Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global enzymes market size was valued at approximately USD 11.61 Billion in 2025. The market is projected to grow at a CAGR of 6.70% during the forecast period of 2026-2035 to reach around USD 22.21 Billion in 2035.

Base Year

Historical Period

Forecast Period

The food and beverage sector dominates the enzyme market, accounting for a significant portion of the total share.

This growth is driven by factors like increasing demand for processed foods, rising awareness about healthy and nutritional foods, and advancements in enzyme technology.

Enzymes can be reused and a single one is capable of catalysing around 10,000 chemical reactions per second.

Compound Annual Growth Rate

6.7%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Enzymes Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 11.61 |

| Market Size 2035 | USD Billion | 22.21 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.70% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 7.5% |

| CAGR 2026-2035 - Market by Country | India | 8.2% |

| CAGR 2026-2035 - Market by Country | China | 7.2% |

| CAGR 2026-2035 - Market by Type | Protease | 7.4% |

| CAGR 2026-2035 - Market by Industry Type | Special | 8.1% |

| Market Share by Country 2025 | Italy | 2.9% |

Enzymes are tiny molecules that act as biological catalysts, speeding up chemical reactions in living organisms. They are essential for life, playing a crucial role in everything from digestion and metabolism to DNA replication and muscle movement. Most enzymes are made up of long chains of amino acids folded into specific shapes. This shape determines the enzyme's function and which molecules it can interact with.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The global enzymes market growth is being driven by the growing demand for enzymes in various end-use industries like food and beverage, biofuel, animal feed, home cleaning, and others, as it helps manufacturers increase their production, and enhance the quality of their final products. With the growing consumer shift towards nutritious food and beverage products, the demand for enzymes, especially in processed and flavoured foods applications, has increased.

Increasing demand for enzymes in various fields; growing health consciousness; and the rising demand for nutritious products are positively impacting the global enzyme market growth.

Eco-friendly enzymes are gaining popularity for their ability to decrease usage and improve energy efficiency across industries

Biotechnological innovations are leading to the creation of effective enzymes that are finding new uses in the pharmaceuticals, biofuels and waste management sectors

There is a surge in demand for enzymes in supplements and functional foods, fuelled by consumers’ increasing awareness of health, nutrition and natural well-being solutions

Enzymes play a vital role in bioprocessing by facilitating the production of biofuels, paper, and textiles, among others. Their capacity to catalyse processes at temperatures and pH levels helps reduce energy consumption and environmental impact significantly

Technological advancements are poised to significantly boost the global enzyme market size in the coming years, driven by the rising popularity of eco-friendly technologies, featuring enhanced product attributes and overall performance improvements. The market expansion is also fuelled by the growing application of enzymes in sectors like food and animal feed, textiles, detergents, and biofuel production. Additionally, the enzymes market revenue is expected to benefit from the increasing prevalence of major health issues, such as digestive disorders and inflammation, coupled with a heightened demand for renewable energy sources like biofuels.

The increased product demand across the globe is also supported by the applications of enzymes in bakery and brewing applications. To improve fruit quality and yield, enzymes are utilised in the creation of fruit juices. The rising consumer awareness regarding health has led to increased consumption of functional food items, leading to the growing demand for enzymes in the food and beverage industry.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

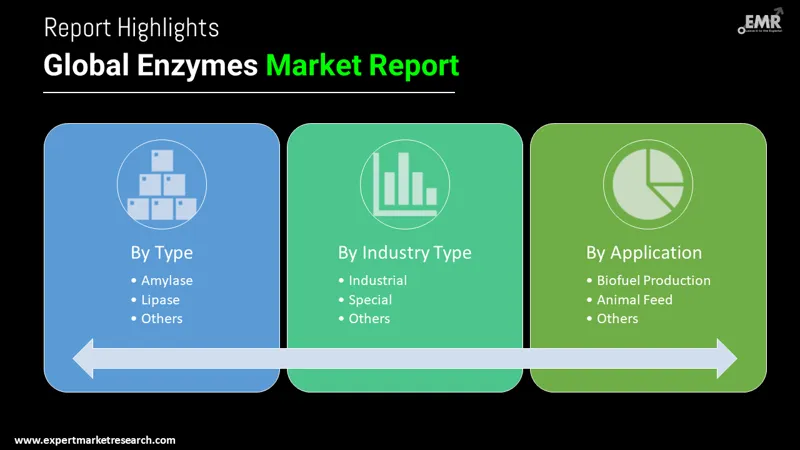

“Global Enzymes Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Industry Type

Market Breakup by Application

Market Breakup by Region

Amylase to hold a dominating position in the market

Amylase is a highly valued enzyme across various sectors, playing a crucial role in converting starches into sugars. It covers a substantial portion of the enzymes market share as it is extensively utilised in the food and beverage sector, particularly in brewing and baking, where its starch-breaking properties are essential. Amylase also plays a key role in the detergent sector by aiding in the removal of starchy stains and contributes significantly to the bioethanol sector by transforming starches into fermentable sugars.

Similarly, protease and lipase are enzymes with wide-ranging applications. Protease is indispensable in industries such as detergents, pharmaceuticals, and food, owing to its protein-digesting capabilities. Meanwhile, lipase is utilised in food processing, detergents, and the pharmaceutical sector, highlighting its versatility and importance in various fields.

The food and Beverage sector is likely to be the leading user of enzymes in the coming years

The food and beverage sector heavily relies on enzymes for different processes. Enzymes play a crucial role in breaking down starches into sugars for brewing and baking, enhancing the texture and flavour of dairy products, improving dough stability, extending the shelf life in baking, and aiding in the production of fruit juices and wine.

Utilising enzymes not only boosts process efficiency and enhances product quality but also promotes sustainability by reducing energy and water consumption, along with minimising waste production.

Meanwhile, in the biofuel sector, enzymes are vital for producing bioethanol and biodiesel. Their use enables the conversion of waste materials and non-food biomass into energy, thereby fostering eco-friendly fuel options.

In the animal feed sector, enzymes enhance feed value and nutrient digestibility. For instance, phytases are employed to break down acid in grains, making phosphorus more accessible to animals for their growth and bone strength development.

The industrial enzymes sector in North America is distinguished by its extensive applications across various industries. Innovations in technology have expanded the availability of enzymes for diverse uses, including in the food and beverages, detergents, textiles, paper, pulp, and animal feed sectors.

| CAGR 2026-2035 - Market by | Country |

| India | 8.2% |

| China | 7.2% |

| Mexico | 6.7% |

| Canada | 6.2% |

| Saudi Arabia | 6.0% |

| USA | XX% |

| UK | XX% |

| Germany | 5.7% |

| France | XX% |

| Australia | XX% |

| Brazil | XX% |

| Italy | 5.2% |

| Japan | 5.1% |

Growing concerns over obesity in the region have heightened consumer awareness towards health, prompting a surge in demand for natural and clean-label ingredients, particularly in food-related applications.

Meanwhile, the Asia Pacific enzymes market size is expected to register rapid growth during the forecast period owing to the region's large population base, coupled with growing awareness about health and nutrition. Additionally, the region has been going through major industrial, pharmaceutical, and biotechnological developments, which further bolsters the opportunities for the market.

Major players in the enzymes market are increasing investment in research and development for the improvement of products:

| Company | Established Year | Location | Description |

| Koninklijke DSM N.V. | 1902 | Netherlands | Global leader in health, nutrition, and materials. Pioneer in leveraging scientific innovation to promote sustainable living. |

| Amano Enzyme Inc. | 1899 | Japan | Specializes in the development and production of unique enzyme solutions for a variety of sectors. Recognized for its commitment to quality and innovation. |

| Advanced Enzyme Technologies | 1989 | India | Forefront company in the production of enzymes and probiotics. Focuses on delivering innovative solutions across human healthcare, animal nutrition, and industrial processing. |

| AB Enzymes GmbH | 1907 | Germany | Leading biotechnology company specializing in the production of enzymes for various industrial applications. Subsidiary of Associated British Foods. |

Other key players in the global enzymes market are Novozymes A/S, MetGen Oy. Cooperation, Aum Enzymes, F. Hoffmann-La Roche Ltd, BASF SE, ABF Ingredients Limited, Codexis, Inc., Creative Enzymes, Chr. Hansen Holding A/S, Enzyme Solutions, Inc., and International Flavors & Fragrances Inc., among others.

Leading players in the enzymes market are dedicating resources to research and development in order to innovate enzymes that offer improved features, increased effectiveness, and wider uses. Through advancements in biotechnology, their goal is to produce enzyme solutions that are not only more sustainable and cost-efficient but also exhibit excellent performance. This involves modifying enzymes to function optimally in environments leading to reduced energy usage and promoting conscious practices.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global market for enzymes reached a value of approximately USD 11.61 Billion.

The market is projected to grow at a CAGR of 6.70% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 22.21 Billion by 2035.

The major drivers of the market include the rising consumer awareness regarding health, increased consumption of functional food items, growing demand for enzymes in the food and beverage industry, and increased funding and investment.

The rising prevalence of various health conditions and growing demand for enzymes in various end-use segments are expected to significantly enhance the growth of the market.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Protease, amylase, lipase, and cellulase are the different types of enzymes in the market.

The major players in the market are Koninklijke DSM N.V., Amano Enzyme Inc., Advanced Enzyme Technologies, AB Enzymes GmbH, Novozymes A/S, MetGen Oy. Cooperation, Aum Enzymes, F. Hoffmann-La Roche Ltd, BASF SE, ABF Ingredients Limited, Codexis, Inc., Creative Enzymes, Chr. Hansen Holding A/S, Enzyme Solutions, Inc., and International Flavors & Fragrances Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Industry Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share