE) and linear low-density polyethylene (LLDPE), are favored for their flexibility, resistance to corrosion, and ease of installation.

The gas supply sector demands robust piping solutions that can withstand pressure and environmental stress. PE pipes, especially MDPE and HDPE, are favored for gas distribution pipelines for their safety and flexibility. Expansion of natural gas infrastructure to meet rising energy needs is a key driver.

Key players in the Saudi Arabia PE pipes market are focusing on expanding production capacities and enhancing product quality to meet growing domestic demand. They are investing in advanced manufacturing technologies and adopting international standards to improve durability and performance. Collaborations with construction and utility sectors are also being strengthened to secure large-scale projects, while emphasizing sustainability and cost efficiency in their product offerings. These companies in the Saudi Arabia PE pipes market are also exploring export opportunities within the Gulf region to leverage regional infrastructure growth. Innovation in pipe materials and customization options is gaining traction, allowing them to cater to diverse applications such as water supply, sewage, and oil and gas pipelines. Strengthening after-sales services and technical support remains a priority to maintain competitive advantage and customer loyalty.

Saudi Plastic Products Company Ltd. specializes in manufacturing high-quality polyethylene pipes and fittings for water and industrial applications. The company is known for its advanced technology, strict quality control, and adherence to international standards. It serves diverse sectors by providing durable, corrosion-resistant pipe solutions, contributing significantly to infrastructure projects within Saudi Arabia.

Alwasail Industrial Company manufactures and supplies a wide range of plastic piping systems, including PE pipes. The company focuses on innovation, product reliability, and customer satisfaction. It caters to water, sewage, and industrial sectors, supporting Saudi Arabia’s growing infrastructure and environmental initiatives through efficient pipeline solutions.

Al Tamam Modern Plastic Factory produces polyethylene pipes and fittings tailored for municipal and industrial use. It emphasizes quality manufacturing processes and compliance with industry standards. The company serves key sectors, facilitating reliable water distribution and sewage management systems essential for urban development in Saudi Arabia.

Saudi Hepco LLC is a prominent manufacturer of polyethylene piping systems, offering durable and high-performance solutions for water, gas, and industrial applications. It invests in advanced technology and quality assurance to meet evolving market demands. The company supports infrastructure growth by providing efficient and sustainable piping products across Saudi Arabia.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Saudi Arabia PE pipes market report are Al-Jubail Sanitary Pipe Factory, Al-Munif Factory Company, and Green Pipes Factory, among others.

Unlock comprehensive insights into the Saudi Arabia PE pipes market trends 2026 with our expert-driven report. Understand market dynamics, growth opportunities, and key developments shaping the future of this sector. Download a free sample report or contact our team today to schedule a consultation and stay ahead in the competitive market landscape.

Saudi Arabia PPR Pipes Market

Saudi Arabia PVC Pipes Market

GCC PPR Pipes Market

Iraq PVC Pipes Market

Latin America PVC Pipes Market

United States PVC Pipes Market

North America PVC Pipes Market

United States PE Pipes Market

North America PE Pipes Market

South Africa PE Pipes Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The PE pipes market in Saudi Arabia attained a volume of 288.45 KMT in 2025.

The market is estimated to grow at a CAGR of 5.40% during 2026-2035

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of 488.06 KMT by 2035.

The major market drivers are the development of megacities, the growing adoption of PE pipes for water supply, and the robust growth of the oil and gas sector.

Technological advancements and the development of sustainable products are the major trends expected to guide the market growth.

HDPE, MDPE, LDPE, and LLDPE are the major types of PE pipes in the market.

The significant applications of PE pipes are water supply, irrigation, sewerage and drainage, gas supply, and mining and slurry lines, among others.

The key players in the market are Saudi Plastic Products Company Ltd., Alwasail Industrial Company, Al Tamam Modern Plastic Factory, Saudi Hepco LLC, Al-Jubail Sanitary Pipe Factory, Al-Munif Factory Company, and Green Pipes Factory, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share