Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global triacetin market was valued at USD 308.84 Million in 2025. The industry is expected to grow at a CAGR of 4.00% during the forecast period of 2026-2035 to reach a value of USD 457.16 Million by 2035. Feedstock security and upstream integration are becoming the major factors that significantly influence the market growth, as producers are deliberately stabilizing costs and ensuring the availability of raw materials.

Production in the triacetin market requires acetic acid and glycerol to be the main sources, which is why one cannot think of production of acetyl products without directly associating it with acetyl value chain. To give an example, Eastman Chemical Company obtained three major feedstock contracts in May 2023 and thus, it was able to announce that its one billion US Dollars molecular recycling plant in Normandy (France) will be the world largest material-to-material plant, the contracts will pave the way for easy access to feedstock streams that will facilitate the business of acetyl and ester derivatives.

Moreover, Celanese Corporation disclosed that it hit a significant milestone in March 2024 with the launch of a 1.3 million-ton per annum acetic acid expansion at its Clear Lake, Texas facility, which has been deemed as a "lowest-cost, lowest-carbon footprint" plant in the company's Acetyl Chain business. By implementing these strategic moves, key players in the chemical industry are building a strong foundation of feedstock security that reduces production risks, opens the doors for large-scale production of downstream esters like triacetin, and eventually expands the triacetin market market scope on a global scale.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4%

Value in USD Million

2026-2035

*this image is indicative*

One of the main factors that influence the use of triacetin is the increasing focus on advanced drug delivery systems and clean-label excipients. In this way, triacetin is raised in position as a multifunctional plasticizer and solubilizer. As an illustration, BASF advertizes its Kollisolv® GTA (triacetin) as a very clear, high purity product which is an ideal excipient for lipid-based and film-coated formulations. By incorporating triacetin with its pharma-grade excipient portfolio, BASF is a step ahead of the trend of premium, regulatory compliant ingredients in pharmaceutical and nutraceutical end uses.

The rise of food & beverage and industrial applications in Asia has led to significant growth in local triacetin market through expansion production by players to cater to the regional consumer and industrial demand. As a matter of fact, KLK OLEO initiated the production of a new high purity fatty acids and glycerine complex in Zhangjiagang, China, July 2024 among the products made is triacetin. This noteworthy move is consistent with the trend of supply chain shortening, more localized and fast consumer end markets across Asia.

Chemical companies in the region are responding to rising domestic demand and policy-driven localization by building new facilities for the production of triacetin. One such an example is the Kanoria Chemicals & Industries Ltd. that in January 2023 announced a new 6,000 MTPA triacetin plant at Ankleshwar, Gujarat, which will provide the industrial and food sectors with triacetin. These kinds of shifts are indicative of a larger trend in emerging markets where manufacturers take the lead in setting the pace for self-sufficiency and local triacetin market value chain growth.

The specialty chemicals sector has been consolidating, and one of the effects of this is the broadening of ester portfolios by companies with the aim of increasing their competitive advantage in downstream markets such as triacetin. Polynt Group, as an example, agreed to this proposal in the non-binding sense when it signed the MoU in March 2024 to purchase the Polyprocess in France. Thus, the company can both extend its product offering and its production capability worldwide. It is on the same track as the integrated players who scale globally for supply and can meet diverse end use needs, thereby contributing to the sustained growth in the triacetin market.

Producers are unveiling high purity triacetin grades specifically for pharmaceutical, cosmetic, and other advanced applications as consumers and formulators insist on cleaner, sustainable, and premium-grade ingredients. KLK OLEO, as an example, rolled out its “ENHEX GTX 99.9 PH” high purity triacetin in October 2025, produced to EXCiPACT™ GMP/GDP standards. This conforms with industry trends that prefer sustainable, high-performance ingredients and encourage triacetin use in high-end markets.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Triacetin Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Grade

Key Insight: Tobacco grade acquires notable triacetin market share as it benefits from enduring demand in cigarette filter rods as manufacturers seek reliable humectants and plasticizers. Food grade is gaining traction as ingredient makers like Eastman Chemical Company emphasise their ‘Triacetin-Food Grade’ product certified under FCC and GMP for use in food and cosmetic applications. Industrial grade is advancing as firms promote triacetin as a non-phthalate plasticiser and high-performance ester for coatings, adhesives and polymers, responding to sustainable materials and regulatory compliance pressures.

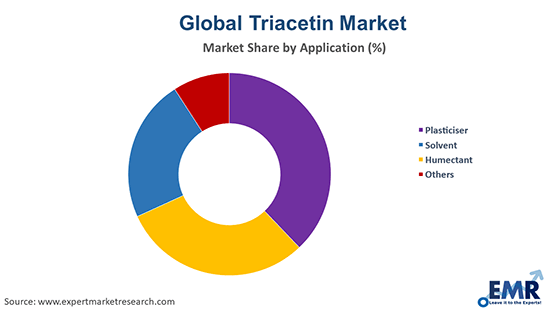

Market Breakup by Application

Key Insight: In the plasticizer segment, producers are reformulating PVC and biodegradable films using triacetin as a non-phthalate, biobased option. In the Solvent segment, firms are developing ultra low Odor, high solvency triacetin grades for coatings and adhesives. In the Humectant space, ingredient suppliers are offering clean label, high purity triacetin formulations tailored for baked goods and personal care products. Under Others (emulsifier, flavor carrier, stabilizer), specialists are expanding technical service, customizable grades and niche additives to unlock new end use applications, contributing to the triacetin market revenue.

Market Breakup by End-Use

Key Insight: In Tobacco, firms are developing high-performance and biodegradable filter solutions to enhance moisture retention. In food & beverage, companies are innovating clean-label, high-purity triacetin grades for moisture control and flavor-carrying applications. Pharmaceuticals drive product development of triacetin as a capsule plasticizer and solvent. In cosmetics, textiles, and metal & mining, firms are enhancing formulations, coatings, adhesives, and stabilizers, while expanding technical support and regulatory compliance to boost adoption across all end-use segments.

Market Breakup by Region

Key Insight: Asia Pacific accounts for a significant triacetin market share owing to the accelerating industrial growth and expanding manufacturing intensive sectors that are boosting uptake of triacetin in food, coatings and chemicals. In Europe, the focus is on regulatory compliant, sustainable additive solutions and high purity grades tailored for premium applications. North America is characterised by mature end-use industries and strong innovation in specialty grades and biobased variants. Meanwhile, Latin America and Middle East & Africa are gradually enhancing local production and supply chain capabilities, aligning with rising industrialization and regional consumption trends.

By grade, food grade triacetin witness consistent demand

Triacetin food-grade segment grows significantly as processed food manufacturers adopt clean label ingredients that improve product texture, moisture retention, and shelf-life. hubergroup, for instance, in August 2023 unveiled three new solvent-based, food-safe ink series for Asia’s packaging market, thus indirectly elevating the demand for triacetin as the latter is used as a solvent/plasticiser in the release of food packaging. This exemplifies that suppliers are enhancing and adjusting product specifications to food and packaging trend requirements.

Industrial grade witnessing high demand in the triacetin market is becoming more popular and one of the major uses is as a plasticiser and solvent in the carbon fiber, and polymer industries that are non-phthalate and use sustainable additives. The trend of the market players is that they adjust commercial strategies in a way to benefit off such trends by upgrading production assets, unveiling new products to meet the needs of global customers in the plastics and coating sectors, and marketing triacetin, an ester, as a value-added by-product source. They also aim to expand the technical support, and service offers to accelerate the implementation of high-performance industrial applications.

By application, plasticisers are registering substantial demand globally

Non-phthalate, bio-based plasticizers demand is rapidly increasing as both regulators and consumers require safer, more sustainable materials. Companies are diligently reformulating PVC, cellulose acetate, and flexible films to incorporate triacetin, thus replacing old plasticizers and improving the product's performance. For instance, Japanese polymer and coatings companies significantly increased the use of triacetin as a plasticizer and solvent substitute in PVC and flexible materials, which is their fast way to solve the environmental issue and still meet the requirement for high-performance materials.

Triacetin market opportunities are increasing in the field of versatile solvent due to its increasing use in inks, adhesives, paints, and specialty formulations and is preferred for its high solvency and low toxicity. The producers are innovatively establishing bio-based production methods, making the supply chain better and targeting industrial and consumer markets. Several specialty chemical companies located in the United States have amplified the production of glycerol-derived triacetin, thus signaling their readiness to meet the increasing demand for sustainable, high-performance solvent solutions.

By end-use, food & beverage show remarkable market growth

The food & beverage segment is rapidly expanding as manufacturers seek multifunctional, clean label ingredients that improve moisture retention, flavour delivery, and shelf life. Companies are innovating high purity triacetin grades specifically designed for food applications to meet this demand. Ingredient producers are committed to the large-scale bio-based triacetin production from glycerol by-products and are targeting syrups, confectionery, and dairy products.

In the pharmaceutical industry, triacetin is rapidly becoming a prominent choice as a solvent, plasticiser, and excipient in soft-gel capsules, coatings, and advanced drug delivery systems. Market players are taking the lead in creating partnerships, revamping production lines, and offering GMP-certified variants to aid complex formulations. This strategic move of firms shows they are in sync with pharmaceutical trends, thus ensuring the availability of high-quality, compliant, and formulation-ready triacetin for drug manufacturers worldwide.

By region, Asia Pacific leads the market growth

The Asia Pacific region is booming with the growth accelerating rapidly due to the spreading of the dynamic food-processing, pharmaceutical, and tobacco industries over the markets like China and India. Jiangsu Ruijia Chemistry Co., Ltd., for instance, whose triacetin portfolio serves tobacco filters, food additives, coatings, inks, and eco-friendly industrial esters, is lengthening the production, securing glycerol feedstocks, and smoothing distribution routes to satisfy local end-use demand. Such activities provide a quick turnaround to the rapidly expanding regional sectors, at the same time, they deepen the local supply chains.

In Europe, the regulatory pressure (like REACH) and the sustainability demands are the main drivers of the triacetin market growth propelling the adoption of high-purity, bio-based triacetin and the implementation of circular economy supply chains. Lanxess AG, whose Polymer Additives unit offers plasticisers, hydrolysis stabilisers, and specialty esters across packaging, cosmetics, food & beverage, plastics, and metal finishing, is actively modifying the production processes, making green feedstock investments, and conforming to formulation standards for food, pharma, and industrial applications. This is helping the European trend towards premium and eco-compliant specialty esters to become stronger.

Companies are making strategic moves to meet the ever-changing consumer demands for cleaner and more sustainable ingredient profiles. As a case in point, major triacetin market players are converting to high-purity GMP-certified triacetin types that are specially designed for pharmaceutical and personal-care applications, e.g., excipient-grade triacetin marketed for oral solid dosage forms and plasticised capsule shells. These tactics demonstrate that brand owners are increasingly demanding the replacement of old solvents and plasticisers with functional, regulation-ready esters that conform to patient safety and regulatory requirements.

Innovation in product is leading the market expansion at an even faster pace by providing triacetin variants to be used in advanced applications with better performance. For example, researchers are using continuous-flow processing, nano-encapsulation methods, and smart separation to produce triacetin that has better oil-solubility, lighter odour, enhanced release properties, and uniform quality. This kind of innovation allows triacetin companies to enter high-value segments (cosmetics, drug-delivery, sustainable plastics) and thus supports premium pricing and differentiation across end-use industries.

With a history since 1920, Eastman Chemical Company, a renowned leader in global specialty chemicals, is located in Kingsport, Tennessee, USA. Besides, the company offers a full range of materials, additives and functional products. Eastman is committed to sustainability through its solutions for plastics, coatings and acetyl derivatives, such as triacetin.

The origins of Lanxess AG date back to 2004 and the company is headquartered in Cologne, Germany. Being a specialty chemicals company, it supports the automotive, construction, and industrial sectors. Its extensive product line features plasticizers, additives, and performance chemicals with the continuous invention of ester-based solutions like triacetin.

Daicel Corporation, the major player in the triacetin market and the areas of cellulose derivatives, organic chemicals; and polymers, was established in 1919 in Tokyo, Japan. Daicel produces triacetin and other acetylated esters for use in pharmaceuticals, plastics, and coatings.

The company was founded in 2003 and is situated in Jiangsu, China. Jiangsu Ruijia Chemistry Co., Ltd. is a chemical manufacturer that provides esters, solvents, and intermediates. Their triacetin products are designed for food, pharmaceutical, and industrial markets in the domestic and international regions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Mosselman S.A., KLK OLEO, among others.

Explore the latest trends shaping the Global Triacetin Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global triacetin market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global triacetin market reached an approximate value of USD 308.84 Million.

The market is projected to grow at a CAGR of 4.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 457.16 Million by 2035.

Key strategies driving the market include feedstock security through upstream integration, production capacity expansions, local manufacturing in emerging regions, high-purity and bio-based product innovations, and strategic partnerships or acquisitions to strengthen global supply chains.

The key trends guiding the market include the growing use of triacetin as plasticiser in cigarette filter rods and the rising demand for the product in the chemical sector owing to its favourable properties like compatibility with natural and synthetic rubber and resistance to light.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading grades of triacetin in the market are tobacco grade, food grade, and industrial grade.

The major applications of triacetin include plasticiser, solvent, and humectant, among others.

The significant end uses of triacetin are tobacco, food and beverage, pharmaceuticals, cosmetics, textiles, and metal and mining.

The key players in the market include Eastman Chemical Company, Lanxess AG, Daicel Corporation, Jiangsu Ruijia Chemistry Co., Ltd., Mosselman S.A., KLK OLEO, among others.

Asia Pacific holds the largest share of the global triacetin market, driven by rapid industrial growth, expanding food & beverage, pharmaceutical, and tobacco sectors, and increasing local production capabilities.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Grade |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share