Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India dairy market attained a value of INR 11306.52 Billion in 2025. The industry is expected to grow at a CAGR of 14.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach INR 41915.77 Billion.

India's dairy industry stands as a cornerstone of its agrarian economy, with the nation being the world's largest producer and consumer of milk. India’s milk output increased by 3.83% in 2022-23, with a per-capita availability of 459 grams per day. The average daily yield per animal is 8.55 kg for exotic/crossbred cattle and 3.44 kg for indigenous/non-descript cattle. Milk production rose by 3.75% for exotic/crossbred cattle, 2.63% for indigenous/non-descript cattle, and 3.69% for buffaloes compared to 2021-22, according to the DAHD, Government of India.

Key drivers of India dairy market growth include a rising population, increasing urbanization, and a burgeoning middle class with higher disposable incomes. These factors have led to a surge in demand for both traditional and value-added dairy products. Technological advancements in dairy farming, such as automated milking systems and improved cold chain infrastructure, have further enhanced production efficiency and product quality. According to International Monetary Fund (IMF), in 2023, India's per capita income was USD 2,600 per annum. The International Monetary Fund (IMF) forecasts that this figure will rise to approximately USD 4,000 by 2028. This increase in income levels is anticipated to result in the addition of around 14 crore middle-income households and 2.1 crore high-income households in India by 2030. Additionally, the proportion of middle-income households is expected to grow from 54% in 2018 to 78% by 2030. According to the Investec Report, the rise in income levels is likely to lead to higher disposable incomes, driving consumer preference for premium and nutritious food products such as milk and milk products.

According to the India dairy market analysis, India is a significant exporter of dairy and dairy products on a global scale. According to India Brand Equity Foundation, in the fiscal year 2021-22, India exported 108,711 metric tons (MT) of dairy products, generating revenue of INR 2,928.79 crore (USD 391.59 million). Key export destinations included Bangladesh, UAE, Bahrain, Malaysia, Saudi Arabia, and Qatar. Bangladesh is the largest importer with USD 91.45 million, followed by the UAE (USD 58.66 million), Bahrain (USD 28.59 million), Malaysia (USD 25.36 million), and Saudi Arabia (USD 24.88 million). The trend of India’s dairy product exports shows a significant rise from USD 186.71 million in 2019-20 to USD 201.37 million in 2020-21, reaching USD 391.59 million in 2021-22. This upward trend reflects India's growing presence in the global dairy market and the increasing demand for its dairy products.

Base Year

Historical Period

Forecast Period

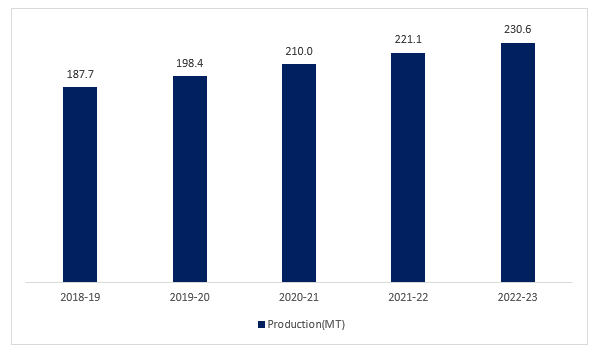

India is the world's largest dairy market in terms of milk production. In the 2022-23 period, India produced approximately 230.58 million tonnes of milk.

Gujarat Co-operative Milk Marketing Federation Ltd (GCMMF), Karnataka Co-operative Milk Producers Federation Limited (KMF), and Orissa State Cooperative Milk Producers Federation Ltd (OMFED) are some of the major companies in the India dairy market.

In 2022-23, the leading milk-producing states were Uttar Pradesh (15.44%), Rajasthan (14.44%), Madhya Pradesh (8.6%), Gujarat (7.49%), and Andhra Pradesh (6.70%), collectively accounting for 53.08% of the nation's milk output.

Compound Annual Growth Rate

14%

Value in INR Billion

2026-2035

*this image is indicative*

| India Dairy Market Report Summary | Description | Value |

| Base Year | INR Billion | 2025 |

| Historical Period | INR Billion | 2019-2025 |

| Forecast Period | INR Billion | 2026-2035 |

| Market Size 2025 | INR Billion | 11306.52 |

| Market Size 2035 | INR Billion | 41915.77 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 14.00% |

| CAGR 2026-2035 - Market by Region | West India | 14.6% |

| CAGR 2026-2035 - Market by Product | UHT Milk | 35.4% |

| CAGR 2026-2035 - Market by Sales Channel | Online | 20.2% |

| Market Share by Region | North India | 30.1% |

| Market Share by Product | Liquid Milk | 48.4% |

| Market Share by Sales Channel | Direct Selling | 43.8% |

Government initiatives like the Rashtriya Gokul Mission and the Dairy Entrepreneurship Development Scheme (DEDS) have provided financial support and infrastructure development, fostering a conducive environment for the India dairy market. In March 2025, the central government approved the revised Rashtriya Gokul Mission with an additional Rs 1,000 crore, taking the total allocation to Rs 3,400 crore. This move aims to strengthen livestock development and increase farmers’ income through enhanced milk production.

Clean-label dairy products are gaining popularity due to consumers’ inclination towards a healthy lifestyle. Consumers are increasingly demanding transparency in the manufacturing process, with brands adopting the clean label criteria. A 2021 Nielsen survey revealed that 63% of consumers are willing to pay more for clean-label food products, highlighting a shift towards preservative-free and traceable dairy options. This trend is particularly prominent among urban consumers, where quick commerce and direct-to-consumer models facilitate access to premium dairy products, which further increases the demand in the India dairy market.

During 2014–15 to 2022–23, India’s milk production expanded by 58%, accounting for 230.58 million metric tons during 2022–23. This expansion is attributed to factors such as improved animal husbandry practices, increased adoption of technology, and supportive government initiatives. India is also a critical exporter of dairy products, globally. During 2022-23 India exported milk and milk products worth INR 3.36 thousand crores, retaining its position as a net exporter of dairy commodities, thus supporting the growth of the India dairy market.

The rapid adoption of advanced technologies, such as sensors, data analytics, and digital technology are helping dairy companies make profitable and data-driven decisions. The adoption of automated milking systems and the application of artificial intelligence and machine learning for enhanced farm management are further aiding the India dairy market development. Automated milking systems (AMS) are being adopted to improve milking efficiency and maintain hygiene standards, thereby reducing labor costs and the risk of contamination.

Figure: Milk Production in India (in Metric Tonnes), 2019-2025

The EMR’s report titled “India Dairy Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Key Insight: In India, most of the processed liquid milk sold is produced by dairy cooperatives. As of 2024, liquid milk accounts for approximately 61% of the total India dairy market share. This enduring preference is bolstered by the widespread availability and affordability of liquid milk, making it a staple in Indian households. The prominence of liquid milk is further supported by the robust infrastructure of dairy cooperatives, which facilitate efficient procurement and distribution. For instance, Comfed, Bihar's state dairy cooperative, processes up to 40 lakh liters of milk daily and has expanded its operations to international markets, including the US and UAE.

Market Breakup by Sales Channel

Key Insight: Direct selling remains a dominant force in India dairy market, primarily through local milk vendors and dairy cooperatives. This channel thrives on its deep-rooted presence in both urban and rural areas, offering consumers fresh, unprocessed milk and traditional dairy products. The personal relationships and trust established between sellers and customers contribute to its sustained relevance, especially in regions where convenience and freshness are paramount.

Market Breakup by Region

Key Insight: Uttar Pradesh's bovine population, standing at 67.8 million, represents 16% of India's total bovine population. Despite a national decline, UP's livestock population has grown, yet half are low yielders, as per the 20th Livestock Census 2019. Uttarakhand's 4.42 million livestock include 50% local cows, 17% crossbreeds, and 33% buffaloes, with five districts housing half the in-milk bovine. Haryana and Punjab report 6.93 million and 6.99 million livestock, respectively.

| CAGR 2026-2035 - Market by | Product |

| UHT Milk | 35.4% |

| Organic Milk | 27.2% |

| A2 Milk | 25.8% |

| Liquid Milk | XX% |

| Flavoured Milk | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Sales Channel |

| Online | 20.2% |

| Convenience Stores | 12.6% |

| Direct Selling | XX% |

| Supermarkets and Hypermarkets | XX% |

Available Customizations:

We're here to assist you with tailored insights and solutions to ensure you have all the data you need for your strategic decisions.

Expert Market Research provides tailored reports to meet your unique business requirements. If you cannot find what you're looking for, please contact us at [email protected]

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

UHT Milk and Ghee Occupy a Large Share in the Indian Dairy Industry

UHT milk segment is expected to hold a significant share in India dairy market due to the growing demand for lactose-free milk in cafes, bars, and restaurants. Several prominent brands dominate this market, offering a variety of UHT milk options to cater to different consumer needs. Some popular UHT milk brands include Amul Taaza Homogenised, Mother Dairy's UHT milk, and Nestle Pure Life, among others.

Ghee or clarified butter is considered an integral part of Indian cuisine. In India, about 60-70% of the total ghee produced is used for direct dressing, and about 15-20% for the cooking, frying, and sauteing of foods. The increasing awareness of the health benefits of ghee is increasing its consumption.

Growth of Supermarkets and Online Retail in India Dairy Market

Supermarkets and hypermarkets have become central hubs for dairy shopping, especially in metropolitan regions. These large-format stores offer an extensive variety of dairy products, from everyday essentials to premium items, under one roof. The convenience of one-stop shopping, coupled with organized shelf spaces and competitive pricing, makes these outlets a preferred choice for consumers seeking variety and quality in their dairy purchases.

The online retail channel is experiencing rapid growth in India dairy market, driven by the increasing penetration of the internet and smartphones. Consumers are increasingly turning to e-commerce platforms for the convenience of home delivery and the ability to compare products. This shift is particularly evident among urban millennials and Gen Z consumers, who value the ease and efficiency of online shopping for their dairy needs.

West and East & Central India are the Key Milk Producing Regions

In West India, Rajasthan (15.05%), Gujarat (7.56%) and Maharashtra (6.47%) are amongst the leading milk-producing states in the country from the region in 2022-23. Gujarat, in particular, stands out due to its rich agricultural ecosystem and the presence of around 18 domesticated animal breeds out of India’s total 137. These breeds are known for their adaptability to local climates, high milk yield, and resilience. This diversity in livestock breeds presents unique opportunities for innovation and growth within the India dairy market, such as developing specialized products, improving breeding techniques, and enhancing milk quality.

| CAGR 2026-2035 - Market by | Region |

| West India | 14.6% |

| East and Central India | 14.2% |

| North India | XX% |

| South India | XX% |

In East and Central India, Bihar (5.48%) and Madhya Pradesh (8.60%) stand out as leading milk-producing states in India, prominent in the East and Central regions in 2022-23. Bihar has seen a steady increase in dairy farming due to favorable climatic conditions, a large rural population involved in traditional dairy practices, and government initiatives supporting the India dairy market. Madhya Pradesh’s dairy farming is supported by extensive agricultural land, allowing for the cultivation of fodder and crops that sustain the livestock population. Moreover, the state's proximity to major dairy processing hubs and its investments in modern dairy farming technologies have further boosted its dairy output.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key players in the India dairy market are actively pursuing strategies to enhance production efficiency and expand their market presence. These companies are investing in technological advancements, such as automated milking systems and improved cold chain infrastructure, to streamline operations and ensure product quality. Additionally, they are focusing on expanding their retail networks and exploring new product offerings to cater to the evolving consumer preferences.

Furthermore, these industry leaders are adopting sustainable practices to align with environmental goals and regulatory standards. Initiatives include the utilization of dairy byproducts for biofuel production and the implementation of waste-to-energy solutions. By integrating circular economy models, these companies aim to reduce their carbon footprint and contribute to renewable energy efforts, thereby supporting both economic growth and environmental sustainability.

Headquartered in Gujarat and founded in 1973, Gujarat Co-operative Milk Marketing Federation Ltd (GCMMF), commonly called AMUL, is India’s largest producer of milk and milk products. The company offers a wide range of dairy products under the ‘AMUL’ and ‘SAGAR’ brands; products including butter, milk, bread spreads, cheese, paneer, dahi, and others.

Headquartered in Bengaluru and founded in 1974, Karnataka Cooperative Milk Producers' Federation Limited (KMF) is the leading organization for the dairy cooperative movement in Karnataka. The company offers a wide range of dairy products under the brand name ‘NANDINI’. Its product portfolio includes milk, UHT milk, flexipack milk, curds and other fermented products, including ghee, butter, cheese, and paneer, among others.

Headquartered in Odisha and founded in 1980, Orissa State Cooperative Milk Producers Federation Ltd (OMFED) focuses on promoting, producing, procuring, processing, and marketing milk and milk products, aiming to enhance the economic development of the rural farming community in Orissa. The company offers a wide range of milk and milk products, including milk, curd and other fermented products, ghee and butter, ice cream and frozen desserts, milk sweets, and others.

Headquartered in Mumbai and founded in 1967, Maharashtra Rajya Sahakari Dudh Mahasangh Maryadit serves as the apex federation of district and taluka milk unions in Maharashtra. The cooperative operates all across Maharashtra with its units in Goregaon, Pune, Varvand, Latur, and Nagpur. The cooperative offers products, including Annapurna milk, toned milk, double-toned milk, standardised milk, high-fat milk, chass, and other dairy products.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the India dairy market report are Mother Dairy Fruit & Vegetable Pvt. Ltd, Britannia Industries Limited, Nestle India Limited, and others.

Download our India Dairy Market Report 2026 today for the latest insights and trends shaping the industry. Stay ahead of the competition with expert data and forecasts to enhance your business strategy. Contact us now to explore tailored solutions and gain a competitive edge in India's dairy sector!

United States Dairy Packaging Market

Middle East and Africa Dairy Market

Saudi Arabia Dairy Products Market

United States Dairy Market

Asia Pacific Dairy Market

Oman Dairy Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Indian dairy market reached a value of around INR 11306.52 Billion.

The market is projected to grow at a CAGR of 14.00% between 2026 and 2035.

The India dairy market is estimated to register a healthy growth in the forecast period of 2026-2035 to reach INR 41915.77 Billion by 2035.

The key trends include the rising adoption of advanced production technologies leveraging sensors, the growing demand for clean-label dairy products, and increasing partnerships among small and medium-sized dairy farms across India.

The different sales channels of dairy include direct selling, convenience stores, supermarkets and hypermarkets, and online.

North India, East and Central India, West India, and South India are the significant markets for dairy.

The key players in the market report include Gujarat Co-operative Milk Marketing Federation Ltd (GCMMF), Karnataka Cooperative Milk Producers' Federation Limited (KMF), Orissa State Cooperative Milk Producers Federation Ltd (OMFED), Maharashtra Rajya Sahakari Dudh Mahasangh Maryadit, Mother Dairy Fruit & Vegetable Pvt. Ltd, Britannia Industries Limited, and Nestle India Limited, among others.

The market drivers include the introduction of favourable government initiatives to expand milk production, chilling, and processing capacity and the significance of dairy products in Indian culture.

The strict government policies related to mining, including its negative environmental impact, and high-risk nature of mining operations are the key challenges in the industry.

UHT milk dominates due to long shelf life and convenience, while ghee leads as a traditional staple with high demand, cultural significance, and wide household consumption.

Key strategies driving the India dairy market include expanding value-added dairy products, strengthening cold chain infrastructure, adopting digital sales platforms, promoting cooperative farmer models, investing in sustainable farming, launching fortified health products, enhancing branding, expanding rural procurement, and boosting dairy exports.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Sales Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share