Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global seed treatment market size reached approximately USD 11.19 Billion in 2025 and is expected to continue expanding at a compound annual growth rate (CAGR) of 9.70% during the forecast period from 2026 to 2035. By 2035, the market is projected to attain around USD 28.24 Billion.

Seed treatment therapy is crucial in enhancing crop production by improving seed resistance against pests and insects, which can significantly impact agricultural products. The application of seed treatment solutions helps protect seeds from seed and soil-borne infections, ultimately promoting healthier crops and reducing the risks associated with pathogens. Additionally, seed treatment can shorten germination time, boosting overall productivity and ensuring higher yields. With increasing demand for efficient agricultural practices and a growing focus on sustainable farming, the global seed treatment market is positioned for robust growth. As farmers seek better methods to manage pests and diseases, the demand for advanced seed treatment solutions is anticipated to rise substantially over the next decade.

Base Year

Historical Period

Forecast Period

France is the leading European seed producer, with nearly 400,000 hectares in 2021, driving the market demand.

As per industry reports, Ukraine is the leading exporter of seed oils, with exports valued at USD 5.54 billion in 2022.

The Netherlands is the top exporter of sowing seeds, with exports valued at USD 1.89 billion in 2022.

Compound Annual Growth Rate

9.7%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Seed Treatment Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 11.19 |

| Market Size 2035 | USD Billion | 28.24 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 9.70% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 10.6% |

| CAGR 2026-2035 - Market by Country | India | 10.8% |

| CAGR 2026-2035 - Market by Country | Brazil | 10.4% |

| CAGR 2026-2035 - Market by Treatment Method | Seed Pelleting | 10.5% |

| CAGR 2026-2035 - Market by Seed Treatment | Off-Farm | 10.7% |

| Market Share by Country 2025 | Mexico | 2.1% |

The market is expanding as seed treatments protect crops from seed-borne and soil-borne diseases. Organic treatments are gaining popularity over hazardous chemicals, enhancing agricultural yield while promoting safer and more sustainable farming practices. Seed treatments play a crucial role. ICAR-IIOR developed a biopolymer-based seed treatment technology to protect microbial agents and soil nutrients. It signed MoUs with two private seed companies to commercialise this patented technology, aiming to improve crop yields by 25-30%, as announced in November 2024.

The seed treatment market is witnessing increased seed treatment usage, particularly in developing economies where the demand for improved agricultural practices is rising. This is especially evident in the cultivation of fruits and vegetables, where seed treatments help bridge the demand–supply gap. With growing concerns over pests, the usage of insecticides and other pesticide products is also on the rise. Seed treatments provide effective solutions for pest management, leading to higher crop yields and better-quality produce in these emerging markets.

The seed treatment market is driving the growth of high-yield crops through integrated pest-management strategies. By enhancing pest resistance, bio-based seed treatment supports sustainable crop protection. This aligns with the increasing adoption of organic farming practices, improving overall agricultural productivity and reducing reliance on harmful chemicals. In February 2024, Locus Agriculture launched six new biological treatments for its Rhizolizer® Duo product line, targeting row crop farmers. The additions included in-furrow treatments for corn, cotton, and legumes, and seed treatments for wheat, soybeans, and cereals, enhancing yield and resource efficiency.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The seed treatment market is experiencing significant growth, particularly in emerging economies in the Asia Pacific region. As demand for high-quality agricultural products increases, seed treatments are vital in enhancing crop production and export potential. These treatments support higher yields and better disease resistance, contributing to the global industry’s growth and strengthening agricultural economies worldwide.

The seed treatment market is increasingly focusing on bio-based seed treatment solutions to address challenges posed by climate change and global warming. These treatments help combat soil-borne and seed-borne diseases, promoting sustainable agricultural practices. In September 2024, India introduced 109 new climate-resilient crops to combat the effects of climate change, including cereals, oilseeds, and horticultural varieties. These crops are designed to withstand erratic rainfall, extreme temperatures, and soil degradation, ensuring food security and supporting sustainable agricultural practices amidst environmental challenges. Additionally, bio-based solutions support a clean environment and enhance pandemic resilience, ensuring more robust crops in changing conditions while reducing environmental impact.

The seed treatment market has seen substantial growth, driven by ongoing research and development (R&D) efforts. Industry trends focus on the development of more effective and sustainable solutions to enhance crop protection and yield. This growth reflects increasing demand for advanced seed treatment technologies, supporting agricultural productivity worldwide.

Advancements in seed treatment technology, popularity of hybrid and genetically modified seeds, and increased focus on crop protection are factors boosting the seed treatment market growth.

Advancements in seed treatment technology is a key trend shaping the seed treatment market outlook as new products and techniques are being developed to improve seed quality. For example, biological seed treatments that use beneficial microorganisms to control pests and diseases are gaining popularity.

The seed treatment market development is influenced by the growing popularity of hybrid and genetically modified seeds. As the demand for these seeds increases, so does the demand for seed treatments that can effectively protect and enhance their quality.

Farmers are seeking solutions that can improve crop yields while reducing losses due to pests and diseases. Seed treatments that offer these benefits are gaining popularity, as they help farmers maintain profitability and meet the growing demand for food.

Cereals, including wheat and rice, benefit from seed treatment by enhancing resistance to diseases, improving germination rates, and boosting yields. These treatments help protect against pests, soil-borne infections, and environmental stress, contributing to higher productivity in the global seed treatment market. According to USDA and Australian government data, wheat is the leading cereal crop in Australia, with production hitting a record 37 million metric tons in MY 2022/23. Barley production was also strong, reaching 13.5 million metric tons.

Oilseeds such as soybeans, sunflower, and canola are vital to the global seed treatment market due to their high demand for both food and industrial uses. Seed treatments for oilseeds improve disease resistance, protect against pests, and enhance germination. They also promote robust plant growth and higher oil content. These treatments are crucial for ensuring the health of oilseed crops, enabling increased yields and contributing to sustainable agriculture in various regions.

Seed treatments for fruits and vegetables improve crop quality and yield by protecting against pathogens and pests. These treatments ensure better germination and stronger plant health, which results in higher-quality produce. They play a significant role in enhancing agricultural efficiency globally. According to Statistics Canada, the farm-gate value of fruits and vegetables rose by 2.5% year-on-year to reach USD 3.0 billion in 2024. Canada's total fruit and vegetable production increased by 3.3% to 3.3 billion kilograms, driven by a 10.6% rise in fruit yields and a 3.7% increase in vegetable yields.

Corn benefits significantly from seed treatments, which protect against pests, diseases, and environmental stressors. Seed treatment enhances seedling emergence and root development, ensuring faster germination and stronger plants. This leads to improved yields and overall crop productivity. By mitigating risks associated with seed and soil-borne diseases, seed treatments for corn offer farmers a cost-effective solution to enhance both the quality and quantity of their harvests, supporting the growth of the global seed treatment market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Synthetic seed treatments are widely used in the global seed treatment market for their effectiveness in protecting crops from pests, diseases, and environmental stress. These treatments offer reliable and quick results, enhancing seedling growth, improving yield potential, and ensuring consistent crop protection across a range of agricultural environments. BioConsortia partnered with H&T to launch a nitrogen-fixing microbial seed treatment in New Zealand for the 2024/2025 season. The treatment improves yield, reduces fertilizer use, and extends shelf life up to two years. Successful trials since 2021 demonstrated its effectiveness across multiple countries, offering both economic and environmental benefits.

Biological seed treatments utilise natural organisms, such as beneficial microbes, to protect seeds from pests and diseases. These eco-friendly solutions promote soil health and improve plant growth, offering sustainable alternatives to chemical treatments. Biological treatments support the global seed treatment market by encouraging organic farming practices and enhancing long-term crop resilience. In June 2024, DPH Biologicals partnered with KitoZyme to develop the first fungal chitosan seed treatment for U.S. growers. ChitoNox FC provides broad seedling protection against nematodes and soil-borne diseases, offering a sustainable biocontrol and biostimulant solution. This biopesticide uses renewable, non-GMO fungal chitosan, enhancing plant resilience.

Seed protection in the global seed treatment market ensures seeds are shielded from pests, diseases, and environmental stress. By preventing seed and soil-borne infections, it improves germination rates and seedling health, contributing to higher crop yields and overall productivity. In May 2022, Syngenta Seedcare launched VICTRATO®, a seed treatment targeting nematodes and fungal diseases in crops like soybeans, corn, and rice. Featuring TYMIRIUM® technology, it increases yield, protects roots, and supports no-tillage practices, while being safe for beneficial insects and soil health.

Seed enhancement in the global seed treatment market focuses on improving seed quality and performance. It boosts seed germination, enhances nutrient absorption, and strengthens resistance to diseases and environmental stress. Through seed coating technologies, seeds are fortified with vital nutrients and growth stimulants, promoting stronger root development and faster growth. This leads to improved crop establishment, better yields, and more efficient use of resources, benefiting both farmers and the agricultural industry at large.

Seed coating in the global seed treatment market enhances seed protection against pests, diseases, and environmental stress. It improves seed handling, provides nutrients, and supports faster germination, ultimately boosting crop yield and ensuring healthier, more resilient plants. In December 2024, The Indian Institute of Oilseeds Research (IIOR) introduced biopolymer technology for seed coating, enhancing crop yields by 25-30%. Developed by KSVP Chandrika and RD Prasad, it provides nutrients, protects against pests, and improves resilience, offering a cost-effective solution for farmers.

Seed dressing is a process where seeds are coated with chemicals or biological agents to protect them from diseases, pests, and other environmental factors. It improves seed health, boosts germination rates, and enhances crop productivity. Seed dressing is essential for safeguarding crops against early-stage infections, ensuring better seedling establishment. It also promotes more efficient use of resources by reducing the need for excessive pesticide or fungicide applications, supporting sustainable farming practices.

Seed pelleting involves coating seeds with a layer of material that improves seed handling, uniformity, and planting precision. It enhances germination and protects from environmental stress and pests, contributing to more consistent crop establishment and increased yields. In September 2022, Corteva Agriscience introduced seed coating technology to protect paddy crops from pests like leaf folder and yellow stem borer. The technology, initially launched in Thailand, reduces pesticide use and boosts yields by 5-6%, with a rollout planned for Indonesia.

On-farm seed treatment provides direct control to farmers over seed quality and protection, ensuring optimal germination and early growth. It reduces reliance on external suppliers, offers cost-effectiveness, and allows for the timely application of treatments suited to specific environmental conditions. In May 2024, Savannah Seeds and ADAMA India launched the FullPage® Rice Cropping Solution for paddy farmers in Chhattisgarh. The solution promises increased yields by 25-40%, cost savings of Rs 6,000 per acre, and reduced greenhouse gas emissions by 25-30%, addressing wild rice issues and enhancing sustainability.

Off-farm seed treatment involves treating seeds at specialised facilities before they are delivered to farms. This approach ensures a higher level of consistency, quality, and expertise in applying advanced treatments. It allows farmers to focus on other aspects of production while benefiting from professionally treated seeds, leading to improved germination rates and crop protection. Off-farm treatment can also reduce the risk of contamination and ensure better disease and pest resistance for higher yields.

Asia Pacific has a rapidly growing agricultural market, benefiting from increasing demand for high-yield crops and innovative seed treatments. It offers significant opportunities due to the region's large agricultural base and diverse crop production. In August 2024, Citic Group invested up to USD167 million in Longping High-Tech, increasing its stake to 25.9%. The investment aimed to support China's seed industry revitalization plan by funding R&D, repaying loans, and enhancing industry integration for food safety and innovation.

Europe remains a key region in the global seed treatment market, driven by stringent environmental regulations and the growing demand for sustainable agricultural practices. The adoption of bio-based and organic seed treatments has increased in Europe, with significant investment in research and development. Europe's focus on innovation, crop protection, and sustainability positions it as a leading market for seed treatment solutions.

North America, particularly the United States and Canada, is a dominant force in the global seed treatment market. The region benefits from advanced agricultural practices, a strong focus on R&D, and early adoption of innovative seed treatment technologies. With the rising need for efficient pest control and higher crop yields, North America continues to lead in seed treatment applications and sustainable solutions.

Latin America’s agricultural sector is growing rapidly, with significant demand for improved crop yields. Seed treatment technologies provide essential benefits, including pest management, disease control, and increased productivity in the region. In March 2025, Promotora Social México and Impacta VC launched the USD 5M Impact Ventures PSM Fund to invest between USD 100K and USD 300K in 20 Latin American pre-seed and seed-stage startups addressing social and environmental challenges, particularly in education, health, and climate.

The Middle East and Africa face unique challenges, such as drought and soil degradation. Seed treatments are vital in enhancing crop resilience, improving yields, and reducing water usage. With a focus on sustainability and food security, this region is increasingly adopting advanced seed treatment solutions. This market is expected to grow as agricultural practices become more efficient and resilient to climate change.

| CAGR 2026-2035 - Market by | Country |

| India | 10.8% |

| Brazil | 10.4% |

| China | 10.4% |

| Canada | 10.2% |

| Mexico | 10.1% |

| USA | XX% |

| UK | 9.7% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Germany | 9.2% |

Market players are focused on developing innovative seed treatment solutions that enhance crop yields and protect seeds from pests and diseases.

Bayer CropScience is a leading global agriculture company that develops and sells crop protection products, seeds, and digital farming solutions. Headquartered in Monheim am Rhein, Germany, the company was founded in 2002 as a subsidiary of Bayer AG.

Indian Farmers Fertiliser Cooperative Limited (IFFCO) is the world's largest fertiliser cooperative, manufacturing and marketing a wide range of fertilisers and other agricultural inputs for Indian farmers. Based in New Delhi, India, IFFCO was founded in 1967.

Valent BioSciences LLC is a leading global provider of biorational products and technologies for agriculture, public health, and forest health applications. Headquartered in Illinois, United States, the company was founded in 1975. Valent BioSciences help farmers manage pests and diseases.

BioWorks, Inc. is a leading provider of biological pest control and plant health products for the professional horticulture and agriculture markets. Based in New York, United States, the company was founded in 1991. BioWorks’s product also promote sustainable agriculture practices.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

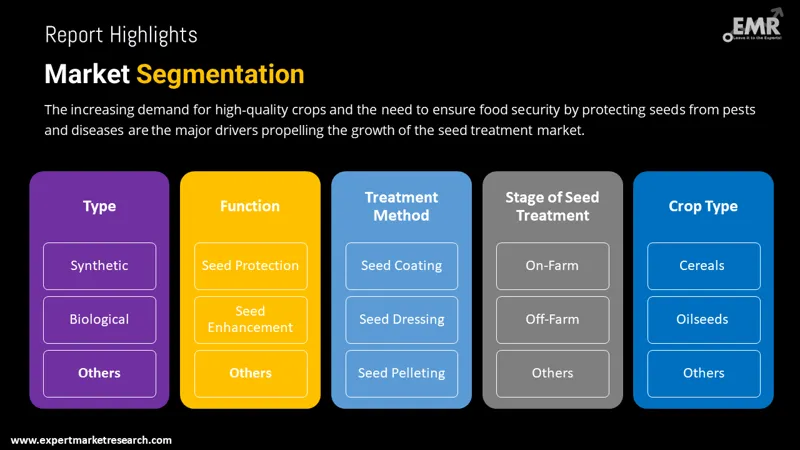

The global seed treatment market is expected to experience significant revenue growth, driven by industry trends and innovations in seed treatment technologies. Market segmentation, based on type, crop, and region, highlights key opportunities across global, regional, and country levels. Revenue growth forecasts suggest a strong demand for advanced seed treatments, with increased focus on improving crop yield and disease resistance. These trends are shaping market dynamics, influencing investments, and driving future growth across various sectors.

Type Outlook (Revenue, Billion, 2026-2035)

Function Outlook (Revenue, Billion, 2026-2035)

Treatment Method Outlook (Revenue, Billion, 2026-2035)

Stage of Seed Treatment Outlook (Revenue, Billion, 2026-2035)

Crop Outlook (Revenue, Billion, 2026-2035)

Region Outlook (Revenue, Billion, 2026-2035)

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the seed treatment market reached an approximate value of USD 11.19 Billion.

The market is expected to grow at a CAGR of 9.70% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to USD 28.24 Billion by 2035.

The rising demand is driven by the growing use of seed treatment in the crop production industry to enhance seed resistance to pests and insects, owing to its high effectiveness. This treatment also strengthens leaves and fruits, protecting them from various damaging pests and insects.

Key trends aiding market expansion include the growing need to protect seeds from various types of infestations, increasing growth of high-value crops, and rising popularity of biological seed treatment.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The different types of seed treatments in the market are synthetic and biological, with synthetics further divided by type into fungicides, and insecticides, among others, while biological is divided by type into bio pesticides, bio fertiliser, and bio stimulants.

The primary functions of seed treatments in the market are seed protection and seed enhancement.

The various crop types in the market for seed treatment are cereals, oilseeds, and fruits and vegetables, among others.

Key players in the market are Bayer CropScience, Syngenta AG, BASF SE, Corteva, FMC Corporation, Incotec, Nufarm US, UPL Ltd., Solvay S.A., Eastman Chemical Company, Novozymes, Verdesian Life Sciences, ITALPOLLINA S.p.A., Croda International plc, Germains Seed Technology, Certis Europe, Lanxess AG, Sumitomo Chemical Co., Ltd., Precision Laboratories, LLC, BioWorks, Inc. , Pro Farm Group, Indian Farmers Fertiliser Cooperative Limited (IFFCO), Valent BioSciences LLC, Albaugh LLC, Rizobacter Argentina SA, Monsanto, Crop Science, Chemtura, and DuPont, among others.

The insecticide segment led the global market, capturing the largest share of total revenue. The growth in this segment can be attributed to the rising demand from emerging economies in the Asia Pacific region, particularly India and China.

Asia Pacific holds the highest market share.

Factors driving seed treatment adoption include increased pest resistance, higher crop yields, environmental sustainability, and cost-effective farming solutions.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Function |

|

| Breakup by Treatment Method |

|

| Breakup by Stage of Seed Treatment |

|

| Breakup by Crop |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share