Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Middle East copper rod and busbar market size reached around USD 3147.52 Million in 2025. The market is projected to grow at a CAGR of 7.40% between 2026 and 2035 to reach nearly USD 6427.04 Million by 2035.

Base Year

Historical Period

Forecast Period

Saudi Arabia’s aim to increase homeownership to 70% by 2030 under Vision 2030 aids the growth of the construction sector.

Qatar’s goal of obtaining 20% of its electricity from renewable sources by 2030, aids the demand for copper busbars due to their impressive electrical conductivity and corrosion resistance.

Kuwait’s infrastructure development goals under Vision 2035 drive the market for copper products, such as bars for HVAC systems.

Compound Annual Growth Rate

7.4%

Value in USD Million

2026-2035

*this image is indicative*

The overall construction sector of the Middle East is expanding, driven by a rise in foreign investment, the expansion of tourism, and the demand for residential and commercial real estate. The growth of the construction industry supports the Middle East copper rod and busbar market development. Saudi Arabia, the United Arab Emirates, Qatar, and Kuwait are the most significant nations in this region in terms of construction. For instance, Saudi Arabia's construction sector is expanding due to major projects like NEOM and major entertainment complexes like Qiddiya near Riyadh.

The main copper markets in Middle East includes the UAE, Saudi Arabia, and Iran. Annually, these countries account for around 5% of global copper consumption.

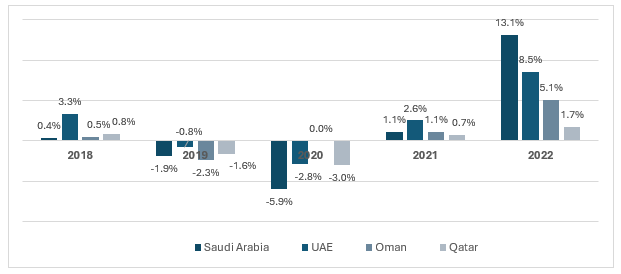

Figure: Middle East Annual Percentage Growth of the Industry* (Including Construction); 2018-2022

(*Industry (including construction) corresponds to ISIC divisions 05-43 and includes manufacturing (ISIC divisions 10-33). It comprises value added in mining, manufacturing, construction, electricity, water, and gas.)

Growing construction sector; extensive adoption of copper products in the industrial sector; the presence of recyclable characteristics; and increasing adoption of EVs are the key trends impacting the Middle East copper rod and busbar market growth.

Saudi Arabia is considered the most active player in the Middle East construction sector, with the country’s total value of capital projects estimated to be USD 1.2 trillion. Further, the UAE comes second with about USD 713 billion.

In the GCC countries, the oil sector contributes about one-third to the total GDP. Copper finds application in pump impellers, valve stems, pump shafts, and other industrial equipment. Further, in the aviation sector, copper square bars are used in the engines of rockets, helicopters, and other aircraft.

The incorporation of copper products greatly improves life-cycle costs and energy efficiency. On average, copper products comprise over 35% of recycled content, which lowers the copper's impact on the environment. Further, copper is fully recyclable making it an ideal material to help end users boost their sustainability.

Copper is used in motors, batteries, inverters, wiring, and charging stations for electric vehicles. Copper busbars play pivotal roles in EVs to distribute electric current from the batteries to the vehicle’s components and systems.

Solar energy investments in the Middle East are anticipated to triple between 2022 and 2027. Copper busbars are widely employed in solar panels as they enhance panel performance and durability.

Additionally, copper is a vital component in rechargeable batteries and renewable power systems, crucial in producing green energy in the region. The increasing government investment in clean energy projects is expected to aid the Middle East copper rod and busbar market.

Copper rods are employed in the automotive sector in radiators and brake tubing as well as in EV charging stations. Further, copper wire rods are deployed in the automotive sector for wiring harnesses, ignition systems, and connectors. By 2025, Saudi Arabia aims to install 50,000 domestic charging stations to promote the adoption of EVs.

Saudi Arabia’s Vision 2030 programme is supporting the growth of its construction sector by envisioning mega-projects. Renowned mega construction projects in the Kingdom include Jeddah Economic City, the Red Sea Project, and the NEOM housing development project.

“Middle East Copper Rod and Busbar Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by End Use

Market Breakup by Sales Channel

Market Breakup by Country

By end use, the construction sector dominates the Middle East copper rod and busbar market share

Saudi Arabia is the largest economy in the Middle East. The Saudi Arabian construction sector is backed by the Public Investment Fund, Saudi Arabia’s sovereign wealth fund. It is financing major giga-projects like Neom, a USD 500 billion futuristic city, and Red Sea Global, a USD 23.6 billion luxury tourism project. The UAE is also a prosperous country, with consumers increasingly investing in mega-construction projects. The ease of financing contributes to the growth of the region’s construction sector, which, in turn, supports the Middle East copper rod and busbar market expansion.

Within the industrial equipment sector of the Middle East, the demand for transformers is driven by power generation, petrochemical, and infrastructure projects in countries such as the UAE, Oman, and Saudi Arabia. The UAE and Saudi Arabia are among the major markets for transformers in the Middle East region.

The transformer is a crucial component in a substation. Power transformers, for instance, increase the voltage to transmit electric energy to the electricity-consuming area but also lower the voltage to the voltage used at all levels to meet the needs of electricity consumption. The expansion of the industrial sector in the region is expected to drive the growth of the Middle East copper rod and busbar market.

Manufacturers are upgrading their product portfolios and incorporating the latest capabilities to innovate their offerings and meet the evolving demands of consumers.

Ducab is a leading manufacturing entity in the Emirates, that offers top-tier solutions to the worldwide energy industry. Ducab has a presence in 45 countries spanning the Middle East, Africa, Asia, Australasia, Europe, and the Americas.

Headquartered in the UAE, Aeris Stream Copper Manufacturing LLC is an innovative facility specializing in the production of copper rods and wires.

Emirates National Copper Factory LLC also known as Nuhas, a privately-held enterprise, is a pioneering company in the United Arab Emirates. Nuhas manufactures Oxygen Free Copper products to a purity of 99.99% and 101% IACS conductivity.

Union Copper Rod operates as a wholly owned subsidiary of Ittihad International Investment. Headquartered in the UAE, the company boasts the Middle East's largest production line, with a rod capacity surpassing 200,000 metric tons annually.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Middle East Copper Rod and Busbar market are Oriental Copper Co., Ltd., ALIF AIMS Leading Industrial Factory, Vedanta Resources Ltd. and Bahra Advanced Cable Manufacture Co. Ltd. among others.

Copper wire rods find application in electrical wiring for residential, commercial, and industrial structures. In March 2024, Saudi Arabia attracted an investment of around USD 13 billion in its tourism sector. The investments are expected to add around 150,000 to 200,000 hotel rooms in the next two years.

In May 2023, Qatar announced a USD 630 million investment in two solar plants in Mesaieed and Ras Laffan industrial cities. The rising investments in clean energy projects, such as solar projects, are aiding the demand for copper products like busbars to distribute power efficiently in PV modules.

UAE Copper Rod and Busbar Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 3147.52 Million.

The market is projected to grow at a CAGR of 7.40% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 6427.04 Million by 2035.

The market is driven by a growing construction and industrial sector and a demand for EVs to facilitate green mobility.

The countries include Saudi Arabia, the United Arab Emirates, Iran, Kuwait, Qatar, Oman, Bahrain, and others.

The end uses include construction, industrial equipment, and transport and non-industrial.

Direct and distributors are the two major sales channels in the market.

The key players in the market include Dubai Cable Company (Private) Limited, Aeris Stream Copper Manufacturing LLC, Emirates National Copper Factory LLC, Oriental Copper Co., Ltd., ALIF AIMS Leading Industrial Factory, Union Copper Rod LLC, Vedanta Resources Ltd., and Bahra Advanced Cable Manufacture Co. Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by End Use |

|

| Breakup by Sales Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,839

USD 4,355

tax inclusive*

Five User License

Five User

USD 5,999

USD 5,099

tax inclusive*

Corporate License

Unlimited Users

USD 7,259

USD 6,170

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share