Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global facade market was valued at USD 329.55 Billion in 2025. The industry is expected to grow at a CAGR of 7.10% during the forecast period of 2026-2035 to attain a valuation of USD 654.36 Billion by 2035.

Base Year

Historical Period

Forecast Period

The use of digital tools like BIM for façade design and installation is enhancing the efficiency of façade construction.

The market players are focusing on developing façades that can reduce energy consumption and minimise carbon footprints.

Regulations and building standards are pushing for the adoption of energy-efficient façade solutions, impacting design and material choices.

Compound Annual Growth Rate

7.1%

Value in USD Billion

2026-2035

*this image is indicative*

Facade is an architectural term which literally translates from French to ‘face’ and usually refers to the building exterior. The market has been driven by the increased focus of consumers towards the external appearance of a building. Along with adding to the aesthetic appeal, it also acts as an insulator against heat, cold, moisture, and noise, and protects the structure from damage.

The facade market growth is driven by rapid urbanisation around the world, which is creating a need for the construction of new buildings. Moreover, with the growing investments in research and development, the global market has undergone several technological advancements and changes, especially those related to resistance to extreme weather conditions, durability, waterproofing, and permitting more natural light to enter the building. The architecture and construction sectors are also carrying out major research and development operations to develop sustainable and eco-friendly facades which absorb solar energy, creating a new source of energy generation in residential and commercial buildings. These eco-friendly facades are expected to witness increased demand from eco-conscious consumers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Sustainability and energy efficiency; use of advanced materials and composites; digitalisation and BIM integration; and smart and adaptive façades are the major trends impacting the façade market expansion

This includes the use of materials that enhance insulation, reduce energy consumption, and minimise carbon footprints, thereby promoting sustainable development.

Materials such as fibre-reinforced polymers (FRP), titanium dioxide coatings for self-cleaning properties, and aerogel for superior insulation are being explored.

Digital tools and technologies, particularly Building Information Modeling (BIM), are increasingly being used in the façade design and construction process.

Technological advancements have led to the development of smart façades that can adapt to environmental conditions to optimise indoor comfort while minimising energy use.

The trend towards energy-efficient and sustainable facade solutions is a response to global environmental concerns, regulatory pressures, and a growing recognition of the impact buildings have on energy consumption and carbon emissions. For instance, high-performance facade materials are designed to have superior insulating properties, which help in maintaining stable indoor temperatures and reduce the need for heating and cooling, leading to lower energy consumption. By optimising the use of natural light while minimising unwanted heat gain or loss, these materials lead to significant reduction in a building's overall energy demand.

In May 2023, Hydro Building Systems announced a joint venture with Saint-Gobain Glass Company. By combining Hydro Building Systems' expertise in aluminium facade systems with Saint-Gobain Glass's innovations in glass technology, this partnership aims to create facade solutions that are not only energy-efficient but also manufactured with a lower carbon footprint.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

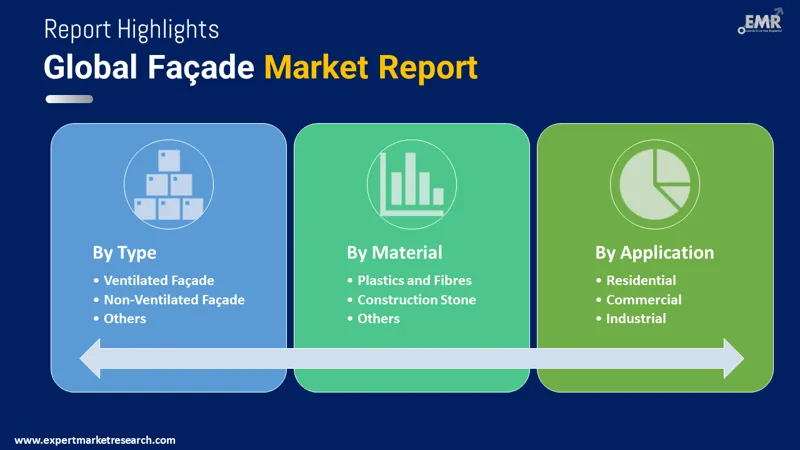

“Façade Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Material

Market Breakup by Application

Market Breakup by Region

Non-ventilated facades account for a major market share due to their ease of installation as well as superior insulation properties

Non-ventilated facades occupy a significant share of the overall facade market. Non-ventilated facades can provide excellent thermal insulation as they allow for a continuous insulation layer without gaps, reducing thermal bridging and heat loss. These facades also offer superior air tightness, minimising air leakage and contributing to energy savings in heating and cooling, which is a significant consideration in climates with extreme temperatures. Moreover, non-ventilated facades can be simpler to install compared to ventilated systems, as there is no need to construct a cavity or additional structural components for ventilation.

Metal maintains its dominance in market due to its low maintenance cost and excellent resistive properties

By material, metal dominates the facade market share. Metallic facade materials like steel and aluminium are increasingly being used in modern and retro-style buildings, specifically to construct cladding walls and structural panels. Their popularity is due to their low maintenance cost, and improved resistance against weather, fire, and other conditions as well as being long-lasting and environmentally friendly. Aluminium, especially, finds extensive application as a facade material due to its lightweight and durability as well as its high elasticity which allows designers to modify its shape and size according to the requirements.

Glass material is anticipated to witness sizeable growth in the coming years. The use of glass in building facades has grown significantly due to advancements in glass technology and a greater emphasis on sustainable and efficient building designs. Glass facades offer unparalleled transparency, allowing for abundant natural light, which can enhance the interior environment's quality and reduce the need for artificial lighting. This is not only beneficial for occupants' well-being but also aligns with sustainable building practices.

The market players are innovating their products, leveraging advanced technologies, and are also focusing on offering solutions that contribute to sustainable building designs

| Company | Founded | Headquarters | Products |

| Rockwool Rockpanel B.V | 1909 | Hedehusene, Denmark | Durable panels for exterior cladding |

| YKK AP Inc | 1972 | Tokyo, Japan | Windows, doors, curtain walls, and entrance systems |

| Saint-Gobain Corporation | 1665 | Courbevoie, France | Building materials, glass products, roofing, and wall facades |

| Norsk Hydro ASA | 1905 | Oslo, Norway | Primary aluminum and rolled products |

Other major players in the facade market include Skanska AB, Kawneer Company, Inc., Schüco International KG, Reynaers, and Trimo D.O.O., among others. The players are investing in research and development to introduce innovative products like self-cleaning facades and photovoltaic glass, among others.

The growth of the construction sector with rapid development of residential, commercial, and industrial complexes in Asia Pacific, specifically in China, India, and Southeast Asia, has made the region a dominant force in the global facade market. The regional market growth is supported by increase in the number of high-rise buildings as well as government initiatives encouraging the development of educational institutions, hospitals, etc.

There is also a rise in demand for facade materials in North America and Europe. The growth of the facade market in these regions is especially supported by the integration of environmentally friendly materials, especially in the US and the UK where consumers are more conscious about the choice of material, with a focus on reducing energy consumption. In Europe, Germany, Italy, the U.K., and the Nordic countries, are expected to see further investments from private and public investors for new construction of residential structures supported by various government schemes, which, in turn, will favor the market for facade.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 654.36 Billion by 2035.

The market is estimated to grow at a CAGR of 7.10% between 2026 and 2035.

The major drivers of the global façade market include rising disposable incomes, increasing population, rising urbanisation, growing architecture and construction industries, and increased focus on external façades of buildings.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the global façade market.

The major product types include ventilated, non-ventilated, and curtain wall façade, with the non-ventilated types leading the market.

The materials used in the market are glass, metal, plastics and fibres, and construction stone, among others.

The product finds wide applications in residential, commercial, and industrial sectors.

The growing investments in research and development is expected to be a key trend guiding the growth of the global façade market.

The major players in the market are Rockwool Rockpanel B.V., YKK AP Inc., Saint-Gobain Corporation, Norsk Hydro ASA, Skanska AB, Kawneer Company, Inc., Schüco International KG, Reynaers, and Trimo D.O.O., among others.

In 2025, the market attained a value of nearly USD 329.55 Billion.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Material |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share