Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global helium market size reached a volume of about 6976.42 MMCF in 2025. The market is further estimated to grow at a CAGR of 3.60% in the forecast period of 2026-2035 to reach a volume of around 9936.43 MMCF by 2035. North America, Europe and Asia Pacific are expected to be key markets.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3.6%

Value in MMCF

2026-2035

*this image is indicative*

| Global Helium Market Report Summary | Description | Value |

| Base Year | MMCF | 2025 |

| Historical Period | MMCF | 2019-2025 |

| Forecast Period | MMCF | 2026-2035 |

| Market Size 2025 | MMCF | 6976.42 |

| Market Size 2035 | MMCF | 9936.43 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 3.60% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 4.1% |

| CAGR 2026-2035 - Market by Country | India | 4.8% |

| CAGR 2026-2035 - Market by Country | China | 4.0% |

| CAGR 2026-2035 - Market by Phase | Liquid | 4.2% |

| CAGR 2026-2035 - Market by Application | Cryogenics | 4.5% |

| Market Share by Country 2025 | Germany | 4.4% |

According to the helium market research, helium is commonly used in welding, pressurising and purging, cryogenics, breathing mixtures, leak detection, controlled atmospheres, and other processes. The chemical is used in a wide range of applications, including welding, metal production, nuclear power, semiconductors, aircraft, electronics, and electronic devices. Over the anticipated period, it is anticipated that the development of effective gas storage and transportation technologies will likely be one of the key global helium market trends.

Helium is used in the semiconductor manufacturing process for a variety of reasons, an aspect likely to influence the helium market price in coming years. Moreover, it is a gas that does not interact with other chemicals, as it is considered to be an inert gas. Helium also effectively conducts heat due to its high thermal conductivity, aiding in keeping silicon at a constant temperature throughout, which is becoming more significant as silicon circuitry gets smaller. It would be challenging to achieve this reduction without the process control that helium provides. Consequently, it is anticipated that the special properties of helium, which cannot be replaced by any other element, will increase the helium market share over the foreseeable future.

Helium (He), an inert gas, is the second lightest element (behind only hydrogen in lightness); it is colourless, odourless, and tasteless. Helium becomes liquid at −268.9 °C (−452 °F). The freezing and boiling points of helium are lower than those of any other substance known to man. To solidify helium, pressure of 25 atmospheres at a temperature of 1 K (−272 °C, or −458 °F) is required. According to the helium market report, helium has several applications which are supporting the market growth. It is employed as an inert-gas atmosphere for welding metals like aluminium.

As helium maintains its gaseous state at liquid-hydrogen temperature, it is used in rocket propulsion to pressurize fuel tanks, particularly those for liquid hydrogen. Helium is used as lifting gas for instrument-carrying balloons in meteorology. Liquid helium, being the coldest substance, is employed as coolant in cryogenics. Helium displays low solubility in the bloodstream, therefore, it is employed in high-pressure breathing operations, for example, a combination of helium and oxygen is employed for activities such as scuba diving and caisson work. Meteorites and rocks have been examined for helium content for the purpose of dating.

Today, helium is often found in laboratories to maintain very cold temperatures for experiments as helium can be cooled to temperatures near absolute zero. In the United States, the major use of helium is in cooling magnets in magnetic resonance imaging (MRI) machines, thus aiding the helium market size US. Liquid helium is used to cool magnets in the Large Hadron Collider, the world's largest particle accelerator, down to -456.34 degrees Fahrenheit (-271.3 degrees Celsius). Qatar and the United States are major producers of helium, along with Algeria, Australia, and Russia.

The use of liquid helium in magnetic resonance imaging (MRI) continues to increase with developments and new uses for equipment in the medical domain, thus increasing the helium market size. Modern equipment has to some extent reduced the need for exploratory surgery through accurate diagnosis. Another medical application includes MRE to conclude (through analysis of blood) whether an individual has any type of cancer. Canisters containing helium are used in the medical field to observe breathing; the gas is used in the treatment of asthma, emphysema, and other breathing related conditions, which is a major helium market trend.

As per the helium market forecast, helium is also used widely to advertise on blimps for different companies. Other lifting gas applications are being developed by defence forces to detect low-flying cruise missiles. Military submarine detectors employ liquid helium to clean up noisy signals. It is reported that the U.S. Air Force employs helium in experiments on superconductors as a power source. The Drug Enforcement Agency is reported to employ radar-equipped blimps to detect drug smugglers along the borders of the United States. NASA is reported to use helium-filled balloons to sample the atmosphere in Antarctica to identify the causes of depletion of the ozone layer. This will likely increase the global helium market size.

Helium is used in the manufacture of fibre optics, vital to the deployment of 5G, which is expected to catalyse the helium market 2024. Helium is used in the preform production process, stage one of optic fibres manufacturing which comprises creating a precursor to the fibre, in particular for its reinforcement, and in the preform stretching process, to attain the optic fibre for efficient cooling.

Furthermore, helium is used in the production of electronic devices (semiconductors, flat screens, etc.) As per helium market analysis, helium has important uses in fundamental research applications. The gas is used in research on nuclear fusion (ITER) or for particle accelerators (CERN).

However, fluctuations in and uncertainties related to helium production, supply and prices may hinder market growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

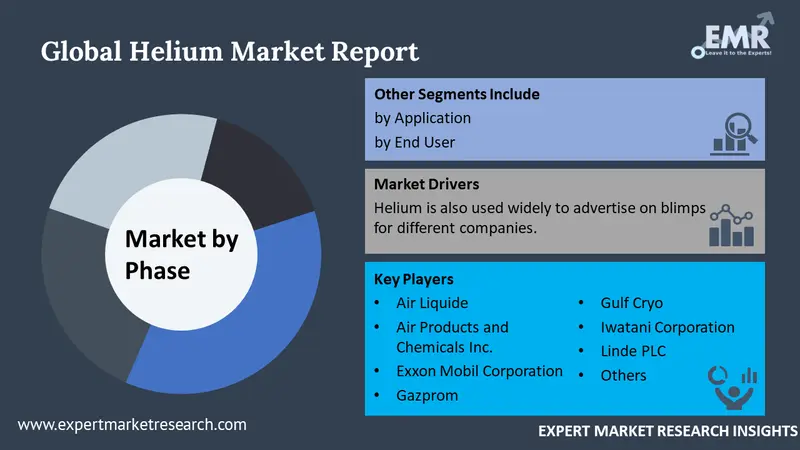

The EMR’s report titled “Helium Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Phase

Market Breakup by Application

Market Breakup by End User

Market Breakup by Region

| CAGR 2026-2035 - Market by | Country |

| India | 4.8% |

| China | 4.0% |

| USA | 3.2% |

| Germany | 3.0% |

| France | 2.8% |

| Canada | XX% |

| UK | XX% |

| Italy | XX% |

| Japan | 2.5% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The report presents a detailed overview of the top helium companies in the market, looking into their capacity, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

The EMR report gives an in-depth insight into the industry by providing a SWOT analysis as well as an analysis of Porter’s Five Forces model.

Australia Helium Market

Canada Helium Market

Brazil Helium Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the helium market attained a volume of 6976.42 MMCF.

The global helium market is projected to grow at a CAGR of 3.60% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach 9936.43 MMCF by 2035.

The major drivers of the market include the development of efficient storage and transport methods for gases, heavy investments in R&D, advancements in electronic industry, growing population, and increased income.

The increasing consumption of helium in the electronics and semiconductor industry and the growing usage in the healthcare industry are the key trends propelling the market's growth.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Based on phase, the market is segmented into liquid and gas.

The major applications of the market are breathing mixes, cryogenics, leak detection, pressurising and purging, welding, and controlled atmosphere, among others.

The end users of the market are aerospace and aircraft, electronics and semiconductors, nuclear power, healthcare, welding and metal fabrication, among others.

The major players in the market are Air Liquide, Air Products and Chemicals Inc., Exxon Mobil Corporation, Gazprom, Gulf Cryo, Iwatani Corporation, Linde PLC, TOTAL HELIUM LTD, Messer SE & Co. KGaA, Acail Group, Taiyo Nippon Sanso Corporation, and HeliumOne, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Phase |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share