Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Africa Diaper Market attained a value of USD 4.56 Billion in 2025. The market is estimated to grow at a CAGR of 8.20% during 2026-2035 to reach a value of USD 10.03 Billion by 2035.

Base Year

Historical Period

Forecast Period

Sub-Saharan Africa has a fertility rate of 4.45, and Niger, Chad, Somalia, and the Democratic Republic of the Congo lead the region with fertility rates of over 6.0.

Africa is experiencing a steady decline in infant mortality rate (-2.6% from 2020), contributing to a greater demand for diapers.

Innovations such as maximum skin protection and anti-leakage features in diapers are increasingly being demanded after across Africa.

Compound Annual Growth Rate

8.2%

Value in USD Billion

2026-2035

*this image is indicative*

Baby wipes and diapers are two necessities for infant care that reduce the risk of bacterial illness and offer comfort. The lifestyle and the standard of living of people in the West African region are improving along with rising awareness of hygiene, which is supporting the Africa diaper market development.

Increasing urbanisation, an expanding older population suffering from urinary incontinence, and development of the healthcare sector are some of the major reasons driving the adult diaper segment growth in Africa. Adult diapers are commonly worn by individuals with typical health conditions such as incontinence, mobility issues, or dementia.

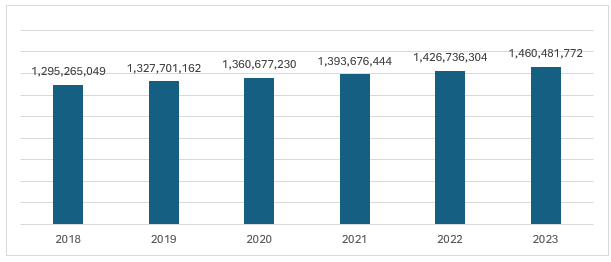

The diaper market is directly correlated with the population growth. Africa holds a significant share of the world's population with a year-over-year population growth of 2.49%.

Figure: Population Growth in Africa (2019-2025)

Population growth in Africa; rising awareness regarding the importance of diapers; growing demand for sustainable products; and the presence of favourable government initiatives are the major factors impacting the Africa diaper market growth

According to estimates of the United Nations in the annual ‘World Population Prospects’, released in July 2022, countries of sub-Saharan Africa - Nigeria, Congo, Ethiopia, and Tanzania and the Democratic Republic of the Congo – are expected to contribute to over half of the population boom by 2050. Further, based on estimates of the United States Census Bureau’s International Database, by 2050, the older African population (aged 60 years and older) is projected to total 235 million, surpassing that of Latin America and Northern America.

A growing elderly population Increases the risk of health ailments. For adults suffering from conditions such as incontinence, mobility impairment, severe diarrhoea or dementia, diapers are necessary. Adult diapers are made in such a way that they are convenient and comfortable to use.

Rising disposable income and expanding population

The growing population in Africa and the rising disposable income are boosting the consumption of diapers. The changing lifestyle of West African working women is resulting in increased demand for good quality baby diapers.

Rising health awareness

International companies in the region are introducing programmes to spread awareness regarding the benefits of using diapers and the number of times they should be changed. Additionally, they are introducing promotional offers with diaper packs to influence consumer decisions and increase their market share.

Demand for sustainable diapers

The rising concerns regarding sustainability are resulting in the launch of eco-friendly disposable diapers made from organic raw materials that are safe for the environment.

Favourable government initiatives

Kenya’s government considers diapers as “essential items” and has been encouraging manufacturing firms to set up shop in the country to supply the East African region. Diaper firms are allowed to import materials important for manufacturing, largely plastics, duty-free.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Africa Diaper Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Distribution Channel

Market Breakup by Country

Based on product type, baby diaper dominates the Africa diaper market share owing to the increasing demand from new parents

Manufacturers are offering a range of baby diapers that have a wetness indicator, a dual leakage barrier, and an absorbent gel that will keep the baby dry for several hours and are completely fragrance and chemical free.

Additionally, government efforts to increase the percentage of women in the region's workforce are enhancing their spending power, boosting the purchase of disposable baby diapers.

Africa’s rising ageing population is increasing the consumption of adult diapers designed to neutralise odour and protect against moderate incontinence.

Based on distribution channel, supermarkets and hypermarkets account for a significant share of the Africa diaper market

In Morocco, manufacturers are utilising multiple distribution networks to sell their products. Several manufacturers in the region produce diapers under their brand names and also supply several private-label products to retail and wholesale traders across Africa.

South Africa has a mature modern retail sector, with supermarkets such as Shoprite, Pick ‘n’ Pay, and Spar aiding diaper sales. Supermarkets are rapidly expanding their presence across Zambia, Nigeria, and South Africa, among others.

Convenience stores owned by local entrepreneurs are growing in Egyptian cities, namely Cairo and Alexandria. In Kenya, local modern retail chains are seeking expansion with the help of convenience stores and small supermarkets and by franchising.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The market players are involved in innovations to create better quality products like adding anti-leakage features in their diaper products.

With headquarters in the United States, the company is one of the largest producers of personal care products. They operate through three business segments including Personal Care, Consumer Tissue, and K-C Professional (KCP).

Founded in 1837, the Procter & Gamble Company is one of the world’s largest consumer goods companies and home to iconic, trusted brands, including Always, Charmin, Braun, Fairy, Febreze, Gillette, Head & Shoulders, Oral B, Pantene, Pampers, Tide, and Vicks.

African Cotton Industries Ltd is an indigenous Kenyan Company engaged in the manufacture of products for all age groups including baby, adult, personal, feminine, institutional, and home hygiene products.

Hayat, based in Turkey is one of the largest branded diaper producers and largest tissue paper manufacturers in the Middle East, Eastern Europe, and Africa.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the Africa diaper market are L’il Masters, Unicharm Corporation, and National Pride (Pty) Ltd., among others.

Modern cloth nappies are gaining popularity in South Africa among consumers looking for sustainable alternatives to disposable products. The increasing demand for eco-friendly products is also driving the share of biodegradable diapers in the overall Africa diaper market.

In Nigeria, there is a high consumer awareness regarding the benefits of disposable diapers over cloth ones, increasing their adoption by middle- and upper-class consumers.

With an increasing birth rate, the consumption of diapers in Kenya is gradually rising with the government encouraging manufacturing firms to set up units in Kenya to supply the East African region. As of June 2021, Kenya had a total of seven diaper manufacturing firms which were allowed to import manufacturing materials, including plastics, duty-free.

Global Adult Diaper Market

Global Biodegradable Diapers Market

Global Cloth Diaper Market

Global Diaper Market

Global Cloth Diaper Market

India Diapers Market

South Korea Baby Diapers Market

Asia Pacific Adult Diapers Market

United Kingdom Diapers Market

South Korea Diapers Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of USD 4.56 Billion in 2025.

The market is expected to grow at a CAGR of 8.20% in the forecast period of 2026-2035.

The major product types are adult diaper and baby diaper.

The major countries include Egypt, South Africa, Nigeria, Kenya, Tanzania, Morocco, Algeria, Ethiopia, Namibia, and others.

The various distribution channels include supermarkets/hypermarkets, pharmacies, convenience stores, online stores, and others.

The different types of baby diapers include disposable diapers, training diapers, cloth diapers, swim pants, and biodegradable diapers.

The factors aiding the growth of the market are the decline in infant mortality rates, increasing awareness regarding the importance of hygiene, and the rising geriatric population.

The key players in the market include Kimberly-Clark Corporation, The Procter & Gamble Company, African Cotton Industries Ltd., Hayat Kimya San A.S., L’il Masters, Unicharm Corporation, and National Pride (Pty) Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Distribution Channels |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share