Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Colombia paints market size reached around USD 1078.16 Million in 2025. The market is estimated to grow at a CAGR of CAGR% during 2026-2035 to reach a value of USD 1611.35 Million by 2035.

Base Year

Historical Period

Forecast Period

Rising home renovation activities in Colombia have led to increased usage of paints that provide anti-bacterial properties and high gloss finish.

Rising concerns about climate change and demand for sustainable offerings have fueled the demand for eco-friendly paints.

Technological advancements such as antibacterial coating technology, thermal insulation technology, and bio-based acrylic emulsion are revolutionising the market.

Compound Annual Growth Rate

4.1%

Value in USD Million

2026-2035

*this image is indicative*

| Colombia Paints Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 1078.16 |

| Market Size 2035 | USD Million | 1611.35 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.10% |

| CAGR 2026-2035 - Market by Raw Material | Resin | 4.4% |

| CAGR 2026-2035 - Market by Technology | Water-Borne | 5.1% |

| CAGR 2026-2035 - Market by Application | Industrial | 4.6% |

| Market Share by Technology 2025 | Pigments and Fillers | 25.7% |

The growth in the Colombian housing sector is a crucial factor driving the demand for paints and coatings. Consumers are increasingly adopting decorative paints to enhance the aesthetic appeal of their homes.

The expanding urbanisation and population growth in Colombia is supporting the construction of transportation infrastructure, including roads and airports. The government's attention to public infrastructure development and modernisation of roads, subways, and highways, such as the ongoing construction of Bogotá's subway scheduled to start operating in 2028, supports the paints market development.

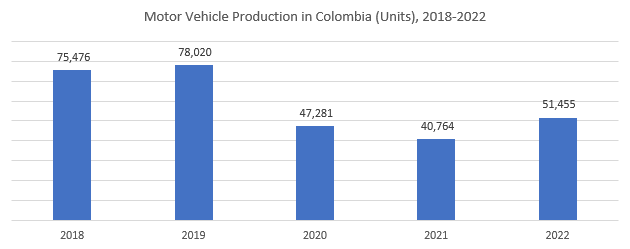

Paint protects automobiles from corrosion. The Colombian automotive sector is specialised in the production, painting, and assembly of cars and motorcycles. Colombia’s manufacturing sector is also a crucial consumer of paints. In 2022, its y-o-y output expanded by 11.26%, contributing to the market growth.

Expansion of Colombia’s housing infrastructure to support its economic development favours the market growth.

With rising health and environmental concerns, there is a growing consumer demand for paints that are low in VOCs, water-based, and derived from biological sources.

The growing demand for new aircraft as well as expanding aircraft maintenance is expected to support the use of thin, eco-friendly, scratch-proof, and dirt-resistant paints.

Companies are consistently dedicating their efforts towards the industrial maintenance sector, specifically aiming to develop paints with high chemical resistance suited for environments with severe conditions, including chemical plants, petrochemical industries, and the maritime sector.

Paints act as a protective barrier and enhance the aesthetic appeal of structures. Rising demand for affordable housing is increasing the consumption of paints and coatings solutions. The growth of Colombia’s infrastructure sector is driven by the government’s need to improve the country’s economy. The ongoing construction of Bogota Metro Rail, Line 1, El Dorado Airport expansión, and RegioTram Bogot, provide an opportunity for players.

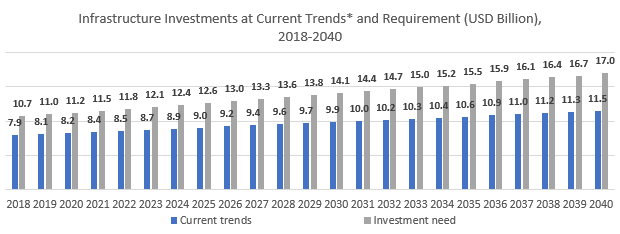

Colombia has devised the Intermodal Transport Master Plan (PMTI) 2021-2051, as a strategic roadmap for the nation's intermodal connectivity over the next two decades, impacting 294 prioritised municipalities through 86 projects with approximately USD 48 billion investment. Colombia ranks third in the World Bank's assessment of efficiency in PPP programs through efficient formulation and execution of public-private initiatives, with a project portfolio exceeding USD 10 billion. The Community Roads for Peace initiative is slated to receive an estimated USD 1.6 billion investment for the rehabilitation of 33,000 km of roads.

Further, paints are crucial for manufacturing machinery to protect it against corrosion, enhance its lifespan, and ensure productivity. The country’s manufacturing output was USD 35.59 billion in 2021, which increased to USD 39.59 billion in 2022. The increasing demand for manufacturing machinery and equipment supports the Colombia paints market expansion.

Moreover, consumers are transitioning towards sustainable paints with limited impact on environment and human health. Manufacturers can capitalise on this trend by incorporating more bio-based raw materials, adopting refillable packaging, reducing water and energy use, and enhancing carbon neutrality in the production process.

“Colombia Paints Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Raw Material

Market Breakup by Technology

Market Breakup by Application

| CAGR 2026-2035 - Market by | Raw Material |

| Resin | 4.4% |

| Pigments and Fillers | 4.0% |

| Solvents | XX% |

| Additives | XX% |

| CAGR 2026-2035 - Market by | Technology |

| Water-Borne | 5.1% |

| Powder-Based | 4.8% |

| Solvent-Borne | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Application |

| Industrial | 4.6% |

| Architectural/Decorative | XX% |

| 2025 Market Share by | Technology |

| Pigments and Fillers | 25.7% |

| Solvents | XX% |

| Resin | XX% |

| Additives | XX% |

Resins, among other raw materials, dominate the Colombia paints market share

Acrylics, epoxies, and polyurethane resins are widely consumed in low-VOC water-based paints. The growing inclination towards low volatile organic compounds (VOCs)-based paints is increasing the demand for these resins.

Alkyd resin serves as a film-forming agent in interior paints and clear coatings and improves the drying time of paints. Further, acrylic resins are deployed in automotive and architectural paints due to their exceptional weather resistance and durability.

A combination of polyurethane paint with epoxy primers results in a heavy-duty anti-corrosion coating system, ideal for internally coating metal sewage tanks, pipelines, storage tanks, and pipelines.

Solvent-based paints are ideal for humid environments that increase the difficulty of letting water-borne coatings cure properly. Additionally, these paints work efficiently on surfaces contaminated with grease and dirt.

Water-borne technology is most widely preferred in the Colombia paints market

Water-borne paints predominantly use water as a dispersion media, which makes them environmentally friendly and easy-to-apply. The growing concerns regarding environmental safety and pollution make water-borne paints a desired option.

According to the Colombia paints market analysis, powder-based paints are also gaining popularity in the region; they are applied on metals by spray application. Surfaces coated with powder coating have high-quality finishes and are thicker in nature. The key companies offering powder-based paint solutions include Sherwin-Williams Company and PPG Industries, Inc.

The market players are focusing on developing paints and coatings solutions that are environmental friendly, driven by the growing need to lower environmental impact and reduce carbon emissions

| Company | Founded | Headquarters | Products/ Services |

| Sherwin-Williams Company | 1866 | United States | Specialises in architectural coatings and industrial coatings. |

| PPG Industries, Inc. | 1883 | United States | The company provides paints and coatings products to various sectors including aerospace, architectural coatings, automotive refinish, etc. |

| Pintuco SA | 1945 | Colombia | The company offers paints and coatings under four business segments including home, industrial, automotive, and construction and maintenance of buildings. |

| Pintubler de Colombia S.A. | 1980 | Colombia | The company offers paints and coatings under key business segments that include industrial, automotive, woods, and others. |

Other notable players operating in the Colombia paints market include WEG S.A., Pinturas Super LTDA, Organizacion Corona S A, Akzo Nobel N.V., INVESA SA, CLQ / COLORQUIMICA SAS, and Sun Chemical Corporation, among others. The manufacturers are upgrading their product portfolios and incorporating the latest capabilities to innovate their offerings and meet the evolving demands of consumers.

United States Conferences, Concert, and Event Market

MENA Maintenance, Repair, and Operations (MRO) Market

Saudi Arabia Bottled Water Market

North America Natural and Organic Face Care Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of USD 1078.16 Million in 2025.

The market is projected to grow at a CAGR of 4.10% during 2026-2035

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 1,456.8 million by 2035.

The major drivers of the market include the rising utilisation of paints in automotive and general industries, the growing construction sector, and increasing focus on building protection.

Rapid urbanisation and industrialisation, rising government investments towards infrastructure development, and development of innovative paints are the key trends propelling the market growth.

The primary raw materials are resin, pigments and fillers, additives, and solvents.

The various technologies in the market include powder-based, water-borne, and solvent-borne, among others.

Architectural/decorative and industrial are the major applications of paints in Colombia.

The lifespan of paint depends upon the type of paint, for example, while latex paint has an average lifespan of 2 to 10 years, acrylic and oil-based paints can last up to 15 years.

The key players in the market include Sherwin-Williams Company, PPG Industries, Inc., Pintuco SA, Pintubler de Colombia S.A., WEG S.A., Pinturas Super LTDA, Organizacion Corona S A, Akzo Nobel N.V., INVESA SA, CLQ / COLORQUIMICA SAS, and Sun Chemical Corporation, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Raw Material |

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share