Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global oleochemicals market attained a value of USD 29.44 Billion in 2025. The market is forecast to grow at a compound annual growth rate (CAGR) of 5.80% from 2026 to 2035, potentially reaching USD 51.74 Billion by 2035.

Base Year

Historical Period

Forecast Period

The easy availability of raw materials, especially in regions like Malaysia, Indonesia, China, as well as Thailand, is likely to drive the industry growth further.

Palm kernel oil and coconut oil are the leading feedstock because they have a wide mix of all the fatty acids.

The UK is currently dependent on the European Union for feedstock, which leads to an increase in imports, aiding the market growth.

Compound Annual Growth Rate

5.8%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Oleochemicals Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 29.44 |

| Market Size 2035 | USD Billion | 51.74 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.80% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 6.5% |

| CAGR 2026-2035 - Market by Country | India | 6.6% |

| CAGR 2026-2035 - Market by Country | China | 6.4% |

| CAGR 2026-2035 - Market by Type | Fatty Alcohol | 6.8% |

| CAGR 2026-2035 - Market by Application | Personal Care | 7.0% |

| Market Share by Country 2025 | Brazil | 2.6% |

Oleochemicals are plant- and animal-derived chemicals. Various chemical and enzymatic reactions are involved in the development of basic oleochemical products such as fatty acids, fatty acid methyl esters, fatty alcohols, fatty amines, and glycerols. These oleochemicals have special properties such as excellent emollience, surface activity, emulsifying characteristics, and other beneficial biological characteristics.

The oleochemicals market expansion is due to the increased demand for personal care products. The industry is significantly driven by the expanding food and beverage sector and the growing pharmaceutical industry. The increasing biodiesel demand is also an essential factor in driving the market growth. The trade volume of oleochemicals has been rising ever since 2017 after witnessing an economic slowdown between 2011 and 2016. The Trans-Pacific Partnership is expected to open better trade opportunities for Asia, thus supporting the market growth.

The growth of the oleochemicals market is driven by the growth of the end-use industries and the increasing purchasing power of consumers in growing economies, like India and China. The rising environmental and regulatory pressures on surfactant manufacturers are increasing the natural and renewable raw materials usage and, hence, are supporting the growth of the market. The Asia Pacific is one of the most important demand markets due to growing industries in countries like India and China.

Oleochemicals are commonly used in the formulation of soaps, shampoos, and cosmetics due to their surfactant, emulsifying, and moisturizing properties. As consumer preference for natural and eco-friendly personal care products rises, the demand for oleochemicals, particularly fatty alcohols, fatty acids, and glycerine, is witnessing substantial growth.

Shift towards bio-based products, expansion in the biofuel industry, and a rise in regulatory standards and consumer awareness are increasing the oleochemicals market value.

There is a growing demand for sustainable and renewable alternatives to petrochemical-based products. Oleochemicals, derived from renewable sources like palm oil and soybeans, are increasingly preferred due to their eco-friendly nature, contributing to oleochemicals demand. For instance, KLK Oleo, a leading player in the oleochemicals sector, is expanding its production capabilities to meet the rising demand for bio-based products. The company focuses on producing fatty acids, fatty alcohols, and glycerin from renewable feedstocks, emphasising sustainability in its operations. KLK's commitment to environmentally friendly practices aligns with the growing consumer preference for biodegradable and eco-friendly alternatives. Furthermore, Wilmar International has been investing in sustainable practices within its oleochemical production processes. The company has made strides in utilising waste materials from palm oil production to create high-quality oleochemicals, thereby reducing environmental impact while meeting the increasing market demand for sustainable products.

Advances in biotechnological processes and bio-refining techniques are improving the efficiency of oleochemical production, enhancing product quality and reducing costs, which is positively impacting the oleochemicals market value. For instance, P&G Chemicals is focusing on the development of oleochemicals that serve as inerts and adjuvants in agrochemical applications. Their products are designed to be more sustainable and efficient, reflecting a broader industry trend towards integrating bio-based materials into traditional chemical processes. Moreover, Kumar Metal is advancing its oleochemical production processes by focusing on renewable feedstocks, including byproducts from edible oil processing. Their approach includes utilising microbial lipids from oleaginous yeasts as feedstocks for producing wax esters and biolubricants, which helps avoid competition with food production.

Oleochemicals are finding new applications in the production of biofuels, particularly biodiesel. Fatty acids derived from vegetable oils and animal fats are converted into biodiesel, providing a renewable alternative to conventional fuels. As global energy demands increase, there is growing interest in biofuels as a clean and sustainable energy source, boosting the demand for oleochemical-derived biodiesel and further aiding the oleochemicals market development. The environmental appeal of biodiesel made from vegetable oils (such as palm oil, soybean oil, and rapeseed oil) and animal fats is significant. Unlike fossil fuels, which are derived from non-renewable sources, biodiesel is biodegradable and poses less risk of environmental pollution.

Growing concerns about environmental impact, coupled with tightening regulations around the use of harmful chemicals, are prompting companies to adopt oleochemical-based solutions. Regulations such as REACH in Europe, FDA standards in the United States, and various global eco-labelling schemes are encouraging the use of eco-friendly oleochemicals in oleochemicals market. For instance, REACH restricts the use of harmful substances and requires companies to provide safety data for chemicals used in their products. As a result, industries are increasingly turning to oleochemicals, such as fatty acids, glycerine, and bio-based surfactants, to replace harmful, non-renewable petrochemicals. Moreover, consumer awareness about the environmental and health impact of synthetic chemicals is driving demand for bio-based products across sectors.

A major trend of the oleochemicals market is that several global eco-labeling schemes are driving the adoption of environmentally friendly products, encouraging companies to use oleochemical-based ingredients. Labels such as EU Ecolabel, Nordic Swan, and Green Seal help businesses demonstrate their commitment to sustainability. These certifications often require companies to use renewable resources, minimize waste, and reduce harmful emissions, making oleochemicals a preferred choice in various applications, including detergents, paint coatings, and biodegradable plastics.

Moreover, the global demand for cleaner fuels is expected to continue growing, particularly in countries with high energy consumption and environmental concerns. For instance, countries in South America and Asia-Pacific, where large-scale palm oil production takes place, are increasingly investing in biodiesel production.

Oleochemicals are gaining traction in industrial applications such as bio-lubricants, coatings, and plastics due to their performance and sustainability benefits, aligning with the growing demand for greener industrial solutions which can impact oleochemicals demand growth. For instance, Godrej has been pioneering the use of oleochemicals in various sectors, including paints and coatings. The company manufactures eco-friendly surfactants and emulsifiers derived from vegetable oils, which are used as binders and additives in paint formulations. These bio-based products improve adhesion and durability while reducing reliance on harmful synthetic chemicals.

Furthermore, Cargill produces a range of bio-based lubricants and greases that are used in automotive and industrial applications. Their oleochemical formulations provide superior lubrication properties while being biodegradable, making them an attractive alternative to conventional lubricants.

The production of oleochemicals, particularly fatty acids, is significantly affected by high input costs. The prices of raw materials such as palm kernel oil, coconut oil, and beef tallow are volatile, making it difficult for manufacturers to predict production costs and maintain profitability, which can impact oleochemicals market opportunities. The fluctuation in crude oil prices further complicates this issue, as it can influence the pricing of both raw materials and finished oleochemical products. As of early 2024, palm kernel oil (PKO) prices experienced fluctuations due to adverse weather conditions and export restrictions from key producers like Malaysia and Indonesia.

The oleochemical industry is heavily reliant on a limited number of raw materials sourced primarily from specific regions, particularly in Asia. This dependence makes the supply chain vulnerable to geopolitical tensions, natural disasters, and fluctuations in agricultural output. For instance, rising import volumes of finished oleochemicals in markets like India have pressured local producers due to lower-priced imports.

Oleochemicals are increasingly being used in bio-based coatings and resins, especially in the automotive, construction, and consumer goods industries, driven by the shift toward eco-friendly products. NIPSEA Group has developed a high solid content waterborne polyurethane resin that is widely used in automotive OEM coatings and can increase the oleochemicals market revenue. This innovative bio-based resin offers excellent adhesion, stone chipping resistance, and water resistance, making it suitable for high-performance automotive applications. NIPSEA's commitment to sustainability was recognized with the prestigious Ringier Technology Innovation Award 2023, highlighting its role as a leader in eco-friendly coating solutions.

Lubrizol is further advancing its portfolio of bio-based coating technologies by developing resins, dispersants, and wax additives derived from renewable materials. Their bio-content ingredients help improve the sustainability profile of coatings and inks while maintaining high performance.

Read more about this report - REQUEST FREE SAMPLE COPY

“Oleochemicals Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by Region

By Type Insights

The fatty acid segment holds a major oleochemicals market share. This is primarily due to its widespread use across various industries, including personal care, pharmaceuticals, food and beverages, and industrial applications. Fatty acids are essential raw materials for the production of soaps, detergents, lubricants, and cosmetics, which significantly drive their demand. Fatty alcohols also contribute notably to the market share with a CAGR of 6.8% between 2026 and 2035, especially in surfactants, detergents, and personal care products. They are derived from fatty acids and are used for making emulsifiers, wetting agents, and other chemicals.

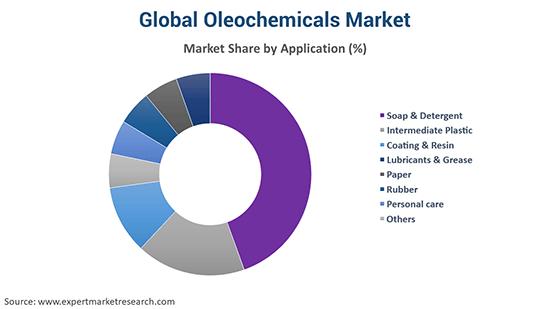

By Application Insights

Oleochemicals have wide applications in the production of soap and detergent, intermediate plastic, coating and resin, paper, rubber, personal care, lubricants, and grease, among others. The soap and detergent segment holds the largest share. This is due to the high demand for fatty acids and fatty alcohols in the production of surfactants used in personal care products, laundry detergents, and industrial cleaners. The segment is driven by the global consumption of household and industrial cleaning products.

The personal care segment also holds a significant share and is expected to have a CAGR of 7.0% in the forecast period, driven by the use of oleochemicals such as fatty alcohols, glycerine, and esters in cosmetics, skincare, and hair care products.

North America Oleochemicals Market Trends

The North American market is growing due to the increasing demand for bio-based products across various industries such as personal care, automotive, and packaging, which can impact oleochemicals market dynamics and trends. The USA is expected to grow at a CAGR of 5.5% in the forecast period. Additionally, government regulations favoring eco-friendly chemicals and innovations in bio-refining technologies are contributing to market expansion. The demand for bio-lubricants and bio-based surfactants is also growing, particularly in industrial sectors focusing on sustainability.

| CAGR 2026-2035 - Market by | Country |

| India | 6.6% |

| China | 6.4% |

| Brazil | 6.3% |

| Mexico | 6.1% |

| UK | 5.7% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | 5.6% |

| Saudi Arabia | XX% |

| USA | 5.5% |

| Germany | 5.2% |

Asia Pacific Oleochemicals Market Drivers

The Asia Pacific market is the leading region for oleochemicals, accounting for more than 40% of the global production. The regional market is anticipated to continue to be the most profitable regional market in the future, as well with a CAGR of 6.5% in the forecast period. As per the oleochemicals industry analysis, it has a significant consumer base in countries such as Korea, China, India and Japan, and many other developing economies within the region. The markets in India, China, and Australia are expected to grow at CAGRs of 6.6%, 6.4% and 5.6% in the forecast period.

Europe Oleochemicals Market Opportunities

Europe is readily boosting the growth of the oleochemicals industry, driven by the region’s strict environmental regulations and a strong emphasis on sustainability. The European Union’s Green Deal and the commitment to reducing carbon emissions have encouraged the shift toward renewable and eco-friendly chemicals. Countries like Germany and the Netherlands are key players, with a focus on bio-based plasticizers, bio-lubricants, and bio-degradable surfactants in industries such as personal care, automotive, and packaging. The UK and German markets are anticipated to grow at a CAGR of 5.7% and 5.2% in the forecast period.

Latin America Oleochemicals Market Growth

The oleochemicals sector in Latin America is expanding, largely driven by the availability of raw materials like palm oil and soybeans, which are key feedstocks for the production of oleochemicals. Brazil, Argentina, and Mexico are major producers and exporters, leveraging their agricultural resources. Increasing demand for bio-based surfactants, eco-friendly lubricants, and renewable chemicals in various sectors such as personal care, agriculture, and manufacturing is further increasing the oleochemicals industry revenue. The Brazilian market accounted for 2.6% of the global market share in 2023. The market in Mexico is expected to grow at a CAGR of 6.1% in the forecast period.

Middle East and Africa Oleochemicals Market Dynamics

Countries like the UAE, Saudi Arabia, and South Africa are increasingly adopting oleochemicals in sectors such as plastics, rubber, and coatings. The Middle East, in particular, benefits from its established petrochemical industry, which is now diversifying into more sustainable and renewable solutions and aiding the demand of the oleochemicals market. The African market is seeing increased demand for bio-lubricants and green chemicals, driven by eco-conscious initiatives in countries like South Africa and Nigeria. For instance, PETRONAS has expanded its portfolio to include bio-lubricants that are suitable for both automotive and industrial applications in Africa.

Startups in the market are increasingly focused on developing innovative and sustainable alternatives to traditional petrochemical products. These companies leverage biotechnology and fermentation processes to create eco-friendly oils and ingredients derived from renewable resources. Additionally, some startups specialize in microalgae-based oils for various industries, including food and cosmetics.

C16 Biosciences

C16 Biosciences is a biotechnology startup focused on producing sustainable palm oil alternatives through innovative fermentation processes. By engineering microbes to create oils that replicate the properties of palm oil, C16 aims to address environmental concerns associated with traditional palm oil production, such as deforestation and habitat destruction.

Sophie’s BioNutrients

Sophie’s BioNutrients specializes in utilising microalgae to produce high-quality, plant-based oils and proteins. This startup focuses on creating sustainable alternatives for food and cosmetic applications, leveraging the nutritional benefits of microalgae while minimizing environmental impact. By harnessing biotechnology, Sophie’s BioNutrients aims to provide eco-friendly solutions that cater to the increasing consumer demand for plant-based and sustainable products in the market.

The report gives a detailed analysis of the following key players in the global oleochemicals market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds. Companies are primarily focused on producing basic oleochemicals such as fatty acids, fatty alcohols, glycerin, and methyl esters. These compounds serve as raw materials for various applications across multiple industries, including personal care, food, pharmaceuticals, and industrial sectors.

BASF SE, headquartered in Ludwigshafen, Germany, is the world's largest chemical producer. BASF's business segments include Chemicals, Performance Products, Functional Solutions, Agricultural Solutions, and Oil and Gas.

Founded in 1991 and headquartered in Singapore, Wilmar International Limited is Asia's leading agribusiness group. The company operates an integrated agribusiness model that encompasses the entire value chain from cultivation to processing and distribution of agricultural commodities.

Kuala Lumpur Kepong Berhad (KLK), established in 1906, is a Malaysian multinational company primarily involved in oil palm and rubber plantations. The company manages over 300,000 hectares of plantations across Malaysia and Indonesia.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other major players in the market are IOI Corporation Berhad, Kao Corporation, and Ecogreen Oleochemicals Pte. Ltd, among others.

Latin America Oleochemicals Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 29.44 Billion.

The oleochemicals market is assessed to grow at a CAGR of 5.80% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 51.74 Billion by 2035.

The major market drivers include increasing population, rise in industrialisation, and the expanding food and beverage sector.

The key trends are rising demand for personal care products and growing pharmaceuticals industry.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific, with Asia Pacific accounting for the largest share in the market.

Fatty acid, fatty alcohol, glycerine, and ester, among others, are the different types of oleochemicals in the market.

The applications of oleochemicals include soap and detergent, intermediate plastic, coating and resin, lubricants and grease, paper, rubber, and personal care, among others.

The major players in the market include BASF SE, Wilmar International Ltd, Kuala Lumpur Kepong Berhad, IOI Corporation Berhad, Kao Corporation, and Ecogreen Oleochemicals Pte. Ltd, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share