Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India diaper market reached a value of USD 1995.89 Million in 2025. The market is further estimated to grow at a CAGR of 15.30% during 2026-2035 to reach a value of USD 8287.62 Million by 2035.

Base Year

Historical Period

Forecast Period

The market has been aided by the growing participation of women in the workforce and the rising awareness regarding the benefits of diaper for both babies and elderly.

Technological advancements and innovations to boost the comfortability, absorption, and cost-effectiveness of diaper pants are aiding the market.

During April-December 2023, Pampers had 40.3% of the diaper market share, while Mamy Poko held 38.2%.

Compound Annual Growth Rate

15.3%

Value in USD Million

2026-2035

*this image is indicative*

It is estimated that by 2050, India will have the third-largest elderly population. The rising media coverage and public health initiatives for incontinence management are breaking taboos, increasing the adoption of diapers among adults and babies. There is a growing adoption of dry pants among adults, which are easier to wear and more comfortable to manage.

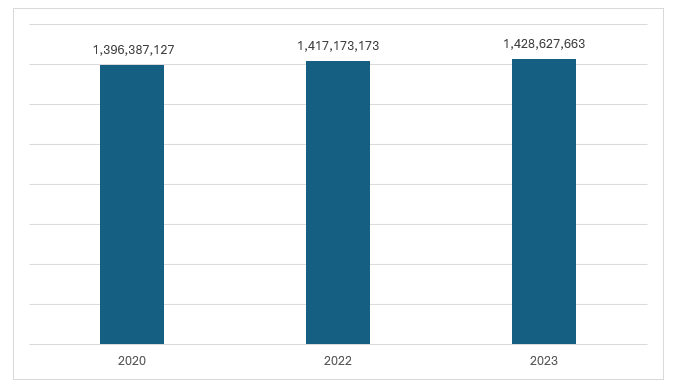

In April 2023, India overtook China as the largest populated country across the globe. The country’s population is expected to grow, indicating a steady influx of infants and toddlers requiring diapers.

Changing Population Demographics and Expanding E-commerce Sales to Support Diaper Sales in India

The total fertility rates (TFR) for India from 2010-2100 indicate significant demographic shifts and trends. According to data from the World Population Prospects by the UN's Department of Economic and Social Affairs Population Division, India had a fertility rate of 2.44 in 2010-2015, slightly below the global average of 2.52. By 2025-2030, India's TFR is expected to decline to 2.10, aligning closely with the replacement level fertility rate of 2.1, which is the rate required to keep the population stable. By 2095-2100, India's TFR is projected to reach 1.78, below the replacement level, indicating a future trend towards smaller family sizes. This projected decline reflects improvements in education, economic development, and increased access to family planning services.

According to data from the Ministry of Statistics and Programme Implementation (MOSPI), the elderly population (those aged 60 and above) has been growing at a much faster rate than the general population over the past several decades. The elderly population is expected to grow by a remarkable 40.5%, compared to just 8.4% for the general population during 2021-2031. This projection underscores the accelerating pace of population aging in India. Elderly individuals often experience restrictions in activities of daily living (ADL), which significantly impacts their quality of life and independence. These restrictions likely necessitate increased care and support services, highlighting the need for adult diapers. The anticipated rise in demand for adult diapers is expected to contribute to the overall India diaper market value.

As per Periodic Labour Force Survey (PLFS) 2019-20, in rural areas, 6.3% of males and 4.0% of females were employed as legislators, senior officials, and managers, while in urban areas, 17.8% of males and 11.7% of females held similar positions. For professionals, 2.0% of rural males and 1.7% of rural females were employed in this category, compared to 8.8% of urban males and 13.7% of urban females. In the category of technicians and associate professionals, rural employment included 2.1% of males and 2.9% of females, while in urban areas, 6.1% of males and 11.7% of females held these roles.

According to India Brand Equity Foundation, the rapid rise in e-commerce Gross Merchandise Value (GMV) in India from FY2019 to FY2023 reflects a significant transformation in consumer behavior and the retail landscape. In FY2019, the GMV stood at USD 22 billion. This figure increased to USD25 billion in FY2020, representing a year-over-year (YoY) growth rate of 13.6%. The subsequent fiscal years saw substantial accelerations in growth, particularly spurred by the COVID-19 pandemic, which significantly boosted online shopping as physical stores faced restrictions and consumers turned to digital platforms for their purchasing needs. The growing use of online platforms to purchase personal care and hygiene products, including diapers, is expected to aid the India diaper market expansion.

By FY2021, the GMV had escalated to USD36 billion, marking a YoY growth rate of 44%. In FY2022, the GMV further climbed to USD 49 billion, maintaining a strong YoY growth rate of 36.1%. The most remarkable growth occurred in FY2023, where the GMV soared to USD 60 billion, reflecting a YoY growth rate of 22.5%. Despite the slight deceleration in the growth rate compared to the previous years, the absolute increase in GMV indicates the consolidation of e-commerce as a dominant force in the retail sector. Factors contributing to this growth include the expansion of internet and smartphone penetration, enhanced logistics and delivery networks, sustained shift towards online shopping, improved digital infrastructure, and increased consumer confidence in e-commerce platforms. The continued growth in e-commerce enables diaper manufacturers to expand their market reach, improving diaper market opportunities in India.

Figure: Population of India (2020 - 2023)

Increasing number of working parents; rising adoption of eco-friendly diapers; rising awareness of health and hygiene; and expansion of e-commerce channels are boosting the India diaper market value.

With the increasing number of women joining the workforce, adoption of diapers has become essential. Working parents are choosing diapers as a practical solution, in order to provide comfort and hygiene for the child, which is expected to support the India diaper demand growth.

The rising environmental concerns and the focus on reducing waste generation are boosting the adoption of eco-friendly diapers. Introduction of diapers made with sustainable materials will likely increase their use by environmentally conscious parents, increasing the India diaper market revenue.

There is a growing awareness regarding the importance of maintaining proper hygiene, particularly for infants and toddlers, which is leading to the India diaper market development. The improved convenience and health benefits offered by diapers are driving its adoption among new parents.

E-commerce platforms are gaining traction across India, with the increased digitisation efforts. Online platforms provide a wide variety of options to choose from and enhance convenience with the added benefit of home delivery.

The diaper market in India has been aided by the growing participation of women in the workforce, the rising awareness regarding the benefits of diapers, the expansion of distribution channels, and the increasing availability of diapers in diverse sizes and designs.

With the rising demand for convenient baby care products, especially among young parents, the demand for diapers as a substitute for traditional open and tie diapering systems is surging.

As the penetration of diapers is low in low-income households, leading companies are introducing pack sizes and affordable diapers to cater to evolving consumer demands. Moreover, the growing demand for diapers in the rural areas owing to the rising focus on infant care is expected to drive diaper sales in India.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“India Diapers Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Distribution Channel

Market Breakup by Region

Based on product type, baby diapers are widely used by new parents, significantly contributing to the Indian diaper industry growth

Various companies are offering extensive product variants with features, such as dryness, softness, and comfort. These companies are making huge investments in product innovations to draw engagement from recent-mothers and to-be-mothers, leading to the growing demand for baby diapers.

According to the India diaper industry analysis, the demand for adult diapers is expected to increase in the coming years. This is likely to be supported by the growing incidences of piles, prostate disorders, incontinence, diabetes, and urology problems among the geriatric population, necessitating the use of personal care products.

Based on distribution channel, pharmacies account for a significant share of the India diaper market

The proximity of pharmacies, along with the quality customer service and personalised advice provided by pharmacists regarding the usage of the product, are some of the factors that are propelling the segment growth.

Supermarkets and hypermarkets offer extensive availability of baby products, including diapers, from several brands. As various supermarkets and hypermarkets are looking to expand their presence in the country, especially in tier-II and tier-III cities, the sales of diapers from supermarkets and hypermarkets are likely to grow.

The market is expected to be fuelled by the growing penetration of various direct-to-consumer (D2C) brands of diapers in India which are offering their products via online channels.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The market is highly competitive, with leading players increasingly investing in product marketing to increase their customer base.

Procter & Gamble is a multinational company headquartered in the US. The company offers its products through renowned brands such as Pampers, Ariel, Tide, Whisper, Gillette, among several others.

Kimberly-Clark, with global headquarters in the United States, offers several products through its business segments such as adult care, baby and child care, feminine care, family care and Kimberly Clark professional.

Established in 1961, Unicharm Corporation s pecializes in the sales of wellness care products, pet care products, feminine care products, baby and child care products, food-packaging materials, etc.

Headquartered in India, the company provides hygiene products for adults under the brand name ‘Friends’ and a wide product range of baby care products under the brand name ‘Teddyy.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the India diaper market are The Himalaya Drug Company, Abena International A/S, Swara Baby Products Pvt. Ltd., PAN Healthcare Pvt. Ltd, Millennium BabyCares Pvt Ltd, and R for Rabbit Baby Products Pvt. Ltd, among others.

Procter & Gamble (Pampers)

Kimberly-Clark (Huggies)

Unicharm (MamyPoko)

Nobel Hygiene (Teddyy)

Pigeon

Diapers are being adopted by high-income families, office-goers, and young parents living in a nuclear ecosystem. Diapers are majorly being consumed by households in tier 1, tier 2 and tier 3 cities in India. Some of the strong markets for diapers include Lucknow, Kanpur, Patna, Ranchi, Indore and Ahmedabad.

Furthermore, increased penetration of e-commerce channels such as Amazon and Flipkart in urban areas is contributing to increased online sales of diapers in India.

Latin America Biodegradable Diapers Market

Asia Pacific Baby Diapers Market

South Korea Baby Diapers Market

United Kingdom Diapers Market

Asia Pacific Diapers Market

United States Diaper Market

South Korea Diapers Market

India Baby Diapers Market

Peru Adult Diaper Market

Australia Diaper Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The India diaper market reached a value of USD 1995.89 Million in 2025.

The Indian diaper market is estimated to grow at a CAGR of 15.30% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 8287.62 Million by 2035.

The different types are baby diaper and adult diaper.

The key Indian markets are North Region, East and Central Region, West Region, and South Region.

The major distribution channels include supermarkets and hypermarkets, convenience stores, pharmacies, online, and others.

The increasing disposable income, rising awareness of health and wellbeing, and expanding distribution channels are driving the market growth.

The key players in the market include The Procter & Gamble Company, Kimberly-Clark India Pvt. Ltd, Unicharm Corporation, Nobel Hygiene Pvt. Ltd, The Himalaya Drug Company, Abena International A/S, Swara Baby Products Pvt. Ltd., PAN Healthcare Pvt. Ltd, Millennium BabyCares Pvt Ltd, and R for Rabbit Baby Products Pvt. Ltd, among others.

Key trends in the market include growing online sales, rising adoption of eco-friendly diapers, and increasing product innovations by manufacturers.

The high cost of diapers and its negative impact on the environmental are the key challenges in the industry.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share