Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America renewable electrical maintenance market size reached nearly USD 667.04 Million in 2025. The market is projected to grow at a CAGR of 19.30% between 2026 and 2035 to reach around USD 3895.44 Million by 2035.

Base Year

Historical Period

Forecast Period

The abundance of natural resources in North America has made the region lucrative for renewable energy production.

RESA Power, LLC, Shermco, and General Electric Company are a few of the major companies in the market.

Canada’s renewable energy investment tax credit (ITC) introduced in the 2023 federal budget provides a 30% tax write-off for renewable technologies deployed until 2034 in Canada.

Compound Annual Growth Rate

19.3%

Value in USD Million

2026-2035

*this image is indicative*

The increasing focus on sustainability has generated a higher need for renewable energy solutions like solar, wind, hydro, and geothermal power. The primary drivers behind the swift adoption of these energy systems include their cost-effectiveness, ability to enhance energy security, and their minimal or negligible environmental impact.

Some of the factors driving the North America renewable electrical maintenance market growth are the growing adoption of renewable energy sources and favourable government initiatives, such as the Build Back Better Act in the United States, actively promoting the installation of wind turbines and solar panels. Additionally, states like Arizona are setting ambitious targets, aiming to source 15% of their energy exclusively from renewable sources by 2025.

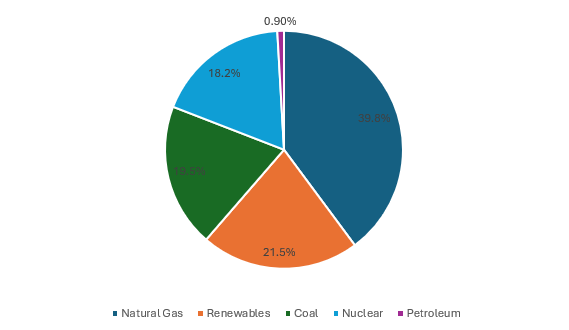

Figure: Sources of Electricity Generation in the USA, 2022

Rising adoption of renewable energy sources; technological advancements and innovations; the growing awareness regarding regular maintenance of renewable energy sources; and implementation of holistic data strategy are aiding the market growth.

The USA’s goals under the Climate Act aimed at achieving 70% renewably sourced electricity by 2030 and a zero-emission electric grid by 2040 are driving the adoption of renewable energy sources, fuelling the North America renewable electrical maintenance market development.

There is an increasing adoption of technological advancements, such as artificial intelligence and machine learning, to propel the automation in maintenance services. As a result, this trend is yielding increased effectiveness, decreased time and resource utilisation, and financial economies.

The United States government aims to achieve 80% renewable energy generation by 2030. As of 2021, 79% of the USA’s total energy production was from fossil fuel sources. As a result, the country is expected to significantly invest in in renewable energy projects to achieve these targets.

The collection of data points for the entire fleet, instead of focusing solely on individual turbines, opens up the potential to apply insights on a much broader scale.

Service providers are responsible for plant monitoring, performance management, and preventative and corrective maintenance of the assets. These long-term projects ensure a steady stream of revenue for maintenance companies.

Canada is one of the largest per-capita consumers of energy, globally. To achieve the requirement of the United Nations Sustainable Development Goal 7 (SDG 7), Canada is transitioning to clean energy sources, including solar, wind, hydro, and geothermal. As part of SDG 7, Canada intends to achieve 90% of electricity from renewable and non-emitting resources by 2030. In July 2023, The Government of Canada, in partnership with Indigenous communities invested in nine solar power projects in Alberta. These projects in total are aimed at creating 163 MW of new solar generation and providing 48 MW of battery storage capacity.

Furthermore, innovations such as remote sensors and AI help substantially reduce maintenance expenses for operators, propelling the North America renewable electrical maintenance market expansion. For instance, a wind operator can detect a condition and opt to schedule a repair during a period of low wind. This early identification can minimise downtime and enable the wind operator to proactively plan.

North America Renewable Electrical Maintenance Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Component

Market Breakup by Service Type

Market Breakup by Deployment

Market Breakup by Country

Solar energy services are expected to dominate the North America renewable electrical maintenance market share due to their easy installation and cost-effectiveness

Solar energy maintenance services usually consist of microinverter replacement, wiring repairs, trunk cable replacement, and critter nest removal. With use, solar systems' energy yield decreases, owing to single cells breaking down, and inverters not operating at their maximum efficiency. Panels may also experience warming and overheating due to parasitic currents, which can lead to fires. The use of thermal imaging can help operators detect these faults and take necessary actions.

Wind turbine maintenance is crucial to ensure uninterrupted operation and performance. As a result, operators need to regularly maintain wind turbines to identify and correct problems to prevent equipment failures, as well as to ensure maximum equipment lifespan and reliability.

As hydropower is North America’s largest source of renewable energy, the North America renewable electrical maintenance market expansion is witnessing an upward trajectory. The USA and Canada are among the top hydropower producers, globally, supporting the demand for timely maintenance services. Hydro energy services include commissioning support, in-place machining, welding, consulting, inspections, and assessments of hydro turbines. Service providers offer a range of critical plant support services, including technical support, emergency services, maintenance and repair, and diagnosis.

Besides, the USA is a significant producer of geothermal electricity, globally. In 2022, the country was home to geothermal power plants in seven states, producing around 17 billion kWh of power equal to around about 0.4% of the total utility-scale electricity generation in the country.

Major players in the North America renewable electrical maintenance market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

RESA Power, LLC, founded in 2003, is headquartered in the United States. The company provides customised solutions by NETA Certified Technicians, encompassing system commissioning and continuous maintenance.

Shermco, headquartered in the United States, was founded in 1974. The company provides a wide range of electrical power services, encompassing testing, maintenance, and repair, excelling in designing maintenance programmes.

General Electric Company, headquartered in the United States, was founded in 1892. It delivers a spectrum of services, from remote monitoring to comprehensive plant maintenance and performance optimisation.

ABB Ltd. was founded in 1988 and headquartered in Switzerland. The company offers solar solutions, covering everything from PV panel DC output to medium and high voltage grids.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the North America renewable electrical maintenance market include Emerson Electric Co., RENEW, Canadian Solar Inc, Suntrek Industries, Inc.

The United States of America accounts for a significant market share as it aims to achieve 70% renewably sourced electricity by 2030. Various government policies aid the growth of the renewable sector in the USA. The Inflation Reduction Act of 2022 includes tax provisions and grant and loan programmes to aid the deployment of commercially available clean energy technologies. As a result, solar energy adoption is rising across the USA, especially in California and Texas, as an appealing source of new power generation. This is positively influencing the North America renewable electrical maintenance market growth.

Hydroelectricity is a crucial form of renewable energy produced in Canada. The adoption of an emissions-free grid is expected to help Canada decarbonise its economy and achieve its net-zero emissions targets. Canada is home to over 19 GW of utility-scale wind and solar energy capacity, with more than 1.8 GW of new generation capacity added in 2022. Canadian wind, solar and energy storage sector grew by 10.5% in 2022.

United States Waterproofing Market

United States Cold Storage Market

North America Waterproofing Market

Europe Dietary Supplements Market

North America Renewable Electrical Maintenance Manufacturers

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was approximately USD 667.04 Million.

The market is projected to grow at a CAGR of 19.30% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 3895.44 Million by 2035.

The major drivers include rising adoption of renewable energy sources due to favourable government policies and rising investments in renewable energy projects.

The key trends include increasing integration of artificial intelligence (AI) in regular maintenance of renewable energy systems and technological advancements and innovations.

The different types of renewable electrical maintenance include geo-thermal energy services, hydro energy services, wind energy services, and solar energy services.

The major deployment modes of renewable electrical maintenance include onsite and offsite.

The major players in the market include RESA Power, LLC, Shermco, General Electric Company, ABB Ltd., Emerson Electric Co., RENEW, Canadian Solar Inc, and Suntrek Industries, Inc.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Component |

|

| Breakup by Service Type |

|

| Breakup by Deployment |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share