Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Colombia automotive lubricant market was valued at USD 614.14 Million in 2025. The industry is expected to grow at a CAGR of 6.90% during the forecast period of 2026-2035. The increasing awareness about the environment and corresponding government regulations in the region has resulted in a considerable demand for biodegradable and eco-friendly lubricants, driving further market growth. In turn, all these factors have resulted in the market attaining a valuation of USD 1196.86 Million by 2035.

Base Year

Historical Period

Forecast Period

As the world increasingly shifts preferences as per the sustainability goals, companies are increasingly concentrating on developing eco-friendly products including lubricants that are used in vehicles. Researchers at Oak Ridge National Laboratory of the Department of Energy have created lubricant additives that safeguard water turbine machinery and the environment.

Companies, to boost the Colombia lubricant market growth, are formulating their products with high-performance synthetics and additives. They are increasingly integrating advanced technology to enhance engine efficiency, reduce wear, and extend vehicle lifespan.

New suppliers are increasingly concentrating on the commercial vehicle segments, which is using half more lubricants simply to keep the weight on older trucks, such as lubricants that require a higher frequency of changes and maintenance.

Compound Annual Growth Rate

6.9%

Value in USD Million

2026-2035

*this image is indicative*

The automotive lubricant market growth in Colombia is contributed by the growing automotive fleets, greater vehicle maintenance, and increasing demand for high-performance lubricants. The market is increasingly trending towards more biodegradable and synthetic lubricants, depending on environmental regulatory frameworks. Further, technological improvements have positively impacted on the automotive lubricant demand in terms of fuel economy or prolonged engine life. Key players such as Chevron, Shell, and Terpel have put increased emphasis on product development, strategic partnerships, and upgrading their distribution networks. With the growing adaptability of electric vehicles, there emerges a special need for electric lubricants, laying bases for new market growth and opportunities for innovation.

Colombia is a significant automobile manufacturer, exporting vehicles to around 19 countries. Colombia’s automotive sector is specialized in the production and assembly of vehicles and motorcycles. The growth in demand for automotive lubricants in Colombia is primarily driven by the sales of lightweight vehicles in the country. Lubricants are used in automobiles to lessen wear and friction in the engine, gearbox, and other mechanical systems.

Additionally, low-conductivity coolants are gaining momentum in the Colombia lubricant market with the rising popularity of electric vehicles, as these coolants improve the energy efficiency and general performance of EVs while also ensuring their safety and lifetime. Moreover, the increasing need for eco-friendly lubricants that are biodegradable and have a reduced environmental impact is influencing Colombia automotive lubricants market development.

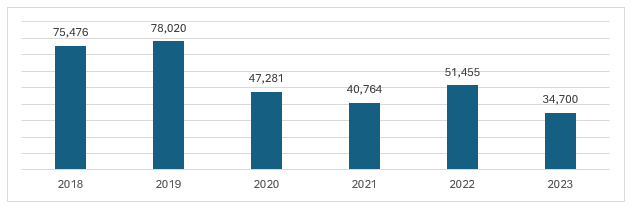

Figure: Motor Vehicle Production in Colombia (Units), 2019-2025

Major trends influencing the Colombia automotive lubricant market include synthetics, eco-friendly lubricants, technology integration, and e-commerce and online distribution.

The growing preference for synthetic lubricants is an emerging trend in the Colombia automotive lubricant market due to their enhanced performance, longer life, and lesser environmental impact in the automotive segments. Shell and Chevron have expanded their synthetic lubricant offerings in response to the market. For example, Shell's "Helix Ultra" range gives better fuel economy and engine protection to meet the requirement for high-performance oils.

Growing awareness regarding the environment from eco-conscious consumers’ end has resulted in the heavy demand for bio-based and eco-friendly lubricants. As a result, companies are increasingly shifting toward greener formulations to meet the stringent environmental regulations. One of the key examples include Petro-Canada’s range of biodegradable oils, which specifically targets eco-friendly consumers in urban locations experiencing a growing level of environmental consciousness, thereby boosting the Colombia automotive lubricant market dynamics and trends.

The Colombia automotive lubricant market experiences growth due to a gradual integration of cutting-edge technologies including AI and IoT in automotive lubricants. The lubricants are now formulated to optimize the performance of a vehicle leading to fuel economy and engine performance. Mobil 1 creates smart lubricants providing real-time information on its performance to allow for predictive maintenance for fleet managers and manufacturers of automotive products.

The growing penetration of e-commerce or online channels have directly impacted the demand in the Colombia automotive lubricant market. Companies are heavily investing in direct-to-consumer platforms and partnering with online retailers. For instance, Liqui Moly has engaged in a robust online campaign, delivering seamlessly and offering product support to address consumer demand for convenience in obtaining quality lubricants.

In the Colombia automotive lubricant market, companies can capitalize on the rising demand for lubricants in the electric vehicle (EV) sector, as these vehicles call for specialized lubricants for components like gears and cooling systems. Furthermore, the trend toward fleet management services provides an entire set of opportunities for companies to regenerate bulk lubricants supply contracts for businesses with large vehicle fleets, such as delivery and trucking companies. Such an evolution to fleet management provides opportunities for forming relationships with customers that last for many years, putting a large uptick in volume of that lubricant and an avenue for customized products that would assist fleet managers in optimizing performance and efficiency for all types of commercial vehicles.

Government investments in infrastructure projects, particularly in transportation networks, stimulate demand for automobiles. For instance, by August 2026, the Colombian government aims to invest around USD 24.9 billion in its transport infrastructure to boost economic development. This includes investment in the country’s rail, port, river, and road infrastructure including the construction of 15 highway projects. As the road network is improved, consumers will invest in passenger and commercial vehicles to transport passengers and goods. This can shape the Colombia automotive lubricants market outlook positively.

Stringent environmental regulations concerning emissions and fuel efficiency in Colombia present a significant opportunity for the market. For instance, Colombia aims to reduce its greenhouse gas emissions by 51% by 2030 and achieve net zero by 2050. As vehicle manufacturers strive to meet these regulations, there is a growing demand for high-quality synthetic and bio-lubricants that can improve engine performance, enhance fuel efficiency, and reduce emissions.

“Colombia Automotive Lubricant Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Grade

Market Breakup by Distribution Channel

Market Breakup by Vehicle Type

Market Insights by Product Type

The engine oil segment is on great demand in the Colombia automotive lubricant market because of the rising need for vehicle servicing. Similarly, gear oil and transmission fluid are rising in multiple commercial vehicle segments because of the heavy-duty lubrication needs. Brake fluids and coolants are also on demand, focusing on safety as well as efficiency, especially amongst commercial and fleet vehicles. Greases still remain relevant in terms of industrial functioning, running industrial machinery and fleets.

Analysis by Grade

The Colombia automotive lubricant market value is mainly added by mineral oil as these are cost-effective yet readily available. The growing popularity of synthetic automotive lubricants derives from their superior performance along with a longer lifespan and the growing need of consumers to make high-quality products. Semi-synthetics have emerged as an appealing alternative for buyers who would like to balance their performance and price. The bio-based automotive lubricants are appealing to those environmentally aware shoppers who are now influencing the development of lubricants because of environmental regulations and trends encouraging sustainability.

Market Insights by Distribution Channel

As per the Colombia automotive lubricant market analysis, the OEM distribution channel is fast becoming popular. OEMs offer recommendations for lubricants in order to ensure certain performance levels, reliability, and honoring of warranties. The aftermarket segment is growing due to the rising demand from vehicle owners and fleet operators for high performance lubricants. They have become more willing to purchase high-quality products at an affordable rate for routine maintenance. Greater e-commerce accessibility witnesses' growth in both channels, with online platforms providing access for consumers to both OEM-approved and aftermarket alternatives that meet a diverse set of consumer needs and preferences.

Analysis by Vehicle Type

Passenger cars have significantly dominated the Colombia automotive lubricant demand forecast because of the car fleet and routine maintenance requirements. The increase in the commercial use of vehicles, drawn by the several logistics and transport businesses, is driving demand for lubricants for heavy-duty applications. The increase in urban mobility solutions is expanding share with two-wheelers including motorcycles and scooters. The demand in these segments for high-performance lubricants attuned to the needs of their various types is driving growth across these segments.

Colombia automotive lubricant market players are increasingly developing eco-friendly, biodegradable, and synthetic lubricants, and high-performance lubricants. Colombia automotive lubricant companies are attempting to improve the distribution channels and take up digital marketing platforms to safely establish a connection with consumers. Alternative custom-made solutions for commercial vehicles and electric vehicles are being developed to meet the evolving number of customers demands along with regulatory standards.

Exxon Mobil Corporation is involved in exploration, production, and manufacturing of crude oil, natural gas, petroleum products, petrochemicals, and a wide range of products. Founded in 1999 and headquartered in the Texas, United States, it sells their products under the brands including Exxon, Mobil, Esso and XTO Energy.

Chevron Corporation was founded in 1879 and is based in California, United States. It is a multinational oil and gas company and operates through three main businesses: Upstream, Downstream, and Midstream. The company boasts a notable market share in automotive fuels and lubricants in Colombia.

TotalEnergies SE, a prominent multinational energy corporation, offers a wide spectrum of energy resources such as oil, biofuels, natural gas, renewables, and electricity. Founded in 1924 and headquartered in Paris, France, the company operates across more than 120 countries.

Repsol, S.A., founded in 1986, is engaged in oil and gas exploration and production to transformation, development, and energy marketing. Headquartered in Madrid, Spain, the company markets its wide range of products in more than 90 countries worldwide.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the automotive lubricants market in Colombia are BP PLC (Castrol), Shell plc, Motul S.A., Petroliam Nasional Berhad (PETRONAS), and Amsoil Inc, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 614.14 Million.

The Colombia automotive lubricant market is assessed to grow at a CAGR of 6.90% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 1196.86 Million by 2035.

The factors driving the market growth are increasing vehicle sales, expansion of manufacturing, logistics, and construction sectors, and government's stringent emission standards.

Key trends aiding Colombia automotive lubricants market growth include the increasing adoption of synthetic and semi-synthetic lubricants, the rise of electric vehicles, and the growing emphasis on sustainability and environmentally friendly products.

Engine oil, gear oil, transmission fluids, brake fluids, coolants, and greases are the product types.

The vehicle types include passenger vehicles, commercial vehicles, and motorcycle.

The grades include mineral oil lubricants, synthetic lubricants, semi-synthetic lubricants, and bio-based lubricants.

The demand is highest for passenger cars, followed by commercial vehicles and two-wheelers. The growth in passenger car sales has been a significant contributor to the overall market expansion.

The key players in the market include BP PLC (Castrol), Exxon Mobil Corporation, Chevron Corporation, TotalEnergies SE, Repsol, S.A, Shell plc, Motul S.A., Petroliam Nasional Berhad (PETRONAS), and Amsoil Inc, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Grade |

|

| Breakup by Distribution Channel |

|

| Breakup by Vehicle Type |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share