Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

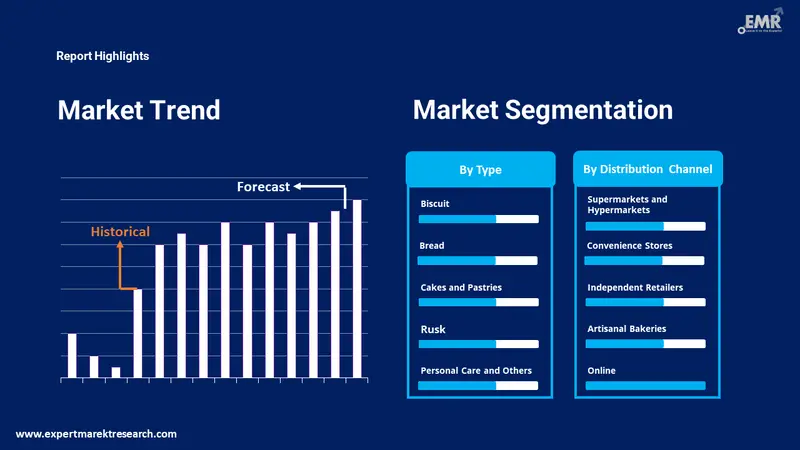

The India bakery market was valued at USD 12.12 Billion in 2025. Growing demand for health-centric baked goods, such as multigrain and gluten-free options, is prompting bakeries to revamp offerings, with premiumisation driving demand in metro and Tier I cities. As a result, the market is expected to grow at a CAGR of 9.50% during the forecast period of 2026-2035 to reach a value of USD 30.04 Billion by 2035.

Growth in the market is also fuelled by changing urban diets, fusion food demand, and expansion of modern retail. From millet-based bread innovations to AI-enabled baking systems, the sector is currently undergoing a dynamic transformation. A key milestone motivating the India bakery market trends is the Ministry of Food Processing Industries’ Pradhan Mantri Kisan SAMPADA Yojana, which has encouraged bakery startups through mega food park schemes and cold chain subsidies.

Another standout lever driving growth has been the country’s burgeoning demand for health-oriented baked goods. The FSSAI's Eat Right India initiative has pushed bakers to reformulate products with reduced sugar, whole grains, and fortified ingredients. This health-conscious trend in the India bakery market has triggered a surge in launches like probiotic rusks and gluten-free pastries.

Moreover, the country’s regional baking traditions are finding new applications. Artisanal bakeries are gaining strong foothold by their digital-first approach, experimenting with regional flours like ragi and sorghum while building pan-India supply chains through direct-to-consumer (D2C) models. Notably, India exported 2,148 shipments of bakery products in 2023-24, owing to the surging demand from UAE, United Kingdom, and Southeast Asia.

Base Year

Historical Period

Forecast Period

India is one of the largest biscuit manufacturers, and cookies and biscuits account for a major share of baked goods sales.

The growing health concerns are boosting the demand for bakery products that are gluten-free, free from chemicals and additives, and sugar-free, thereby aiding the Indian bakery market.

Factors like rapid urbanisation, evolving customer preferences, and rising disposable incomes are aiding the Indian market for baked goods.

Compound Annual Growth Rate

9.5%

Value in USD Billion

2026-2035

*this image is indicative*

| India Bakery Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 12.12 |

| Market Size 2035 | USD Billion | 30.04 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 9.50% |

| CAGR 2026-2035 - Market by Region | West India | 9.8% |

| CAGR 2026-2035 - Market by Region | North India | 8.7% |

| CAGR 2026-2035 - Market by Distribution Channel | Artisanal Bakeries | 10.6% |

| CAGR 2026-2035 - Market by Type | Cakes and Pastries | 10.8% |

| Market Share by Country 2025 | North India | 30.0% |

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Health and wellness have been a key trend that is largely reshaping the India bakery market dynamics, pushing firms to revamp traditional recipes. Urban Indians are demanding high-fibre, sugar-free, and protein-enriched baked items. In response, several regional brands have launched millet-based cookies and vitamin-fortified bread. The FSSAI's ‘Eat Right Mela’ and Smart Food initiative are supporting such product lines. Modern bakers are also incorporating flaxseeds, quinoa, and plant proteins to gain a competitive edge in the healthy foods category. Even traditional players are tweaking recipes for school and hospital catering contracts, targeting bulk supply deals.

With more artisanal and preservative-free products entering shelves, cold chain logistics has been a key motivator driving growth in the India bakery market. The PM Kisan SAMPADA scheme has approved 399 cold chain projects since inception, helping bakery startups maintain quality during transit. Tier-2 and Tier-3 cities are also witnessing this cold chain expansion, allowing perishable baked goods like cream cakes and desserts to be delivered within 24 hours. Logistics partners like Snowman Logistics are offering bakery-specific warehousing zones to ensure freshness for B2B institutional buyers.

The D2C trend has gained momentum in the bakery market in India. Home bakers and cloud bakeries have scaled operations using technology platforms and central kitchens. Zomato and Swiggy now support local bakeries with real-time delivery, making small brands instantly scalable. Moreover, companies like Bake Well are scaling their home operations owing to aggregators and local sourcing of ingredients. Such hyperlocal brands are also collaborating with cafés and co-working spaces, offering freshly baked, made-to-order goods under white-label contracts.

Advanced baking technologies are further boosting the India bakery market trends and dynamics. Companies are integrating AI-based dough monitoring systems and conveyor oven technology to reduce manual errors and increase output. Companies like Samsung, LG, Whirlpool, Bosch, Haier, and Tovala have introduced smart ovens that use humidity control to maintain quality in variable conditions. These systems are helping players deliver consistent results at scale, which is crucial for B2B clients in airline catering or hotel chains. In addition, the government’s PLI scheme for food processing is also incentivising technology investments, enabling bakeries to automate without compromising on artisanal quality.

Fusion and premium formats are further gaining traction in the market. Brands are crafting ghee-laced croissants, saffron-dusted Danish rolls, and mawa-cakes with European flair. High-margin, limited-edition lines are becoming more common in metro cities, accelerating the India bakery market development. Moreover, the National Institute of Food Technology Entrepreneurship and Management (NIFTEM) has begun R&D collaborations with startups to refine shelf-life of fusion bakery items. These products appeal to upscale cafes, boutique hotels, and airline menus.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India Bakery Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: The India bakery industry spans across bread, biscuits, cakes, rusks, and other niche products. Bread remains dominant in the market due to institutional demand and fortified offerings. Biscuits cater to mass-market and export needs, while cakes are gaining popularity owing to the urban café culture. The rusk category is witnessing steady growth due to long shelf life and tea culture. Other bakery products including protein bars and fusion bakes appeal to millennials and Gen Z consumers.

Market Breakup by Distribution Channel

Key Insight: As per the India bakery market report, supermarkets dominate the industry as they ensure large visibility and storage, while online channels offer convenience and personalisation. Artisanal bakers now use digital platforms to reach niche B2B customers. Convenience stores thrive in local neighbourhoods. Independent retailers remain key bakery hubs in small towns. While online platforms and supermarkets lead in volume, artisanal bakery sellers are carving out premium demand from affluent urban neighbourhoods and niche health-conscious consumer clusters.

Market Breakup by Region

Key Insight: The southern region dominates the bakery industry in terms of scale and innovation, driven by organised retail and hospitality demand. North India is rapidly evolving with event-driven growth and D2C expansion. West India balances between heritage bakeries and modern outlets, while East and Central India show promise with millet-based products and government-led food processing clusters.

| CAGR 2026-2035 - Market by | Type |

| Cakes and Pastries | 10.8% |

| Biscuit | 10.3% |

| Bread | XX% |

| Rusk | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Distribution Channel |

| Artisanal Bakeries | 10.6% |

| Convenience Stores | 9.0% |

| Supermarkets and Hypermarkets | XX% |

| Independent Retailers | XX% |

| Online | XX% |

| CAGR 2026-2035 - Market by | Region |

| West India | 9.8% |

| North India | 8.7% |

| East and Central India | XX% |

| South India | XX% |

By Type, Bread Accounts for the Dominant Share, Bolstered by Deep Market Penetration

Bread continues to be the dominant owing to deep market penetration, especially through government-aided midday meal schemes and railway catering services. Urban manufacturers are rolling out multi-grain, protein-rich, and low-GI bread loaves targeting institutional buyers like gyms, school canteens, and hospitals. Companies such as Modern Foods have introduced fortified bread lines aligned with India’s Poshan Abhiyaan. This category is also benefitting from private label expansions in large retail chains, where standardisation and hygiene compliance make bread the most preferred bakery product.

Driven by birthday culture and café chains, cakes and pastries represent the fastest-growing bakery type in the India bakery market. Growth in this category is fuelled by customised, eggless, and health-friendly variants, which are largely preferred by younger demographics. Cloud kitchens such as D Dark Bakery and Juice Bar in Bangalore, or The Dark Room Bakery and Cake in Jamnagar are increasingly supplying to premium hospitality clients with demand for theme-based or vegan cakes.

By Distribution Channel, Supermarkets and Hypermarkets Register Majority of the Market Share

Supermarkets and hypermarkets have largely contributed to the India bakery market revenue, especially in urban belts where packaging and hygiene heavily influence buyer choices. Chains like Reliance Fresh and Spencer’s are offering shelf space for private-label bread, cakes, and rusks. These outlets also enable better product placement and seasonal promotions. Cold storage-enabled bakery counters have become industry standard, allowing storage of premium pastries and chilled dough products. Partnerships between regional bakery brands and supermarket chains have become a key distribution strategy. Brands are also experimenting with in-store bakeries for freshness appeal, serving bulk-buying B2B clients like restaurants, school canteens, and catering companies sourcing via wholesale tie-ups.

The online distribution channel is registering explosive growth in terms of the India bakery market value, driven by urban convenience and B2B delivery systems. Platforms like Amazon Fresh, BigBasket, and Blinkit now offer real-time stocking of artisanal bread, gluten-free cookies, and celebration cakes. Many bakeries have launched D2C platforms to serve bulk corporate gift orders, events, and hotel requirements. AI-driven apps also allow clients to personalise cake designs and track delivery timings.

By Region, South India Occupies the Leading Position in the Market Owing to the Increased Adoption of Western Dietary Habits

The southern region accelerates consistent bakery demand in India, propelled by the growing adoption of Western dietary habits and robust café culture. Kerala and Tamil Nadu have particularly nurtured a strong base of legacy bakeries that now operate in industrial formats. The region’s tropical climate has driven demand for cold storage bakery lines. States like Tamil Nadu and Kerala boast an organised bakery sector and companies in the region are actively launching new products. For instance, In August 2023, Kerala-based Craze Biscuits launched a chocolate sandwich biscuit, Bourbon, and chocolate cookie, Choco Rocky, in Kochi amid the rising demand for local and indigenous products.

| 2025 Market Share by | Region |

| North India | 30.0% |

| East and Central India | XX% |

| West India | XX% |

| South India | XX% |

The North India bakery market is gaining more momentum, particularly across NCR, Punjab, and Uttar Pradesh. Rising disposable incomes, festive culture, and growth of wedding/event catering firms have expanded B2B demand. Cities like Ludhiana and Lucknow are witnessing bakeries scale through franchise networks and online sales. Delhi-NCR remains a hub for premium cake studios, while food parks in Haryana are supporting industrial bread manufacturing.

The India bakery market players are investing in smart baking technology, shelf-life extension R&D, and premiumisation to attract institutional clients. Brands are expanding via private label partnerships with modern retailers and entering bulk procurement channels for airlines, hospitals, and hotels. Millet-based bakery products, AI-enabled ovens, D2C bakery technology, probiotic rusks, and regional-European fusions are reshaping the market through health, innovation, speed, and premium appeal.

Export readiness is another key priority for India bakery companies with a focus on compliance and customisation. Sustainability is emerging as a major differentiator, with eco-friendly packaging and energy-efficient ovens becoming investment hotspots. Training hubs in metro cities are helping build specialised baking skills, enabling faster expansion for regional chains. Opportunities also lie in Tier-2 cities where demand for hygienic and affordable bakery items is growing.

Britannia Industries Ltd., established in 1892 in Kolkata, India, is a leading food product company in India. Its key business areas include dairy, bakery, and adjacent snacks spanning more than 80 countries in the world.

Surya Food & Agro Ltd., headquartered in Uttar Pradesh, India, is a company that manufactures and sells biscuits under the Priyagold brand. The company boasts strong manufacturing capabilities and extensively invests in developing products for customer preference.

Parle Products Pvt. Ltd., founded in 1929, is a leading manufacturer of biscuits and confectionery products in India. Its flagship product, Parle-G, is one of the most popular biscuits in India and is synonymous with nutrition, quality, and superior taste.

Established in 1910 and headquartered in Kolkata, ITC Limited plays a key role in the India bakery market through its brand Sunfeast. The firm has expanded into premium biscuits and filled cakes, targeting health and indulgence simultaneously, ITC also supplies packaged bakery goods to schools and railways through centralised kitchens, leveraging scale with innovation.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Anmol Industries Ltd., Jubilant FoodWorks Limited, Ravi Foods Pvt. Ltd., Mondelez International, Inc, Mrs Bectors Food Specialities Ltd., and Patanjali Ayurved Limited, among others.

Explore the latest trends shaping the India bakery market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on India bakery market trends 2026.

Latin America Bakery Products Market

United States Bake-off Bakery Market

Australia Bakery Ingredients Market

South Korea Bakery Premixes Market

Bakery Processing Equipment Market

Australia Bakery Products Market

France Bakery Products Market

Bakery Ingredients Market

Bakery Products Market

Bakery Enzymes Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the India bakery market reached an approximate value of USD 12.12 Billion.

The market is projected to grow at a CAGR of 9.50% between 2026 and 2035.

The market is estimated to reach a value of about USD 30.04 Billion by 2035.

Key strategies driving the market include investing in cold chains, launching health-centric SKUs, adopting automation, forming B2B partnerships with retailers, and leveraging regional ingredients.

The rising penetration of bakery chains and the launch of healthy products in the bakery segment is likely to be a key trend guiding the growth of the market.

North India, East and Central India, South India, and West India are the leading regions in the market.

Biscuit segment is the dominant type of the product in the market.

The leading distribution channels include convenience stores, supermarkets and hypermarkets, independent retailers, artisanal bakeries, and online, among others.

The leading players in the market are Britannia Industries Ltd., Parle Products Pvt. Ltd., Surya Food & Agro Ltd., ITC Limited, Anmol Industries Ltd., Jubilant FoodWorks Limited, Ravi Foods Pvt. Ltd., Mondelez International, Inc, Mrs Bectors Food Specialities Ltd., and Patanjali Ayurved Limited, among others.

The key challenges hindering the India bakery market growth are high perishability, inconsistent cold chain infrastructure, and regulatory bottlenecks.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share