Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Latin America antifreeze market size was around USD 846.37 Million in 2025. The market is estimated to grow at a CAGR of 5.10% during 2026-2035 to reach a value of USD 1391.83 Million by 2035.

Base Year

Historical Period

Forecast Period

Rising eco-consciousness is enhancing the demand for eco-friendly antifreeze produced from sustainable feedstocks that are recyclable.

In 2022, the air conditioner demand in Latin America reached about 7.02 million units, driving the demand for antifreeze for heat transfer and cooling applications.

In 2022, Latin America attracted nearly USD 100 billion in FDI project announcements, with the automotive sector representing 13%, led by the hydrocarbons sector (24%), thereby widening antifreeze applications.

Compound Annual Growth Rate

5.1%

Value in USD Million

2026-2035

*this image is indicative*

In the automotive sector, a mixture of antifreeze and water serves as a coolant to prevent overheating of engines by raising the boiling point of the water-based liquid in the engine. The demand for antifreeze is rising along with the sales and manufacture of passenger cars. Antifreeze is a component of the engine coolant and is crucial to maintain the ideal temperature inside the engine of a vehicle. It reduces the excess heat produced while the automobile is running and prevents serious damage to its internal components.

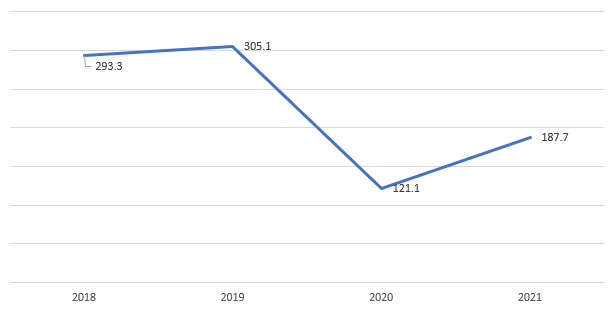

The number of air passengers flying to, from, and within Latin America and the Caribbean (LAC) is rising from a critical COVID-19-induced drop in 2020. The rise in air travel aids the demand for antifreeze for aircraft de-icing and lavatory fluids. From January to November 2023, the total number of passengers travelling to and from the region reached 410.5 million, a rise of 13.9% y-o-y, highlighting a positive trend of recovery and expansion in the sector.

Figure: Latin America and Caribbean Air Transport of Passengers (2018-2021); Million

Table: Latin America Vehicle in Operation

| Country | VIO |

| Brazil | 44 Million |

| Mexico | 32 Million |

| Argentina | 14 Million |

| Colombia | 6 Million |

| Chile | 6 Million |

| Venezuela | 4 Million |

| Peru | 3 Million |

| Jamaica | 3 Million |

| Ecuador | 2 Million |

| Guatemala | 2 Million |

| Dominican Republic | 2 Million |

| Bolivia | 1 Million |

| Paraguay | 1 Million |

| Uruguay | 1 Million |

| Nicaragua | 0.5 Million |

Rising use as a heat conductor in heating and cooling systems; increasing automobile manufacturing; demand for eco-friendly antifreeze; and the expanding aviation sector are positively impacting the Latin America antifreeze market growth

| Date | Company | Event |

| Oct 2023 | Shell Lubricants | Shell Lubricants has introduced a range of single-phase immersion cooling fluids to keep computer components cool efficiently while helping to cut energy consumption and lower carbon dioxide emissions, especially in energy-intensive facilities such as data centres. |

| Sep 2023 | Dow | Dow has launched a new line of propylene glycol (PG) solutions in Europe, utilising alternative, lower-carbon, bio-based, and circular feedstocks. This allows customers in industries like pharmaceutical, agricultural, and food to provide end-products with validated sustainability benefits. |

| Aug 2023 | TotalEnergies | In Chile, TotalEnergies launched its new Cooltech Supra Perf Organic Refrigerant in its 4-liter format diluted at 50% and ready-to-use format. Supra Perf Organic Refrigerant is a long-lasting antifreeze based on monoethylene glycol and organic corrosion inhibitors. |

| Apr 2022 | ExxonMobil | ExxonMobil launched two new antifreeze products namely Mobil Delvac Modern Extended Life and Mobil Delvac Legend Heavy Duty for commercial vehicles in Mexico. |

| Trends | Impact |

| Rising number of commercial vehicles and growing automobile sector support antifreeze demand | In Latin America, the commercial vehicle market is expected to witness significant growth in the coming years, propelled by key factors such as substantial infrastructure investment, ongoing mining development, increased export activities, and the implementation of multimodal transportation projects. Increasing number of commercial vehicles on road favours the Latin America antifreeze market. |

| Demand for antifreeze for aerospace applications | The enhancement of air travel infrastructure in Latin America is fostering increased connectivity between regional destinations, facilitating domestic tourism and promoting multi-destination travel. This contributes to the demand for antifreeze for aerospace applications. |

| Preference for eco-friendly antifreeze | The introduction of ECO2 represents a non-toxic, fully inhibited heat transfer fluid with antifreeze capabilities derived from refined vegetable extracts. |

| Favourable temperatures in Latin America | Several nations, including Bolivia, Peru, Ecuador, and Colombia, feature extensive high-altitude regions in the Andes mountains. In these areas, colder temperatures and even snowfall are common, necessitating the use of antifreeze for proper vehicle functioning. |

Rising environmental consciousness is increasing the demand for eco-friendly products. Manufacturers can capitalise on this opportunity by substituting petroleum feedstocks with sustainably harvested renewable and biological feedstocks. Additionally, they can manufacture products free of persistent synthetic compounds, such as additives.

With the number of vehicles in operation rising, there is a greater demand for tires, spare parts, and car chemicals, including antifreeze. In Mexico, there are around 34 million units in operation and the average age of vehicles is 16.1 years. The average vehicle age has continued to grow in Latin America and some vehicles are the oldest globally, which adds to the demand for car chemicals like antifreeze.

According to the Federal Aviation Administration (FAA), the Latin American aviation sector is expected to grow by 4.5% per year by 2034. Antifreeze finds use in the de-icing of aircraft during the flight. It also finds use for lavatory anti-freezing applications in aircraft lavatory fluids.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Latin America Antifreeze Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

market Breakup by Technology

Market Breakup by Application

Market Breakup by Region

Based on application, automobiles dominate the Latin America antifreeze market share, as the chemical is crucial for maintaining the ideal temperature inside a vehicle’s engine

In 2020, Latin American countries constituted 7% of the global new vehicle sales, showcasing one of the highest motorization growth rates globally. As of the year-end 2022, Latin America boasted 128 million cars and light trucks, with Brazil leading the Vehicles in Operation (VIO) count at 44 million. Mexico follows with 32 million, and Argentina has 14 million units.

Latin America witnessed the second-fastest global recovery in passenger air traffic, rebounding strongly from the COVID-19 pandemic with June 2022 figures just 14% below pre-crisis levels. The region's robust recovery is attributed to large domestic markets and fewer travel restrictions, outpacing the overall market growth.

With rising power densities in electronic systems, liquid cooling solutions gain traction for enhanced thermal management. The solutions, employing optimal cooling fluids, improve accuracy, performance, and safety while reducing downtime and maintenance costs, meeting environmental compliance standards in diverse applications such as R&D labs and diagnostic facilities.

Based on products, ethylene glycol holds a significant share of the Latin America antifreeze market

Ethylene glycol is considered a key ingredient for low-temperature hydronic systems where chillers and air handling units (AHUs) operate outdoors, or when equipment plays a vital role in low-temperature processes. The inclusion of ethylene glycol helps in reducing water’s freezing temperature, further enabling the lowering of operation temperature. Propylene glycol is being widely adopted to remove ice and other contaminants from aeroplanes in addition to its use as an ingredient in antifreeze products sold in supermarkets and garages.

The market players are innovating in terms of offering premium quality and environmentally safe antifreeze products to meet the demand of eco-conscious customers

| Company | Founded | Headquarters | Services |

| TotalEnergies SE | 1974 | France | Provides antifreeze solutions such as Coolelf Supra, and Glacelf Supra. The company also offers products for businesses such as aviation, batteries, bitumen, fuels etc. |

| Roux Industrial Group | 1949 | Mexico | Offers antifreeze products under the brand name Straton. The other products offered include oil gasoline engines, oil diesel engines, differentials and manual transmission oils, automatic transmission oils, etc. |

| Chevron Corporation | 1879 | United States | Provides Havoline Conventional Antifreeze/Coolant, Havoline Xtended Life Antifreeze/Coolant, Havoline Universal Antifreeze/Coolant, Chevron Delo ELC, Advanced Antifreeze/Coolant 50/50, etc. |

| Raloy Lubricantes, S.A. de C.V. | 1980 | Mexico | Offers ANTI-FREEZE MX – Ready to Use Antifreeze RL, Antifreeze HD, automotive gasoline, automotive diesel. |

Other notable players operating in the Latin America antifreeze market include Shell PLC, Dow Inc., PJSC Lukoil, and Motul S.A., among others.

Brazil holds a significant share in the Latin America antifreeze market due to the growing product demand for automobile and aerospace applications. This demand is supported by the growth of these industries in Brazil. In 2022, the Associacao Nacional dos Fabricantes de Veiculos Automotores (ANFAVEA) reported that new vehicle sales in Brazil, including trucks and buses, accounted to 2.10 million vehicles. While in 2022, Brazil recorded 831,000 flights, marking a substantial increase from 2021, as reported by ANAC. Among these, domestic flights accounted for 731,000, while international flights reached 100,000, as per the Anuario do Transporte Aereo 2022.

Mexico is another important market for antifreeze in LATAM. In 2022, the Mexican light vehicle sales witnessed a 7.0% increase accounting for a volume of 1.08 million units. Mexico has 77 airports, with 45 serving as international commercial hubs. Grupo Aeroportuario del Centro Norte (OMA), a major airport operator, manages 13 airports in northern and central Mexico. In 2022, these airports accommodated 23.2 million passengers while in 2021 they managed 15.7 million passengers.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The Latin America antifreeze market attained a value of USD 846.37 Million in 2025.

The market is estimated to grow at a CAGR of 5.10% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 1391.83 Million by 2035.

The expansion of the automotive sector, rising sustainability concerns, and the growing aviation sector are fuelling the growth of the market.

The major regional markets are Brazil, Mexico, Argentina, and Chile, among others.

The technologies of antifreeze are organic acid technology antifreeze (OAT), hybrid organic acid technology (HOAT), and inorganic acid technology antifreeze (IAT).

Antifreeze finds application in automobile, heat transfer and cooling system, aerospace, and others.

The key players in the market include TotalEnergies SE, Roux Industrial Group, Chevron Corporation, Raloy Lubricantes, S.A. de C.V., Shell PLC, Dow Inc., PJSC Lukoil, and Motul S.A., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share