Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global labels market size attained a volume of 71.91 Billion Sq. Metres in 2025. Sustainable label substrates, such as biodegradable and recycled films, are gaining prominence among manufacturers due to tightening EU regulations and rising demand from eco-conscious B2B clients across retail and logistics. In turn, the market is expected to grow at a CAGR of 4.50% during the forecast period of 2026-2035 to reach a volume of 111.67 Billion Sq. Metres by 2035.

Market growth is also driven by smart packaging, recyclability mandates, and automation-ready solutions. Labels are rapidly becoming touchpoints for traceability and sustainability. These shifts are fuelled by regulatory pressure and retail automation. In the United Kingdom, for instance, the Packaging Waste (Data Reporting) Regulations, introduced in 2023, now require brands to track and report label waste in granular detail.

Digital label printing is also accelerating further labels market growth. EU’s Horizon Europe programme has significantly invested in projects focused on intelligent labelling technologies, including QR-based traceability and temperature-sensitive inks for pharma and cold chain logistics. Asia-Pacific remains dominant in the global market, with China’s smart label rollout under its “Made in China 2025” policy boosting local production.

Simultaneously, developing economies are prioritising food safety and pharma traceability. For example, India’s FSSAI labelling regulations now enforce front-of-pack nutrition labels on packaged foods. Brands are increasingly aligning with evolving rules while leveraging labels for brand differentiation and digital marketing via embedded NFC chips and blockchain-based authentication. These innovations are transforming the labels market dynamics with real-time consumer engagement and inventory control tools.

Base Year

Historical Period

Forecast Period

Linerless labels are gaining popularity as types of labels that are intended for sustainable development.

The food and beverage sector is the major end-use sector, contributing nearly 30% to the laminated labels market.

There is a rise in the product labels that possess brand colours and shades to promote brand awareness.

Compound Annual Growth Rate

4.5%

Value in Billion Sq. Metres

2026-2035

*this image is indicative*

Smart labels, including RFID, NFC, and blockchain-based tags, are growing popular across pharma and logistics sectors. Governments are mandating traceability, boosting the labels market development. For example, Brazil’s National Medicine Control System (SNCM) and the EU Falsified Medicines Directive now require pharmaceutical traceability via coded labelling. In March 2023, Avery Dennison launched atma.io, a connected product cloud, linking labels to supply chains via real-time digital twins. Retailers like Zara and Decathlon now embed RFID in every product tag to automate stock visibility. The demand is being amplified by Industry 4.0 initiatives, with smart labels acting as critical data carriers for automated warehousing and delivery systems.

As brands direct their efforts to reduce their carbon footprints, labels made from compostable and recyclable materials are becoming standard. The United Kingdom Plastic Packaging Tax, which penalises packaging with less than 30% recycled content, is pushing companies to adopt eco-friendly label substrates, boosting the labels market trends and dynamics. For instance, Avery Dennison’s CleanFlake technology allows PET bottles to be fully recyclable without label contamination. In Germany, ALDI and Lidl have shifted to FSC-certified paper label variants. Sustainability certifications like Cradle-to-Cradle and Blue Angel are becoming competitive differentiators, fuelling R&D activities for water-based adhesives and biodegradable inks.

The shift toward customisation is driving digital label printing demand. HP Indigo and Xeikon are enabling ultra-short-run jobs with high variability, ideal for seasonal promotions and influencer tie-ins. Coca-Cola’s personalised name label campaign is one key example. EU-backed SMEs are accessing grants under the Eurostars programme, which supports SMEs developing digitally enabled label solutions. Digital presses also reduce waste and speed up time-to-market, aligning with agile marketing models. FMCG and cosmetics brands are exploiting variable data printing to localise messages, comply with multi-lingual labelling laws, and meet SKU diversification needs.

Automation is reshaping how labels are used in logistics and retail, boosting the labels market development. Linerless labels, which eliminate backing waste, are experiencing fast adoption in high-speed printing lines. Retailers like Tesco and Carrefour are trialling linerless technology to reduce operational waste and improve print efficiency. Industrial players are switching to pre-encoded RFID tags for use with robotic sorters. The United States Department of Energy is supporting R&D into high-efficiency labelling systems as part of its smart manufacturing roadmap. As e-commerce grows, automation-ready labels are helping to streamline operations in micro-fulfilment centres.

Temperature-sensitive and tamper-evident labels have become critical in pharmaceuticals, vaccines, and perishable food logistics. The WHO’s CCEOP initiative and GAVI-supported cold chain programmes in Africa have spurred demand for sensor-integrated labels. In the United States, the FDA’s Drug Supply Chain Security Act mandates serialised labelling for all prescription drugs. Such developments are boosting adoption of smart indicators and serialised barcodes across healthcare logistics, increasing the labels market value. This trend is also attracting major innovation funding from public and private players focused on pandemic preparedness and vaccine traceability.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Labels Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Material

Key Insight: The market can be categorised into paper, plastics, and specialty materials like aluminium foils and biodegradable films. Paper leads the market with their adoption in the food and beverage sector due to sustainability alignment, while plastics gain traction in pharma and logistics for their resilience and smart technology integration. Specialty materials are emerging for niche applications like security, anti-counterfeit, and luxury branding. Market shifts are primarily driven by cost, recyclability, and compliance with region-specific waste management laws. Manufacturers are balancing between print quality, lifecycle impact, and machine compatibility when selecting materials.

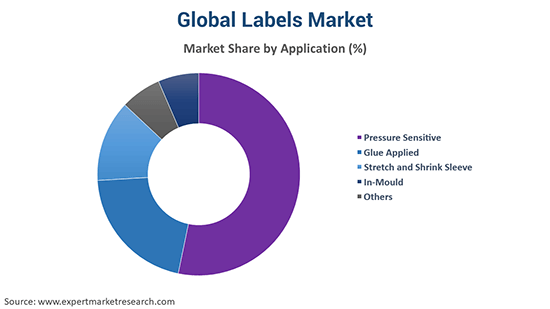

Market Breakup by Application

Key Insight: Label applications span across pressure-sensitive, glue-applied, in-mould, stretch and shrink sleeves, and specialty formats. Pressure-sensitive occupies a considerable share in the labels industry revenue through logistics and retail due to automation compatibility. Shrink sleeves are emerging fast in branding-heavy categories. In-mould finds niche use in rigid containers, while glue-applied dominates low-cost, high-volume markets. Each application is being reshaped by end-use compliance, sustainability mandates, and packaging innovation. Functional integration like tamper-evidence, re-sealability, and smart labelling is influencing the choice of label type among B2B buyers.

Market Breakup by Region

Key Insight: The global labels market report covers growth dynamics across North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. Asia Pacific dominates the industry due to its expanding industrial base and compliance upgrades. Europe and North America are shifting toward sustainability and traceability. Latin America is balancing export-driven demand with packaging reform. Middle East and Africa is emerging fast through public health and trade initiatives. Each region aligns label use with economic goals including automation, waste reduction, export quality, or food traceability.

By Material, Paper Accounts for the Dominant Share of the Market

As per the market report, paper remains the most widely used label material due to its cost-efficiency, printability, and compatibility with eco-friendly packaging goals. Leading FMCG and beverage firms are reverting to paper labels as part of their plastic reduction pledges. In March 2024, in partnership with German packaging expert Karl Knauer, Krones AG, and AB InBev, the premium beer brand Stella Artois unveiled a sustainable packaging innovation with FSC-certified paper. Paper also aligns well with compostable packaging, and the growth in organic and clean-label food brands is further fuelling its demand. Regulatory support, like the EU Green Deal and the United Kingdom's Extended Producer Responsibility rules, is pushing converters to prioritise recyclable substrates like paper, especially in retail and beverage packaging formats.

Plastic-based labels, especially BOPP and PE films, are rapidly boosting growth in the labels market, through pharma, personal care, and logistics due to their durability and moisture resistance. Their compatibility with high-speed application machinery makes them ideal for high-volume SKUs. Smart functionalities like embedded sensors and tamper seals are easier to implement with plastic films. This material category is witnessing innovation in bio-based plastics derived from corn or sugarcane, addressing sustainability concerns. Companies like UPM Raflatac are introducing wash-off plastic labels that aid closed-loop recycling.

By Application, the Pressure Sensitive Segment Registers the Largest Market Share

Pressure-sensitive labels (PSLs) are dominating the global market due to their ease of application and adaptability across industries, from consumer goods to e-commerce. They do not need heat or water, which makes them suitable for automated lines. PSLs are also highly customisable and compatible with variable data printing, essential for SKU diversity. Retailers are increasingly demanding PSLs with reseal features and tamper evidence. This application benefits from a low failure rate and is pivotal in cold chain tracking, medical packaging, and high-velocity distribution environments.

Shrink and stretch sleeves are considerably boosting the labels market value through beverage, personal care, and home care categories. Their 360-degree print surface offers maximum branding real estate, which is especially valued in crowded retail spaces. According to industry reports, shrink sleeve use in beverages accounts for 70%. Global brands like Nestlé and L'Oréal have started combining augmented reality with shrink sleeve labels for consumer engagement. Sustainability innovations like floatable shrink sleeves for PET bottle recycling are driving adoption. These sleeves also allow late-stage decoration and are ideal for irregular container shapes.

By Region, Asia Pacific Occupies a Sizeable Share of the Global Market Revenue

Asia Pacific dominates the global market revenue owing to rapid industrialisation, retail growth, and government-backed digital traceability mandates. China’s smart factory initiatives and India’s compulsory food labelling laws under FSSAI are reshaping labelling standards. Japan is leading in functional labels for electronics and precision parts, while ASEAN nations are witnessing the introduction of traceable labelling in agricultural exports. Regional players are investing in flexographic and digital label presses to cater to both domestic and export markets. Growing e-commerce and modern retail are further accelerating label demand across diverse end-user categories.

Middle East and Africa considerably boosts the labels market value, supported by a rising focus on food safety, pharmaceuticals, and exports. In Saudi Arabia, SFDA regulations mandate smart labelling on medical and food products. Nigeria and Kenya are modernising agro-processing with traceable export labelling funded by the AfDB. UAE’s smart city vision is encouraging digitised retail ecosystems where RFID labels enable frictionless checkout. The region is witnessing high demand for tamper-evident and trackable packaging in healthcare and halal-certified products. Despite infrastructural hurdles, strong policy support and investments in domestic manufacturing are driving sustained growth.

Global labels market players are expanding their production capacity via acquisitions and investing in linerless, RFID, and low-migration ink technologies. Innovation have given rise to multifunctional labels, those that can be used as security tags, freshness indicators, or digital engagement points. Startups are also disrupting with custom short-run label printing-on-demand for SMEs. Sustainability remains a core differentiator, with converters competing to get FSC, Cradle-to-Cradle, or Blue Angel certification.

Meanwhile, digital labelling ecosystems like smart label clouds are helping brands automate inventory and enhance traceability. Smart labels, sustainable substrates, digital short-runs, pharma-compliant labelling, and linerless automation are reshaping the market by blending compliance, speed, and branding with traceability and material innovation. Label companies focusing on recyclable substrates, data-rich printing, and fast-turn solutions are poised to gain traction across regulated and tech-driven sectors like pharma, food, and e-commerce. Localisation strategies and just-in-time label delivery models are offering fresh revenue streams.

CCL Industries, founded in 1951 and based in Toronto, Canada, is a global leader in specialty labels and packaging. The firm offers RFID, eco-friendly, and digital printing solutions for consumer goods, healthcare, and industrial sectors. Their acquisition of Checkpoint Systems and Innovia Films boosted its smart labelling and film capabilities across Europe and North America.

Multi Packaging Solutions International Limited, established in 2005 and headquartered in New York, United States, is known for high-end labelling and carton solutions. They cater to pharmaceuticals, personal care, and premium beverage markets with an emphasis on tactile finishes, metallic foils, and anti-counterfeit labelling technologies.

Multi-Color Corporation, founded in 1916, is one of the largest label printers worldwide. They specialise in shrink sleeves, pressure-sensitive, and in-mould labels for food, beverage, and home care industries, with facilities across 26 countries ensuring region-specific supply chain efficiency.

Fuji Seal International, Inc., established in 1897 and headquartered in Osaka, Japan, pioneers shrink sleeve and spouted pouch solutions. The company focuses on automation-ready and smart labelling technologies for FMCG, contributing to sustainability through lightweight label materials and energy-efficient printing systems.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Another key player in the market is DPS Group among others.

Explore the latest trends shaping the global labels market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on labels market trends 2026.

North America Cryogenic Label Printer Market

United States Label Release Liner Market

Automatic Labelling Machine Market

Warning Labels and Stickers Market

North America Print Label Market

Label-Free Array Systems Market

Electronic Shelf Label Market

Linerless Labels Market

France Labels Market

Smart Labels Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the labels market reached an approximate volume of 71.91 Billion Sq. Metres.

The market is projected to grow at a CAGR of 4.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of almost 111.67 Billion Sq. Metres by 2035.

Key strategies driving the market include investing in digital presses, adopting linerless formats, developing region-specific label variants, integrating RFID tech, and forming recycling partnerships.

The key trends aiding the market include sustainable packaging labels, clean and allergen-free labels, variable data printing in labels, and the rising adoption of smart labels.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major materials of labels considered in the market report include paper and plastic, among others.

The significant applications of labels include pressure sensitive, glue applied, stretch and shrink sleeve, and in-mould, among others.

The major players in the market are CCL Industries, Multi Packaging Solutions International Limited, Multi-Color Corporation, Fuji Seal International, Inc., and DPS Group, among others.

The key challenges are high raw material volatility, recycling compliance costs, and complex global regulatory divergence. Integrating smart tech with legacy systems also remains a barrier for mass-scale adoption.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Material |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share