Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States online food delivery market size attained a value of USD 27.58 Billion in 2025. The market is further expected to grow at a CAGR of 10.50% between 2026 and 2035 to reach a value of almost USD 74.85 Billion by 2035.

Base Year

Historical Period

Forecast Period

According to the National Restaurant Association, Far West, including California with 83,501 and Washington with 16,379, showcases high numbers of dining establishments, driving online food delivery.

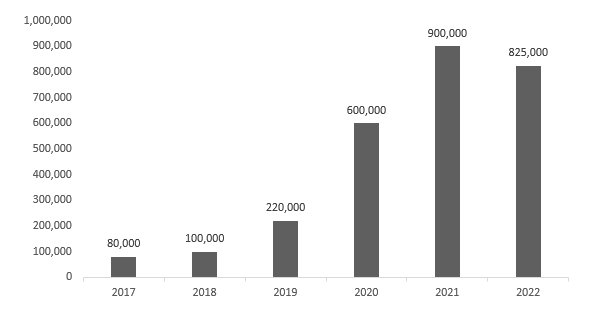

Uber Eats collaborated with 825,000 restaurants in 2022, as per company records, elevating online delivery services across the United States.

Domino's promises delivery within 30 minutes of ordering when placed through their website/app.

Compound Annual Growth Rate

10.5%

Value in USD Billion

2026-2035

*this image is indicative*

Ordering food online entails using mobile apps or websites to request meals, with restaurants and food providers linked to these platforms for doorstep delivery. Customers place orders through dedicated websites or third-party apps, often selecting from nearby eateries or food cooperatives. Many platforms include account management tools to simplify repeat orders, like the convenience of online shopping for other products.

Restaurants can opt for direct sales to customers using efficient ordering software, bypassing external gateways. Through this approach, consumers can place orders directly via the restaurant's website. Additionally, these applications and websites offer various filters and payment options, such as cash on delivery, net banking, prepaid cards, and more, to accommodate diverse consumer preferences. In the United States, numerous delivery services like Grubhub, Uber Eats, and others collaborate with restaurants to deliver meals to customers, thus impacting the United States online food delivery market outlook.

UBER EATS PARTNERED RESTAURANTS 2017 TO 2022

The United States online food delivery market growth is boosted by changing consumer preferences, sustainable efforts, swift delivery, and technological advancements.

Changing lifestyles, including busy schedules and a focus on convenience, have spurred demand for dining solutions that prioritise efficiency. Online food delivery addresses this need by providing a diverse range of culinary options accessible from the comfort of one's home or workplace, accommodating modern living requirements.

The United States online food delivery market growth can further be attributed to the adoption of eco-friendly transportation like electric vehicles and robots to reduce pollution while ensuring customers receive their goods. Third-party delivery chains and restaurants are also using recyclable and eco-friendly packaging materials and cutlery, contributing to sustainability efforts.

Ordering food online through delivery apps or restaurant websites ensures timely delivery to the designated location. Many platforms offer account management tools to simplify repeat orders, ensuring a quicker and smoother ordering process. Domino's, for example, guarantees delivery within 30 minutes of placing an order.

United States online food delivery market size is increasing owing to the widespread adoption of smartphones and fast internet which has transformed the way how people order food, boosting the popularity of mobile app ordering. User-friendly interfaces, personalised suggestions, and effective tracking enhance customer satisfaction, driving market growth alongside GPS technology, fostering transparency and reliability, and meeting the demands of consumers.

The increasing demand for convenient on-the-go meals and efficient home delivery services, offering accessible, affordable, and pre-prepared options, is driving the expansion of the online food delivery market in the United States. This convenient service is prized for its accessibility and the opportunity to relish restaurant-quality meals in the comfort of one's own home.

Extensive partnerships between delivery platforms and restaurants, offering exclusive deals, discounts, and seamless payment methods, have improved the overall customer experience, contributing to sustained growth in the online food delivery market.

United States Online Food Delivery Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:

Market Breakup by Platform:

Market Breakup by Business Model:

Market Breakup by Payment Method:

Market Breakup by Region:

Based on platform, the United States online food delivery market share is dominated by mobile applications as they are extensively utilised due to their ease of use and user-friendly interface.

The surging popularity of online food delivery mobile applications is driven by their accessibility, customisation, and real-time interaction advantages, spurring market growth. These platforms provide immediate access to a variety of restaurants and cuisines, enabling exploration without geographical limitations. Users can tailor orders to their preferences, allergies, and portion sizes, while real-time interactions through notifications and tracking systems improve transparency and control, enhancing the overall customer experience.

Restaurants utilise online ordering technology via websites for both pickup and delivery services. Unlike third-party apps, these systems integrate the restaurant's menu directly into their website, enabling customers to place orders directly with the establishment.

Based on the business model, the order-focused food delivery system accounts for most of the United States online food delivery market due to its hassle-free and reliable experience

Order-focused food delivery systems primarily serve as intermediaries connecting customers with local restaurants. They enable customers to browse restaurant options and place orders, streamlining the process and reducing miscommunication. Direct customisation through the platform minimises misunderstandings, enhancing the dining experience and driving increased demand. Real-time updates and tracking features allow customers to monitor order progress and anticipate delivery times accurately.

The main purpose of logistics-focused food delivery systems is to provide delivery services for restaurants that lack their delivery infrastructure. This enables customers to order from their preferred restaurants, even if those restaurants do not offer delivery services independently.

Growing preference for cashless transactions, improving security, and streamlined convenience is propelling the market through online payments method.

As digital payment methods gain acceptance and trust, customers increasingly favour the convenience of paying for food orders online. Secure storage of payment information within platforms eliminates the need for physical cash transactions and reduces concerns about carrying money or making exact changes, driving the United States online food delivery market growth. Additionally, online payment options often include loyalty programs, discounts, and exclusive offers, encouraging customer engagement and fostering loyalty.

Cash on delivery is a popular payment method offered by various food delivery services like DoorDash, Uber Eats, and Grubhub, depending on the individual restaurant's policy. This option often leads to high number of orders.

In the United States online food delivery market, competitiveness arises from fast delivery, sustainable practices, business innovations, and evolving consumer choices.

DoorDash Inc. was established in 2013 and is based in the United States, operates as an online food ordering and delivery platform. Acting as a liaison between local consumers and restaurants, it utilizes independent contractors to facilitate delivery, serving as a bridge in the realm of technology-driven food services.

Uber Technologies Inc. was established in 2009 and based in the United States, introduced Uber Eats in 2014, an online food delivery platform. Utilizing a fleet of couriers employing various modes of transportation including cars, scooters, and bikes, Uber Eats facilitates the delivery of meals ordered online.

Grubhub Holdings Inc. was established in 2004 and is based in the United States, is affiliated with Just Eat Takeaway.com, a prominent global online food delivery marketplace. Grubhub aids restaurants in expanding their operations and exploring innovative concepts while offering drivers flexible earning opportunities through adaptable work arrangements.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the United States online food delivery market report are Delivery.com, LLC, GoBrands, Inc., Goldbelly, Inc., ChowNow, Inc., and Others.

Changing consumer preferences in the Far West are pushing the market development in the United States.

According to the National Restaurant Association, California boasts 83,501 eating and drinking establishments in 2022, while Washington has 16,379, fuelling the demand for online food delivery in the Far West. Similarly, Texas has 54,685 establishments, and Ohio holds 23,912 in the Great Lakes region, this offers food delivery companies access to a large pool of restaurants and a sizable consumer base, thereby driving up the demand for online food delivery services.

Philippines Online Food Delivery Market

Vietnam Online Food Delivery Market

North America Online Food Delivery Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The online food delivery market is projected to grow at a CAGR of 10.50% between 2026 and 2035.

The revenue generated from the market is expected to reach USD 74.85 Billion in 2035.

The changing consumer preferences, swift delivery, and rising food and beverage indystry are driving the growth of the market.

Based on the platform, the market is bifurcated into mobile applications and websites.

Key players in the industry are DoorDash Inc., Uber Technologies Inc., Grubhub Holdings Inc., Delivery.com, LLC, GoBrands, Inc., Goldbelly, Inc., ChowNow, Inc., and Others.

The major market areas include New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West.

The different payment methods in the market include online and cash on delivery.

The different business models in the market order focused food delivery systems, logistics-based food delivery systems, and full-service food delivery systems.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Platform |

|

| Breakup by Business Model |

|

| Breakup by Payment Method |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share