Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Vietnam LED lighting market was valued at USD 772.95 Million in 2025. The market is expected to grow at a CAGR of 6.80% during the forecast period of 2026-2035 to reach a value of USD 1492.33 Million by 2035. The market is fueled by a combination of government policy, urban planning, and technological innovation. The Ministry of Industry and Trade National Energy Efficiency Plan (VNEEP) and the Vietnam Energy Efficient Public Lighting Project (VEEPL) are leading the charge, requiring LED uptake in public facilities and encouraging energy-efficient upgrades in residential and commercial arenas.

With Vietnam's urban population expected to surpass 50% by 2030, the need for eco-friendly lighting in new residential, office, and public facilities is increasing. The commercial building is also expanding quickly in Vietnam, further driving LED installations in retail and office complexes. In addition, Local players such as Rang Dong and Dien Quang are extending their market reach via e-commerce sites and strategic alliances, making LED more accessible throughout the nation.

With increased electricity prices, stricter environmental policies, and greater emphasis on smart city plans, LED lighting has emerged as a pillar of Vietnam's plan for creating sustainable, cost-effective, and forward-looking lighting infrastructure. The Vietnam LED lighting market is also dominated by huge government efforts, including reaching 100% LED streetlight in 2025. It will help cut down the city's forecasted energy demand by 1.6% to 1.8% as part of the National Program on Energy Conservation and Efficiency in Hanoi. In addition to this, the use of smart, IoT-based lighting solutions is gaining pace, especially in new urban areas and industrial estates. Significantly, as more public and private sector schemes grow in size, LEDs will come to dominate the lighting technology landscape in Vietnam by the end of the decade as the lighting solution of choice across the country.

Base Year

Historical Period

Forecast Period

In 2023, Hanoi and Ho Chi Minh City saw nearly 13,000 and 8,700 new residential units, respectively, marking the lowest supply in a decade, as reported by industry reports. The restricted supply of residential properties increases the demand for energy-efficient LED lighting solutions as homeowners aim to improve their living spaces while cutting down on energy costs.

The commercial construction sector is expected to grow by 7.2% in 2024, driven by investments in retail and office spaces, according to the Vietnam Construction Industry Report 2024. The rise in commercial developments creates opportunities for the installation of LED lighting in new buildings, promoting energy efficiency and sustainability in modern workplaces.

Vietnam’s industrial sector is anticipated to grow significantly, with FDI reaching VND 433.7 trillion (USD 18 billion) in the first half of 2024, according to the Ministry of Planning and Investment, October 2024. The expansion of high-tech industries is boosting demand for advanced LED lighting in factories and warehouses, improving operational efficiency and reducing energy use.

Compound Annual Growth Rate

6.8%

Value in USD Million

2026-2035

*this image is indicative*

| Vietnam LED Lighting Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 772.95 |

| Market Size 2035 | USD Million | 1492.33 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.80% |

| CAGR 2026-2035 - Market by Installation Type | Retrofit Installation | 6.1% |

| CAGR 2026-2035 - Market by End Use | Residential | 7.3% |

| 2025 Market Share by | Commercial | 43.5% |

The convergence of IoT and smart technology is revolutionizing the Vietnam LED lighting industry. Large manufacturers, such as Panasonic and Philips introduced smart LED systems in 2024, featuring remote control, automation, and monitoring of energy use. On the other hand, domestic businesses such as Rạng Đông are upgrading connectivity with Bluetooth-connected downlights, which enable users to control and personalize lighting remotely via the internet. These technologies address increasing consumer interest in networked home and office solutions, making it easier and more efficient to live and work. The use of smart streetlights in cities such as Hanoi and Ho Chi Minh City illustrates the way that technology is improving urban security, cutting energy consumption, and helping Vietnam's smart city plans.

The Vietnamese government has initiated several ambitious programs relating to energy efficiency and reductions in carbon emissions. These include the Vietnam National Energy Efficiency Program (VNEEP) and the Vietnam Energy Efficiency and Pollution Reduction Program (VEEPL). The major emphasis of these programs is on the increasing role of LED technology, particularly in street lighting. VNEEP and VEEPL have also aggressively promoted the use of LED lighting by creating economic incentives in the form of tax rebates and regulatory requirements. This level of political support has been the main contributing factor to the increased penetration of the market for LED lights in Vietnam.

Consumer and business anxiety around climate change, energy prices, and the switch to alternatives is propelling demand in the Vietnam LED lighting market. LEDs deliver up to 80% energy savings relative to traditional lighting alongside lower heat generation and longer lives. Support for the transition to LEDs is also driven by reasonable prices, the growing number of eco-conscious, high-performance goods designed for Vietnam's market needs.

Vietnam’s rapid urbanization is fueling demand for efficient lighting in new residential and commercial developments. In 2024, the housing market recorded nearly 81,000 units up for sale, doubling the 2023 figure amid signs of a slight recovery, according to the Vietnam Association of Realtors (VARS). The expansion of smart cities and public infrastructure, including roads and industrial parks, is driving large-scale LED installations. These trends are expected to continue as the urban population grows, supporting sustained Vietnam LED lighting market development.

Vietnam’s industrial sector attracted FDI of USD 15.2 billion in the first half of 2024, with a focus on high-tech manufacturing and logistics. This influx is driving demand for advanced LED lighting in factories, warehouses, and industrial parks. Companies are upgrading to LEDs to enhance operational efficiency, meet sustainability targets, and reduce maintenance costs. The trend is reinforced by the government’s push for green manufacturing and the adoption of international energy standards in new industrial projects.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

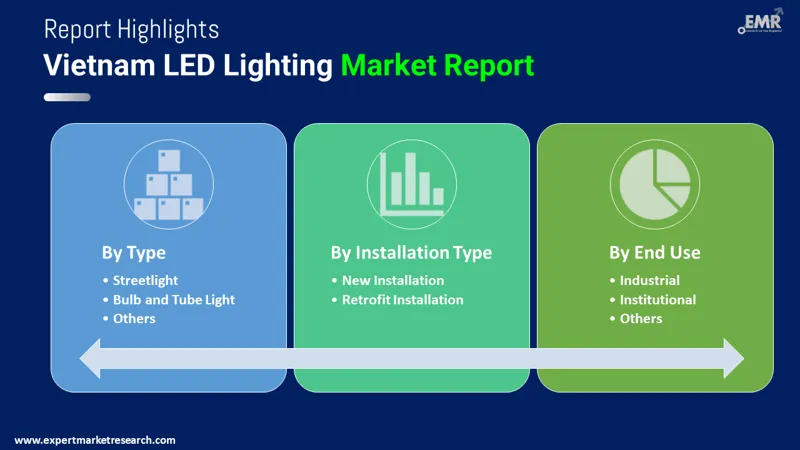

The EMR’s report titled “Vietnam LED Lighting Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Panel lights dominated the market due to their versatility and efficiency. Their superior energy efficiency, sleek design, and adaptability made them the preferred choice for offices, schools, and modern homes. The segment is further expanding with demand driven by new commercial developments and institutional upgrades. Streetlights emerged as the fastest-growing segment, expanding at, fueled by government-led urban infrastructure projects and smart city initiatives. Bulbs and tube lights maintained steady demand, especially for cost-effective residential retrofits.

Market Breakup by Installation Type

Key Insight: Retrofit installations accounted for significant Vietnam LED lighting market share, as businesses and homeowners prioritized upgrading outdated lighting systems for immediate energy savings and rapid returns. Government incentives and urban energy-efficiency mandates have made retrofitting the preferred choice in Vietnam’s major cities, especially given the minimal disruption and quick payback. Meanwhile, new installations are gaining traction in newly constructed buildings, driven by Vietnam’s ongoing construction boom and stricter green building standards. Both retrofit and new installation segments are expected to see steady growth, ensuring comprehensive market expansion across the country.

Market Breakup by End Use

Key Insight: The residential sector led the Vietnam LED lighting market, as homeowners increasingly adopted LEDs for their energy savings, longevity, and affordability. Government campaigns and falling LED prices have made efficient lighting accessible to a wider population, especially in urban and peri-urban areas. The commercial segment is the fastest growing, fueled by the expansion of retail, hospitality, and office spaces, where lighting quality and operational efficiency are critical. Industrial and institutional demand is also rising, driven by modernization, regulatory compliance, and a growing focus on sustainable lighting solutions in factories, schools, and hospitals across Vietnam.

Market Breakup by Region

Key Insight: The Southeast region, anchored by Ho Chi Minh City, commanded the largest Vietnam LED lighting market share, reflecting its dense urbanization, robust economic activity, and significant infrastructure investment. The Red River Delta, centered on Hanoi, comes next, also benefiting from upgrades of public infrastructure and smart city plans. The Mekong River Delta and South-Central Coast are becoming growth-stretched regions, buoyed by tourism, urbanization, and state funded programs. As modernization rolls out over the country, with regional differences reducing, LED adoption will advance in every region, assisting Vietnam's wider energy efficiency and sustainability objectives.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By type, panel lights to retain the largest market share due to focus on sustainability

Panel lights remain the biggest segment in Vietnam LED lighting market, thanks to energy efficiency, modern design, and widespread use in offices, schools, and residential areas. The segment has remained on an upward trend since it can meet the demand for new installations and retrofits. Business players like Rang Dong Light Source are leading this growth, with a focus on innovation and sustainability. Rang Dong's contribution towards developing advanced, eco-friendly LED solutions aligns with the market's general direction towards energy-saving technology. Such added focus on sustainability, along with the direction towards high-end illumination solutions, makes panel lighting a bestseller across industries like residential, commercial, and industrial.

Streetlights constitute the fastest-evolving segment. This is supported by government-led urban infrastructure development and smart city initiatives aimed at public safety and energy efficiency. The Hanoi municipal government plans to replace all street lighting with 100% LED by the end of 2025 for electricity saving and for promoting public safety. Similarly, Da Nang initiated the installation of 500,000 LED bulbs in the city as of July 2023, which is a significant step towards energy-efficient street lighting. It is a reflection of the overall trend of replacing street lights with LED setups across most of Vietnam's big cities.

| CAGR 2026-2035 - Market by | Installation Type |

| Retrofit Installation | 6.1% |

| New Installation | XX% |

Retrofit installations to capture large share due to government support

Retrofit installations continue to dominate the Vietnam LED lighting industry. The popularity of retrofitting is driven by cost savings, quick payback periods, and minimal disruption to existing infrastructure. Many projects, supported by government incentives, have contributed to making retrofitting the preferred solution for upgrading outdated lighting systems in urban centers and institutional facilities across Vietnam. In March 2025, Ho Chi Minh City replaced existing street lighting across 13 central districts with 8,370 LED streetlight fixtures, part of their 2021 2025 urban lighting renovation.

New installations are the fastest-growing segment. As urbanization accelerates, developers are increasingly specifying LED lighting during the design phase of residential, commercial, and industrial projects to ensure compliance with green building codes and future-proof their properties. The government’s focus on smart city initiatives and infrastructure modernization further supports new installations, especially in emerging urban areas. In line with these efforts, the recent smart city partnership between Australia and Vietnam is expected to boost demand for sustainable lighting solutions, fostering innovation in urban infrastructure.

| CAGR 2026-2035 - Market by | End Use |

| Residential | 7.3% |

| Industrial | 6.9% |

| Commercial | XX% |

| Institutional | XX% |

| Others | XX% |

The residential sector to lead market growth due to surging households

The residential sector is contributing to the Vietnam LED lighting market revenue. The strong demand is driven by rapid urbanization, increased disposable incomes, and growing consumer focus on energy efficiency. Vietnamese households are increasingly adopting LEDs due to their lower operational costs, longer lifespans, and superior lighting quality. Government-backed initiatives and incentives aimed at promoting energy-efficient lighting have further fueled the transition, especially in urban and peri-urban regions. With LED prices continuing to decrease and product offerings expanding, the residential segment is projected to maintain its leadership in the market.

The commercial sector in Vietnam is experiencing significant growth, driven by robust investments in retail, hospitality, and office developments, creating substantial opportunities for LED installations in new buildings and renovations. As businesses increasingly prioritize sustainability and energy efficiency, LED lighting installations are becoming integral to new construction projects, aligning with global trends toward intelligent and eco-friendly buildings. In June 2025, Vung Tau City officially launched a comprehensive lighting renovation for its core coastal area, “Bai Sau Street,” investing over USD 10 million. The growing focus on energy-efficient solutions in commercial spaces is expected to drive the market growth.

Southeast claims the dominant market position led by rapid urbanization

The Southeast region dominates the Vietnam LED lighting market, and it is powered by the latter's robust economic growth, high density of industrial and commercial developments, and urban growth. Ho Chi Minh City, the economic hub of Vietnam, is at the forefront of this growth, with huge investments in infrastructure, residential, and commercial developments. As urbanization gets into high gear, companies are gravitating more towards energy-efficient LED lighting solutions to offset operational costs and achieve sustainability objectives. Government programs encouraging energy-efficient technologies have further fueled the adoption of LEDs in the region.

The Mekong River Delta is the rapidly expanding area for LED lighting demand in Vietnam, led by fast urbanization as well as robust government support for energy-efficient technology. The urbanization level in the Mekong Delta reached 32% in September 2023. With the region rapidly developing its infrastructure, there is an increasing need for LED lighting solutions in residential, commercial, and agricultural developments. Government-driven sustainability and energy-saving schemes are driving the transition towards LED lighting, especially in urban and agricultural development schemes.

The Vietnam LED lighting market is highly competitive, with both domestic players and international brands vying for market share. Companies focus on innovation, product quality, energy efficiency, and competitive pricing to stay ahead. Key growth drivers include strategic partnerships, investments in research & development, and the introduction of smart, IoT-enabled lighting solutions.

Market leaders are diversifying their product offerings to meet the needs of residential, commercial, and industrial customers. Differentiation comes from sustainability, compliance with international standards, and strong after-sales support. Additionally, government policies promoting local manufacturing and the rising demand for customized, high-performance lighting solutions further shape the market.

Founded in 1961, Rang Dong is based in Hanoi, Vietnam. It leads in LED lighting, smart home/city and agricultural lighting solutions. The company built a Lighting Research & Development Center (2011) for innovation, integrates thermal management tools (Ansys) and pursues ecofriendly products and high export performance.

Dien Quang was founded in 1979 and is headquartered in Ho Chi Minh City. It has diversified from fluorescent lamps to LED and smart lighting solutions. Dien Quang has developed modern automated production lines and established overseas operations; its smart lighting and energy efficient lamps comply with CE, RoHS etc.

Asled was established in 2012, headquartered in Cholet, France. It designs and manufactures commercial and industrial LED luminaires, with a focus on quality and performance. Asled emphasizes innovation, responsibility, and service, and has built certification and production excellence, targeting energy efficient lighting systems.

Signify began as part of Philips in Eindhoven, founded in 1891 and became a separate entity in 2016. Headquartered in Eindhoven, Netherlands, it maintains global operations in over 70 countries. Signify is known for innovating in connected lighting, IoT-enabled systems, and invests heavily in research & development.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Vietnam LED lighting market are Osram Licht AG, Nichia Corporation, Cree Inc., and Seoul Semiconductor Co Ltd, among others.

Stay ahead in the fast-evolving Vietnam LED Lighting Market with our latest report, featuring comprehensive analysis, trends for 2026, and actionable forecasts through 2035. Download your free sample today to access expert insights, data-driven strategies, and in-depth market segmentation. Empower your business with the most trusted Vietnam LED Lighting Market report and make informed decisions for sustainable growth and competitive advantages.

Vietnam Solar LED Lighting Market

Vietnam Industrial LED Lighting Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 772.95 Million.

The market is projected to grow at a CAGR of 6.80% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 1492.33 Million by 2035.

Vietnam’s government is pushing energy efficiency through policies, subsidies, and mandates like replacing streetlights with LEDs, helping reduce power use and emissions. Rapid urbanization, infrastructure expansion and smart city initiatives in cities like Hanoi and Ho Chi Minh City are boosting demand.

With the growing awareness about the environment, various government programs are seeking greater adoption of LED lighting by supporting the local LED lighting products manufacturers and encouraging its use among the consumers.

The leading types of LED lighting in the market are panel lights, down lights, flood lights, street lights, and bulb and tube light, among others.

The significant installation types of LED lighting in the market are new installation and retrofit installation.

The major end use sectors in the market are residential, commercial, industrial, and institutional, among others.

The key players in the market include Rang Dong Light Source and Vacuum Flask JSC (Ralaco), Dien Quang Light Source Company, Asled Co., Ltd, Signify (Philips Lighting), Osram Licht AG, Nichia Corporation, Cree Inc., and Seoul Semiconductor Co Ltd, among others.

The market faces several challenges, including high initial investment costs, which deter adoption among price-sensitive consumers. Limited public awareness about long-term energy savings and durability also slows market penetration. The widespread availability of counterfeit or low-quality products undermines consumer trust.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Installation Type |

|

| Breakup by End Use |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

Regional Players:

Global Players:

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share