Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global industrial mixers market was valued at USD 2.79 Billion in 2025. The industry is expected to grow at a CAGR of 5.20% during the forecast period of 2026-2035 to reach a value of USD 4.63 Billion by 2035.

Growth in the industrial mixers market is largely propelled by the demand for high-performance blending technologies in process-intensive industries. From pharmaceuticals to wastewater treatment, mixers now play a crucial role in meeting hygiene, consistency, and sustainability standards. In the United Kingdom, the government’s “Made Smarter” initiative is accelerating digital adoption in manufacturing, encouraging use of smart mixers with IoT connectivity. Meanwhile, Germany’s “Industrial Resource Efficiency” programme is pushing energy-efficient mixing systems in chemical plants. Both policies directly incentivise automation and control-based mixers.

Moreover, there is a rising demand for industrial mixers that can address the specific needs of different industry verticals. Manufacturers are increasingly investing in mixing equipment which offers great flexibility for usage in different end-use sectors. Leading companies such as MIXACO and UTG Mixing Group are offering fully customisable industrial mixers which can meet different process needs. For instance, these mixers offer the flexibility for regular modifications and incorporate user-friendly cleaning features, which are important for sectors such as food processing, chemicals, and pharmaceuticals. The CM i4 fleX mixer from MIXACO is suitable for different container sizes and is gaining popularity in businesses which may require frequent changes in their production workflows.

Base Year

Historical Period

Forecast Period

The food and beverage sales in the United States reached around USD 979.16 billion in 2023, indicating a significant increase in the usage of industrial mixers within this sector. This surge is largely driven by the rising consumer preference for processed and packaged foods, which require efficient mixing solutions to ensure product quality and consistency. As manufacturers strive to meet the growing demand for ready-to-eat and convenience food items, the adoption of advanced industrial mixers becomes essential. These mixers facilitate the blending of various ingredients, ensuring uniformity and compliance with stringent food safety regulations, thus propelling industrial mixers market growth.

In addition to the food and beverage sector, the global production of ores was around 88.6 million tonnes in 2021, highlighting another area where industrial mixers are crucial. The mining and mineral processing industries rely on industrial mixers to blend different materials effectively, ensuring consistent quality in ore processing. The need for efficient mixing technologies in these sectors is expected to drive market demand.

Furthermore, India has established itself as one of the largest chemical industries globally, creating a lucrative demand for industrial mixers in the country. The rapid expansion of India's chemical sector necessitates advanced mixing solutions to ensure precise blending of raw materials, including hazardous chemicals and viscous fluids. As manufacturers increasingly focus on product quality, safety, and regulatory compliance, the demand for efficient and eco-friendly industrial mixers is set to rise significantly.

Compound Annual Growth Rate

5.2%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Industrial Mixers Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 2.79 |

| Market Size 2035 | USD Billion | 4.63 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.20% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 6.7% |

| CAGR 2026-2035 - Market by Country | India | 7.1% |

| CAGR 2026-2035 - Market by Country | Brazil | 5.7% |

| CAGR 2026-2035 - Market by Type | Liquid-Liquid | 5.5% |

| CAGR 2026-2035 - Market by End Use | Pharmaceuticals | 5.6% |

| Market Share by Country 2025 | Saudi Arabia | 0.8% |

Industry 4.0 has reshaped mixer operations by embedding sensors, AI analytics, and remote diagnostics into traditional systems. Siemens and Alfa Laval have introduced mixers that self-diagnose wear and predict servicing windows, reducing downtime while boosting the industrial mixers market trends and dynamics. India’s Ministry of Heavy Industries is incentivising adoption of smart manufacturing technologies through its Capital Goods Scheme. This has encouraged chemical firms to adopt digital twin-enabled mixers for hazardous material blending, improving workplace safety.

Modular, purpose-built machines tailored for hybrid materials have been increasingly gaining traction in the industrial mixers market. For instance, in biopharma, single-use homogenisers are replacing traditional mixers to meet stringent purity regulations. GEA has launched adaptive mixers with interchangeable blades for solid-liquid suspensions, ideal for nutraceuticals and plant-based protein manufacturing. In 2023, the U.S. FDA revised its process validation rules, prompting pharma firms to invest in mixers that guarantee reproducibility and compliance during scale-up.

The European Commission’s Ecodesign Directive has mandated industrial machinery, including mixers, to meet minimum energy standards. This push has catalysed innovations such as low-shear static mixers and high-efficiency paddle blenders with variable frequency drives, adding to the industrial mixers market value. Companies like Ekato and Silverson are leveraging magnetically driven mixing shafts to reduce energy use. In wastewater management plants, especially in the Netherlands and Singapore, sustainable drum mixers are used to reduce sludge retention time reducing treatment costs and emissions by a significant extent.

The food processing industry is propelling demand for industrial mixers that handle high-viscosity and allergen-sensitive products with zero cross-contamination. Leading this trend is Brazil, where ANVISA’s updated hygiene norms have prompted brands to adopt automated ribbon blenders with CIP (clean-in-place) systems. Start-ups like Fooditive based in Netherlands are also experimenting with bio-based emulsifiers integrated into the mixer design to naturally stabilise formulations without synthetic additives.

With construction and mining sectors expanding in remote geographies, the industrial mixers market experiences a growing interest in portable drum mixers and skid-mounted homogenisers. In Africa’s copper belt, companies like BMG are deploying containerised agitator systems to blend chemical additives on-site. This allows for responsive production without investing in permanent infrastructure. Government-funded infrastructure projects in Kenya and Indonesia have integrated compact, mobile mixers for asphalt and concrete batch plants. These trends reflect the decentralisation of industrial operations.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Industrial Mixers Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Technology

Key Insight: Technologies like ribbon blenders, agitators, static mixers, paddle mixers, emulsifiers, homogenisers, and drum mixers, each cater to specialised needs. Ribbon and paddle mixers dominate the industrial mixers market with batch solid blending, while homogenisers and emulsifiers serve fluid precision sectors. Static mixers suit continuous operations, especially in water treatment and adhesives. Agitators are common in chemical reactors, offering high adaptability. Drum mixers appeal in mobile use-cases, especially in construction.

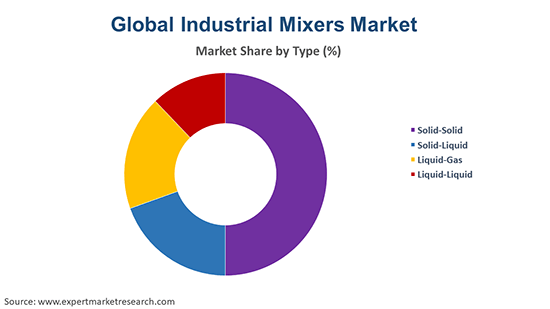

Market Breakup by Type

Key Insight: Solid-solid mixers dominate the industrial mixers market as these largely cater to powder and granular blending, ideal for plastics and food ingredients. Solid-liquid mixers are preferred in industries needing uniform dispersion and quick dissolution. Liquid-gas mixers serve fermentation, oxidation, and aeration needs in biotechnology and wastewater treatment. Liquid-liquid mixers are critical in emulsification and extraction processes, often used in cosmetics and pharmaceuticals. The rising shift towards continuous processing, modular setups, and automated CIP integration across all types is reshaping how mixing technologies are deployed within diverse industrial applications.

Market Breakup by End Use

Key Insight: Food and beverages boost heavy demand in the industrial mixers market due to high processing output and hygiene needs. Mineral and plastic industries prefer rugged mixers for abrasive materials and granule uniformity. Chemical and pharmaceutical sectors require precision, safety, and contamination control. Wastewater applications focus on sludge dispersion and chemical dosing efficiency. Other industries like adhesives, paints, and agriculture demand application-specific mixers balancing energy efficiency and adaptability.

Market Breakup by Region

Key Insight: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each show distinct drivers. North America focuses on smart technology and pharma-grade mixing. Europe is sustainability-led, with energy-efficient and hygienic designs in demand. Asia Pacific continues to dominate the industrial mixers market due to manufacturing capacity and policy-driven scaling. Latin America adopts mixers in mining and food sectors, while Middle East and Africa market's growth stems from water infrastructure and chemicals.

| CAGR 2026-2035 - Market by | Type |

| Liquid-Liquid | 5.5% |

| Liquid-Gas | 4.7% |

| Solid-Solid | XX% |

| Solid-Liquid | XX% |

| CAGR 2026-2035 - Market by | End Use |

| Pharmaceuticals | 5.6% |

| Plastic Industry | 4.7% |

| Food and Beverages | XX% |

| Mineral Industry | XX% |

| Chemicals | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 6.7% |

| Europe | 4.0% |

| North America | XX% |

| Latin America | XX% |

| Middle East and Africa | XX% |

By Technology, Ribbon Blenders Clock in the Largest Share of the Market

Ribbon blenders hold a commanding share in the industrial mixers market as industries require uniform dry mixing, particularly in food, pharmaceuticals, and plastic processing. Their ribbon design ensures consistent radial and axial mixing of powders and granules. Firms like Jaygo and Vortex deploy hybrid ribbon-vacuum systems to handle heat-sensitive ingredients enhancing product integrity. For example, Jaygo introduced a GMP-compliant ribbon blender line for pharmaceutical granule mixing, focusing on low-shear, dust-tight operations. Their simplicity, low power consumption, and adaptability make ribbon blenders a staple in batch operations across the globe.

As per the industrial mixers market report, homogenisers are witnessing rapid growth in biotechnology, cosmetics, and specialty chemical industries. These systems enable nano-emulsion which makes them essential in high-precision applications. China’s State Council has increased R&D subsidies for biopharma firms incorporating high-pressure homogenisers into fermentation lines. By 2023, China’s total biopharma R&D expenditure reached USD 15 billion, marking a sharp increase from USD 35 million in 2015. Companies such as Microfluidics and Bertoli are delivering lab-to-industrial scale homogenisers with real-time monitoring, allowing tighter control on particle size distribution. In 2022, SPX FLOW launched next-gen technology of homogenizers, reducing Water consumption by up to 97%. With the surge in vegan cosmetics and mRNA research, demand for lab-scale homogenisers with scalability potential is expanding in Europe and Southeast Asia.

By Type, Solid-Liquid Secures a Substantial Share of the Market Revenue

Solid-liquid mixers register a significant share of the industrial mixers industry due to their widespread application across food processing, chemicals, pharmaceuticals, and wastewater sectors. These systems ensure even dispersion of solids into liquids, crucial for suspensions, emulsions, and dissolution processes. Their popularity is growing among nutraceutical and agrochemical sectors where uniform mixing impacts final efficacy. Technological innovations such as vacuum-assisted loading, inline dispersion, and shear-controlled agitation are enhancing the mixing of powders into high-viscosity liquids.

Liquid-liquid mixing systems are seeing fast-paced growth in the industrial mixers industry due to rising demand in the cosmetics, biotechnology, and chemical industries. These mixers are essential for emulsion, blending, and solvent extraction processes where uniform droplet dispersion defines product quality. Innovations like high-pressure homogenisers, magnetic stirrers, and ultrasonic mixers are enhancing process outcomes. The flexibility of liquid mixers to handle immiscible fluids, combined with scalable modular designs, makes them ideal for continuous operations in pharma and fine chemical industries.

| 2025 Market Share by | Country |

| Saudi Arabia | 0.8% |

| USA | XX% |

| Canada | XX% |

By End Use, Food and Beverages Secure the Dominant Share of the Market

The food and beverage industry remains the most dominant end-use segment boosting the industrial mixers market growth. The segment, expected to grow at 5.6% over the forecast period, is driven by rising processed food consumption and safety regulations. Mixers in this sector must offer hygiene, speed, and ingredient versatility. Tetra Pak and Silverson are investing in automated inline blending systems for dairy and beverage plants in Europe and India. Automated ribbon blenders, emulsifiers, and planetary mixers are being increasingly deployed for their precision and sanitation features. The need for allergen separation, batch traceability, and clean-label production is pushing manufacturers toward advanced mixing technologies. Moreover, global shifts toward plant-based and fortified food require flexible systems that accommodate varied textures and moisture levels.

Pharmaceuticals represent the fastest-growing segment gaining traction in the industrial mixers market due to stringent production requirements, increasing biologics output, and investments in domestic manufacturing capacity. Mixing systems here are central to blending APIs, excipients, and sterile solutions. High-shear mixers, homogenisers, and magnetic stirrers dominate due to their ability to provide micron-level dispersion under GMP conditions. Demand is especially high for mixers with closed systems, CIP/SIP functionality, and real-time monitoring.

Asia Pacific Holds the Leading Position in the Global Market

Asia Pacific dominates the global industrial mixers market with its booming manufacturing hubs and supportive policies. China and India are investing in mega industrial parks with built-in processing infrastructure, fuelling demand. Moreover, under the “Make in India” campaign, local production of pharmaceuticals and chemicals has led to widespread adoption of ribbon and paddle mixers. For instance, ACG Engineering expanded its Maharashtra facility to include high-capacity mixers for tablet and capsule manufacturing. In Japan, Mitsubishi and Fuji Techno are rolling out energy-efficient mixers tailored for food automation. Southeast Asia’s food exports are also pushing demand for multi-zone mixing systems with automated batching capabilities.

| CAGR 2026-2035 - Market by | Country |

| India | 7.1% |

| Brazil | 5.7% |

| Saudi Arabia | 5.2% |

| Australia | 5.0% |

| Canada | 4.9% |

| USA | XX% |

| UK | XX% |

| Germany | XX% |

| France | 4.5% |

| Italy | XX% |

| China | XX% |

| Japan | XX% |

| Mexico | XX% |

North America boosts the growth of the industrial mixers industry due to its advanced manufacturing sector, particularly in the pharmaceuticals and food and beverage sectors. In 2022, the manufacturing sector contributed around USD 2.3 trillion to the GDP, which accounted for around 11.4% of the country’s GDP. Industrial mixers are also essential for ensuring compliance with sanitary standards in these sectors and benefit greatly from significant investments in automated mixing technologies with the manufacturing sector being one of the top investors in automation technology in the region.

The industrial mixers market players are increasingly focusing on intelligent automation, modular design, and industry-specific innovations. A major shift noticed in the market is the convergence of mechanical engineering with digital technologies, including AI-integrated mixers, self-cleaning mechanisms, and real-time analytics are fast becoming differentiators.

Industrial mixer companies are also tapping into localised manufacturing to reduce lead times and meet custom compliance norms. European companies are expanding their footprint into Southeast Asia and Latin America through joint ventures and regional R&D hubs. Sustainable design remains top priority as many are switching to recyclable components, magnet-driven shafts, and low-noise systems to meet ESG targets. Opportunities lie in retrofitting legacy systems with modular upgrades. Players offering cloud-based mixer control dashboards and remote diagnostics are gaining significant traction.

Established in 1933, the company has emerged as a prominent leader in industrial mixing technology. The company focuses on offering innovative solutions for mixing, blending, and processing in various sectors such as pharmaceuticals, chemicals, cosmetics, and food production.

Philadelphia Mixing Solutions, Ltd., a company based in the United States, specialises in offering tailored mixing solutions for sectors such as oil and gas, water and wastewater, chemical processing, and power generation, among others.

The Statiflo Group, based in the United Kingdom, is known for its static mixers that facilitate the mixing of liquids, gases, and solids without the demand for moving parts. It offers its services in water treatment, oil and gas, chemicals, and food processing sectors.

Established in 1979 and headquartered in Wisconsin, United States, Mixer Systems, Inc. focuses on heavy-duty concrete and batch mixers for the construction sector. Its EconoBatch and Turbin mixers are built for rugged performance, with PLC controls and long wear-life liners. The company serves infrastructure and precast clients across North America and is expanding portable mixers for site-level flexibility.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Silverson, and Sulzer Ltd, among others.

Explore the latest trends shaping the Industrial Mixers Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Industrial Mixers Market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 5.20% between 2026 and 2035.

Key strategies driving the market include investing in smart retrofits, collaborating across industries, exploring local manufacturing hubs, integrating IoT control, and redesigning mixers to meet region-specific compliance, portability, and material-handling demands.

The key market trends guiding the growth of the market include the growing shift towards automation and the rising demand for PLC based industrial mixers.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading technologies of industrial mixers in the market are agitators, paddle mixers, static mixers, ribbon blenders, emulsifiers, drum mixers, and homogenizers, among others.

The significant types of industrial mixers in the industry are solid-solid, solid-liquid, liquid-gas, and liquid-liquid.

The major end use sectors in the market are food and beverages, mineral industry, chemicals, pharmaceuticals, plastic industry, and wastewater, among others.

The major players in the industry are Ekato Group, Philadelphia Mixing Solutions, Ltd., Statiflo Group, Mixer Systems, Inc., Silverson, and Sulzer Ltd, among others.

In 2025, the industrial mixers market reached an approximate value of USD 2.79 Billion.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 4.63 Billion by 2035.

The key challenges are high initial costs, strict sanitation compliance, and integration complexities with legacy systems remain barriers.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Technology |

|

| Breakup by Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share