Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India digital marketing market size was valued at USD 6.71 Billion in 2025. The market is expected to grow at a CAGR of 30.20% during the forecast period of 2026-2035 to reach a value of USD 93.94 Billion by 2035. Rising retail-media networks exploiting first-party data are fueling hyper-targeted ads, enabling brands to directly convert consumers via integrated, shoppable content across platforms and in-store digital touchpoints.

Growth in the market is fueled by soaring internet and smartphone usage. In fiscal year 2024-25, digital advertising spending surged to approximately INR 40,800 crore, marking 29% growth over the prior year. According to the India digital marketing market analysis, digital media crossed television for the first time, claiming 41% of India’s total ad expenditures. This shift reflects a deepening digital-first mindset among businesses.

The government’s Digital India push, rollout of public Wi-Fi, and rising 5G availability are expanding digital reach into tier-II and III markets. Meanwhile, industry reports suggest that digital advertising in India is set to surge by 20.2% to reach INR 59,200 crore by 2025, overtaking traditional media spend this year, boosting the India digital marketing market growth.

As digital channels expand, B2B marketers are increasingly relying on hyper-personalization, AI tools, and vernacular content to engage India’s diverse consumers. With digital media being a strategic imperative for both established brands and MSMEs, its effects extend beyond marketing, driving economic inclusion, e-commerce growth, and media innovation across the country.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

30.2%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

AI is reshaping how brands engage, with 71% of CMOs planning AI/ML investments for personalization and nearly half exploring immersive features like virtual try-ons. Tools like AI-powered chatbots, dynamic content generation, and predictive ad targeting are enabling precision at scale. Meanwhile, MarTech startups focused on first-party strategies and SaaS AI solutions are gaining venture traction. This automation trend in the India digital marketing market is replacing human creativity, it is helping marketers deliver highly relevant messages to diverse audiences in real time.

The country’s digital audience is increasingly taking the regional-first approach. According to the India digital marketing market analysis, 75% of new internet users prefer vernacular content. Brands like Swiggy and Zomato are crafting hyper-localized ads for tier-II/III markets, doubling engagement metrics versus national campaigns. Influencers fluent in regional idioms are boosting trust and conversion. Brands that ignore this shift risk missing lucrative opportunities. By embracing vernacular strategies, marketers are unlocking deeper connections across the country’s complex linguistic mosaic.

Video and short-form content topics currently dominate India’s internet traffic. With platforms like YouTube, Instagram Reels, and TikTok drawing massive consumption, brands are shifting storytelling tactics, creating snappy, interactive videos that drive discovery and retention. Live streaming and interactive video campaigns have become core strategies for capturing attention in crowded feeds.

India’s influencer economy, expected to be valued at INR 2,200 crore by 2025, is evolving. Micro and regional creators are now driving stronger engagement than celebrity-driven campaigns, accelerating demand in the India digital marketing market. Social commerce, with integrated shoppable posts and live-selling features, is streamlining discovery to purchase journeys. Brands partnering with influencers in niche communities are seeing measurable conversions.

Government policies are laying the groundwork for responsible digital marketing. Initiatives like Digital India’s public Wi-Fi expansion and Digital Personal Data Protection Bill are building secure, inclusive access and trust. At the same time, proposed removal of the 6% digital ad tax signals relief for platforms and advertisers. These regulatory shifts are encouraging businesses to scale digital strategies ethically and confidently, while expanding reach into emerging markets.

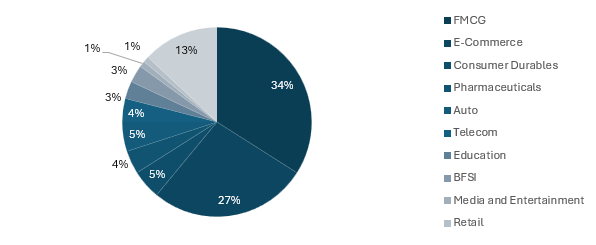

Figure: Digital Media Spends across Industry Verticals

The Expert Market Research’s report titled “India Digital Marketing Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:Key Insight: The India digital marketing market scope spans across social media, SEO, digital OOH, influencer platforms, affiliate and email marketing, and emerging content forms like blogging and podcasts. Each channel serves unique strategic goals. For example, social media excels in reach and engagement, SEO in discovery and long-term authority, video in storytelling, influencers in authenticity, email in nurturing, and podcasts in niche engagement.

Market Breakup by Type

Key Insight: The India digital marketing market scope spans across social media, SEO, digital OOH, influencer platforms, affiliate and email marketing, and emerging content forms like blogging and podcasts. Each channel serves unique strategic goals. For example, social media excels in reach and engagement, SEO in discovery and long-term authority, video in storytelling, influencers in authenticity, email in nurturing, and podcasts in niche engagement.

Market Breakup by End Use

Key Insight: Digital marketing demand in India is being propelled by sectors like e-commerce, FMCG, BFSI, automotive, education, media & entertainment, telecom, and others. E-commerce and FMCG lead the market due to direct conversion and frequent touchpoints, while BFSI and education invest in digital for trust-building and customer journeys. Media & entertainment rely on video and influencer content, telecom and automotive target through mobile-first campaigns, and edtech uses vernacular webinars. Each sector tailors content, format, and channel choice to fit their customer’s digital behavior, creating a landscape where innovation fuels overall growth.

Market Breakup by Region

Key Insight: Regional trends in the India digital marketing market indicate that the West and Central region leads the market in terms of investment and innovation, North (Delhi NCR) thrives in e-commerce and startups. The Southern region pioneers regional tech-led campaigns, and the East is rapidly growing its share with increased connectivity and digital literacy. Rural and semi-urban markets across all regions are becoming reachable owing to Digital India initiatives and affordable mobile access.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By Type, Social Media Marketing captures the dominant share of the market due to Massive User Reach

Social networks like Facebook, Instagram, LinkedIn remain dominant in India’s digital spend. In FY 2024–25, social media accounted for roughly INR 14,480 crore or 29% of digital ad spending, anchoring campaigns with wide reach and granular targeting. Short-form video and influencer-led formats are particularly effective here, enabling brands to boost engagement. Social platforms now integrate e-commerce links, interactive stories, and regional content, maximizing ROI. For B2B brands, these platforms offer visibility and highly targeted demand generation tools, especially in emerging markets where digital-first engagement is growing rapidly.

SEO is emerging as the fastest-expanding digital channel in the India digital marketing market dynamics, driven by voice search and vernacular queries. As internet users increasingly search in Hindi, Tamil, Bengali and other regional languages, brands optimizing content accordingly are capturing untapped demand. With the rise of affordable smartphones and search-assisted discovery, regional SEO is becoming crucial. Firms that invest in multilingual, long-tail keyword strategies are seeing organic traffic growth with lower CAC. This is especially important in technical and regional services, where visibility can hinge on appearing in local language search results.

By End Use, the E-commerce sector Dominates the market Digital Ad Spend with Direct Purchase Focus

E-commerce firms are the biggest consumers of digital advertising in India. Platforms like Flipkart and Amazon dominate ad impressions, particularly in the shopping category that commands 30% of digital ad spend in the first half of 2025. These platforms leverage first-party data, deep personalization, and retail media networks to drive purchases directly from ads. For B2B marketers, understanding this ecosystem is vital, whether through partnerships on retailer media networks or by crafting content optimized for shoppable ads.

FMCG players contribute to the India digital marketing market value by a high margin, propelled by high turnover, frequent launches, and regional targeting needs. Together with e-commerce, FMCG accounted for 67% of digital ad spend in FY 2024–25. From tea to toiletries, these brands deploy multi-format campaigns with video, influencer, regional content. Their pace of innovation, especially around vernacular messaging and live commerce, sets a benchmark for other sectors striving to engage mass, diverse audiences.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

West & Central India clocks in the largest share of the market with Urban Infrastructure, tech-savvy consumers, and regional content

West & Central India, including Mumbai, Pune, Ahmedabad, leads digital ad investment owing to strong urban infrastructure, high ad budgets, and advanced media agencies. Brands frequently pilot innovative formats like multilanguage social campaigns, regional video, and live commerce here. Mumbai remains India’s proving ground for new marketing tools and vernacular content.

The South India digital marketing market, powered by Bengaluru, Chennai, Hyderabad, is the fastest-growing regional market. The industry is driven by tech talent, startup culture, and high smartphone adoption. Marketers experiment with AI, AR/VR, regional SEO, and multi-language storytelling here. With markets like Kannada, Tamil, Telugu flourishing, agencies craft highly localized campaigns, micro content targeting tech-savvy, regional audiences. South India’s digital ecosystem is pioneering content formats that blend innovation with cultural relevance.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The market is fragmented, comprising global networks like Dentsu and Bain-backed agencies, alongside homegrown startups focused on vernacular content, AI-MarTech, and retail media networks. Competition among India digital marketing companies centers around offering different tools such as advanced analytics, algorithmic personalization, content in regional languages, and integrated shoppable formats. Demand is driving innovation in performance dashboards, voice-search optimization, and influencer commerce platforms.

The rise of retail media networks, where platforms like Flipkart and Amazon enable brands to advertise directly on their apps, offers a powerful new channel for conversion. India digital marketing market players that can blend first-party data insights with fluid regional storytelling are gaining an edge. Partnerships, acquisitions, and platform-level integrations are accelerating, especially as brands seek solutions that serve both reach and relevance. For stakeholders, opportunities lie in building modular, data-driven solutions that scale across languages, devices, and sectors, while keeping ethical and privacy-compliant practices at the core.

Oxedent Technologies Private Limited was incorporated in 2017 and is registered in Kolkata, West Bengal. The firm operates in media and publishing and is serving clients with digital marketing and content solutions that emphasize local language outreach and programmatic ad placements.

The NineHertz was founded in 2008 and is headquartered in Jaipur, India. Known originally for software and mobile solutions, the company has expanded into integrated digital marketing services including app-first campaigns, tech-driven creative, and analytics. The NineHertz caters to clients by combining product engineering with marketing tech, building campaign APIs, in-app commerce funnels, and data pipelines.

Kinnect Media Private Limited was incorporated in 2018 and is headquartered in Mumbai, Maharashtra. As a digital agency, Kinnect is focusing on social strategy, content engineering, and regional influencer networks. The agency is known for creating localized social ecosystems and measurement frameworks that connect brand content to commerce.

iProspect India Private Limited was incorporated in 1999 and operates from Mumbai, India. As a part of the global performance network, iProspect India delivers search, programmatic, and measurement services to enterprise clients. It is serving the market by integrating global data science capabilities with local media buying, building retail-media playbooks, and leveraging advanced attribution models.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are WATMedia Private Limited, FoxyMoron, Social Pulsar, Blusteak Media, QUBIX Integrated Media Services Pvt. Ltd, Creative Monkeys, and GH Digital Media Pvt Ltd, among others.

Explore the latest trends shaping the India digital marketing market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on India digital marketing market trends 2026.

Germany Digital Marketing Market

South Korea Digital Marketing Market

Singapore Digital Marketing Market

United Kingdom Digital Marketing Market

Australia Digital Marketing Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the India digital marketing market reached an approximate value of USD 6.71 Billion.

The market is projected to grow at a CAGR of 30.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 93.94 Billion by 2035.

The key trends guiding the growth of the market are rising digitisation, favourable government initiatives, rising penetration of social media, and technological advancements such as AI.

The key regional markets are West and Central India, North India, South India, and East India.

Social media marketing, search engine optimization (SEO), digital OOH media, influencer marketing, affiliate marketing, email marketing, and blogging and podcasting, among others are the types of digital marketing.

The end uses include FMCG, e-commerce, automotive, telecom, BFSI, education, media and entertainment, retail, and others.

The key players in the market include Oxedent Technologies Private Limited, The NineHertz, Kinnect Media Private Limited, iProspect, WATMedia Private Limited, FoxyMoron, Social Pulsar, Blusteak Media, QUBIX Integrated Media Services Pvt. Ltd, Creative Monkeys, and GH Digital Media Pvt Ltd, among others.

Building regional content teams, deploying first-party data platforms, piloting retail-media buys, integrating shoppable video experiences, and adopting privacy-centric measurement are strengthening reach, conversion, and compliance across markets.

Fragmented state regulations, scarce first-party data, rising CPCs, talent shortages in regional content, and complex measurement across offline/online touchpoints are constraining scalable, cost-efficient growth for digital agencies.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share