Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United Kingdom semiconductor market was valued at USD 14.00 Billion in 2025. The market is expected to grow at a CAGR of 6.70% during the forecast period of 2026-2035 to reach a value of USD 26.78 Billion by 2035. Expanding compound semiconductor clusters, particularly in Wales and Scotland, are strengthening international trade flows, boosting exports, and positioning the country as a leader in energy-efficient chip technologies.

The market is being driven by advances in connectivity, green mobility, and next-generation design capabilities. A major driving factor is the rollout of 5G, fueling demand for sophisticated semiconductors across telecom, mobile, and IoT. In January 2024, the ORanGaN project was launched to establish a domestic RF-GaN supply chain, ensuring sovereign capability and export potential for 5G chips, boosting the United Kingdom semiconductor market growth. On the other hand, in August 2025, Vodafone announced an EUR 11 billion investment in expanding 5G coverage, in line with its merger with Three United Kingdom, a move expected to deliver standalone 5G access to nearly the entire population by 2034.

With more than 1,200 companies active in the sector, the market benefits from an advanced design ecosystem and a skilled workforce. The government’s EUR 1 billion investment in National Semiconductor Strategy by 2033 underscores the importance of enhancing domestic production, strengthening resilience, and stimulating high-value innovation.

Innovation is being reinforced by university-led breakthroughs and a focus on advanced skills. For instance, in April 2025, the University of Southampton unveiled Europe’s first electron-beam lithography facility, enabling semiconductor development at sub-5nm features for AI, quantum computing, and defense. In addition to this, a EUR 4.75 million talent package was introduced to bridge workforce gaps. With focus on green mobility, sustainable chips, and digital transformation, the United Kingdom semiconductor market is positioned for steady global competitiveness over the coming decade.

Base Year

Historical Period

Forecast Period

The UK has well-established material science R&D, design and manufacturing base with several applications in areas including 5G and electric vehicles, clean energy, and defence.

There are 23 semiconductor fabrication plants spread across the country, with some of the leading providers of semiconductor design and IP solutions.

The design and IP developed by UK manufacturers are leading to improvements in computing power and power management, enabling consumers to get access to powerful and energy-efficient technology.

Compound Annual Growth Rate

6.7%

Value in USD Billion

2026-2035

*this image is indicative*

5G is central to the United Kingdom semiconductor market expansion, reshaping domestic manufacturing and connectivity. The ORanGaN initiative is building a local RF-GaN supply chain, reducing dependence on imports while creating high-value export opportunities. These projects will heighten demand for advanced chips in telecom and IoT. By embedding sovereignty in 5G component supply and scaling local capacity, the United Kingdom is setting itself apart as a leader in next-generation digital infrastructure.

Investments in semiconductor plants are transforming the United Kingdom’s production landscape. Vishay Intertechnology’s EUR 250 million commitment to Newport Wafer Fab in South Wales, launched in March 2025, is establishing a compound semiconductor cluster, making the region an advanced hub for global innovation. Alongside this, the government’s EUR 200 million investment in Octric Semiconductors in Durham to secure sovereign production of gallium arsenide chips, critical for defense and advanced electronics, is driving the United Kingdom semiconductor market opportunities.

Next-generation R&D is shaping long-term growth in the market. University of Southampton’s electron-beam lithography facility is enabling chips smaller than 5nm. This breakthrough supports future applications in AI, quantum computing, healthcare diagnostics, and defense. By investing in both physical infrastructure and human capital, the United Kingdom is reinforcing its status as a design-driven semiconductor hub. These advances are expanding opportunities for commercialization while securing the country’s reputation in global next-generation chip innovation, boosting demand in the United Kingdom semiconductor market.

The automotive sector is powering semiconductor demand through its shift to electric and connected mobility. In October 2022, Jaguar Land Rover partnered with Wolfspeed to secure long-term supplies of silicon carbide chips, essential for EV drivetrains and powertrains. These chips enhance energy transfer efficiency and support the company’s Reimagine strategy to achieve net-zero emissions by 2039. Such collaborations highlight the importance of these chips in enabling greener transport solutions, reshaping the United Kingdom semiconductor market dynamics.

Consumer electronics and IoT adoption are rapidly expanding semiconductor demand in the United Kingdom. In 2023, the manufacturing sector reflected a 2.1% increase from 2022. This growth reflects rising adoption of wearables, smart home devices, and connected appliances. Firms are actively developing advanced microcontrollers, sensors, and low-power chips to meet these needs. With the proliferation of connected systems, demand for energy-efficient chips is scaling rapidly.

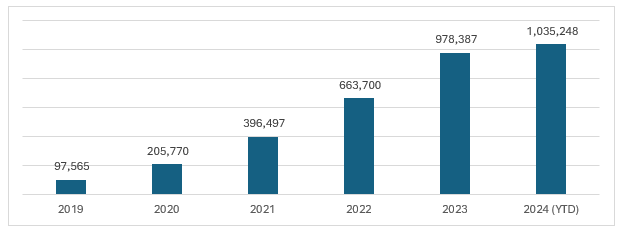

Figure: Cumulative number of battery-electric cars in the UK (2019 to date)

The EMR’s report titled “United Kingdom Semiconductor Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Technology

Key Insight: The technology landscape considered in the United Kingdom semiconductor market report, spans across from traditional silicon simple chips to advanced compound semiconductors, each serving distinct needs. Simple silicon with larger node sizes dominates by offering cost savings, proven reliability, and broad ecosystem support for consumer and industrial applications. On the other hand, complex silicon with smaller node sizes caters to cutting-edge computing and high-performance tasks, driven by miniaturization and power efficiency.

Market Breakup by Form

Key Insight: Semiconductor forms vary widely in function and application, each with specific driving factors. ICs dominate due to their versatility, compact design, and central role in powering everyday electronics, computing, and industrial systems. Optoelectronics are rapidly growing in terms of the United Kingdom semiconductor market share as demand for high-speed communication, imaging, and sensing rises across telecom, consumer, and automotive industries. Discrete semiconductors retain significance for their role in power management, switching, and essential circuit functions, ensuring stability in basic electronics. Sensors complete the spectrum, providing intelligence through data collection in IoT devices, healthcare, and smart infrastructure.

Market Breakup by End Use

Key Insight: Consumer electronics largely drives the United Kingdom semiconductor market value through everyday demand for digital devices, wearables, and home automation powered by semiconductors. The automotive sector demand grows rapidly, driven by EV adoption, ADAS, and smart mobility technologies. Industrial applications rely on semiconductors for automation, robotics, and control systems, ensuring productivity gains. Data centers require powerful chips for cloud, AI, and storage solutions, while telecommunications depend on them for 5G expansion and bandwidth efficiency. Healthcare leverages chips in diagnostics, imaging, and connected devices, while aerospace and defense demand resilience in critical systems.

![]()

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By technology, silicon (simple) commands the largest market share due to cost-effective fabrication processes

Silicon-based semiconductors with node sizes greater than 180 NM have established themselves as the dominant technology due to their affordability, mature manufacturing ecosystem, and wide adoption in legacy devices. These chips offer reliability in consumer electronics, industrial automation, and traditional computing systems where ultra-high performance is not a core requirement. Their cost-effectiveness supports large-scale production without the expensive infrastructure demanded by advanced nodes, accelerating the United Kingdom semiconductor market opportunities.

Compound semiconductors, built from materials such as gallium arsenide and silicon carbide, are emerging as the fastest-growing category due to their superior performance in energy efficiency, speed, and power handling. They are increasingly preferred for applications like 5G communication, automotive power electronics, and renewable energy systems, where silicon alone falls short.

By form, ICs dominate the market owing to integration and versatility

Integrated Circuits (ICs) register the leading market share across semiconductor forms due to their versatility, scalability, and ability to power a wide spectrum of devices. Their dominance comes from the seamless integration of multiple functions including logic, memory, and analog, into compact chipsets. ICs drive innovations in smartphones, computers, automotive electronics, and consumer gadgets, offering unmatched efficiency in space utilization and power consumption.

Optoelectronics is experiencing accelerated growth in the United Kingdom semiconductor market as industries increasingly rely on light-based technologies for connectivity, sensing, and displays. The shift toward high-speed data communication, fiber optics, and advanced imaging solutions is propelling the demand in this category. In telecommunications, optoelectronic components enhance bandwidth and transmission reliability, while in consumer electronics, they enable sharper displays and efficient sensors.

By end use, consumer electronics leads the market supported by everyday digital dependence

Consumer electronics represents the largest end-use category, driven by the widespread adoption of smartphones, laptops, tablets, and connected devices. Rising digital lifestyles ensure semiconductors remain at the core of entertainment, communication, and productivity tools. The growing sophistication of consumer devices, such as higher-resolution displays, AI-driven features, and improved battery efficiency, requires increasingly capable chips. Wearables, gaming consoles, and home automation further strengthen this category’s dominance in the United Kingdom semiconductor market revenue.

The automotive industry is advancing its share in the market, propelled by electrification, smart mobility, and the integration of advanced driver-assistance systems (ADAS). Semiconductors play a critical role in enabling electric vehicle powertrains, battery management systems, and safety electronics. The demand for in-vehicle connectivity, infotainment, and autonomous driving capabilities further increases reliance on high-performance chips.

Leading United Kingdom semiconductor market players are directing their focus on domestic power-semiconductor deployment (silicon carbide testbeds), photonics and quantum-photonics R&D in Cambridge and Oxford, and specialized wafer-test and metrology services for defense and space contracts. Firms are seizing niche opportunities in automotive power electronics, telecom RF front-ends for mmWave 5G, and edge-AI accelerators for industrial IoT.

Local strengths including high-value design talent, world-class university spinouts, and a growing network of specialized test houses, are enabling business models that pair United Kingdom design with European assembly and global sales. Opportunities for United Kingdom semiconductor companies lie in building test-and-pack capacity, scaling compound-semiconductor pilot lines, and commercializing photonics IP.

ON Semiconductor Corporation, founded in 1999 and based in the United States is focusing on power-management and vehicle-grade power modules that align with the United Kingdom’s electrification push. In the market the firm is supplying high-efficiency MOSFETs, power-ICs, and packaging expertise for EV charging and motor-control systems.

Founded in 1983, headquartered in Japan, Horiba brings precision metrology and semiconductor-test instruments to the United Kingdom ecosystem. Horiba’s advanced process-control tools, contamination measurement, and emission-analysis equipment are enabling fabs and research labs to scale photonics, compound-semiconductor, and sensor production.

Established in 1930 and headquartered in Texas, United States, Texas Instruments Incorporated is supplying analog and mixed-signal components central to United Kingdom industrial automation, data center power management, and automotive ECUs. TI’s emphasis on analog integration, robust reference designs, and long-lifecycle supply supports OEMs needing durable components for harsh environments.

NXP Semiconductors N.V., founded in 2006 and headquartered in Eindhoven, Netherlands is targeting vehicle networking, secure MCU solutions, and edge connectivity in the United Kingdom. NXP’s portfolio for secure car-to-cloud, near-vehicle security, and high-reliability RF components fits automotive and telecom needs.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Renesas Electronics Corporation, Intel Corporation, Samsung Electronics Co. Ltd., SK hynix Inc., Micron Technology Inc., Qualcomm Incorporated, Taiwan Semiconductor Manufacturing Company Ltd., among others.

Explore the latest trends shaping the United Kingdom semiconductor market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on United Kingdom semiconductor market trends 2026.

Asia Pacific Analog Semiconductor Market

United States Semiconductor Memory Market

United States Semiconductor Market

South Korea Semiconductor Market

Australia Semiconductor Market

Philippines Automotive Power Electronics Market

United Kingdom Semiconductor Companies

UK Consumer Electronics Chipset Market

UK Power Semiconductor Devices Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the United Kingdom semiconductor market reached an approximate value of USD 14.00 Billion.

The market is projected to grow at a CAGR of 6.70% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 26.78 Billion by 2035.

Key strategies driving the market include government funding, R&D focus, talent development, supply chain resilience, advanced infrastructure, international partnerships, SME support, and innovation commercialization to strengthen competitiveness and reduce dependency on imports.

The end uses include automotive, industrial, data centre, telecommunication, consumer electronics, aerospace and defence, healthcare, and others.

The different forms include ICs, optoelectronics, discrete semiconductors, and sensors.

The key players in the market include ON Semiconductor Corporation, Horiba Ltd, Texas Instruments Incorporated, NXP Semiconductors N.V., Renesas Electronics Corporation, Intel Corporation, Samsung Electronics Co. Ltd., SK hynix Inc., Micron Technology Inc., Qualcomm Incorporated, Taiwan Semiconductor Manufacturing Company Ltd., among others.

Supply-chain volatility, high capital intensity, skilled labor shortages, export controls, and scaling advanced-node fabs are constraining growth while regulatory uncertainty, funding gaps, and nationwide talent retention complicate long-term investment.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Technology |

|

| Breakup by Form |

|

| Breakup by End Use |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share