Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America transformer service market was valued at USD 8.40 Billion in 2025. The industry is expected to grow at a CAGR of 5.50% during the forecast period of 2026-2035 to attain a valuation of USD 14.35 Billion by 2035.

Base Year

Historical Period

Forecast Period

A significant percentage of the installed transformers across North America has exceeded the end of their useful service life of 25-40 years.

The USA is home to around 200,000 ageing power transformers, while it also witnesses the installation of over 2,000 new transformers annually.

Canada is a significant producer of transformers, globally.

Growing demand for electricity and the scaling up of renewable energy efforts aid the demand for power transformers and related services in North America.

Compound Annual Growth Rate

5.5%

Value in USD Billion

2026-2035

*this image is indicative*

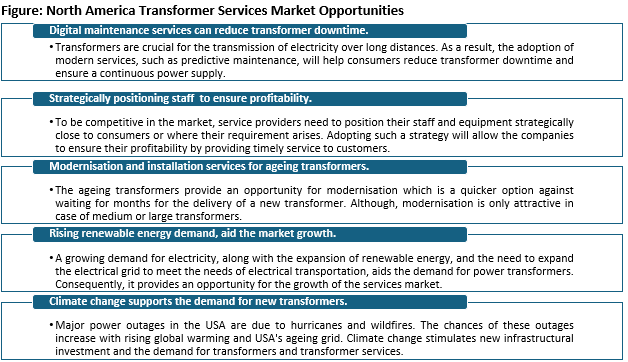

Transformers play a vital role in the efficient transmission of electricity for consumers, thereby ensuring the seamless operation of the economy. As a result, consumers across North America are investing in transformer services to ensure continuous power supply. The adoption of services, like predictive maintenance, assists consumers in minimising transformer downtime by monitoring the transformers remotely.

Some of the factors driving the North America transformer service market growth are an ageing grid infrastructure, growing demand for electricity, and the adoption of digital maintenance services to reduce transformer downtime.

Expansion of the renewable energy sector and frequent occurrences of power outages drive the North America transformer service market development.

| Date | Company | Details |

| June 2023 | RESA Power, LLC | RESA Power acquired Taifa Engineering, Ltd., expanding its presence and expertise in Canada's electrical engineering sector, particularly in western Canada. |

| June 2023 | Integrated Power Services | IPS, expanded its capabilities through the acquisition of Surplec, a prominent player in managing and remanufacturing surplus medium and high-voltage transformers, headquartered in Sherbrooke, Quebec, Canada. |

| March 2023 | RESA Power, LLC | RESA Power acquired Exell Power Services, Ltd (Exell), a British Columbia-based company specializing in professional services for low, medium, and high-voltage electrical installations. |

| October 2022 | Hitachi Energy | Hitachi Energy completed an investment of over US$37 million to expand and modernize its power transformer manufacturing facility in South Boston, Virginia. |

| Trends | Impact |

| Construction of renewable energy systems | The surge in demand for electrical transformers in the USA and Canada is driven by the construction of new renewable energy systems. |

| Need to replace an ageing infrastructure | A large percentage of the installed transformers across the region has exceeded the end of their useful service life of 25-40 years, supporting the need for new installations and the demand for transformer services. |

| Rising spending on AI-centric systems | According to industry reports, global expenditure on AI-focused systems is projected to exceed USD 300 billion by 2026. |

Notably, significant power disruptions in the United States are caused by natural occurrences such as hurricanes, heat waves, and wildfires. As the effects of global warming intensify, the country is projected to witness a rise in power outages, particularly due to its ageing power grid. As a result, stakeholders are expected to invest in the modernisation of the grid providing an opportunity for transformer-related services.

North America Transformer Service Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by Region

Field services are sub-divided into testing, start up and installation, annual maintenance, acceptance testing, and commissioning whereas engineering services are categorised into short circuit testing, power quality audits, and arc flash studies.

In application, power distribution services are divided into field services, field start up and commissioning of new equipment, modernisation, disaster recovery, extended warranty services, safety and risk management, testing, decommissioning, and vibration analysis. While power source equipment service is segmented into power system studies, consulting and advisory services, design engineering, arc flash studies, power quality studies, power factor correction studies and harmonic analysis, and others.

Field services are widely adopted to perform routine diagnostics of transformers

Service providers offer schedule field services, incorporating routine diagnostics, preventive maintenance, and scheduled testing such as DGA (dissolved gas analysis) to guarantee the smooth functioning of transformers. Electrical field services encompass a range of preventive actions conducted to avert malfunction or breakdown of electrical systems, ensuring safety and minimising operational disruptions in commercial and industrial environments.

According to the transformer service market in North America, comprehensive engineering service providers deliver a wide spectrum of analyses while consistently refining processes to align with regulatory and customer requirements. These offerings encompass transformer analyses, process enhancements, and investigative undertakings, among other domains.

According to the North America transformer service market analysis, in the power sector, SCADA systems are now widely used by various companies for on-site and remote monitoring transformers. Service providers take the responsibility of supervising transformer health, environmental conditions, and even underground vault status. The emergency services provided by the service providers comprise tasks such as transformer leak repair, complete replacement of transformer gaskets, spill cleanup and recovery, and fault analysis.

As the transformer nears the end of its operational lifespan or if it fails testing and cannot be effectively repaired, the potential for accidents during its continued operation rises. In such instances, adherence to appropriate decommissioning guidelines becomes imperative, particularly concerning the transformer's designed operational lifespan. Service providers often offer customised decommissioning services to meet specific needs. It includes off-site services, on-site services, and transformer oil services.

Power source equipment service is expected to hold a significant North America transformer service market share

The power source equipment segment is a crucial contributor to North America transformer service market growth. Power system studies are essential to ensure the transformers are robust and dependable. The services carried out identify the flaws or safety risks and rectify them under all operating conditions. The advancements in transformer technology are necessitating design engineering services to ensure good quality which further improves its functioning.

Power distribution services also contribute to the North America transformer service market development. Power distribution service providers provide a range of services that encompass the entire energy supply journey, spanning from transmission to distribution. Their objective is to reduce both customer resource consumption and tied-up capital within the subsequent stages of the power value chain. Power distribution systems are engaged in dismissing the power into different circuits as per requirements. As the system has multiple operations, there are chances of occurrence of delay due to the interrupted power supply hampering the process. This necessitates the employment of transformer services to ensure the proper functioning of power distribution systems.

The range of transformer services offered by market participants can differ in terms of technician expertise, the variety of services provided to clients, and pricing.

| Company Name | Year Founded | Headquarters | Products/Services |

| AKF Group LLC | 1989 | New York, United States | Transformer services: Arc flash, short circuit coordination, and commissioning services. Others: Infrastructure design, instrumentation and building controls, master planning, smart building solutions, and other technology services. |

| Electrical Power Systems | 1987 | Youngsville, United States | Transformer services: Transformer repair, rebuilds, and coil rewinding, transformer testing. Others: Transformers, substations, inductors, motor controls, electric controls, etc. |

| RESA Power, LLC | 2003 | Houston, Texas | Transformer services: Oil testing and analysis, sample guard enclosures, transformer maintenance, transformer retrofill service, and remanufacturing of used transformers, etc. |

| American Electrical Testing Co., LLC | 1981 | Massachusetts, United States | Transformer services: Regular examinations, evaluations, and upkeeping, bushing renewals, LTC fixes, and oil refinement, etc. |

Other key players in the North America transformer service market include Taurus Power and Controls, Inc., Potomac Testing, Electrical Reliability Services, Integrated Power Services, and General Electric Company, among others.

The United States of America is expected to hold a significant share in the market driven by an ageing transformer infrastructure

According to the North America transformer service market analysis, an ageing transformer infrastructure across the United States creates opportunities for modernisation, repair, and replacement transformer services. Further, climate change drives the need for greater infrastructural investment and the demand for transformers to prevent and reduce power outages, as well as support the USA’s transition to renewable energy.

According to the North America transformer service market report, as the development of renewable energy infrastructure is crucial to foster a prospering economy, Canada supports governmental spending on new transmission lines. Consequently, the installation of transmission lines aids the demand for new transformers and the need for transformer services. Further, Canada is a significant manufacturer of transformers globally. The Canadian transformer sector is expanding at a rapid rate and is a significant contributor to the country’s total electrical manufacturing revenue.

Saudi Arabia Silica Sand Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The North America transformer service market is assessed to grow at a CAGR of 5.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 14.35 Billion by 2035.

Operation of power transformers involves processes such as external inspection, measurement of oil temperature and load, phasing, corrective and preventive maintenance, and overhauls, among others.

Transformers need routine maintenance to ensure they run smoothly and operate safely.

The major market drivers are the growing demand for power supply and increased investment in power infrastructure.

The key trends of the North America transformer service market include the growing deployment of energy-efficient transformers, a rise in the demand for maintenance, repair, and replacement services for old transformers, increased investments in smart transformers, and favourable government policies for the refurbishment and modernisation of old grid infrastructure.

The major regions in the market are the United States of America and Canada.

Various applications are power distribution service and power source equipment service.

The key players in the market are AKF Group LLC, Electrical Power Systems, RESA Power, LLC, American Electrical Testing Co., LLC, Taurus Power and Controls, Inc., Potomac Testing, Electrical Reliability Services, Integrated Power Services, and General Electric Company, among others.

In 2025, the market attained a value of nearly USD 8.40 Billion.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share