Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The West Africa alcoholic beverages market size reached around USD 13.25 Billion in 2025. The market is projected to grow at a CAGR of 5.30% between 2026 and 2035 to reach nearly USD 22.21 Billion by 2035.

Base Year

Historical Period

Forecast Period

Reportedly, beer is expected to be the most widely consumed alcoholic beverage.

The export of spirits from the U.S. to Ghana and Kenya declined in 2019 by 48.6 per cent and 40 percent, respectively.

The European Union has established its reign as the largest exporter of beer in the region.

Compound Annual Growth Rate

5.3%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Alcoholic beverage is a commonly consumed fermented drink containing ethanol (alcohol), a psychoactive substance that has a depressant effect on the central nervous system. These beverages are produced through the fermentation of sugars by yeasts or through the distillation of fermented products, resulting in a wide range of drinks with varying alcohol content.

The alcoholic beverages market in West Africa is experiencing significant growth, primarily fuelled by the increasing product demand for alcoholic beverages within the region. This expansion is further aided by the region's recovering economies, leading to higher GDPs and disposable incomes. The growing shifts in lifestyle due to rapid urbanisation, combined with the rising number of women consumers, are providing further impetus to the market growth.

The surge in craft beer popularity, growth in demand for premium spirits with rising incomes, health trends favouring low-alcohol options, and the growth of local brands are positively impacting the West Africa alcoholic beverages market growth

Craft beers are increasingly gaining momentum in West Africa, with consumers increasingly seeking unique, locally brewed beers offering diverse flavours and artisanal quality.

Consumers are gradually shifting towards premium spirits, especially the younger generation, driven by rising disposable incomes and a growing preference for premium alcoholic beverages.

The emerging trend of low-alcohol and non-alcoholic beverages, as health-conscious consumers seek healthier alternatives without sacrificing social drinking experiences is expected to aid the market expansion.

Local brands are rapidly expanding by leveraging traditional flavours and ingredients to cater to the domestic preference for culturally resonant alcoholic drinks.

The increasing population, along with the presence of a significant number of potential younger consumers, is driving the market in the region. The market growth is also being supported by the growing premiumisation and a rising shift from locally brewed to branded products in the region. The market is further being catalysed by the easy availability of raw materials and access to cheap labour.

The West Africa alcoholic beverages market expansion can be attributed to the presence of major international corporations such as Heineken, AB InBev, and Diageo. Additionally, the increase in Foreign Direct Investment (FDI) flows into the region is playing a significant role in propelling the market forward.

The projected expansion of local enterprises within West Africa is expected to further bolster the market growth in the upcoming years. However, the lack of sufficient transportation and storage facilities may serve as further obstacles to the market’s development in the region.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“West Africa Alcoholic Beverages Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Breakup by Product Type

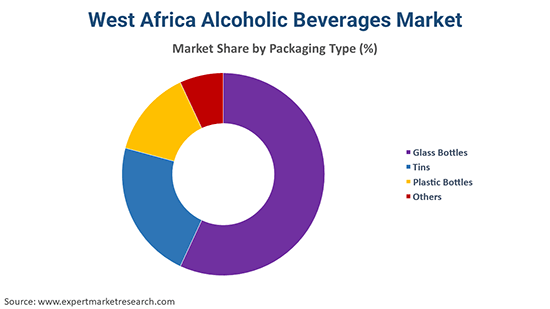

Breakup by Packaging Type

Breakup by Distribution Channel

Breakup by Region

The rising presence of international players has significantly propelled the demand for beer in the region

Beer dominates the West Africa alcoholic beverages market share. The segment in the region is being driven by the rising GDPs and the growing premiumisation of the product.

Investments by major global players and the emergence of local players are expected to drive the West Africa beer market growth. Meanwhile, although slow, wine is expected to rise in demand owing to a noticeable shift in consumer preferences towards more sophisticated and diverse alcoholic options. Furthermore, increasing focus on collaboration with international players is expected to aid the expansion of the market.

Glass is expected to be the most prevalent form of packaging in the coming years owing to its recyclability and aesthetics

Glass bottles are the most widely utilised packaging for alcoholic beverages. Glass bottles are preferred for their ability to preserve the flavour and quality of the beverage for a long period without changing its chemical combination. Moreover, glass can be easily recycled and reused, which is advantageous for companies to meet environmental regulations.

Meanwhile, tins (aluminium cans) and plastic bottles are likely to be used widely in many regions, including West Africa, due to their lightweight nature, lower cost, and convenience.

Nigeria is the leading regional market for alcoholic beverages in West Africa. The regional market is being driven by the rising urbanisation and growing employment rates. The growing consumption of alcohol during social occasions is expected to propel the growth of the West Africa alcoholic beverages market.

Major players in the West Africa alcoholic beverages market are increasingly establishing partnerships with global players

| Company | Founded | Headquarters | Portfolio |

| Diageo Plc | 1997 | London, England | Over 200 brands across spirits and beer categories, including Johnnie Walker, Smirnoff, Baileys, and Guinness |

| The Heineken Company | 1864 | Amsterdam, Netherlands | Over 300 international, regional, local, and speciality beers and ciders, including its flagship beer, Heineken |

| AB InBev | 2008 | Leuven, Belgium | Over 500 beer brands, including globally renowned brands Budweiser, Stella Artois, and Corona |

| Kasapreko | 1989 | Accra, Ghana | Wide range of alcoholic and non-alcoholic beverages, including its flagship product, Alomo Bitters |

Major beverage manufacturers in the West Africa alcoholic beverages market are increasingly partnering with global brands, such as Heineken. Acquisitions and partnerships between international and local companies are expected to increase the investments brought into the region. This synergy can lead to enhanced product offerings, improved distribution capabilities, and more efficient production processes, ultimately expanding the market reach of both international and local brands.

Australia Alcoholic Beverages Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a value of nearly USD 13.25 Billion.

The market is assessed to grow at a CAGR of 5.30% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 22.21 Billion by 2035.

The major drivers of the market are rising disposable incomes, increasing population, growing investments, changing demographics, and an increasing shift towards branded products.

Increasing FDI flows in the region, rising popularity of alcoholic beverages, and the expansion of local players are the major trends propelling the growth of the market.

The major countries for the alcoholic beverages market in West Africa are Nigeria, Cote d’Ivoire, Ghana, Burkina Faso, Republic of Benin, and Senegal, among others.

The various product types of alcoholic beverages in the market are beer, spirits, and wine, among others.

The different packaging types of alcoholic beverages in the market are glass bottles, tins, and plastic bottles, among others.

Distribution channels for alcoholic beverages in West Africa include open markets, supermarkets/hypermarkets, hotels/restaurants/bars, and specialty stores, among others.

The key players in the market are Diageo Plc, The Heineken Company, AB InBev, and Kasapreko, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Packaging Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share