Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Europe autoclaved aerated concrete (AAC) market size reached around USD 1848.31 Million in 2025. The market is projected to grow at a CAGR of 5.50% between 2026 and 2035 to reach nearly USD 3157.18 Million by 2035.

Base Year

Historical Period

Forecast Period

The European Green Deal was put into effect in December 2019 to achieve climate neutrality by 2050 and is encouraging the development of green buildings and the use of green construction materials, such as AAC.

By 2030, the European government aims to renovate 35 million buildings to make them energy efficient. As a result, the demand for AAC insulation is expected to rise as it is a high-quality thermal insulation material.

Members of the European Autoclaved Aerated Concrete Association (EAACA) operate over 100 manufacturing facilities across 18 countries, generating over 17 million m3 of AAC annually.

Compound Annual Growth Rate

5.5%

Value in USD Million

2026-2035

*this image is indicative*

Autoclaved Aerated Concrete (AAC) is a green precast building material that offers insulation, structure, and fire protection. It is extensively deployed in Europe in the residential, commercial, and industrial construction. Due to its thermal insulation qualities, AAC can reduce heating and cooling requirements by up to 30%, which provides long term monetary benefits to homeowners.

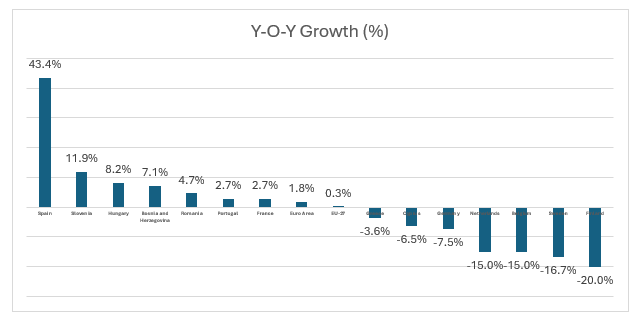

Spain issued the highest number of licenses in Europe in 2022, despite challenges due to higher interest rates and building material prices. The number of licensed square metres expanded by 43.4% in 2022 compared to 2021. In the residential sector, building permits increased by 44.2%, while the non-residential building sector experienced a rise of 41.7%.

The growth in the number of licensed square metres for residential construction in Spain was driven by a strong demand for single-family homes during H1 2022 while the demand for new offices aided the growth of the non-residential sector.

Figure: Year-on-Year Growth in Building Permits in 2022 for European Countries, in m2 of Useful Floor Area

Reduction in carbon emissions of AAC; rising renovation activities across Europe; increasing construction of green buildings; and significant advantages offered by AAC blocks over concrete are impacting the Europe autoclaved aerated concrete (AAC) market growth.

The European Autoclaved Aerated Concrete Association (EAACA)’s NetZero Roadmap is helping the AAC sector reach net-zero emissions by 2050. The key levers, such as the use of low carbon cement and lime, renewable energy sources, low emissions transport, reusing and recycling AAC, and recarbonation are expected to reduce the carbon emissions of AAC products from 180 kg to -70 kg of CO2e per m3 by 2050, increasing their sustainability.

The EU’s building sector is responsible for 40% of energy consumption and 36% of total GHG emissions. Under the EU’s Renovation Wave strategy, the government aims to enhance the energy efficiency of its buildings. This will increase the demand for AAC insulation products due to their superior thermal insulation properties and support the Europe autoclaved aerated concrete (AAC) market expansion.

AAC is the preferred walling material for LEED-certified buildings and is a 100% green building material. There is a growing demand for green buildings in the EU among commercial customers who are willing to pay a premium to lease them. For instance, in London, the average rental premium for green-certified offices is over 11%.

AAC blocks are around 3-4 times lighter than red bricks, making them economical and easy to transport. There is a greater strength-to-weight ratio with AAC blocks. This reduces the number of blocks needed per square metre and provides monetary benefits. Further, AAC blocks result in reduced structural costs as it saves steel use by up to 15%.

AAC products are widely used in the EU. It is used in over 40% of construction projects in the UK and 60% in Germany. AAC is made from natural ingredients, does not contain any chemicals or volatile compounds, and emits no pollutants by-products during manufacturing. This makes it a healthy, safe, and 100% sustainable building material. It is a walling material of choice for LEED-certified buildings. AAC products also enhance the indoor air quality of structures.

In 2022, around 40 million Europeans were unable to afford energy to heat their homes. The EU’s Renovation Wave strategy launched in October 2020 as part of the Green Deal, aims at renovating 35 million buildings by 2030 to improve their energy efficiency. The European Green Deal is viewed by the AAC market as an opportunity for growth that provides it a competitive edge over other building materials due to its sustainability benefits. AAC is a 100% recyclable material, making it an ideal solution to meet the needs of circularity and reduce GHG emissions.

“Europe Autoclaved Aerated Concrete (AAC) Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Element

Market Breakup by End Use

Market Breakup by Country

Based on element, blocks account for a significant share of the market

AAC blocks are known to be half the weight and ten times the size of traditional bricks. This makes it suitable for simple installation and offers the required flexibility, cutting, shaping, etc. AAC blocks are soundproof due to their lightweight and porous characteristics. Hence, it is being widely used across hospitals, schools, studios across the region.

AAC floor elements, on the other hand, are known for their combination of strength, thermal, and acoustic insulation. The adoption of AAC floor elements provides the features of concrete floors at significantly lower cost and with better insulation values.

Meanwhile, AAC industrial wall panels can be used as both internal load-bearing structure or an outer wall. The panels are medium/heavily reinforced allowing them to hold the weight of multiple-story buildings. The presence of high precision on thickness makes them suitable for double-sided applications.

Based on end use, the residential sector significantly contributes to the Europe autoclaved aerated concrete (AAC) market revenue

Autoclaved aerated concrete (AAC) is adopted as masonry blocks and prefabricated reinforced elements majorly in residential buildings. AAC blocks are being used as exterior walls in residential projects. The significant importance of fireproof houses is catering to an increased adoption of AAC panels on roofs to protect the structure from the flying embers that ignite house fires. By 2026, it is estimated that Europe will have finished constructing about 1.5 million housing units.

The market players are investing in upgrading their production plants to enhance energy efficiency, optimize production processes, improve personnel safety, and minimize ecological footprint.

H+H is a prominent supplier of wall-building solutions and materials, headquartered in Denmark. The company has 27 manufacturing plants globally with a total of 2.9 million cubic meters of wall-building materials production registered in 2023.

CRH plc is a leading provider of building materials solutions, specialising in transportation, utility infrastructure, non-residential construction, and outdoor living solutions. Founded in 1970, the company employs 78,500 individuals while operating at 3,390 locations in 29 countries across four continents.

Bauroc, is the largest producer of autoclaved aerated concrete (AAC) in Northern Europe. Headquartered in Estonia, the family-owned group, Bauroc, runs three cutting-edge AAC factories across the Baltic region and a calcium silicate facility in Lithuania.

The company is recognised as one of the world's largest manufacturers of autoclaved aerated concrete and calcium silicate materials. Founded in 1929, Xella leads in building materials made from autoclaved aerated concrete (AAC) and calcium silicate through its brands including Ytong, Silka and Hebel.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the Europe autoclaved aerated concrete (AAC) market are Holcim Limited, and Solbet Sp. z o.o., among others.

According to the US Green Building Council (USGBC), in 2022, Italy ranked ninth in the top countries in the world for LEED-certified buildings. In 2023, about 135 LEED projects were certified in Italy, accounting for nearly two million gross square meters (GSM) of space.

In its 2021-2026 National Resilience and Recovery Plan (NRRP), the government of France has laid out the plan of adopting Climate and Resilience Law, to strengthen its green transition. The plan also put forward the revision of thermal regulation of new buildings (‘RE2020’). Such initiatives are expected to favour the adoption of sustainable building materials, thereby boosting theEurope autoclaved aerated concrete (AAC) market development.

AAC is considered as the second popular construction material, led by clay bricks. The majority of AAC products are set in place in terms of masonry units in residential buildings, especially in one- and two-family houses in Germany. Researchers are engaged in developing belite cement clinker from aerated concrete waste. The clinker can substitute Portland cement used in AAC production, lowering its carbon footprint.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 1848.31 Million.

The market is projected to grow at a CAGR of 5.50% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 3157.18 Million by 2035.

The elements include blocks, floor elements, wall panels, beams and lintels, roof panels, and others.

The key countries analysed in the market report are the United Kingdom, Germany, France, Italy, Spain, Poland, the Netherlands, Switzerland, Sweden, Belgium, and others.

The end uses include residential and non-residential.

The factors driving the market growth are increasing renovation activities, rising inclination towards sustainable construction, and cost savings provided by AAC products, among others.

The key players in the market include H+H International A/S, CRH plc, Bauroc AS, Xella International GmbH, Holcim Limited, and Solbet Sp. z o.o., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Element |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share