Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global fuel oil market attained a value of USD 213.14 Billion in 2025 and is projected to expand at a CAGR of 4.10% through 2035. The market is further expected to achieve USD 318.55 Billion by 2035. Rising demand for lower-sulfur, performance-tuned fuel blends in shipping is pushing refiners to upgrade units and launch compliant, stability-enhanced fuel oils for regulatory and operational resilience.

The industry is steadily reshaping itself as suppliers push deeper into cleaner combustion technologies and hybrid thermal systems. One of the most notable shifts was observed in August 2023, when Neste expanded its renewable fuel oil production line, introducing an upgraded low-sulfur formulation designed for heavy industrial boilers. According to the fuel oil market analysis, nearly 38% of global industrial heat demand still relies on liquid fuels, which makes innovations in cleaner-burning fuel oil surprisingly influential. Hence, this move from Neste signals how producers are trying to protect long-term demand by offering blends that reduce SOx and particulate output without forcing facilities into expensive retrofits.

Apart from the product portfolio upgrades, suppliers are also investing in digital combustion monitoring systems that enhance operational visibility for refineries and shipping fleets. Companies like Valero and PetroChina have been piloting sensor-driven optimization platforms that allow customers to track burn efficiency, sludge formation, and furnace performance in real time. This shift toward smart monitoring is becoming a differentiator, especially in sectors where downtime or poor heat output directly affects production targets, accelerating the overall fuel oil market dynamics.

At the same time, the marine fuel category continues evolving fast. Companies like ExxonMobil offer a next-gen very low sulfur fuel oil (VLSFO) engineered to improve stability during long voyages, addressing one of the major pain points reported by ship owners since IMO 2020. Developments like these indicate a broader fuel oil market trend. Fuel oil suppliers are moving from simply fulfilling bulk demand to engineering performance-focused, compliant products that help industrial users manage both environmental and operational pressures.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.1%

Value in USD Billion

2026-2035

*this image is indicative*

Refiners are reformulating fuel oils to reduce sulfur and improve combustion stability while protecting lubricant systems. This is a commercial response to tighter emission rules and shipowner pain points. Leading refiners are redirecting output toward very-low-sulfur and stabilized blends, pairing additive packages with blend-specific QA. For example, in August 2025, Mahindra announced that the company is working on launching flex fuel SUVs capable of running on over 30 percent ethanol blended petrol. Industrial users demand fuels that burn cleaner without requiring costly burner retrofits, accelerating the overall demand in the fuel oil market. National energy agencies are encouraging higher fuel quality standards as part of air-quality programs and industrial decarbonization roadmaps, which makes investment in refinery hydrotreating and blending capacity a near-term priority for market incumbents.

Companies are deploying sensor suites and refinery-to-boiler digital loops that report real-time viscosity, density, sulfur levels and furnace performance. Refiners and large consumers such as steel, chemicals, shipping fleets are piloting leak-detection networks, burner-tuning telemetry, and predictive maintenance dashboards to extract efficiency gains and reduce sludge issues, driving the fuel oil market opportunities. In October 2025, Vegatron announced the launched the next-gen fuel management software in Singapore, accelerating digital transformation in oil and gas. These systems let traders and bunkering operators certify batch quality, aiding dispute resolution and cargo claims.

The shipping sector’s shift to VLSFO and ULSFO created new handling and stability challenges including sludge, filter clogging and storage degradation, forcing suppliers to offer additives, blending support, and voyage-stability guarantees. Fuel-service firms now provide stability testing, tailored additive programs, and validated shipping-grade mixes to reduce operational risk during long voyages. In April 2025, Baltic Exchange launched a new Fuel Equivalence Converter to simplify the commercial and operational impact assessments of alternative fuels, impacting the entire fuel oil market dynamics. Industry guidance and technical notes from major oil firms and classification societies are shaping best practices, and shipowners are increasingly procuring stability-backed fuel packages rather than plain bulk grades. This trend is turning merchant fuel supply into a technical service as much as a commodity sale.

IMO 2020 and regional low-emission zones have created distinct product categories such as ULSFO, VLSFO, LSFO, forcing refiners to manage yield trade-offs while serving diverse customers. Regulatory pressure is stimulating investment in cleaner product streams and in onshore test labs for compliance verification. For example, GoodFuels Marine and NORDEN A/S offers ‘drop in’ Heavy Fuel Oil (HFO)-equivalent marine biofuel, almost entirely reducing all carbon and sulfur emissions. Public procurement and port authorities are progressively favoring certified low-emission suppliers, which is increasing demand for audited, traceable fuel lots, widening the fuel oil market scope.

Bio-blend and hydrotreated renewable fuel oils are moving from pilots to commercial lanes as refiners leverage co-processing and renewable feedstocks to supply lower-carbon heavy-fuel alternatives for shipping and industry. Since April 2025, Vitol Bunkers is offering customers a new co-processed grade of VLSFO designed for compliance with the FuelEU Maritime regulation. Producers are testing stability and blend behavior for long-haul marine use and high-temperature industrial burners while successful pilots are getting preferential procurement in green-fuel tenders.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Fuel Oil Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Heavy fuel oil (HFO) anchors legacy demand via established terminals and cost advantages. While light fuel oil (LFO) is growing its share in the fuel oil market due to emission rules and easier combustion. Niche grades include bio-blends and specialty low-ash fuels that serve compliant, performance-sensitive buyers. Each type requires different logistics, blending sophistication and warranties; successful refiners are bundling technical services with fuel sales.

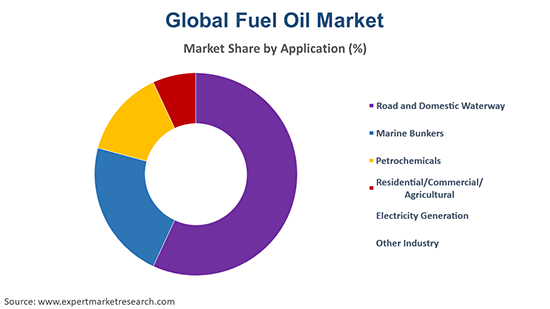

Market Breakup by Application

Key Insight: Applications considered in the fuel oil market report span across marine bunkers, road/domestic waterway, petrochemicals, residential/commercial, electricity generation and others. Marine bunkers drive volume and technical service demand, whereas road and domestic waterways need refined handling and seasonal formulations. Petrochemical feedstock buyers require low-contamination residuals, residential/commercial sectors focus on cleaner light fuels and reliable deliveries, electricity generation values rapid-start, tested fuel.

Market Breakup by Region

Key Insight: Asia Pacific continues to be the dominant region due to refining scale and shipping demand. Europe is growing at a rapid pace because of strict emissions and green procurement. North America focuses on industrial heat and backup generation resilience, while the fuel oil markets in Latin America and Middle East and Africa demand bunker and industrial fuels amid infrastructure expansion.

By type, heavy fuel oil remains dominant in the market due to entrenched infrastructure and ship inventories

Heavy Fuel Oil (HFO) remains the backbone for legacy marine and large-scale industrial burners as existing asset fleets and storage terminals are optimized for high-viscosity, residual blends. Despite sulfur constraints, refiners are adapting HFO production by offering stabilized, low-sulfur variants and bundled handling services to mitigate sludge and storage risk. Service providers are monetizing HFO by offering lab-verified batches, additive dosing programs, and voyage stability warranties, turning into a technical service for risk-averse operators who want lower operating disruption.

Light Fuel Oil (LFO), including VLSFO and LSFO blends, is expanding fast in terms of the fuel oil market revenue share as regulatory regimes and urban air-quality standards push end users toward cleaner products. Wärtsilä, for example, delivers a hybrid solution combining battery energy storage with liquid petroleum gas (LPG) and light fuel oil (LFO) engines. LFO’s appeal lies in easier handling, lower particulate and sulfur emissions, and quicker burner start/stop responsiveness. These are attributes prized in marine auxiliary engines, smaller industrial boilers, and backup generation. Refiners are prioritizing hydrotreating, blending and additive R&D to stabilize these lighter streams. Buyers are paying premiums for stability-tested LFO lots and bundled technical support.

By application, marine bunkers dominate the global industry because shipping consumes large volumes under compliance pressure

Marine bunkers dominate fuel oil consumption because ocean shipping remains a volume-intensive sector with diverse fuel needs. Shipowners manage complex voyage planning, blending, and port restrictions. Bunker traders now provide voyage-stability guarantees and testing services, along with documentation to satisfy port state control. In November 2025, O Bunkering became authorised distributor of Shell Marine Lubricants in Oman.

Fuel oil for electricity, particularly backup, peaking, and islanded generation, is influencing the fuel oil market growth, where grids lack firm capacity or in regions prioritizing energy security. Plants value liquid fuels for reliability and rapid start characteristics during peak events or intermittent renewable swings. Suppliers are responding with lower-ash, low-sulfur lots and remote monitoring services that ensure readiness and reduce maintenance. Governments offering capacity payments and resilience incentives are indirectly boosting demand for fuel-oil peakers. For B2B buyers, fuel stability, storage management and predictable burn profiles matter, and suppliers that can guarantee tested fuel quality and integrated logistics are winning contracts in the market.

Asia Pacic, powered by refining capacity and strong marine trade flows, currently dominates the market

Asia Pacific dominates due to a dense concentration of refineries, major bunkering hubs and large industrial heat consumers. The region’s refining complex supplies diverse residual and light fuel streams, and local traders have built specialized logistics to service long maritime routes. Demand motivators include regional manufacturing, heavy shipping lanes, and retrofit activity for emissions compliance.

Europe is the fastest-growing renewable blends and cleaner fuel oil industry, propelled by strict air-quality standards, marine emission control areas, and decarbonization policies. European ports and utilities are increasingly demanding certified low-sulfur and bio-blend fuels, raising the bar for supplier QA and lifecycle carbon accounting. In October 2024, Poland's ORLEN Group initiated sales of its HVO100 fuel at two service stations in Germany. This is stimulating growth in hydrotreated and co-processed products, as well as in bunker quality testing and traceability services.

Competition in the market is shifting from pure commodity trading toward engineered product offerings and integrated service models. Leading fuel oil market players are differentiating with stability-tested marine blends, bio-co-processed fuel oils, and digital fuel-management services that provide batch verification and voyage stability guarantees. This creates higher margins and stickier B2B relationships with shipowners, utilities and industrial heat users. Opportunities lie in certified low-carbon blends for ports, turnkey bunker quality assurance services, and blended logistics that pair renewable feedstocks with legacy refinery streams.

Fuel oil companies that can offer audited supply chains, rapid port-side testing, and contractual quality warranties are winning premium contracts. There is also rising demand for co-processing capabilities and renewable drop-in fuels which refine houses are deploying to hedge long-term demand shifts toward lower carbon intensity fuels.

Exxon Mobil Corporation was established in 1882 and is headquartered in the United States. ExxonMobil is commercializing marine bio-blend fuel oils and conducting sea trials to validate long-voyage stability, offering ISCC-certified VLSFO variants and technical support for bunkering operations.

Shell International B.V. was established in 1907 and is headquartered in London, United Kingdom. Shell is advancing its VLSFO product suite and port-level QA services, pairing refined low-sulfur blends with supply-chain traceability and additive programs to tackle stability and sludge problems.

Uniper SE was established in 2016 and is headquartered in Germany. Uniper is leveraging fuel oil in its flexible generation portfolio, using tested low-ash, low-sulfur fuels for peaking plants and islanded systems while pursuing decarbonization roadmaps for plant conversion.

Chevron Corporation was established in 1879 and is headquartered in the United States. Chevron is modernizing its product slate through co-processing and lower-carbon initiatives and supporting customers with technical services, such as lubricants, additives, and sampling labs, to reduce operational risk.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market report include GS Caltex Corporation, Gazpromneft — Lubricants Ltd., PJSC Lukoil, MOL Group, Neste Oyj, and Petróleo Brasileiro S.A., among others.

Unlock the latest insights with our fuel oil market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

Trade Surveillance System Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 213.14 Billion.

Refiners are upgrading hydrotreating lines, rolling out certified VLSFO blends, integrating digital QA and traceability, co-processing renewables, and launching port testing services to secure premium, long-term contracts.

The key trends guiding the market include the surging applications of heating oils, the rising demand for electricity in power plants, and the robust economic growth in countries like India and China.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The various types of fuel oil considered in the market report are heavy fuel oil and light fuel oil.

The significant applications of fuel oil are road and domestic waterway, marine bunkers, petrochemicals, residential/commercial/agricultural, and electricity generation, among other industries.

The key players in the market include Exxon Mobil Corporation, Shell International B.V., Uniper SE, Chevron Corporation, GS Caltex Corporation, Gazpromneft — Lubricants Ltd., PJSC Lukoil, MOL Group, Neste Oyj, and Petróleo Brasileiro S.A., and others.

The market is projected to grow at a CAGR of 4.10% between 2026 and 2035.

Meeting tightening sulfur and emissions rules, guaranteeing long-voyage fuel stability, managing co-processed biofeedstock complexities, capex for refinery upgrades, and resolving quality disputes under tighter regulatory scrutiny.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share