Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global zinc micronutrient for animal feed market was volumed at 67.01 KMT in 2025. The industry is expected to grow at a CAGR of 4.36% during the forecast period of 2026-2035 to attain a volume of 102.68 KMT by 2035.

Base Year

Historical Period

Forecast Period

In 2022, the world feed production reached a volume of 1.266 billion tonnes.

Micronutrients such as zinc when added to feed help improve reproduction, health, and general performance of animals.

The growing awareness of the advantages of utilising feed additives to prevent diseases is increasing the use of zinc micronutrient.

Compound Annual Growth Rate

4.36%

Value in KMT

2026-2035

*this image is indicative*

Animal performance and general well-being are enhanced by zinc. While severe zinc deficiency can cause skin parakeratosis, reduced growth, general debility, increased susceptibility to infection, and lethargy, adding zinc to animal feed can aid in protein synthesis, carbohydrate metabolism, and other biochemical reactions.

Increasing focus on animal health along with the rising demand for protein-rich animal-based food products is increasing the use of zinc micronutrients in animal feed to boost their immunity and promote growth.

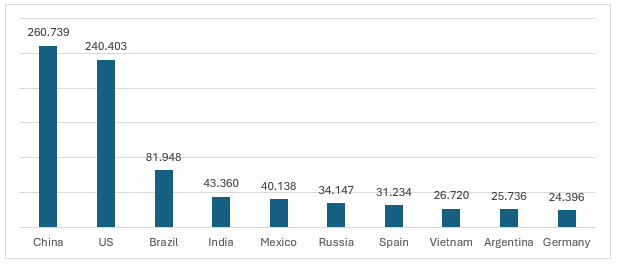

Figure: Top 10 Feed-Producing Countries (Million Tons) (2022)

Increasing addition of premixes; rising demand for animal-based foods; rising consumption of fish; and increasing adoption of nano zinc as an alternative to conventional zinc are the major factors impacting the zinc micronutrient for animal feed market growth

There is a rising incorporation of premixes in animal feed to enhance growth performance and metabolic activities by providing them with a balanced diet. This further aids the demand for zinc micronutrient.

The rising health consciousness and economic growth are increasing the consumption of meat, poultry, and dairy, increasing the addition of zinc in animal feed.

The consumption of fish and sea food is rising, and according to forecasts by the Organisation for Economic Co-operation and Development (OECD), by 2029, 90% of the produced fish will be consumed. This is expected to potentially increase the demand for zinc micronutrient for fish feed.

Advancements in nanoscience in the field of mineral nutrition and increasing research activities to find optimal nano zinc levels for animal feed rations to provide economic benefits and enhanced performance are increasing the use of nano zinc in animal feed.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Zinc Micronutrient for Animal Feed Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Species Type

Market Breakup by Region

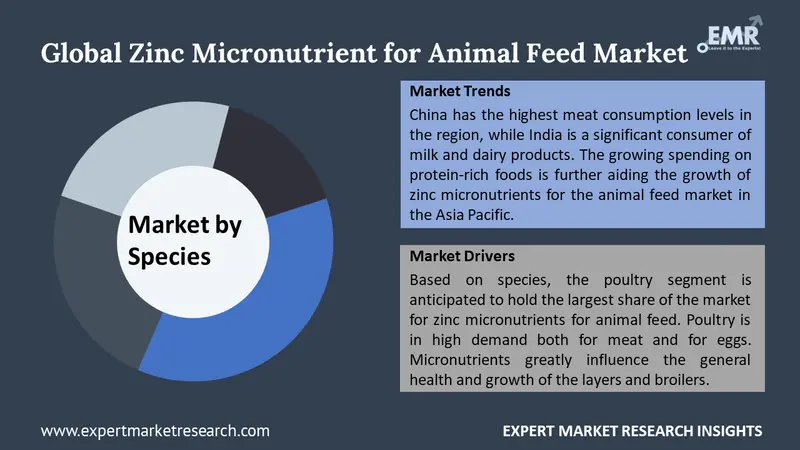

Based on species type, poultry dominates the zinc micronutrient for animal feed market share

With the expanding global population and more people living in urban settings, the demand for animal products to meet their food protein requirements is increasing. The meat of poultry such as chicken, ducks, turkeys and geese, and eggs of chicken and ducks are safe and convenient to consume, making them a favoured choice among consumers. The rising poultry production is increasing the use of zinc to improve their immunity, body weight, and eggshell quality.

In aquaculture, various sources of zinc are used, such as nanoparticles, organic, and inorganic, to improve essential enzyme synthesis and metabolism and support the formation of hormones for growth, immunity, and reproduction.

The market players are focusing on product performance and quality, customer support and service, and cost-effectiveness, while also engaging in research and development to further gain a competitive edge in the market.

Biochem, headquartered in Germany, specialises in the innovation of animal feed products and covers the entire value chain, from the selection of suitable additives for animal health and nutrition to the on-site sale and distribution of the products.

Founded in 2011, the company provides trace elements for swine, poultry, aquaculture, ruminants and horses.

Headquartered in United States, Alltech is engaged in the manufacture and processing of yeast additives, organic trace minerals, feed ingredients, premix and feed and also specialises in yeast fermentation, solid-state fermentation, and the science of nutrigenomics.

Founded in 1991, Novus is a global leader in developing, manufacturing, and commercialising gut health solutions for the animal agriculture sector.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the zinc micronutrient for animal feed market are Balchem Corporation, Zinpro Corporation, Norel SA, and Trouw Nutrition, among others.

In Europe, countries such as Spain, France, Germany, and Italy are home to a large population of livestock, including pigs, bovine animals, sheep, and goats. Dietary supplementation with trace minerals such as zinc helps regulate critical metabolic pathways and improve immune function, fertility, neonatal survival, feed efficiency, growth, and meat quality.

Countries such as Saudi Arabia, Egypt, Algeria, Morocco, and Bahrain are increasingly using dairy ingredients to produce cheese, confectioneries, chocolates, and bakery goods with the support of sophisticated dairy and meat processing plants to meet the global demand for their products.

In the USA, over 300 varieties of cheese are produced from cow's milk. Using zinc in dairy cattle feed helps improve the milk quality and, consequently, cheese.

Artificial intelligence market

Latin America Explosives Market

Animal Feed Micronutrients Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market reached a volume of 67.01 KMT in 2025.

The market is expected to grow at a CAGR of 4.36% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of 102.68 KMT by 2035.

The different species include poultry, swine, dairy, aqua, ruminants, equine, and others.

The key regional markets for zinc micronutrient for animal feed are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The factors driving the growth of the market are the increasing consumption of meat and dairy products amidst the rising food demands, increasing health concerns, growing importance of animal health, and the use of nano zinc.

Animals require zinc as a vital nutrient because it plays a critical role in various metabolic processes, including protein synthesis, glucose metabolism, and many others. As a result, zinc is a popular micronutrient for animal feed.

The key players in the market include Biochem Zusatzstoffe Handels- und Produktionsgesellschaft mbH, Animine, S.A.S.U., Alltech Inc, Novus International, Inc., Balchem Corporation, Zinpro Corporation, Norel SA, and Trouw Nutrition, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Species |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,839

USD 4,355

tax inclusive*

Five User License

Five User

USD 5,999

USD 5,099

tax inclusive*

Corporate License

Unlimited Users

USD 7,259

USD 6,170

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share