Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Vietnam online food delivery market attained a value of USD 1182.87 Million in 2025. The market is expected to grow at a CAGR of 22.18% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 8768.76 Million.

As more Vietnamese people move to cities and as urban life gets busier, time becomes a premium as many consumers have less time to cook or dine in. As per Open Development Vietnam, about 57.3% of Vietnam's population is expected to reside in urban areas by 2050. The convenience of “order‑and‑deliver” meals becomes highly attractive. Also, urban density helps make delivery logistics more viable with restaurants and customers being closer, delivery routes are shorter.

Consumers are not just ordering more as they are becoming pickier, adding to the Vietnam online food delivery industry value. There is growing interest in healthy meals, plant‑based or specialty diets, organic ingredients, sustainable or eco‑friendly packaging. Demand for quality, food safety, hygiene has increased. Also, variety, including more international cuisines, is increasingly sought after. Platforms and restaurants that can meet such expectations can differentiate themselves.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

22.18%

Value in USD Million

2026-2035

*this image is indicative*

The Vietnam online food delivery market is witnessing rapid growth in internet access and smartphone ownership, especially among younger, urban populations. As per DataReportal, there were 76.2 million social media user identities in Vietnam in January 2025. This makes ordering via apps easier, faster, and more ubiquitous. As connectivity improves even in smaller towns and suburbs, the potential user base increases. Better internet infrastructure lowers friction for app use, tracking, real‑time updates.

With rising wages and improvements in living standards, more Vietnamese consumers can afford regular “outside meals” and delivery orders. They are also willing to pay a bit more for convenience, better quality, variety, and more frequent meals delivered. The expanding middle class means more discretionary expenditure. In 2023, Vietnamese labourers’ monthly average income reached 7.1 million VND per person, up 6.9% compared to 2022. This increasing spending power fuels both order volume and willingness to try premium or diverse cuisine.

The rising popularity of cloud kitchens to fulfill orders as they have no dine‑in space is adding to the Vietnam online food delivery market development. CloudEats, which runs cloud kitchens in the Philippines and Vietnam, raised USD 7 million in funding in September 2022. They reduce real‑estate and overhead costs, enabling restaurants to scale faster, experiment with menus without physical constraints, and target specific areas. They also allow platforms to partner or own kitchens dedicated to their delivery volume, improving speed and consistency.

Vietnam has seen growing adoption of e‑wallets and digital payment options. Integration between delivery apps and payment services simplifies the ordering process. Less reliance on cash both saves time and removes friction. Platforms that support multiple payment options like wallets, cards, and online banking also tend to see higher usage. In June 2023, ZaloPay became the first Vietnamese e wallet to integrate as a payment gateway on Shopify, enabling Shopify merchants in Vietnam to accept ZaloPay directly.

Delivery speed and reliability are central to the Vietnam online food delivery industry. Improved route optimization, more efficient fleet management, real‑time tracking, and investment in last‑mile delivery capabilities matter. Also, in densely populated cities, traffic constraints, driver availability etc. are challenges. Companies are investing in more delivery partners, better mapping/data, and sometimes in electric or other sustainable vehicles to reduce cost and environmental impact.

Read more about this report - REQUEST FREE SAMPLE COPY

The EMR’s report titled “Vietnam Online Food Delivery Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Order Mode

Key Insight: The online segment is the most dominating, driven by rapid digital adoption and smartphone penetration. Several platforms have transformed how Vietnamese consumers order meals, offering convenience, variety, and quick service. In July 2025, ShopeeFood introduced a “solo meal” collection uniformly to attract individual customers, especially Gen Z, who want quick, affordable meals. The urban population also prefers digital apps for their user-friendly interfaces and multiple payment options.

Market Breakup by Online Order Method

Key Insight: The mobile application segment leads the Vietnam online food delivery market due to the widespread use of smartphones and increasing mobile internet penetration. Most consumers prefer ordering food via apps like GrabFood, ShopeeFood, and Now due to their convenience, user-friendly interfaces, and integrated payment systems. Mobile apps offer features such as real-time order tracking, push notifications, and personalized recommendations, enhancing the user experience.

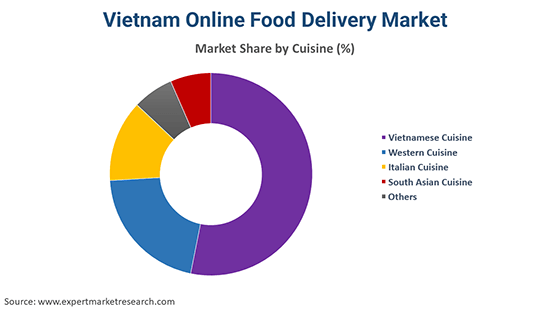

Market Breakup by Cuisine

Key Insight: The growth of the Vietnamese cuisine segment is driven by strong local demand and cultural familiarity. Dishes like phở, bún bò Huế, cơm tấm, and bánh mì are everyday staples, especially for lunch and dinner. Their affordability, quick preparation, and wide availability through restaurants and street food vendors make them ideal for delivery. Platforms like GrabFood and ShopeeFood feature dedicated Vietnamese cuisine sections, often supported by discounts and express delivery options.

Market Breakup by Region

Key Insight: The Southern Vietnam online food delivery market, comprising Ho Chi Minh City, is gaining traction due to its dense population, high smartphone penetration, and fast-paced urban lifestyle. As per World Population Review, the population of Ho Chi Minh City in 2025 is estimated at 9,816,320. The region embraces both local and international cuisines, with high demand for street food, rice dishes, milk tea, and Western fast food. Major platforms like GrabFood and ShopeeFood are also heavily offering fast delivery and aggressive discounts.

Offline Food Delivery to Gain Popularity in Vietnam

The offline segment is recording preference as traditional ordering methods like phone calls and walk-in takeaway remain common, especially in smaller towns and rural areas with limited internet access or digital literacy. Many local eateries rely on this segment to maintain customer relationships and handle orders without the fees charged by online platforms. Moreover, face-to-face interaction and customized orders appeal to some consumers who prefer personal service over digital convenience.

Online Food Delivery Websites to Garner Demand in Vietnam

The website segment holds a massive Vietnam online food delivery industry share. While many food delivery platforms maintain websites for ordering, these are mostly supplementary channels targeting users who prefer desktop access or do not have access to mobile apps. In January 2025, Vietnam’s first social network dedicated to food + travel enthusiasts, Food Travel Vietnam was officially launched in Ho Chi Minh City. With rising smartphone usage, website orders may remain secondary to mobile app transactions in Vietnam’s food delivery ecosystem.

Surging Interest in Western & Italian Cuisine in Vietnam

Western cuisine holds a strong presence in Vietnam’s urban online food delivery scene, especially in major cities like Ho Chi Minh City, Hanoi, and Da Nang, where young professionals and expatriates seek variety. Popular dishes include burgers, steaks, fried chicken, salads, and sandwiches, with chains like McDonald’s, KFC, Lotteria, and Pizza Hut seeing high order volumes. Western food is often seen as convenient, especially for lunch and dinner, and is widely promoted through delivery platforms with deals and combo offers.

Italian cuisine, especially pizza and pasta, continues to boom in the Vietnam online food delivery market. Brands like Pizza 4P’s, Domino’s, and The Pizza Company drive the segment, often targeting family-sized portions or group meals. In April 2024, Domino’s opened its first store in Nha Trang, Central Vietnam, as part of its expansion plan in that region. High-quality ingredients, fusion innovations like seaweed pizza, and vegan-friendly menus have further boosted the segment appeal.

Expanding Online Food Delivery in Northern & Central Vietnam

Northern Vietnam, led by Hanoi, ranks higher in online food delivery. While slightly more conservative in food preferences, the region has seen rapid adoption of delivery apps, especially among students and office workers. In August 2024, Hanoi's Hoan Kiem District launched a culinary tourism app, available on iOS and Android. Traditional dishes like bún chả, phở, and nem rán are top choices, alongside bubble tea and light snacks. Cultural loyalty to northern cuisine keeps local food dominant here.

Central Vietnam online food delivery industry, including cities like Da Nang and Hue, has a strong smallest footprint. While urban areas are developing rapidly, overall digital adoption is slower due to smaller population sizes and lower average income levels. Regional specialties like mì Quảng, bánh bèo, and bún bò Huế are available for delivery, but fewer restaurants are integrated with major platforms. However, tourism in cities like Da Nang is boosting short-term demand, and local digital infrastructure improvements could support future growth.

Key players in the Vietnam online food delivery market are focusing on aggressive promotional campaigns, such as discounts, free deliveries, and loyalty programs to attract and retain customers. Leading platforms like GrabFood, ShopeeFood, and Baemin use these tactics to compete for market share in a price-sensitive consumer base. Partnerships with restaurants are crucial, with platforms offering marketing support and digital tools to help small and medium-sized food businesses increase their visibility.

Many players also focus on expanding their vendor base and offering a wide variety of cuisines to meet diverse customer preferences. With technology integration, companies invest in user-friendly mobile apps, real-time tracking, and AI for personalized recommendations. To ensure service quality, players also optimize last-mile delivery through logistics networks and sometimes use in-house delivery fleets. Further, some platforms localize their approach with regional language support and culturally relevant offerings.

Founded in 2011, VietnamMM is headquartered in Ho Chi Minh City, Vietnam. It was an early mover in Vietnam’s online food ordering space, acquiring Foodpanda’s Vietnam operations in 2015. Later its parent company, Woowa Brothers, phased out the VietnamMM app in favor of Baemin to consolidate services.

Foody Corporation, founded in 2012 and is based in Ho Chi Minh City, built a review/social platform, then expanded into services like online ordering and delivery, restaurant reservations, table booking, and POS solutions. Its innovations include integrating multiple services into one ecosystem and scaling to many cities and thousands of restaurant partners

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Download our free sample report today to explore the latest Vietnam online food delivery market trends 2026. Gain expert insights, quantitative analysis, and strategic forecasts to stay ahead in this rapidly evolving sector. Unlock detailed data on regional growth, consumer preferences, and platform competition to make informed business decisions. Don’t miss out on understanding Vietnam’s dynamic food delivery landscape!

Philippines Online Food Delivery Market

North America Online Food Delivery Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 22.18% between 2026 and 2035.

The key strategies driving the market include aggressive use of promotions and loyalty programs to attract and retain customers, along with strategic partnerships with local restaurants and cloud kitchens to expand reach and menu variety. The market benefits from rising smartphone and internet penetration, enabling seamless app-based ordering.

The key trends guiding the growth of the online food delivery market in Vietnam are the advancements in technology in the region's food delivery market and the growing popularity of food delivery among younger consumers.

The major regions for online food delivery in Vietnam are Southern, Northern, and Central.

Online and offline are the significant order modes of online food delivery in the market.

The major online order methods of in the market are mobile applications and websites.

Vietnamese cuisine, Western cuisine, Italian cuisine, and South Asian cuisine, among others, are the various cuisines in the Vietnam online food delivery market.

The key players in the market report include Vietnam MM Co., Ltd, and Foody Corporation, among others.

In 2025, the market reached an approximate value of USD 1182.87 Million.

The online segment is the most dominating, driven by rapid digital adoption and smartphone penetration.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Order Mode |

|

| Breakup by Online Order Method |

|

| Breakup by Cuisine |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share