Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Asia Pacific renewable energy market was valued at USD 378.58 Billion in 2025. Corporate clean energy procurement in Southeast Asia is fuelling demand for utility-scale solar and wind assets, supported by green PPAs and voluntary market instruments across logistics, technology, and FMCG sectors. As a result, the market is expected to grow at a CAGR of 9.10% during the forecast period of 2026-2035 to reach a value of USD 904.49 Billion by 2035.

Growth in the global market is led by disruptive policies, aggressive investments, and unique innovations tailored to regional demands. This shift is rooted in strategic undertakings by governments and private entities alike. In 2023, China alone added nearly 216 GW of new renewable capacity, which made up more than 55% of the global share. Meanwhile, India's National Green Hydrogen Mission, backed by USD 2.4 billion in government funding, is driving niche renewable categories with export potential.

Japan's floating offshore wind farms and Australia's utility-scale battery storage are steering the Asia Pacific renewable energy market growth into a new generation of energy infrastructure. The region, known for its heavy industrial base, is increasingly banking on decentralised microgrids and grid-parity solar solutions to enhance energy security. The ASEAN Plan of Action for Energy Cooperation (APAEC) aims for 23% renewable energy in the total primary energy supply by 2025, which now looks modest as countries exceed interim targets.

Even mid-tier economies like Vietnam and the Philippines are boosting the market dynamics. Vietnam’s rooftop solar sector has attracted foreign investments from firms like SunPower and First Solar, and regional collaboration. Multilateral agencies are now favouring the region for funding unique hybrid energy projects.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

9.1%

Value in USD Billion

2026-2035

*this image is indicative*

A defining trend in the Asia Pacific renewable energy market is the shift toward smart grid solutions that can absorb volatile renewable outputs. Japan’s smart grid pilots and South Korea’s “Energy Valley” projects have proven the need for grid synchronisation in high-density cities. In Australia, the South Australia Virtual Power Plant (SAPN) project is now one of the largest in the world, combining over 50,000 decentralised Tesla Powerwall battery systems. These setups attract B2B interest from storage suppliers and software providers, fostering an ecosystem of real-time analytics, predictive maintenance and energy-as-a-service models.

Countries like India, Australia, and Japan are spearheading trilateral collaborations to produce and export green ammonia, further boosting the Asia Pacific renewable energy market opportunities. In August 2022, India’s Reliance Industries has committed to transition to green hydrogen by 2025. On the other hand, the Port of Gladstone in Australia is already building infrastructure to support liquefied hydrogen exports to Japan, aligned with the Japan-Australia Hydrogen Energy Supply Chain project. These projects are attracting equipment makers, pipeline developers, and electrolyser manufacturers to participate in B2B procurement contracts, indicating a long-term industrial export pipeline.

Agrivoltaic systems are redefining land-use efficiency in countries like Vietnam, Thailand, and Indonesia, accelerating further demand in the Asia Pacific renewable energy market. The dual-use model not only boosts rural employment but also increases yield by moderating crop temperatures. Vietnam now hosts pilot agrivoltaic farms with co-located water management systems. Moreover, researchers have developed semi-transparent PV panels that support crop growth. This model is turning rural cooperatives into energy producers, opening up opportunities for agricultural equipment firms, panel producers and remote monitoring technology suppliers within the regional B2B landscape.

Asia Pacific leads in diverse storage formats, from pumped storage hydropower in China to lithium-iron phosphate (LFP) batteries in Australia. The largest grid-scale battery in the southern hemisphere, the Victorian Big Battery, started commercial operation, supplying 450 MWh of storage. Meanwhile, in April 2025, Chinese firm CATL launched its sodium-ion battery, that is expected to be pivotal for decentralised renewables in countries with limited lithium reserves. These major advances in the market are enabling consistent power delivery, making intermittent sources like solar and wind more bankable. For B2B players, there is a rising demand for modular storage units, thermal storage systems, and integrated software platforms.

Floating solar and hybrid coastal platforms are being increasingly deployed in land-constrained countries. For example, Indonesia’s Cirata floating solar plant, expected to power 50,000 homes, has largely contributed to the Asia Pacific renewable energy market value. In South Korea, the Saemangeum project combines tidal, wind and floating solar in a hybrid design optimised for coastal resilience. These systems attract marine engineering firms, corrosion-resistant material suppliers, and drone-based O&M technology providers. Notably, the Philippines is exploring offshore wind-floater-tidal hybrids with Danish and Korean partners.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Asia Pacific Renewable Energy Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Hydropower remains dominant as per the Asia Pacific renewable energy market report, due to its sheer scale and stable output, especially in China and India. Solar represents the fastest-growing type category, driven by decentralisation, innovative module technology, and government subsidies. Wind energy gains traction in offshore-heavy countries like Japan and South Korea, while bioenergy plays a role in biomass-rich economies such as Indonesia. Solid biofuels serve dual-purpose heating and power needs in rural regions.

Market Breakup by Region

Key Insight: China largely strengthens the Asia Pacific renewable energy demand forecast with scale and supply chain dominance, while India showcases speed and hybridisation. Japan focuses on offshore wind and hydrogen R&D, capitalising on its technology and energy import challenges. Australia leverages utility-scale battery projects and green hydrogen corridors to position itself as an energy exporter. Each country’s policy framework attracts distinct industry participation, be it grid design, module innovation, or energy trading platforms.

By Type, Hydropower Accounts for the Dominant Share of the Market

Hydropower continues to dominate the market, largely due to China’s vast hydro network and strategic dam expansions in India and Vietnam. The Baihetan Dam, one of the world’s largest, went operational in China with a massive 16 GW capacity in December 2022. Countries like Laos are branding themselves as “battery of Southeast Asia,” exporting hydroelectric power to neighbouring countries like Thailand, Cambodia, and Malaysia, via cross-border grids. Hydropower attracts long-term infrastructure players, turbine manufacturers, and grid consultants. The sector’s resilience lies in its base-load capacity and high reliability. Innovations like fish-friendly turbines and sediment-flow simulation models are drawing attention from new B2B entrants, targeting ecological compliance without compromising on scale.

The solar category is surging demand in the Asia Pacific renewable energy market in both capacity and application. For example, India added 12.8 GW of new solar capacity in FY2023. However, innovations like bifacial solar modules in Taiwan or perovskite R&D in South Korea have contributed to the cateory’s fast-paced growth. Floating solar systems are finding application in agricultural ponds and industrial reservoirs. China's integration of solar into highways (PV roads) reflects unique use cases. These developments are fostering demand for niche panel designs, inverter upgrades and AI-based maintenance platforms. Solar’s scalability and dropping costs make it attractive for urban developers, EPC firms, and regional utilities aiming for quick ROI and flexible deployment.

By Region, China Holds the Leading Position in the Market

China dominates the renewable energy market, largely boosted by the government’s 14th Five-Year Plan targets over 1,200 GW of wind and solar capacity by 2030. However, by the end of 2024, China had already surpassed this target, reaching this milestone 6 years ahead of schedule. The nation leads in battery storage, solar module exports and grid innovation. Projects like the Qinghai-Tibet solar power corridor showcase megawatt-scale installations in extreme terrains. China’s unique scale allows for vertical integration, where firms handle everything from polysilicon production to system integration. For B2B players, China remains both a supplier hub and a collaboration arena, offering pathways into new technology like hydrogen fuel cells and digital twin monitoring.

The renewable energy market in India is surging with large-scale renewable auctions, hybrid power parks and supportive policies. The Green Energy Corridor project and the National Solar Mission have given rise to the demand for renewable energy equipment, storage technology, and smart grid applications. Gujarat’s Hybrid RE park is expected to house over 30 GW capacity. Private firms are also receiving incentives through PLI schemes for solar PV and battery manufacturing. Moreover, the nation’s energy landscape is shifting towards blended models like solar-wind-storage hybrids creating layered opportunities for EPC contractors, AI analytics firms, and component suppliers.

Leading Asia Pacific renewable energy market players are increasingly focusing on hybrid solutions such as solar-plus-storage, hydrogen-plus-wind, or agrivoltaic-bioenergy systems. Procurement models are evolving with long-term corporate Power Purchase Agreements (PPAs) becoming mainstream across India, Australia and Japan. Smart grids, green hydrogen exports, agrivoltaics, energy storage innovations, and coastal hybrid platforms have been the key trends observed in the market.

Moreover, Asia Pacific renewable energy companies are tapping into R&D collaborations, offshore logistics, and digital infrastructure to gain a competitive edge. Urban centres are demanding high-density rooftop and BIPV systems, while rural regions seek microgrid scalability. For B2B firms, opportunities lie in project financing, O&M automation, and capacity-building services. Players who can adapt to fast policy shifts, supply chain resilience, and regional deployment quirks are expected to lead the next growth cycle.

TBEA Sunoasis Co., Ltd. was established in 2000 and is headquartered in Xi 'an, Shaanxi, China. The company provides turnkey solar PV systems and transmission solutions. It supplies utility-scale solar farms with hybrid inverter technology and EPC services tailored for desert terrains.

Mahindra EPC Irrigation Limited, founded in 1981 and based in Nashik, India, began its operations as an irrigation company but currently focuses on solar EPC projects. The company delivers off-grid solutions and rooftop solar setups for agribusiness and industrial clients.

Tata Power Limited, founded in 1911 with headquarters in Mumbai, India, has pivoted aggressively to renewable energy. The company's renewable energy segment boasts over 5.5 GW capacity, including wind, solar and hybrid systems, with a focus on smart grids and energy-as-a-service.

Suzhou Talesun Solar Technologies Co., Ltd., headquartered in Jiangsu, China, was founded in 2010. The company manufactures high-efficiency solar cells and modules and partners with international firms to deploy large-scale projects in emerging Asia Pacific markets.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Windflow Technology Ltd., Zhejiang Chint New Energy Development Co Ltd, Abengoa, and Vestas Wind Systems A/S, among others.

Explore the latest trends shaping the Asia Pacific renewable energy market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Asia Pacific renewable energy market trends 2026.

North America Renewable Energy Market

Latin America Renewable Energy Market

United States Renewable Energy Market

Saudi Arabia Renewable Energy Market

Philippines Renewable Energy Market

Germany Renewable Energy Market

Europe Renewable Energy Market

Africa Renewable Energy Market

India Renewable Energy Market

Renewable Energy Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Asia Pacific renewable energy market reached an approximate value of USD 378.58 Billion.

Key strategies driving the market include localising supply chains, investing in hybrid systems, forming cross-border consortia, digitising O&M services, and aligning with country-specific policy roadmaps to capitalise on Asia Pacific's renewable energy expansion.

The rising environmental concerns, the surging investment in renewable resource expansion, and the growing focus on eco-friendly development in the region are the key trends guiding the market.

The major countries in the market include China, Japan, India, and Australia, among others.

The dominant types of renewable energy in the market are hydropower, wind, solar, bio energy, and solid biofuels.

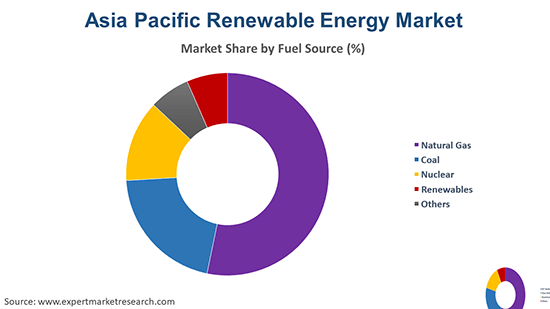

The major fuel sources of renewable energy in the market are coal, natural gas, and nuclear renewables, among others.

The major players in the market are TBEA Sunoasis Co., Ltd., Mahindra EPC Irrigation Limited, Tata Power Limited, Suzhou Talesun Solar Technologies Co., Ltd., Windflow Technology Ltd., Zhejiang Chint New Energy Development Co Ltd, Abengoa, and Vestas Wind Systems A/S, among others.

The market is projected to grow at a CAGR of 9.10% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 904.49 Billion by 2035.

The key challenges are grid instability, land acquisition delays, import dependencies for technology components, and inconsistent regulatory frameworks.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share