Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global biodegradable polymers market value is expected to grow at a CAGR of 21.10% during the period 2026-2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

21.1%

2026-2035

*this image is indicative*

| Global Biodegradable Polymers Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | XX |

| Market Size 2035 | USD Billion | XX |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 21.10% |

| CAGR 2026-2035 - Market by Region | North America | 22.3% |

| CAGR 2026-2035 - Market by Country | UK | 23.1% |

| CAGR 2026-2035 - Market by Country | China | 22.7% |

| CAGR 2026-2035 - Market by Type | Polylactic Acid (PLA) | 22.8% |

| CAGR 2026-2035 - Market by Distribution Channel | Packaging | 23.4% |

| Market Share by Country 2025 | Australia | 2.4% |

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Biodegradable polymers, often referred to as biopolymers, are typically sourced from various natural materials. These biopolymers, such as PLA, PHA, and starch, are widely used in plastics due to their lower environmental impact, which further fuels the biodegradable polymers industry growth.

Biodegradability is a feature of polymers independent of their origin and may be changed by making alterations at the molecular level. For example, some polymers are produced from petroleum feedstock but are biodegradable. Biopolymers from renewable feedstock are the most plentiful and commonly available biopolymers.

Synthetic biopolymers are polymers modified from natural polymers or chemically synthesised from synthetic monomers such that they may undergo natural degradation, without leaving remains harmful to the environment. The biodegradable polymers market trends and dynamics are being driven by the advancement of technology, enabling the creation of synthetic biopolymers such as polycaprolactone (PCL), polyvinyl alcohol (PVOH), polylactic acid (PLA), polyglycolic acid (PGA), and polybutylene succinate (PBS).

The advantages of synthetic biopolymers include the potential to set up a sustainable industry and improvement in properties like high gloss, durability, clarity, flexibility, and tensile strength. These advantages are expected to contribute to the growth of the biodegradable polymers market.

According to the FAO (2022), in 2020, global agricultural land dedicated to permanent meadows and pastures amounted to 3,182,766.3 thousand hectares, while cropland covered 1,561,667.7 thousand hectares. In Africa, the agricultural landscape in 2020 included 842,097.5 thousand hectares for permanent meadows and pastures and 281,861.5 thousand hectares for cropland. In the Americas, 754,663.5 thousand hectares were used for permanent meadows and pastures, with cropland covering 367,297.3 thousand hectares. Asia reported 1,077,740.0 thousand hectares designated for permanent meadows and pastures and 591,266.3 thousand hectares for cropland in 2020.

Europe's agricultural land usage in 2020 comprised 173,300.0 thousand hectares for permanent meadows and pastures and 288,051.6 thousand hectares for cropland. In 2020, Oceania had 334,965.3 thousand hectares of permanent meadows and pastures, along with 33,191.0 thousand hectares of cropland, which boosted the demand for the biodegradable polymers market.

According to the Italian Trade Agency, in 2018, China imported packaging machinery from Italy valued at USD 196.2 million, while its exports to Italy amounted to USD 22.1 million. In 2019, imports surged to USD 275.5 million with a notable 40.4% growth rate. In 2020, imports were valued at USD 271.6 million, and exports were valued at USD 21.8 million, showing a 29.0% growth rate. The upward trend continued in 2021, with imports rising to USD 279.3 million and a growth rate of 2.8%. Exports also increased, reaching USD26.2 million, reflecting a 20.2% growth rate and further driving the biodegradable polymers demand growth.

According to the National Health Expenditure (NHE) historical data (1960–2021) and CMS projections (2022–2031), health spending in the United States as a percentage of GDP was 17.6% in 2018. This percentage remained consistent in 2019. In 2020, there was a notable increase, with health spending rising to 19.7% of GDP. CMS projections for 2031 indicate that health spending will represent 19.6% of GDP, further driving the biodegradable polymers industry revenue.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Biodegradable Polymers Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Distribution Channel

Market Breakup by Region

| CAGR 2026-2035 - Market by | Country |

| UK | 23.1% |

| China | 22.7% |

| USA | 22.4% |

| India | 21.5% |

| Brazil | 21.3% |

| Canada | XX% |

| Germany | 20.8% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Mexico | 19.6% |

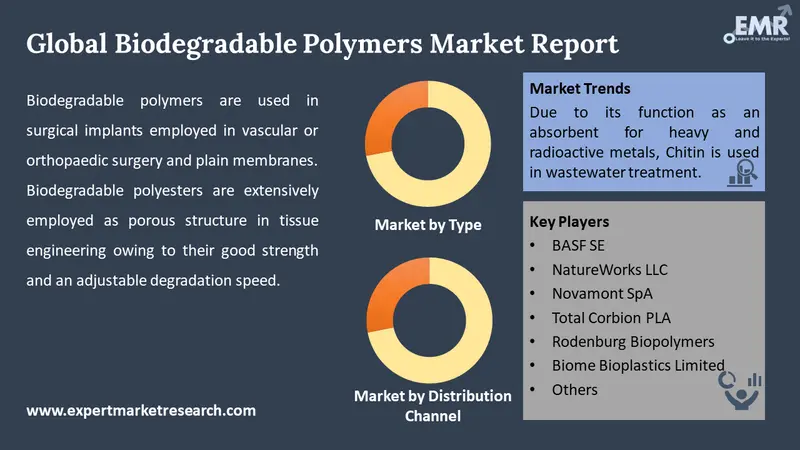

Biodegradable polymers are used in surgical implants employed in vascular or orthopaedic surgery and plain membranes. Biodegradable polyesters are extensively employed as porous structures in tissue engineering owing to their good strength and adjustable degradation speed. Further, biodegradable polymers are employed as implantable matrices for controlled release of drugs within the body or as absorbable sutures.

In the automotive sector, PLA is mixed with fibres of kenaf to replace panels of car doors and dashboards. Starch-based polymers are used as additives in tire production to reduce rolling resistance, fuel consumption, and greenhouse gas emissions, further driving the growth of the biodegradable polymers industry.

The companies produce bioplastics, specialising in crafting biopolymers from renewable plant sources. They emphasise sustainable solutions for packaging, textiles, and consumer products, spearheading innovation in the bioplastics sector.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The biodegradable polymers market value is expected to grow at a CAGR of 21.10% during the forecast period of 2026-2035.

The major drivers of the market include the increasing demand in the packaging industry, industrialisation and urbanisation, favourable government policies, and rise in awareness regarding the benefits of using biodegradable polymers.

The increased interest in biodegradable materials for use in various sectors and growing concerns regarding environmental degradation are the key industry trends propelling the market's growth.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

Based on type, the market is divided into starch-based plastics, polylactic acid (PLA), polyhydroxy alkanoates (PHA), polyesters (PBS, PBAT, and PCL), and cellulose derivatives.

The several distribution channels are agriculture, healthcare, textile, packaging, and consumer electronics, among others.

The competitive landscape consists of BASF SE, NatureWorks LLC, Novamont SpA, Total Corbion PLA, Rodenburg Biopolymers, and Biome Bioplastics Limited, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share