Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global distribution transformer market is expected to grow at a CAGR of 5.00% in the forecast period of 2026-2035.

Base Year

Historical Period

Forecast Period

Asia Pacific is estimated to be the fastest growing and largest regional market for distribution transformers in 2024.

Established global players like Hitachi Energy, Siemens, and Schneider Electric dominate the distribution transformers market share.

The growing need to modernise electricity grids worldwide drives investments in advanced distribution transformers capable of handling modern grid complexities and integrating renewable energy sources.

Compound Annual Growth Rate

5%

2026-2035

*this image is indicative*

The distribution transformer refers to the electric equipment used to provide the final voltage transformation in a distribution grid for electric power. The electricity operating at higher voltage is stepped down appropriately and supplied to the consumers. They are used for electricity supply in commercial, industrial, and household establishments with constant potential difference and frequency.

The key drivers aiding the distribution transformer market development include investments in transmission and distribution infrastructure, particularly in developing regions, and replacement demand in developed regions. The Asia-Pacific region, including countries like China and India, is driving the market's growth due to rapid urbanisation, industrialisation, and electrification programs.

Additionally, the incorporation of renewable energy into the electrical grid has raised investments in electrical power systems, further boosting the distribution transformer business in both developed and emerging nations. The market is also being stimulated by an increase in manufacturing activity and electrification programs in Asian nations, as well as the growth of railways, metros, bullet trains, IT hubs, commercial centers, and other infrastructure projects.

Emergence of smart transformers, increasing demand for renewable integration, and rising demand for compact and modular distribution transformers are shaping the distribution transformers market outlook

The global shift towards renewable energy sources is impacting the distribution transformer market significantly. With the increasing integration of solar, wind, and other renewable energy systems into the grid, transformers must adapt to handle fluctuations in power supply efficiently.

Energy efficiency has become a top priority for utilities and industries, leading to the design of distribution transformers focused on minimising energy losses during power transmission. Eaton's Cooper Power series transformers utilise bio-based insulating fluids, reducing the risk of soil and groundwater contamination.

The emergence of smart transformers, also known as intelligent or digital transformers, is revolutionising the distribution transformer market expansion. These transformers integrate advanced sensors, communication technologies, and data analytics to monitor and control power flow in real-time.

Urbanisation and limited space availability are driving the demand for compact and modular distribution transformers as they enhance scalability, allowing utilities to expand capacity as needed and optimise grid layouts efficiently. Schneider Electric's EcoStruxure Modular Substations provide a plug-and-play solution for distribution transformers, enabling rapid deployment and easy expansion.

Smart transformers leverage the Internet of Things (IoT) to enhance grid efficiency, reduce downtime, lower power costs, and enable predictive maintenance. ABB's AbilityTM Smart Transformer combines digital technologies with power electronics to optimise grid performance and enable remote monitoring and control. Such smart grids are more efficient in transmission of electricity supply, even after power failures. This trend not only optimises power distribution but also contributes to the development of smart grids, further propelling the distribution transformer market growth.

Distribution transformers are evolving to accommodate bidirectional power flow, ensuring seamless integration of renewable energy sources into the grid. Siemens Gamesa's renewable energy solutions include distribution transformers designed to handle the unique requirements of wind and solar power integration. This trend aligns with the global commitment to reduce carbon emissions and transition towards a sustainable energy future.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The Expert Market Research report titled “Distribution Transformer Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Phase

Market Breakup by Capacity

Market Breakup by Mounting

Market Breakup by Application

Market Breakup by Region

Oil-filled and dry type transformers are in high demand due to their safety features and efficient cooling mechanisms

Oil-filled transformers are known for their reliability, cost-effectiveness, and versatility. These transformers are filled with insulating oil, enhancing cooling and insulation properties critical for efficient electricity transmission and distribution. They play a vital role in stepping up or stepping down voltage levels, ensuring stable power distribution across grids and industrial facilities. Oil-filled transformers are favored for their proven track record and efficient cooling mechanisms, which is why they have maintained their dominance in the market.

Dry type transformers represent a growing segment within the distribution transformer industry report, offering enhanced safety features, environmental friendliness, and reduced maintenance requirements compared to oil-filled transformers. These transformers do not require cooling oil, eliminating the risk of oil leaks or spills and associated fire hazards. Dry-type transformers are particularly well-suited for indoor installations where safety and environmental considerations are paramount. The increasing demand for renewable energy sources like wind and solar power has further propelled the adoption of dry transformers due to their reliability and efficiency in such applications.

Commercial and power utility sectors are pivotal in propelling the market forward due to the demand for reliable power distribution across these sectors

As per distribution transformer market analysis, distribution transformers are crucial for powering commercial buildings like shopping malls, office complexes, hospitals, and schools. These facilities have diverse power needs for lighting, HVAC systems, and other operations, making distribution transformers essential for stable electricity distribution. The growing construction of commercial buildings, especially in developing regions, is fueling demand for distribution transformers in this sector.

Power utilities, however, rely on distribution transformers to transmit and distribute electricity to residential, commercial, and industrial consumers. These transformers step down voltage levels for safe and efficient power delivery. Government initiatives to expand electrification in developing regions and the need to modernise infrastructure to accommodate renewable energy integration are driving demand for distribution transformers in the power utility sector.

Asia Pacific leads the market due to the rising demand for electricity in populated countries like India

The developing nations of APAC including China and India have a large population and thereby, a rising household income, which has led to rapid rise in the demand for electricity. The region's growing manufacturing activity, electrification initiatives, and investments in renewable energy projects have significantly boosted the demand for distribution transformers. The increasing number of industrial units, railways, metros, IT hubs, and commercial centers in the region require a stable and reliable electricity supply, further increasing the distribution transformer market size in the region.

North America is the second-largest market for distribution transformers, with the United States being a significant contributor. The region's robust industrial sector and focus on grid modernisation and infrastructure upgrades drive the demand for distribution transformers. Stringent regulations regarding energy efficiency and environmental sustainability in North America incentivise the adoption of advanced transformer technologies, such as smart transformers and energy-efficient designs. Moreover, ongoing investments in renewable energy projects, like wind and solar power, require distribution transformers for efficient power transmission and integration into the grid.

Market players are focused on new product launches, collaborations, expansions to increase their competitive edge; and engaged in R&D to integrate smart technologies in distribution transformers

Eaton Corporation PLC, established in 1911 and headquartered in Dublin, Ireland, is a global power management company with a diverse portfolio spanning aerospace, automotive, and industrial sectors. It is recognised for its expertise in hydraulics, clutches, transmission systems, and programmable logic controllers (PLCs).

Mitsubishi Electric Corporation, founded in 1921 and based in Tokyo, Japan, offers a wide array of solutions, including elevators, escalators, high-end home appliances, air conditioning systems, factory automation systems, train systems, electric motors, pumps, semiconductors, digital signage, and satellites.

Schneider Electric was founded in 1836 and is headquartered in Rueil-Malmaison, France. The company's offerings span residential, commercial, and industrial sectors, integrating energy technologies, real-time automation, software, and services.

Siemens AG, established in 1847 and based in Munich and Berlin, Germany, specialises in automation and digitalisation. Siemens operates across digital industries, smart infrastructure, mobility, and financial services sectors, offering a broad spectrum of products and services.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the global distribution transformer industry include Hitachi ABB Power Grids Ltd, and General Electric Company, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The distribution transformer market is expected to grow at a CAGR of 5.00% between 2026 and 2035.

The major drivers of the market include population growth at a quick rate along with the increase in manufacturing activity, infrastructure development and preferential policies by global institutions.

Key trends aiding market expansion include the growing penetration of huge transformers and demand for IoT-enabled electric infrastructure.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The different types of distribution transformers available are oil-filled and dry type.

The various phases for distribution transformers are single phase and three phase.

Distribution transformers find applications in residential and commercial, industrial, and power utilities, amongst others.

The major mountings of distribution transformers are pole-mounted, pad-mounted, and underground vault.

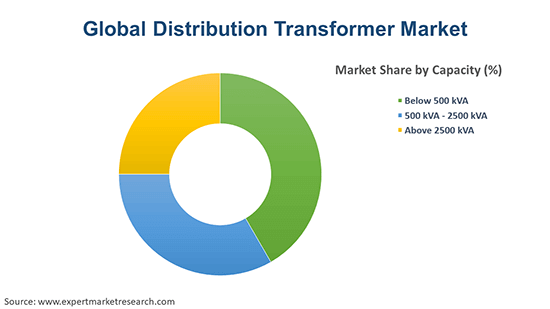

The different capacities of distribution transformers include below 500 kVA, 500 kVA - 2500 kVA and above 2500 kVA.

Key players in the market are Eaton Corporation PLC, Mitsubishi Electric Corporation, Schneider Electric, Siemens AG, Hitachi ABB Power Grids Ltd, and General Electric Company, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Phase |

|

| Breakup by Capacity |

|

| Breakup by Mounting |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share