Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global instrument transformer market was valued to reach a market size of USD 9.59 Billion in 2025. The industry is expected to grow at a CAGR of 5.43% during the forecast period of 2026-2035. The market is driven by rising electricity demand, increasing grid modernisation efforts, and growing renewable energy integration that is boosting the need for reliable instrument transformers. The energy sector is a key driver of the instrument transformer market, thus aiding the market to attain a valuation of USD 16.27 Billion by 2035.

Base Year

Historical Period

Forecast Period

The global demand for energy increased by 4% globally in 2024, which is a substantial increase above the 2.5% growth observed in 2023. Urbanisation, industrial growth, and the increasing tendency of electrification in many industries are the main causes of this spike. Instrument transformers are becoming more and more in demand as energy usage increases. In order to fulfil the changing energy needs of a world that is modernising quickly, these transformers are crucial for providing dependable power transmission, preserving grid stability, and facilitating effective energy distribution.

The expansion of data centers globally is a major consumer of electricity, aiding the instrument transformer demand. By 2026, data centres, artificial intelligence, and cryptocurrencies are expected to double their electricity use, which will have a substantial impact on the world's energy needs. By 2026, data centres alone are expected to use more than 1,000 TWh, making effective power management solutions more and more necessary. These transformers are essential for controlling the spike in power demand while preserving grid dependability and operating efficiency.

The increasing focus on eco-friendly solutions is further propelling the market forward. Reflecting this trend, in 2024, Končar – Instrument Transformers signed a deal with Rede Elétrica Nacional to supply eco-friendly transformers, highlighting the industry's shift towards greener grid infrastructure.

Compound Annual Growth Rate

5.43%

Value in USD Billion

2026-2035

*this image is indicative*

The instrument transformer market continues to grow with increasing energy demand coupled with urbanisation and expanding demand for renewable energy. The number of people without electricity declined from over 760 million in 2022 to below 750 million in 2023, reflecting ongoing electrification efforts. This growing access to power is driving demand for instrument transformers in 2024-2025, as rural and developing regions require reliable energy infrastructure.

Electric trains are now responsible for about three-quarters of all passenger travel, up from just 60% in 2000, as railway electrification continues to spread throughout the world. The demand for more environmentally friendly and energy-efficient transportation options is gaining traction. This shift is being accelerated by the expansion of high-speed rail networks and urban metro systems. These advancements are highlighting the need of effective power management since they necessitate a steady and dependable power source for seamless operations. Consequently, there is an increasing need for instrument transformers in train infrastructure. The continuous functioning and stability of rail networks are supported by these transformers, which are essential for accurate voltage management, power monitoring, and smooth integration with the electrical grid, thereby boosting instrument transformer market revenue.

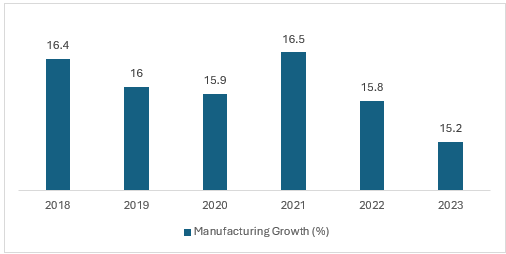

Figure: Global Manufacturing, Value Added (in % of GDP), 2018-2023

Transducers, also known as instrument transformers (ITs), are used to precisely lower the electrical power grid's comparatively high voltage and current levels to levels that can be used by instruments like energy meters or system monitoring devices. By 2027, global electricity consumption is expected to grow at a rate of 4% annually.

Investment in the global power grid increased by 5.3% in 2023, indicating a greater dedication to improving grid stability and modernising energy infrastructure. The need for instrument transformers, which are essential for accurate power monitoring, voltage regulation, and the smooth transfer of electricity across updated grids, is being driven by this increase in expenditure. Instrument transformers are crucial to preserving the stability, effectiveness, and safety of these cutting-edge systems as power networks adapt to meet rising energy demands, the integration of renewable energy sources, and smart grid technology. The success of contemporary, high-performance power transmission networks depends on their capacity to deliver precise measurements and guarantee steady power flow.

The value-added output of the global manufacturing sector increased significantly due to industrial growth, rising from USD 13.68 trillion in 2020 to USD 16.18 trillion in 2023. The need for dependable instrument transformers, which are essential for precise power measurement, grid stability, and facilitating effective energy distribution within manufacturing facilities, is being fuelled by this development. Advanced transformers are becoming increasingly vital to handle high-voltage applications and ensure a steady supply of power as companies expand to meet growing production demands. Large-scale manufacturing enterprises depend on these transformers to meet their energy needs as they maximise energy use while maintaining operational effectiveness and reducing downtime.

Eco-friendly instrument transformer, partnership among leading manufacturers, and growing investment accelerate global instrument transformer market expansion.

In electrical systems, instrument transformers (ITs) precisely reduce high voltage and current levels from the power grid to safer, easier-to-manage levels appropriate for monitoring and measurement. For devices like energy meters, system monitoring tools, and protective relays that depend on accurate data to track and regulate energy consumption, system performance, and grid stability, these transformers are essential, expanding the instrument transformers market. In 2023, global energy consumption growth accelerated by 2.2% compared to 2022.

Smart grids use cutting-edge technologies including fault detection, real-time monitoring, and self-healing capabilities to significantly increase grid resilience. Smart grids can rapidly identify flaws or abnormalities through continuous data gathering and analysis, allowing for quick solutions to stop extensive outages. While self-healing capabilities automatically redirect power or isolate damaged areas, fault detection systems identify the location and type of problems, minimising downtime and lessening the effect of failures.

In the railway electrification, railway trackside transformers are essential as they provide power to rolling stock and other purposes across the train network. These transformers guarantee that power is supplied at the safest and most effective levels to support airport passenger transit, metro power systems, tram systems, railway networks and any other rail-based power networks. In 2022, the length of electrified railway lines in EU countries reached 115 000 kilometres (km), a 31% increase compared to 1990.

The IoT and AI technologies are changing instrument transformers into smart devices that can perform predictive maintenance and advanced analytics. For example, Schneider Electric integrates IoT-enabled solutions with their transformers, providing insights into system performance and potential issues. These innovations enhance operational efficiency and reduce downtime, meeting the growing demand for smart energy management systems in both developed and emerging markets.

The rise in electrification projects in emerging economies, coupled with increasing investments in energy infrastructure, is driving market expansion. The global energy investment is set to exceed USD 3 trillion in 2024, with USD 2 trillion allocated to clean energy technologies and infrastructure, further boosting the demand for instrument transformers in modern power grids.

The growing demand for digital services, cloud computing, and data storage is driving the rapid expansion of data centres, which presently account for almost 1% of the world's electricity consumption. The demand for effective power management systems only increases with the global expansion of data centres. To enable continued, uninterrupted operations, this expansion, particularly in hyperscale and edge data centers requires improved grid stability and dependable power support. As they enable real-time monitoring, provide precise voltage and current measurements, and guarantee the best possible operation of power distribution systems, instrument transformers are crucial for power distribution systems, supporting the instrument transformers market development.

The instrument transformer market is witnessing growth due to the global electricity demand and rising investments in smart grids. Increasing investments in smart grids are significantly driving the demand for advanced instrument transformers, which are essential for accurate monitoring and efficient energy distribution. The European Commission's "Digitalisation of the Energy System" action plan outlines a projected EUR 584 billion (USD 633 billion) in grid investments by 2030, with EUR 170 billion (USD 184 billion) allocated specifically for digitalisation efforts. This focus on upgrading grid infrastructure, including the integration of smart meters and automated grid management systems, underscores the growing need for high-precision instrument transformers. These transformers are crucial for ensuring real-time data collection, improving voltage regulation, and enhancing overall grid stability. As grids become increasingly digital and interconnected, the role of instrument transformers in supporting efficient energy flow, reducing losses, and facilitating seamless integration of renewable energy sources becomes even more vital, helping to ensure a sustainable and reliable power supply for the future.

Additionally, the need for effective instrument transformers to guarantee seamless grid integration and preserve power stability is being further increased by the expanding use of solar and wind energy. In 2023, solar photovoltaic (PV) systems accounted for three-quarters of the 50% growth in global renewable energy capacity, which reached around 510 GW. This increase in the production of renewable energy emphasises the importance of sophisticated instrument transformers in order to provide dependable energy transmission, guarantee accurate monitoring, and stabilise varying power intakes from renewable sources such as wind and solar. These transformers are essential for improving grid resilience, facilitating the smooth integration of renewable energy sources, and preserving a steady power supply in order to satisfy the growing energy demands of a sustainable future as the grid grows more intricate and decentralised.

Global instrument transformers market challenges include complex installation and maintenance of transformers and its extreme weather and industrial exposure.

The setup and upkeep of instrument transformers require skilled professionals and meticulous procedures. Improper installation or maintenance can lead to inaccurate measurements and potential safety hazards. A study highlighted that around 95% of instrument transformer failures are due to causes introduced before service or incorrect operation, underscoring the importance of proper handling.

“Global Instrument Transformer Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of type, the market can be divided into the following:

On the basis of dielectric medium, the market can be segmented into the following:

Based on voltage, the market can be divided into the following:

On the basis of enclosure type, the market can be divided into the following:

On the basis of end use, the market can be categorised into the following:

Based on region, the market can be segregated into:

Market Analysis by Type

Current transformers are gaining popularity due to the rising demand for power distribution and transmission systems is driven by ongoing grid expansions and distribution upgrades. The growing demand for sustainable energy solutions has led companies to take sustainability initiatives. High-voltage equipment transition towards ester fluid from mineral oil in 2023 in its entire instrument transformer range including current, voltage, and metering transformers highlights this trend.

Further, the DASN series current transformers launched by HEYI Electric in 2024 align with the growing emphasis on high-precision monitoring, flame-retardant safety, and smart grid integration, meeting the increasing demand for reliable, safe, and efficient energy management solutions.

Market Analysis by Dielectric Medium

The growing focus towards SF6 is driven by its superior insulation properties and regulatory standards, emphasizing minimal leakage and high reliability. The rising shift toward railway electrification in India, with 97% of the BG network electrified and 44,199 RKM completed between 2014-2024 grew from 30,512 RKM before 2014, highlights the growing need for SF6 gas dielectric transformers.

Market Analysis by Voltage

The increase in utility-scale generation from 41,94,014 thousand megawatt-hours in November 2023 to 42,90,046 thousand megawatt-hours in November 2024 in the United States is projected to boost the instrument transformer market, driven by the need for accurate monitoring, protection, and grid efficiency.

Market Analysis by Enclosure Type

The growing electrification of railway and metro networks is driving the demand for instrument transformers globally.

Indoor and outdoor instrument transformers differ mainly in durability and design. Outdoor units feature corrosion-resistant materials and larger spacing for safety, while indoor units are more compact, and designed for bus-type electrical connections in controlled environments, contributing to the growth of the instrument transformer market.

Market Analysis by End Use

Increasing investments in smart grids and high-voltage transmission networks are driving the demand for instrument transformers in power utilities. Instrument transformers are key to monitoring transmission line reliability and ensuring grid stability in both transmission and distribution systems. In 2023, High Voltage Equipment (HVE) began transitioning its instrument transformers to eco-friendly ester fluid insulation, expecting strong adoption across power utilities, municipalities, and renewable energy sectors.

North America Instrument Transformer Market Opportunities

Increasing government focus on upgrading grid infrastructure in the region is driving instrument transformer demand. Upgrade of grid infrastructure across the region evident by Smart Grid Program as well as Grid Resilience Innovative Partnership (GRIP) Program and the Transmission Facilitation Program, is supporting the demand for instrument transformer. In 2023, in United States, annual spending by major utilities on grid infrastructure reached USD 320 billion. This is primarily driven by the upgradation of aging infrastructure, which is a key trend in the instrument transformer market.

Europe Instrument Transformer Market Dynamics

Europe needs over USD 606 billion in investment over the next decade to achieve the Fit for 55 targets of 42.5% renewable power by 2030, with ENTSO-E coordinating large-scale grid investments that is expected to necessitate the demand for instrument transformers.

Asia Pacific Instrument Transformer Market Trends

Asia is experiencing high electricity demand growth than any other region, at about 5% per year with ASEAN's electricity demand expected to rise by 41% by 2030. This is expected to encourage the use of instrument transformer for monitoring of electricity networks. China's electricity consumption rose 7% YoY in the first eight months of 2024, reaching 6,456 TW. With a goal of 1,200 GW of solar and wind by 2030, demand for instrument transformers is expected to grow during the forecast period.

Latin America Instrument Transformer Market Insights

Latin America's renewable energy sector has demonstrated steady growth, with investments expanding at an average annual rate of 10% over the last decade, culminating in wind and solar installations reaching a cumulative capacity of over 100 GW by 2022, aiding in the instrument transformer market growth.

Middle East and Africa Instrument Transformer Market Drivers

The Middle East and Africa instrument transformer market is driven by the expansion in power and green energy projects. UAE, Saudi Arabia and Oman are increasingly investing in clean power generation projects, thus boosting the demand of instrument transformer for measuring power networks. By 2030, the Middle East is anticipated to add over 600,000 MVAs in transmission capacity.

The instrument transformer market players are advancing to develop advanced, high resolution imaging capabilities for precise sound source identification

Founded in 1921 and headquartered in Japan, Mitsubishi Electric also offers control technologies and power electronics products used in industries such as logistics and transportation, power distribution, building controls, and shipping. The company offer Transformers under Power Systems such as Current Transformers, Voltage Transformers, Earthed Voltage Transformers, and others.

Founded in 1937 and headquartered in India, CG is a global leader in the management and application of electrical energy. CG provides electrical products, systems and services for utilities, power generation and industries. The company offer Transformers under Power Systems category.

Founded in 1910 and headquartered in Japan, Nissin Electric manufactures and sells products and services that support social and industrial infrastructure, with a focus on power systems and energy equipment. The company offer Instrument transformers under its Power Supply and Environment Systems category including current transformers (CTs), capacitor voltage transformer, and others.

Founded in 2012 and headquartered in Switzerland, the company specialises in manufacturing and supplying electrical infrastructure products, including various types of transformers such as free-breathing, cast-resin, oil-immersed distribution, instrument, and power transformers.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the global instrument transformer market are Schneider Electric SE, Arteche Lantegi Elkartea SA, and Trench Group.

Visualisation and 3D Rendering Market

India Hospital Hand Sanitisers Market

Glue-Laminated Timber (Glulam) Market

Indonesia Cold Chain Logistics Market

Australia and New Zealand Cheese Market

Styrene Acrylonitrile Copolymer Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global instrument transformer market is assessed to grow at a CAGR of 5.43% between 2026 and 2035.

The major drivers of the market include the increased adoption of renewable energy and smart monitoring units, rising investment to develop smart grids, technological advancements, and the increasing significance of instrument transformers’ condition-based monitoring (CBM).

Rising demand for electricity and the growing concerns regarding grid stability are the key industry trends propelling the market's growth.

The major regions in the industry are North America, Latin America, Middle East and Africa, Europe, and Asia Pacific.

The instrument transformer market can be divided based on its type as current transformers, potential transformers, and combined instrument transformers.

Based on dielectric medium, the market is divided into liquid dielectric instrument transformers, SF6 gas dielectric instrument transformers, and solid dielectric instrument transformers.

The voltages are divided into distribution voltage, sub-transmission voltage, high voltage transmission, extra high voltage transmission, and ultra-high voltage transmission.

On the basis of enclosure type, the market is divided into indoor instrument transformers and outdoor instrument transformers.

The end-use of the market includes power utilities, power generation, railways and metros, and industries and OEMs.

The major players in the industry are Mitsubishi Electric Corporation, CG Power and Industrial Solutions Limited, Nissin Electric Co., Ltd, R&S International Holding AG, Schneider Electric SE, Arteche Lantegi Elkartea SA, Nissin Electric Co., Ltd., Trench Group, Others.

The global instrument transformer market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 16.27 Billion by 2035.

In 2025, the global instrument transformer market reached an approximate value of USD 9.59 Billion.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical andn Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Dielectric Medium |

|

| Breakup by Voltage |

|

| Breakup by Enclosure Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share