Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India EV charging market size reached a volume of approximately 1.56 Million Units in 2025. The market is further expected to grow at a CAGR of 22.20% between 2026 and 2035, reaching a volume of 11.58 Million Units by 2035.

Base Year

Historical Period

Forecast Period

India has 1 charging station for around 135 electric vehicles, which increases the chance of the country achieving its EV adoption goals for 2030.

As per India EV charging market report, Karnataka leads in terms of public EV charging stations, with 5,059 stations as of 2023. Bengaluru Urban district has the most with 4,281 stations, which is 85% of the state's charging infrastructure.

As per industry reports, other states with a significant number of public EV charging stations include Maharashtra (3,079), Delhi (1,886), Kerala (958), Tamil Nadu (643), Uttar Pradesh (583), and Rajasthan (500).

Compound Annual Growth Rate

22.2%

Value in Million Units

2026-2035

*this image is indicative*

| India EV Charging Market Report Summary | Description | Value |

| Base Year | Million Units | 2025 |

| Historical Period | Million Units | 2019-2025 |

| Forecast Period | Million Units | 2026-2035 |

| Market Size 2025 | Million Units | 1.56 |

| Market Size 2035 | Million Units | 11.58 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 22.20% |

| CAGR 2026-2035 - Market by Region | North India | 23.9% |

| CAGR 2026-2035 - Market by Charging Type | AC | 23.2% |

| CAGR 2026-2035 - Market by Power Output | Rapid Chargers | 25.1% |

| Market Share by Region | South India | 31.1% |

Electric vehicle charging refers to the process of utilising EV charging equipment to deliver electricity to the battery of the electric vehicle. EV charging stations are used for providing electricity to charge hybrid electric vehicles and electric vehicles and these chargers are available in varying charging capacities. Fixed stations can be set up for electric vehicle charging as well as portable charging options. The key drivers aiding the India EV charging market development include the government's initiatives such as the FAME-II scheme, which has extended the deadline to March 31, 2024, and the allocation of INR 800 Crore for setting up public fast EV charging stations.

Additionally, oil PSUs like Bharat Petroleum (BPCL), Hindustan Petroleum (HPCL), and Indian Oil (IOCL) have plans to set up 22,000 EV charging stations at their retail outlets, further enhancing the infrastructure. The increasing adoption of electric vehicles, driven by the need for sustainable transportation and the benefits of reduced carbon emissions, also contributes to the growth of the India EV charging market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Growing From FY17-18 to FY23-24, electric vehicle sales in India have demonstrated robust growth across all categories, as reported by Society Of Manufacturers Of Electric Vehicles (SMEV). Electric 2-wheeler sales surged from 2,005 units in FY17-18 to 944,126 units in FY23-24, reflecting the increasing consumer adoption. Electric 3-wheelers also saw substantial growth, from 91,970 units in FY17-18 to 632,485 units in FY23-24. Electric bus sales rose from 19 units in FY17-18 to 3,693 units in FY23-24.

Between FY18 and FY25, there was a significant increase in electric 4-wheeler sales in India, according to Society Of Manufacturers Of Electric Vehicles (SMEV) as of June 24, 2024. Sales began at 1,204 units in FY18 and saw a steady rise, reaching 2,377 units in FY20. A notable jump occurred in FY21 with sales climbing to 5,154 units. This upward trend continued, peaking at 47,499 units in FY23. The current fiscal year FY24 has already recorded 90,432 units, indicating sustained growth in India EV charging market.

The total sales of electric vehicles reached 1,670,736 units in FY23-24, up from 95,198 units in FY17-18, indicating a widespread shift towards electric mobility. The data, current as of June 24, 2024, excludes Telangana.

According to the IEA, global investment in EV batteries has increased eightfold since 2018 and fivefold for battery storage, reaching USD 150 billion in 2023. Approximately USD 115 billion was dedicated to EV batteries, with China, Europe, and the United States accounting for over 90% of the total investment. China leads the battery supply chain, holding nearly 85% of global battery cell production capacity and significant shares in cathode and anode active material production. The extraction and processing of critical minerals are also geographically concentrated, with China at the forefront. Battery mineral prices have been volatile, rising sharply in 2021 and 2022 before declining in 2023 and early 2024, highlighting the need for increased investment and diversification as the market grows.

The leading players in the Indian electric vehicle market include Tata Motors, MG Motors, and Mahindra. In 2023, Tata Motors led the domestic EV market with a 72 percent share, followed by MG Motors at 10.8 percent and Mahindra at 9 percent. The top-selling models included Tata Motors' Tiago, Nexon, and Tigor, MG's ZS, and Mahindra's XUV400. Citroen's eC3 EV held a 3.5 percent market share.

As per the Ministry of Power, (As of February 2, 2024), there are 12,146 operational public EV charging stations across various states in India. The states with the highest number of charging stations include Maharashtra with 3,079, Delhi with 1,886, Karnataka with 1,041, and Kerala with 852. Other significant contributors are Gujarat with 476, Telangana with 481, and Tamil Nadu with 643 charging stations.

Rising popularity of EVs, focus on reducing carbon emissions, and expansion of charging infrastructure are augmenting the India EV charging market growth

Increasing popularity of electric vehicles is one of the crucial trends boosting the EV charging market size in India. Due to their low running costs, electric vehicles are more economically viable in the long run, this advantage is propelling various users to switch to electric vehicles.

Technological advancements in electric vehicle charging are further fuelling the India EV charging market expansion. Provision of real-time information about vacant spots and convenient booking of slots for charging along with integration of Internet of Things with EV charging stations are aiding the market growth.

Another crucial trend in market is rising environmental concerns. As a result of high carbon emission and release of hazardous pollutants by fuel-based vehicles, individuals are switching to electric vehicles, thus increasing the requirement for EV charging in India.

The emergence of universal charging standards is a notable trend in India EV charging market which is aimed at streamlining the charging experience for EV users. The Bharat EV Charger AC-001 standard aims to ensure interoperability and compatibility across different vehicles and charging stations.

The expansion of charging infrastructure is a significant trend, spurred by the government's initiatives to promote EV adoption. A major contributor to the expansion of the charging network in India is Tata Power, which has been actively involved in installing EV charging stations in major cities. To improve the prognosis for the India EV charging market, this involves setting up charge stations in public areas, apartment buildings, and commercial spaces.

Additionally, the surge in sales of lithium-ion-based EVs, supported by favourable policies and regulations in various states, is increasing the India EV charging market value. Companies like Mahindra Electric, with their electric vehicles like the eVerito, are contributing to the growth of the EV charging infrastructure through collaborations with charge point operators to set up new charging stations, further boosting the electric mobility ecosystem in India.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India EV Charging Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Charging Type

Market Breakup by Power Output

Market Breakup by Location

Market Breakup by Phase

Market Breakup by Region

| CAGR 2026-2035 - Market by | Charging Type |

| AC | 23.2% |

| DC | XX% |

| CAGR 2026-2035 - Market by | Power Output |

| Rapid Chargers | 25.1% |

| Fast Chargers | 23.1% |

| Slow Chargers | X |

| CAGR 2026-2035 - Market by | Region |

| North India | 23.9% |

| East and Central India | 21.4% |

| West India | XX% |

| South India | XX% |

Slow chargers are high in demand due to their easy availability

As per the analysis of India EV charging market, since slow chargers are the most widely accessible in India, their demand is rising. It takes these devices 8-12 hours to fully charge an EV. The best slow chargers are designed for two-wheeler (2W) and three-wheeler (3W) electric vehicles. Also, the private automakers in India have offered their assistance in boosting the India EV charging market. For instance, Hero Electric and RevFin, a digital consumer lending platform, partenered in May 2022 to provide loans to electric vehicle (EV) riders in India. Over the next three years, the partnership hopes to finance and lease 2.5 lakh vehicles. Through this collaboration, Hero Electric will be able to provide prospective buyers the option to ride clean transportation while owning an electric two-wheeler in convenient monthly installments.

| 2025 Market Share by | Region |

| South India | 31.1% |

| North India | XX% |

| East and Central India | XX% |

| West India | XX% |

Highways segment holds a significant market share due to rising number of EV charging stations on such location

By location, highways are expected to account for a sizable India EV charging market share due to increasing efforts by the government of India towards development of electric charging stations on highways. Setting up electric vehicle charging stations on highways is beneficial for those driving electric vehicles long distances where there is an increased risk of low battery life. The easy visibility and accessibility of highway EV charging stations make them faster to locate, and the extensive space availability simplifies the charging process, thus increasing the market share of EV charging stations in India.

Another significant segment is workplaces, where semi-public charging stations are being installed in office parking lots or garages. These charging stations offer a reliable and convenient option for employees who commute to work in electric vehicles, allowing them to recharge their vehicles during the day. Companies like Magenta Power and Ampere Electric are leading the way in installing workplace charging stations in the India EV charging market.

Depot locations are helping in increasing the market value as private charging stations are being installed at fleet depots, which are used by commercial vehicles, public transportation, and logistics companies. This segment addresses the needs of those who rely on their vehicles for commercial purposes, providing them with a reliable charging solution. Companies like Magenta Power and Ampere Electric are leading the way in installing depot charging stations in the India EV charging market.

The Indian EV charging infrastructure market is highly competitive, driven by the rapid growth of the electric vehicle sector and substantial government support. Key players in this market include:

Tata Power, A leading player with extensive experience in energy solutions, Tata Power has established a significant network of EV charging stations across major cities and highways in India.

Fortum India, a subsidiary of the Finnish energy company Fortum, has been actively expanding its EV charging network, focusing on strategic locations to enhance accessibility for EV users.

EVRE is a rising player in the EV charging market, focusing on providing end-to-end charging solutions, including setting up and managing charging stations across various regions.

Delta Electronics India, Known for its advanced technology and energy-efficient solutions, Delta Electronics India offers a range of EV charging solutions, contributing to the growth of charging infrastructure in the country.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the India EV charging market include Ather Energy Private Limited, TechSo ChargeZone Ltd, Reliance BP Mobility Limited, Brightblu Holding B.V, BPM Power Private Limited (chargeMOD), ABB Ltd., Charzera Tech Private Limited, Sharify Services Pvt Ltd, among others.

United States Electric Vehicle Charging Systems and Equipment Market

United States Electric Vehicle Charging Infrastructure (EVCI) Market

Japan Electric Vehicle Charging Equipment Market

Electric Vehicle Charging Infrastructure Market

Electric Bus Charging Infrastructure Market

Wireless Electric Vehicle Charging Market

Philippines EV Charging Station Market

India EV Charging Station Market

Wireless Charging Market

Smart EV Charging Market in India

EV Battery Recycling Market in India

India Solar-Powered EV Charging Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the India EV charging market reached an approximate volume of 1.56 Million Units in 2025.

The market is expected to grow at a CAGR of 22.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach 11.58 Million Units by 2035.

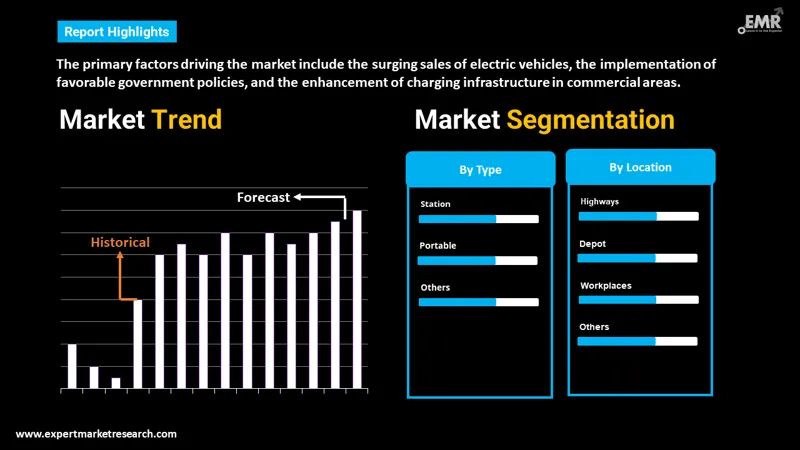

The major market drivers include the increasing sales of electric vehicles, introduction of favourable government policies, and improvement of charging infrastructure in commercial spaces.

The key trends fuelling the growth of the market include technological advancements in EV charging, popularity of portable EV charging, and reducing costs of electric vehicles.

EV cars or electric cars refer to cars that operate on electricity rather than traditional fuels.

Regions considered in the market are North India, East and Central India, West India, and South India.

The various locations of EV charging in the market include retail spaces, workplaces, street parking, highways, and depot, among others.

Key players in the market are Tata Power Company Ltd., Ather Energy Private Limited, Delta Electronics, Inc., TechSo ChargeZone Ltd, Reliance BP Mobility Limited, Brightblu Holding B.V, BPM Power Private Limited (chargeMOD), ABB Ltd., Charzera Tech Private Limited, Sharify Services Pvt Ltd, among others.

High initial investment, technological challenges, and supply chain disruptions are hampering the market growth.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Charging Type |

|

| Breakup by Power Output |

|

| Breakup by Location |

|

| Breakup by Phase |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share