Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States healthcare advertising market value reached around USD 24.70 Billion in 2025. The shift towards digital advertising is significant, as healthcare providers increasingly use online platforms to reach patients directly.

The growing emphasis on patient education and awareness about health issues also drives advertising expenditures, with healthcare organisations investing in campaigns that inform consumers about available treatments and preventive measures. The rise of telemedicine and mobile health applications further supports this trend by enabling providers to reach underserved populations. As a result, the industry is expected to grow at a CAGR of 4.00% during the forecast period of 2026-2035 to attain a value of USD 36.56 Billion by 2035.

Base Year

Historical Period

Forecast Period

In 2022, total healthcare spending in the U.S. reached USD 4.5 trillion, translating to approximately USD 13,493 per person. This high level of expenditure underscores the critical need for effective advertising strategies that inform consumers about available services and treatment options, thereby enhancing patient engagement and awareness.

The Federal government was the largest source of healthcare funding in 2022, which influences the dynamics of healthcare advertising as public health initiatives often require robust communication strategies to reach diverse populations. As healthcare providers and organisations navigate this landscape, advertising becomes essential for promoting services funded by government programs, ensuring that citizens are aware of their options.

Moreover, according to the Census Bureau, there are notable gaps in health insurance coverage by race and ethnicity, highlighting a pressing need for targeted healthcare awareness and advertising campaigns aimed at the uninsured. This demographic gap creates opportunities for healthcare marketers to develop messages that addresses specific community needs.

Compound Annual Growth Rate

4%

Value in USD Billion

2026-2035

*this image is indicative*

The market for healthcare advertising market is driven by the growth opportunities offered to several pharmaceutical marketers by online direct-to-consumer drug advertising. Because of this, they have started shifting their promotional spending to digital promotions such as product websites, online display advertising, and social media campaigns. In addition to this, Google has permitted the advertisement of prescription drugs, addiction services, HIV home tests, and clinical trial recruitment across the country, further aiding the growth of the United States healthcare advertising industry.

The industry is further invigorated by the advertisement of the medications, which is done after obtaining the certification permitting the usage of relevant keywords. Moreover, many pharmaceutical companies have begun advertising through different channels like multiple synchronised communication channels to boost their consumer reach. Apart from this, technological advancement over the years has empowered consumers to find relevant information concerning various health-related conditions and the various available treatments. Because of this, the industry is witnessing an increase and is expected to expand over the forecast period.

Increased integration of AI and digital tools, focus on omnichannel marketing, and rising number of prescription drug advertisements are the key trends propelling the market growth.

Artificial intelligence and machine learning are readily gaining importance in healthcare marketing. Tools such as AI-powered chatbots, conversational AI, and call-tracking systems are being utilised to improve interactions with patients and providers. These advancements can enhance personalised communication and boost the overall effectiveness of marketing efforts, aiding the United States healthcare advertising market value. Generative AI is increasingly used for developing content for healthcare professionals, such as training programs and clinical decision support systems. These technologies assist clinicians in making faster and more accurate diagnoses, while also allowing healthcare marketers to create more targeted and effective advertising strategies. For instance, Amazon is increasing its efforts in AI technology by creating solutions such as HealthScribe, a HIPAA-compliant service, that leverages the capabilities of generative AI to automatically generate clinical notes from discussions between doctors and patients.

Healthcare marketers are increasingly adopting omnichannel strategies to engage with patients and healthcare providers (HCPs) across various platforms. This strategy includes the use of both digital channels, such as Connected TV (CTV) and Over-The-Top (OTT) advertising, as well as traditional media like direct mail and television as TV ads are still considered one of the most prominent ways of marketing in the country. Their goal is to create a seamless experience for users as they navigate their healthcare journey and contribute to the United States healthcare advertising market revenue. For instance, healthcare institutions such as the Mayo Clinic and Cleveland Clinic are leading the way in omnichannel healthcare marketing by setting a high standard for how healthcare organisations can effectively engage with patients across multiple platforms. These companies recognize that the patient journey is not a linear process and rather consists of various stages from the initial inquiry about symptoms or treatment options to the post-treatment follow-up and support.

The focus on patient-centred care is reshaping United States healthcare advertising market outlook. This trend focuses on understanding patients' needs, preferences, and experiences, leading to advertising that highlights real patient stories and testimonials. According to a survey by the Pew Research Center, 73% of patients are more likely to choose a healthcare provider that showcases positive patient experiences. For instance, OhioHealth's "Keep Making Plans" campaign encourages cancer patients to maintain their aspirations despite their diagnoses. By focusing on resilience rather than medical technology, this campaign resonates emotionally with viewers, promoting a message of hope and empowerment. Similarly, New York-Presbyterian Hospital's "Patient Stories" campaign showcases the journeys of patients who received care at the facility. This approach helps healthcare organisations build stronger relationships with patients, leading to increased loyalty and improved health outcomes.

As per United States healthcare advertising market analysis, content marketing is becoming an essential strategy in healthcare advertising. As consumers increasingly seek reliable information about health issues online, healthcare companies are leveraging content to educate and engage their audiences. A study by Demand Metric found that 70% of consumers prefer getting to know a company via articles rather than ads. For example, Planned Parenthood effectively uses educational content to inform the public about breast health through engaging visuals and storytelling. Their campaigns focus on preventive measures and encourage regular checkups, raising awareness while empowering individuals to take charge of their health. Kaiser Permanente's "Thrive Your Way" campaign promotes a healthy lifestyle by providing actionable tips through relatable scenarios. By positioning themselves as trusted sources of health information, these organizations can attract new patients while enhancing community health literacy. The impact of content marketing in healthcare is profound as it drives patient engagement and establishes organisations as thought leaders in the industry.

The USA market is driven by the rising prescription drug advertisements. The industry for healthcare advertising in the United States has evolved substantially after the initiation of the first code of ethics, which happened in the late 1840s. This code involved the prohibition of any advertising associated with healthcare and pharmaceutical products.

As per the United States healthcare advertising market dynamics and trends, healthcare advertising is now used for the purpose of spreading awareness regarding several diseases, health issues, the availability of modern drugs, and procedures in the country. As opposed to advertising in other industries, healthcare advertising is controlled by regulations issued by the Federal Trade Commission, state consumer protection organisations, and other regulatory bodies. The Federal Trade Commission (FTC) Act mandates the establishment of regulations which can address misleading advertising practices in all sectors including healthcare and ensures that the advertisements must be supported by credible evidence and free from misleading information.

The use of video advertising, especially through non-linear television and streaming services, has significantly grown, particularly in the pharmaceutical sector. Streaming audio and video ads are becoming crucial in healthcare marketing strategies, allowing marketers to reach wider audiences while reducing costs. For instance, Disney+ and Hulu have seen a significant shift towards ad-supported subscription models. In 2024, half of the new subscribers to Disney+, including the ones in the United States, opted for the ad-supported plan, whereas 90% of Hulu's audience is using an ad-supported subscription. This change reflects a broader trend where consumers are leaning towards more budget-friendly, ad-supported options, aiding the United States healthcare advertising demand growth.

Advertisers in the country are also relying on the growing popularity of Connected TV which is increasingly being used to boost brand visibility and allow direct engagement with consumers. The introduction of shoppable ads is a new format that allows viewers to make purchases directly from their screens.

Healthcare advertising costs in the country have risen significantly due to factors such as inflation, supply chain disruptions, and increased competition. The cost-per-lead (CPL) in the healthcare sector is expected to be much higher than in many other sectors, with certain end-use sectors such as cosmetic surgery, seeing CPLs as high as USD 134.29. These rising costs create challenges for small healthcare advertising companies, limiting their competitiveness, and restricting their market access and affecting the United States healthcare advertising demand forecast.

Additionally, the U.S. healthcare sector must also comply with stringent regulations, especially regarding advertising. Compliance with FDA, HIPAA, and FTC regulations greatly limits the scope of advertising efforts. The stringent rules which regulate the promotion of pharmaceutical products and medical devices, particularly regarding permissible claims and data usage, can pose significant challenges for healthcare marketers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“United States Healthcare Advertising Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

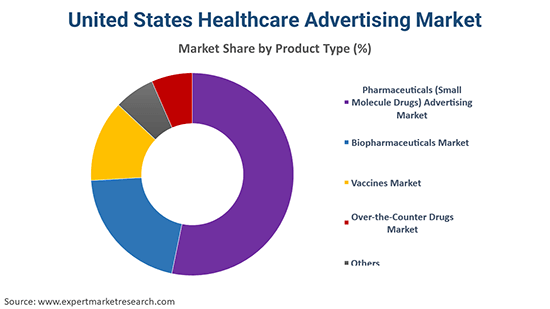

The industry is segmented on the basis product type of:

Market Analysis by Product Type

Biopharmaceuticals, which include biologics such as monoclonal antibodies, gene therapies, and cell therapies, are expected to be the fastest-growing segment in the healthcare sector. This growth is driven by their effectiveness in treating complex diseases such as cancer, autoimmune disorders, and rare genetic conditions. The high demand for these innovative treatments, along with significant marketing investments from leading pharmaceutical companies, has led to biopharmaceuticals boosting the demand of United States healthcare advertising market.

In recent years, the vaccine segment has also seen substantial growth, largely due to the global demand for COVID-19 vaccines. Favourable public health initiatives, government contracts, and increased consumer awareness have helped this sector achieve the second-largest market share. Continued investments in vaccine research and development for various diseases further support the rapid growth of this market. Additionally, advertisements in the pharmaceuticals (small molecule drugs) market in USA have shown an exponential increase in the last few years, driven by direct-to-consumer campaigns. For example, drugs like Humira and Lipitor have seen extensive marketing, leading to increased consumer inquiries and prescriptions. This trend reflects a growing emphasis on patient engagement and awareness in the pharmaceutical industry.

Healthcare advertising in major metropolitan areas such as New York, California, and Texas, among others, is experiencing significant investment due to the increasing presence of healthcare facilities and advanced medical services. These states lead in spending on both digital and traditional advertising, especially in the pharmaceutical and medical device sectors.

Furthermore, the growing use of digital advertising platforms in small markets is also a crucial trend of United States healthcare advertising market. Rural areas are also witnessing an increase in healthcare marketing, supported by telemedicine and mobile health solutions that enable healthcare providers to reach patients in underserved communities.

Several startups are leveraging call-tracking technology in their digital marketing strategies to aid healthcare organisations in improving their advertising strategies. These companies provide insights into customer behaviour, allowing healthcare providers to boost engagement for drawing new patients and retaining existing ones. As per the United States healthcare advertising industry analysis, they also evaluate the success of call-driven campaigns to improve return on investment. Some other startups are offering solutions that improve workflow automation and HIPAA-compliant patient engagement systems to ensure that marketers adhere to regulations.

Cardinal Digital Marketing

Cardinal Digital is an up-and-coming startup in United States healthcare advertising market. The firm offers digital marketing solutions customised for healthcare providers, prioritising omnichannel strategies, search engine optimisation, pay-per-click advertising, and conversion rate enhancement, among others. Cardinal aids healthcare organisations in boosting patient acquisition and retention by using data-driven insights and personalising patient interactions throughout their healthcare journey.

Invoca

It is an innovative startup that focuses on AI-driven call tracking and conversational analytics specifically designed for healthcare providers. The platform assists healthcare marketers in enhancing their advertising efforts by monitoring phone call conversions, delivering valuable insights into patient interactions, and maximising the return on investment for marketing expenses, which enhances United States healthcare advertising market opportunities. This solution enables healthcare organisations to gain a deeper understanding of patient requirements and enhance engagement, thereby offering tailored experiences that facilitate conversions.

The report gives a detailed analysis of the following key players in the healthcare advertising market in the United States, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds. Several companies are adopting AI and machine learning to create more personalised and effective marketing strategies that can aid United States healthcare advertising demand. They are deploying AI chatbots and conversational AI to engage with both patients and healthcare professionals (HCPs) as these tools allow for deeper interactions between HCPs and pharmaceutical companies.

Established in 1886, this company is a prominent multinational corporation known for its diverse offerings in pharmaceuticals, medical devices, and consumer health products. The company offers an extensive portfolio that includes items ranging from baby care and skincare to high-end medical devices, making it one of the largest healthcare enterprises worldwide, and contributing to the United States healthcare advertising industry revenue.

Pfizer, founded in 1849, is one of the leading global pharmaceutical companies headquartered in the United States. It is known for its groundbreaking contributions to medicines, vaccines, and therapeutic solutions, The company gained significant recognition for its role in the development of the COVID-19 vaccine in partnership with BioNTech.

Merck & Co., Inc., also known as MSD outside the U.S. and Canada, was established in 1891 and ranks among the largest pharmaceutical firms globally. The company specialises in prescription medications, vaccines, biological therapies, and products for animal health, which can boost the growth of the United States healthcare advertising market.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other major players in the market are GlaxoSmithKline plc., Eli Lilly and Company, Novartis AG, Sanofi-Aventis U.S. LLC, AstraZeneca, F. Hoffmann-La Roche Ltd, Bayer AG, and Bristol- Myers Squibb Company, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 24.70 Billion.

The market is assessed to grow at a CAGR of 4.00% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 36.56 Billion by 2035.

The major drivers of the market are rising advertisements for drugs, growth opportunities offered to several pharmaceutical marketers, and the rising number of health-conscious consumers in the country.

The key trends guiding the growth of the market include the rise of multichannel marketing and targeting consumers with local advertising.

Pharmaceuticals (small molecule drugs) advertising market, biopharmaceuticals market, vaccines market, and over-the-counter drugs market are the various product types in the market.

In the United States, the goal of healthcare advertising is to increase awareness regarding specific health issues and conditions as well as about the availability of procedures and drugs in the country.

The major players in the United States healthcare advertising market are Johnson & Johnson Services, Inc, Pfizer Inc, Merck & Co., Inc, GlaxoSmithKline plc., Eli Lilly and Company, Novartis AG, Sanofi-Aventis U.S. LLC, AstraZeneca, F. Hoffmann-La Roche Ltd, Bayer AG, and Bristol- Myers Squibb Company, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share